Digital nomad life offers a wonderful opportunity to experience freedom, diverse cultures, and people. But managing money on the move can be tricky, which is why finding the best budgeting apps for digital nomads in 2025 is essential. These apps help you easily set a budget and control your spending while traveling. In this article, I’ll introduce some of the top budget management apps recommended specifically for digital nomads.

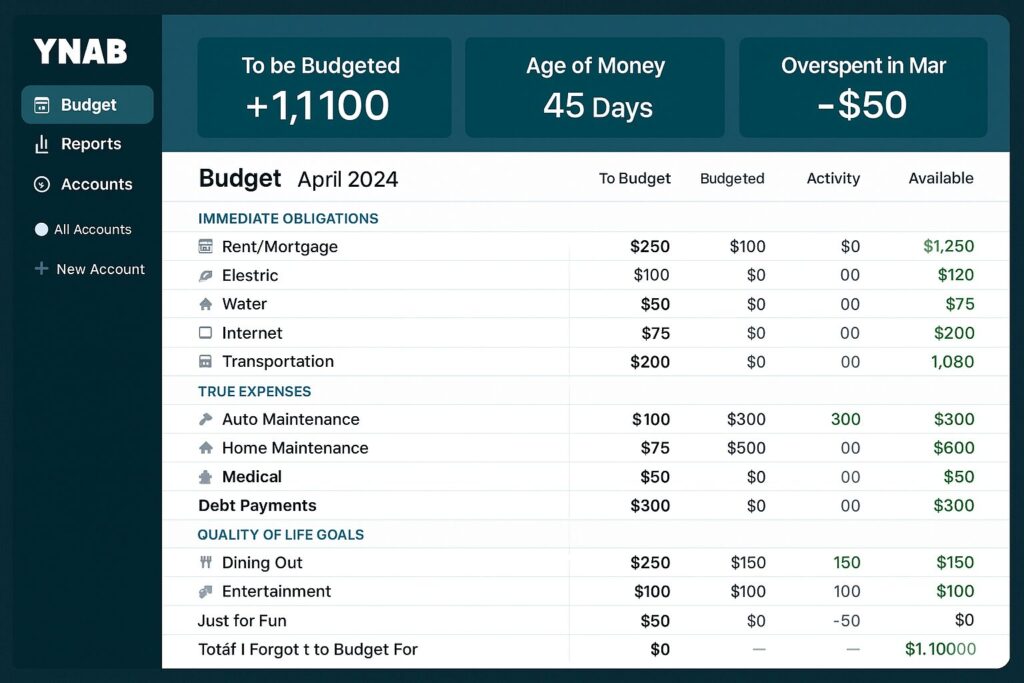

YNAB: The Super Power of Budgeting

Let me introduce you to YNAB (You Need A Budget), which is especially popular among budget management apps. YNAB is not just a simple budget management tool, but a powerful tool that helps you achieve your financial goals. So, let’s take a closer look at the appeal of YNAB.

YNAB is a budgeting app that started in the United States and is loved by many users around the world. This app helps users manage their finances more effectively, and is especially helpful in setting and achieving financial goals. YNAB’s slogan is “Do Money Differently,” which means changing the way you handle money.

Key Features of YNAB

YNAB offers a variety of features, some of which stand out:

- Set a budget : Users can set a budget based on their income and expenses. You can plan in advance how much you will spend in each category.

- Real-time transaction history : YNAB helps users record their transactions in real-time, making it easier to understand their spending patterns.

- Set financial goals : YNAB helps users set and work toward financial goals, like a trip or a new laptop.

- YNAB Together : It also has a feature that lets you manage your budget with friends or family, so you can set and manage common financial goals together.

How to use YNAB

Using YNAB is very simple. First, download the app, create an account, and enter your income and expenses. Then, set a budget for each category and record each transaction. This way, you can easily see your financial status.

Pros and Cons of YNAB

The advantages of YNAB are:

- User-Friendly Interface : YNAB has an intuitive design that makes it easy for anyone to use.

- Providing financial education : YNAB provides a variety of educational materials to help users manage their finances better.

- Goal Achievement Support : It provide ongoing support to help users achieve their set goals.

