Travel Insurance for Digital Nomads

Digital nomads who travel the world and work need travel insurance in particular. Since they work in many different countries, they may not have a good understanding of each country’s medical system and laws.

Life as a digital nomad is full of new experiences every day, but it is important to prepare for unexpected accidents. Choosing the right travel insurance is essential for a safe trip.

And I’ll add one funny tip. “Don’t let a sprained ankle stop your adventure!” Because traveling is always full of unexpected moments.

Tulum Story: Billing for a Medical Treatment in Mexico

Let me tell you a story that will make you realize the real need for travel insurance. It happened when I was in Tulum, Mexico. While I was swimming in the ocean, I sprained my ankle. It was a really scary moment! I had to go to a nearby clinic right away, and the medical bill was $200.

Luckily, I had travel insurance, so I was able to claim the money. That experience made me realize the importance of travel insurance. I learned how important it is to have a plan in place for unexpected situations that may occur while traveling.

Considerations When Choosing Travel Insurance

When choosing travel insurance, there are several things to consider.

- Coverage : See what situations are covered.

- Insurance Premiums : Choose the insurance premium that fits your budget.

- Customer Reviews : Read reviews from other customers to choose a trustworthy insurance company.

Choose your coverage wisely

When choosing travel insurance, you should consider few points like trip cancellation coverage, medical coverage, and equipment protection options.

If you have to cancel your trip, you will need coverage for that. Also, medical coverage is essential in case of an unexpected injury or illness while traveling. Finally, you will also need coverage to protect your valuable travel equipment. It is important to consider these factors comprehensively to choose the coverage that best suits you.

Best Travel Insurance Plans

Here are some of the main plans to consider when choosing travel insurance.

- One of the most popular plans is SafetyWing. This plan offers a variety of coverage options for digital nomads, especially since it includes COVID-19 coverage, which is especially reassuring.

- Another popular plan is World Nomads. This plan also offers comprehensive medical coverage and covers a variety of risks that may occur during your trip.

- Finally, Allianz is synonymous with traditional travel insurance, offering complete coverage with a variety of add-on options. Comparing the prices and features of each insurance company will help you make a more reasonable choice.

Let’s dive into the details!

SafetyWing Travel Insurance Overview

SafetyWing is an insurance product specifically tailored to those who work remotely. It is designed to provide medical care anywhere in the world and includes coverage for epidemics such as COVID-19.

The premiums are affordable and it offers the flexibility to sign up and cancel whenever you need to.

How to sign up for insurance

SafetyWing insurance can be easily signed up for online. When signing up, select the required information and insurance period, and the insurance will be activated immediately.

However, before signing up for insurance, you should carefully check the conditions and exclusions. In particular, you should be careful because coverage for existing diseases is often excluded.

FAQs – Frequently Asked Questions

- Where can I sign up for SafetyWing insurance?

- You can easily sign up through SafetyWing’s official website.

- How do I file an insurance claim?

- After an accident occurs, you can file a claim online with your medical bill receipts.

- What about coverage related to COVID-19?

- SafetyWing also covers medical expenses due to COVID-19.

- How much is the insurance premium?

- Premiums vary depending on your age and the length of coverage. For example, if you are between the ages of 18 and 39, it will cost you $45.08 for four weeks

Before you go on a trip, be sure to consider travel insurance. It will be a good companion to ensure your safe travel abroad.

In conclusion

SafetyWing is one of the most popular and flexible insurance products. Before you go on a trip, learn enough about insurance and choose the insurance product that is right for you.

Allianz travel insurance

Allianz is a globally recognized insurance company that offers a variety of travel insurance products.

In particular, it has customized insurance products for digital nomads, which protects against various risks that may occur during travel.

Benefits of Allianz Travel Insurance

- Worldwide Coverage : Allianz offers insurance valid anywhere in the world.

- COVID-19 Coverage : Includes COVID-19 coverage to ensure you can travel with confidence even during a pandemic.

- 24-Hour Support Service : They provide 24-hour customer support service to help you anytime during your trip.

How to sign up for insurance

It is easy to sign up for Allianz travel insurance. You can apply online, fill out the required information, pay, and your insurance will be issued immediately.

When you sign up, you can choose the right insurance product based on your travel schedule and destination.

