Last year, I watched a friend panic over a California tax notice while sitting in a Bangkok coffee shop. She’d been abroad for two years, filed her federal returns religiously, but forgot one tiny detail—her old voter registration. That $3,200 bill could’ve been avoided with a single conversation with a digital nomad tax accountant. Sometimes the cost of going solo isn’t just money. It’s peace of mind.

Look, I get it. Adding another expense to your nomad budget feels counterintuitive. We’re supposed to be minimalists, right? But here’s what I’ve learned after five years of remote work across 12 countries: the right tax professional doesn’t cost money—they save it. And more importantly, they save you from those middle-of-the-night anxiety spirals about whether you messed something up.

In this guide, I’ll walk you through real scenarios where hiring a digital nomad tax accountant makes sense, share some eye-opening case studies, and help you figure out if professional help is worth it for your situation. By the end, you’ll know exactly when to DIY and when to call in backup.

When DIY Turns Into “Oh No”

The FEIE vs Foreign Tax Credit Dilemma

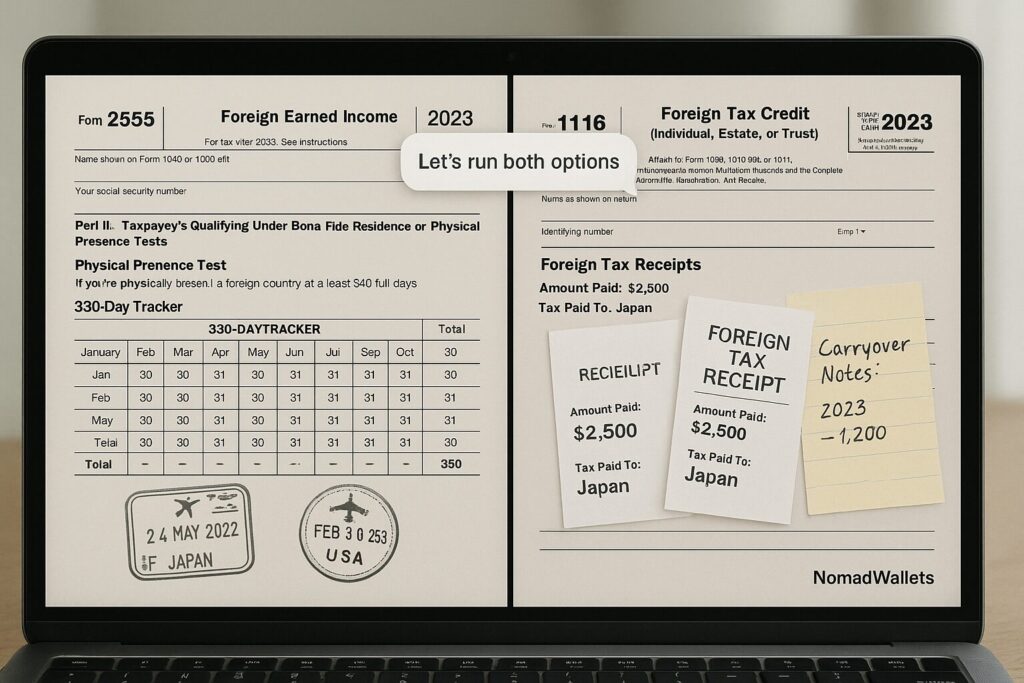

Sarah thought she had it figured out. She’d been claiming the Foreign Earned Income Exclusion (FEIE) for three years straight. Simple, right? Exclude the income, pay less tax. But in 2024, she spent most of her time in Germany, paying hefty local taxes. When she finally ran the numbers with a digital nomad tax accountant, she discovered the Foreign Tax Credit would’ve saved her $4,800 that year.

The kicker? She could’ve claimed both in some situations—partial FEIE for some income, credits for the rest. Her tax pro showed her how to optimize the mix based on where she worked and what she paid abroad. That one consultation paid for itself five times over. greenbacktaxservices

“I was leaving thousands on the table because I thought FEIE was always the answer,” Sarah told me later. “My accountant showed me it’s actually a year-by-year decision based on where you work and what you pay locally.”