But there are also downsides:

- Cost : YNAB isn’t free, so users have to pay for it.

- Learning Curve : It may feel a bit complicated for first-time users.

YNAB User Reviews

Many users have left reviews saying that they have successfully managed their finances with YNAB. In particular, many have said that it has helped them set a budget and achieve their goals. Users also mentioned that YNAB has helped them reduce their financial stress.

Conclusion and Recommendation

YNAB is a really powerful tool for budgeting. If you want to achieve your financial goals, give YNAB a try. It may seem a bit complicated at first, but you will definitely feel its usefulness as you use it. Start managing your finances with YNAB!

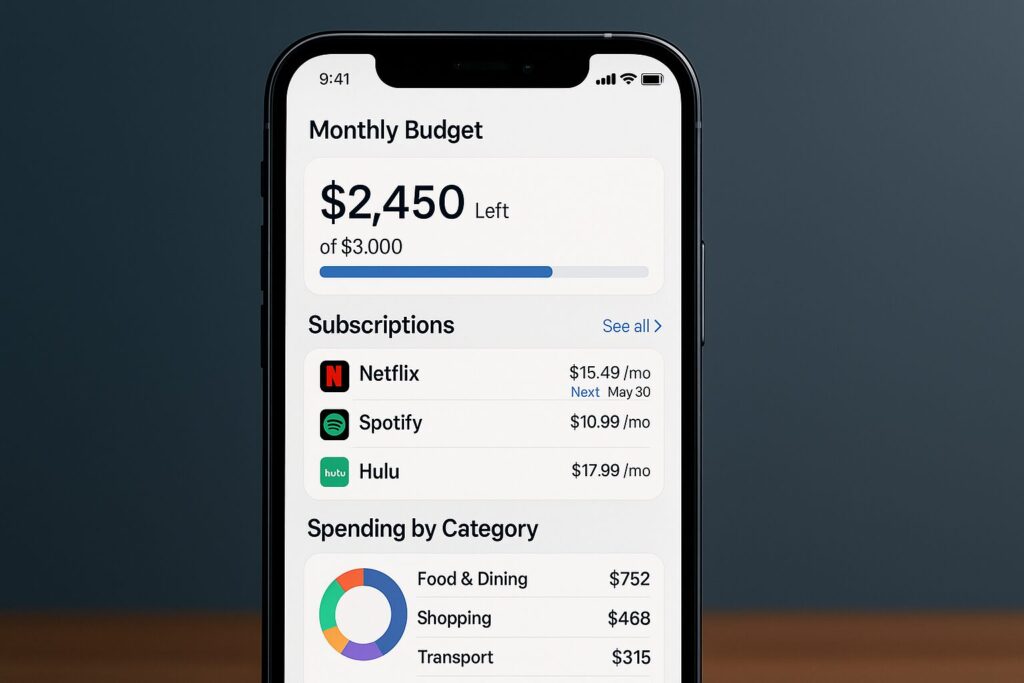

Rocket Money: Smart Budgeting App

Rocket Money, a smart budgeting app designed for digital nomads in the US in 2025. This app helps you manage your personal finances in one place, and it’s packed with useful features, especially for those who travel a lot or move around frequently. Let’s take a look at the main features of Rocket Money and how to use them one by one!

Rocket Money offers a variety of features to help users manage their finances easily. Here are some of the main features this app offers:

Automatic subscription tracking

This feature automatically tracks all the subscriptions you have signed up for. For example, you can easily manage multiple services such as Netflix, Spotify, and Audible. By checking your subscriptions like this, you can easily figure out your fixed monthly expenses.

Unsubscribe

If you have a service that you don’t need or don’t use, you can easily cancel it through Rocket Money. This feature will help you reduce unnecessary spending.

Negotiating a bill

Rocket Money also offers a feature that allows users to negotiate their monthly bills, for example, helping them lower their internet or electricity bills, which is a huge help for those who need these services.

Expense Summary

Rocket Money also provides a feature that lets you see your overall spending at a glance, analyze your spending patterns, and set a budget to help you manage your finances better.

User Experience and Interface

The app’s interface is designed to be very intuitive and easy to use. Even first-time users can easily operate it and quickly find the functions they need. In particular, the colors and design are sophisticated and eye-catching.