Insurance Claims and Support Services

If you have an accident while traveling, Allianz offers a simple claim process. You can file your claim online, submit the required documents, and the process will be completed quickly.

Plus, their customer support team is always on standby to help you whenever you need it.

Conclusion

Before you go on a trip, it is a very important decision to purchase an insurance. Especially if you are a digital nomad and travel to many countries, insurance will be of great help. I will recommend considering Allianz travel insurance for a safe and enjoyable trip!

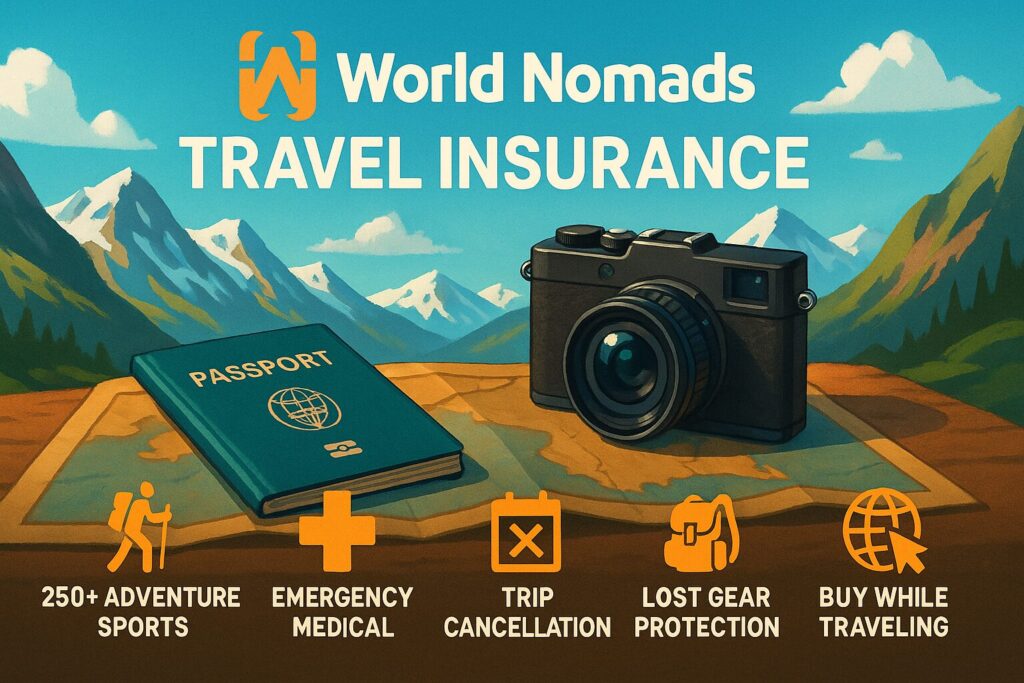

WorldNomads travel Insurance

Features of World Nomad Travel Insurance

Various coverages

World Nomad Insurance has a wide range of coverages. For example, it provides comprehensive coverage for medical expenses, trip cancellation, lost luggage, etc. It also has excellent coverage for adventure sports.

Coverage for adventure sports

This is a must-have insurance for travelers who enjoy sports activities. They have insurance products that cover a variety of activities, including skiing, scuba diving, and mountain biking, so you can enjoy them safely.

24-hour emergency support service

If something unexpected happens during your trip, you can rest assured that World Nomad’s 24-hour emergency support service is available to help you at any time.

How to sign up for World Nomad Travel Insurance

Online Application Process

Applying for World Nomad Insurance is easy. Just go to the official website, fill out the required information, and apply.

Insurance premiums vary depending on the length of your trip, your age, and the type of activity you are doing. You can easily calculate this on our website, so check in advance.

Pros and Cons of World Nomad Insurance

World Nomad has a high coverage limit, so you can prepare for various situations. Even if a major accident occurs during your trip, you will be safely protected.

Because there are so many different insurance products out there, it’s important to compare costs and find the best insurance that fits your travel style.

Conclusion

Before you go on a trip, travel insurance is one of the essential things to prepare. Enjoy a safe and enjoyable trip by utilizing World Nomad’s various insurance options! Hope your trip will be even more special.

Precautions when using travel insurance

Understanding Insurance Terms and Conditions

Before signing up for insurance, you should read and understand the terms and conditions carefully. It is important to understand the coverage items and exclusions in advance.