How to use Rocket Money

The app is also easy to use. First, download the app, sign up, and then link your bank account and card information. Once you do this, you can automatically track your spending and manage your subscription services.

Rocket Money is perfect for digital nomads

There are several reasons why Rocket Money is perfect for digital nomads. First, the app is available anytime, anywhere. It’s really convenient to be able to easily manage your finances on your smartphone while traveling. Second, you can manage multiple subscriptions in one place, which helps you cut down on your expenses. Finally, the bill negotiation feature allows you to save money.

Security and Privacy

Rocket Money has implemented various security measures to safely protect users’ personal information. All data is encrypted and transmitted, and no information is shared with external parties without the user’s consent.

Pricing and Rates

Rocket Money has a free version and a premium version. The free version offers basic features, but you can upgrade to the premium version to get additional features.

*Free Plan Cost: $0/month

Features:

- Track subscriptions and recurring bills

- Set up basic budgets

- Monitor spending across linked accounts

- Receive balance alerts

- Access credit score monitoring

*Premium Plan Cost: $6–$12/month (7-day free trial)

Features:

- All Free Plan features

- Subscription cancellation assistant

- Bill negotiation services (35–60% of first-year savings fee)

- Advanced budgeting tools (custom categories, unlimited budgets)

- Net worth tracking

- Automated savings plans

- Shared accounts

- Chat support

- Additional Costs Bill Negotiation Service:

If Rocket Money negotiates a lower bill for you, they charge a fee of 35–60% of the first year’s savings. You choose the percentage within this range.

Rocket Money Tips for a Nomad Lifestyle

Finally, I’ll share some tips to help you get the most out of Rocket Money.

- First, check your spending regularly.

- Second, cancel any subscriptions you don’t need immediately.

- Third, actively use the bill negotiation feature.

Rocket Money is a smart financial management tool for digital nomads. It’s an app that helps you manage your budget effectively and ultimately maintain a better financial health, so give it a try!

PocketGuard: Keeping it simple

Let’s have a look at PocketGuard, one of the best budgeting apps for digital nomads in 2025. While many people are using various apps to manage their finances, but among them, PocketGuard is especially loved for its simple and intuitive interface. Let’s take a look at the charms of PocketGuard one by one. 😊

Introducing PocketGuard

PocketGuard is an app designed to help you manage your personal finances. It helps you easily track your income and expenses, set a budget, and see your finances at a glance. It has many useful features, especially for those pursuing a nomadic lifestyle in the United States.

Key features of PocketGuard

One of the biggest advantages of PocketGuard is its various features that help users easily understand their finances. For example, users can input their income and expenses, and the app automatically calculates how much money they have left and sets a budget based on that.

PocketGuard also breaks down your spending categories to help you easily see where and how much you’re spending. For example, you can manage your spending by dividing it into categories such as eating out, electronics, and groceries.

User Interface and Experience

PocketGuard’s user interface is very intuitive. It’s designed to be easy to understand even for first-time users, so you can start using it right away without any complicated settings. The app’s main screen shows you all your spending and budget at a glance.

In particular, it is attractive that you can visually check your financial status through various graphs and charts. For example, you can easily see which category you are spending the most money on by showing your spending details in a pie chart.

PocketGuard User Review

I have used PocketGuard myself and found it very useful. In particular, I liked the ability to manage my expenses by category, and it was a great help in setting a budget and adjusting my expenses accordingly.

Also, the app has a clean design and is easy to use, so I didn’t feel burdened at all using it every day. It’s an app I would recommend to anyone who is just starting to manage their finances.

Conclusion and Recommendation

PocketGuard is a simple budgeting app that I think is especially suitable for those pursuing a nomadic lifestyle in the US. Its easy-to-use interface and various features will help you manage your finances more efficiently. You should try it out! 😊

Goodbudget: Old-fashioned sensibility

Let’s learn about a budget management app with an old-fashioned feel. These days, it’s easy to manage your finances with your smartphone, and I’m going to introduce an app that’s especially useful for people who move around a lot. It’s called Goodbudget. This app is characterized by its digital implementation of the traditional envelope system. Let’s take a look at what makes this app so appealing.

Goodbudget is one of the best budgeting apps for digital nomads in 2025 that uses the envelope system, a traditional budgeting method. This app allows you to see your financial situation at a glance and set a budget for each category you need. In particular, this app has a basic version that you can use for free and a paid version that offers more features. Its biggest advantage is that it provides various options so that users can choose according to their needs.

Features of the Goodbudget app

One of the biggest features of Goodbudget is that it is based on a budget set by the user. Users can create various categories and adjust their budgets to fit their spending patterns. For example, if you set categories such as groceries, fuel, and eating out, and set a budget for each, it helps you adjust your spending accordingly.

Also, Goodbudget is cloud-based, so it syncs across multiple devices. It’s a huge plus that you can easily access it anytime, anywhere on your smartphone, tablet, or PC.

User Experience and Interface

Goodbudget’s user interface is intuitive and easy to use. It is designed so that even foreigners who are new to the app can easily understand it. The home screen provides a simple way to check your financial status, and your spending history is displayed at a glance by major category.

In particular, I like how it visually displays how your budget is being managed through various charts and graphs. For example, you can see at a glance how much of your budget has been used up, making it easy to control your spending.

Cost Management Category

Goodbudget helps users set up categories for managing their expenses. This feature is very helpful for managing spending systematically. For example, you can manage expenses such as groceries, eating out, transportation, and utilities by category.

This app allows for more detailed adjustments to categories, allowing users to allocate more of their budget to items they spend more on. In this sense, Goodbudget is an app that reflects personal spending habits well.

Pros and Cons Analysis

The best thing about Goodbudget is that it is intuitive and easy for users to access. And even the free version provides basic budget management functions. Another big advantage is that it is cloud-based and can be used on multiple devices.

However, the downside is that there is an envelope system that may be a bit unfamiliar to first-time users. It may take some time to understand this system. Also, you should consider that some features may be limited unless you upgrade to the paid version.

Compare Goodbudget to other budgeting apps

Goodbudget is a budget management app that operates in a unique way among various other apps. For example, apps like Mint are strong in automatically tracking transactions and analyzing spending habits, but Goodbudget focuses on allowing users to set and manage their own budgets.

Also, when compared to YNAB (You Need A Budget), Goodbudget offers a cheaper option in terms of price, but YNAB has a monthly subscription fee, which can be a financial burden.

Conclusion and Recommendations

Goodbudget is an app that digitizes the traditional envelope system to make budgeting easier. Its user-friendly interface and various functions are well-combined, making it a great app for those who are just starting out with financial management. Of course, it may take some time to understand the envelope system, but once you get used to it, you will find it very useful.

If you want to start managing your budget, I recommend downloading Goodbudget. It will be a great help in understanding your spending patterns and setting the budget you need.

Monarch Money: Team Nomad Power

Monarch Money is a budgeting app optimized for the modern digital nomad, with a variety of features and a user-friendly interface. Today, we’ll take a closer look at how this app supports the nomadic lifestyle and how to use it.

Monarch Money is a personal finance app that offers a lot of useful features for people who are on the go. The app helps users easily understand their finances, set budgets, and track their spending. It is designed to give users a quick overview of their finances through various statistics and visuals.

The Importance of Budgeting for Nomads

Living as a digital nomad is a free and creative experience, but managing your finances is equally important. If you don’t manage your budget well, unexpected expenses can lead to financial difficulties. Monarch Money is an app designed to solve this problem, helping users clearly understand and manage their income and expenses.

Key Features of Monarch Money

Monarch Money offers several useful features. First, users can manage all their accounts in one place. Second, users can set up spending categories and track their spending by each category. Third, users can set up budgets and set goals to manage their finances more systematically.

User Experience and Interface

Monarch Money’s interface is very intuitive. Users can easily access it on both desktop and mobile, and each feature is well organized and easy to use. For example, the cash flow report shows total income, total expenses, net income, etc. at a glance.

These visual aids can be a huge help in helping users easily understand their financial situation.