How to respond in case of an accident

If an accident occurs, it is best to contact your insurance company immediately and get guidance. If you prepare the necessary documents, you can resolve the issue quickly.

SafetyWing vs. World Nomads Comparison

When choosing travel insurance, it is important to compare the main insurance companies. Let’s have a look at SafetyWing and World Nomads.

SafetyWing offers up to $250,000 in coverage and offers a variety of options at affordable prices.

World Nomads, on the other hand, offers coverage from £5,000,000 to £10,000,000, but can be expensive. Below is a table comparing the main features of the two insurance companies.

| Item | SafetyWing | World Nomads |

| Guaranteed limit | $250,000 | £5,000,000 – £10,000,000 |

| Adventure Sports Options | include | include |

| Excluding countries | Limited | Diversity |

| Guaranteed technical equipment | include | include |

| Customer Support | 24 hour support | Weekday support |

| Policy Flexibility | Easy to cancel and join | Can be relatively complex |

| Travel warning impact | No warranty involved | Regarding warranty |

Quick Comparison Table(All 3):

| Feature | SafetyWing | World Nomads | Allianz Travel |

| Best For | Digital Nomads | Adventure Travelers | Vacationers & Families |

| Buy After Departure? | ✅ Yes | ✅ Yes | ❌ No |

| Covers Adventure Sports | ❌ No | ✅ Yes (250+ activities) | ❌ Not by default |

| Trip Cancellation | ❌ Limited | ✅ Yes | ✅ Yes |

| Emergency Medical | ✅ Yes | ✅ Yes | ✅ Yes |

| COVID-19 Coverage | ✅ Yes | ✅ Yes | ✅ Yes |

| Subscription Option | ✅ Yes (4-week cycle) | ❌ One-time | ✅ Annual/Single Trip |

| Child Coverage | ✅ 1 free child/adult | ❌ No | ✅ Yes |

Tip: Buy in advance, check the details, and compare plans

When purchasing travel insurance, there are a few tips to follow.

- It is better to purchase insurance in advance. If you prepare insurance in advance before you leave for your trip, you will have much more peace of mind.

- Read the terms and conditions carefully. It is very important to check the detailed provisions of the insurance.

- It is a good idea to compare several plans. You need to understand the pros and cons of each plan to find the insurance that is best for you.

Your insurance map keeps you safe—choose wisely. Have a fun and safe trip!

Frequently Asked Questions (FAQ)

Q1. What travel insurance do digital nomads need?

Digital nomads should look for plans that combine emergency medical coverage, adventure/expat coverage, gear protection, and trip interruption insurance. Providers like SafetyWing and World Nomads often offer these in one package.

Q2. Do I need insurance if my visa doesn’t require it?

Even if your visa doesn’t mandate it, you still need medical and gear protection. Unexpected healthcare costs abroad or lost camera/laptop gear can quickly outstrip savings, making insurance essential.

Q3. Can I buy travel insurance after I leave my home country?

Yes—some providers let you purchase coverage while abroad, but with limitations. It’s safer and sometimes cheaper to activate your policy before departure to avoid gaps in coverage.

Q4. Can I insure my laptop or camera while traveling?

Absolutely. Many nomad-friendly policies include electronics coverage for gear like cameras, laptops, and drones. Just check the policy limits and conditions—especially around theft or accidental damage.

Q5. What’s the difference between single-trip and multi-trip insurance?

* Single-trip: Ideal if you travel once or twice a year for a specific period.

* Multi-trip (annual): Best for nomads traveling frequently—more cost-effective and convenient.

Q6. Are pre-existing medical conditions covered?

Only if explicitly declared and accepted by the insurer. It’s crucial to disclose any condition during application, or claims may be denied later.

Q7. How do I file a claim from another country?

Almost every provider offers online claim portals or apps. You’ll usually need to upload medical reports, receipts, police reports (for theft), and related documents. Keep all originals and copies in cloud storage.

Found this guide helpful?

Leave a comment below — we’d love to hear your thoughts, personal experiences, or any questions you have!

You may also like :- Health Insurance Options for US Nomads Abroad

Tags

#TravelInsurance #DigitalNomad #SafeTravel #SafetyWing #WorldNomads #TravelTips #InsuranceComparison #Tulum #TravelExperience

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.