How to use Monarch Money

To use Monarch Money, you must first download the app and create an account. After that, you can link your bank account and card information, and your spending history will be automatically updated. Users can set a budget for each category and set monthly goals. For example, you can set housing expenses, food expenses, and entertainment expenses, and manage your spending for each category.

Comparison: Monarch Money vs. Other Budgeting Apps

Monarch Money has several advantages over other budgeting apps. For example, it has great customization features and provides various statistics to help you manage your finances more efficiently. Also, its user interface is more intuitive than other apps, making it easy for beginners to use.

Conclusion and Recommendations

Monarch Money is a very useful budgeting tool for digital nomads. This app allows users to clearly understand their financial situation and manage it systematically. If you are thinking about managing your finances while living a nomadic life, I recommend giving Monarch Money a try.

More than just a budgeting tool, this app will be your partner in helping you achieve financial freedom.

Which Budgeting App Is Best for You? Compare Top Picks Here

| App Name | Pricing | Key Features | Platform | Best For |

| YNAB | $14.99/month or $109/year | Zero-based budgeting, goal tracking, detailed reports, 34-day free trial | iOS, Android, Web | Detailed budgeting & money control |

| Rocket Money | Free; Premium $6–$12/month | Subscription tracking, bill negotiation, net worth tracking, automated savings | iOS, Android, Web | Subscription management & cost savings |

| Monarch Money | $14.99/month or $99.99/year; 7-day free trial | All-in-one financial management, collaborative budgeting, investment tracking, goal planning | iOS, Android, Web | Comprehensive financial planning |

| PocketGuard | Free; Premium $6.25/month or $74.99/year | Spending limits, bill tracking, budgeting | iOS, Android, Web | Simple budgeting & bill alerts |

| Goodbudget | Free; Paid plans start at $7/month | Envelope budgeting, syncing across devices | iOS, Android, Web | Envelope budgeting method lovers |

Manage your money safely, nomad style

The most important thing about nomadic life is to manage your finances safely. That’s why choosing the best budgeting apps for digital nomads in 2025 is essential. These apps can help you track all your bank accounts and cards in one place, monitor your spending in real time, and protect your money while traveling.

It’s also important to check the app’s security features. It’s a good idea to choose an app that has security features like two-step verification. Because nomadic life is so uncertain, it’s essential to have a financial safety net.

Wrapping it up: Nomad Wallet’s new best friend

For digital nomads, budgeting apps are a really important tool. Apps like YNAB, Mint, PocketGuard, Goodbudget, and Monarch Money each have their own characteristics and advantages. By using these apps, you can reduce financial stress while traveling and enjoy a more enjoyable and free nomad life. Choose the app that suits your needs and start managing your finances better!

Whether you’re new to managing money on the road or looking for an upgrade, the best budgeting apps for digital nomads in 2025 offer powerful tools to help you stay financially fit. Try a few to see what fits your style—and take control of your money while you explore the world.

Frequently Asked Questions :-

1: Are budgeting apps free for digital nomads?

Most budgeting apps like Goodbudget and PocketGuard offer free versions with basic tools. However, advanced features such as custom categories or goal tracking may require a paid plan.

2: Which budgeting app is the easiest to use?

PocketGuard and Goodbudget are popular for their user-friendly interfaces and simple setup, making them ideal for beginners and busy travelers.

3: Can I use multiple budgeting apps together?

Yes, many digital nomads combine apps to suit different financial goals. For example, you could use YNAB for goal-based budgeting and Rocket Money to manage subscriptions.

4: Which budgeting app is best for detailed tracking?

Monarch Money and YNAB are both excellent choices for detailed budget tracking, category customization, and planning over long-term travel.

5: Do these apps work for managing nomadic lifestyles?

Yes, budgeting apps like YNAB, PocketGuard, and Monarch Money are well-suited for digital nomads, offering flexible budgeting tools, syncing across devices, and cloud-based access from anywhere.

If you found this guide helpful, leave a comment below and tell us which budgeting app you’re using in 2025 or share your personal tips for managing money on the go!

You may also like :- Tax Hacks for Digital Nomads: A Guide for US Nomads

Tags

#budget management #digital nomad #budget management app #YNAB #PocketGuard #Goodbudget #MonarchMoney #nomad finance #safe finance management #RocketMoney

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.