State Tax Nightmares

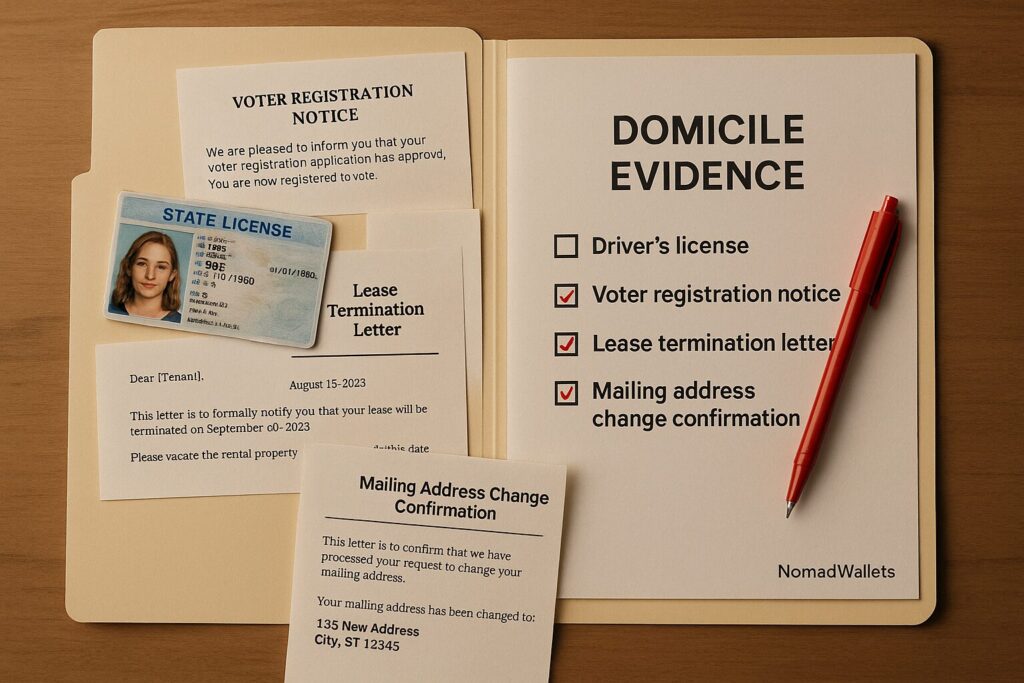

Remember my friend with the California notice? Here’s what happened. Jessica moved from San Francisco to become a full-time nomad in 2022. She dutifully filed her federal returns, claimed FEIE, felt proud of her tax savings. But she missed some critical steps.

Her driver’s license still showed her old SF address. She was registered to vote in California. And she had a small savings account at a local credit union that she forgot to close. California’s Franchise Tax Board eventually caught up.

A digital nomad tax accountant could’ve walked her through the domicile change process from day one. Document everything. Change every official tie. Keep records of the moves. Instead, she spent months fighting the state and ended up paying back taxes plus penalties. fdcapital

“The $1,200 I thought I was saving by not hiring a tax pro cost me $3,200 in the end,” Jessica said. “Plus about 20 hours of stress and paperwork I’ll never get back.”

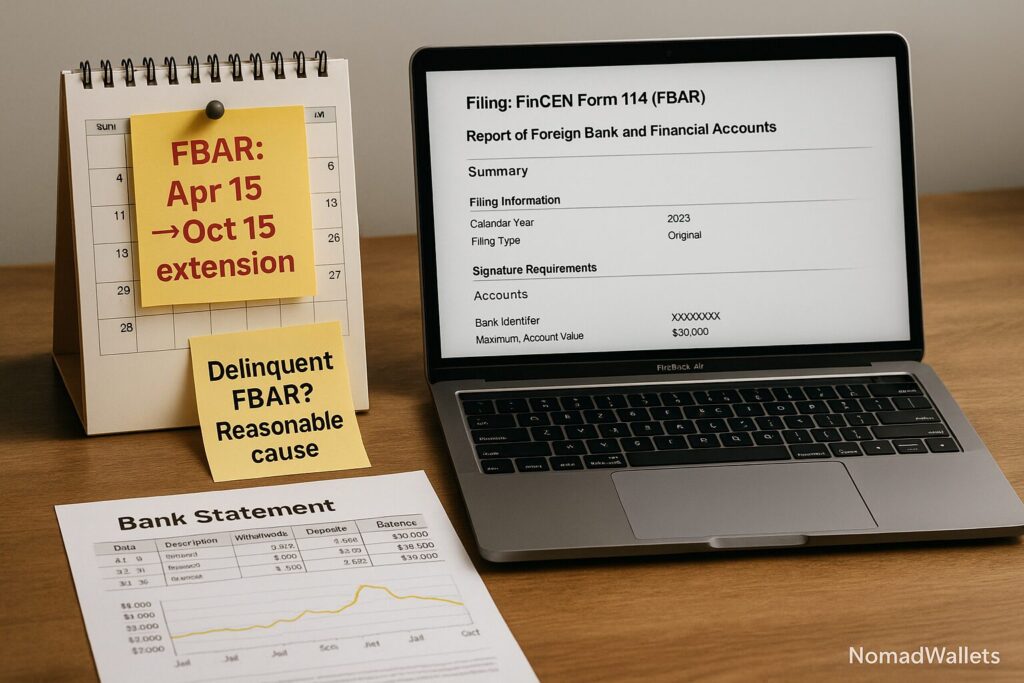

The FBAR Trap

Here’s one that keeps me up at night sometimes. In 2023, I temporarily moved some money to a European account to cover a security deposit and three months of rent upfront. For exactly 11 days, my combined foreign account balances exceeded $10,000.

I almost missed filing the FBAR (Report of Foreign Bank and Financial Accounts). Almost. A quick call to my digital nomad tax accountant caught it just in time. The penalties for willfully not filing FBAR? They can be 50% of the account balance or $12,921, whichever is higher. taxesforexpats

My accountant didn’t just catch the filing requirement—she helped me track the exact dates and amounts to avoid any questions later. “FBAR is one of those things where ‘oops’ can cost you five figures,” she explained. “Better to flag it early.”

Multi-Country Income Chaos

Tom runs a design consultancy and had income from clients in five countries last year. Payments came in euros, pounds, dollars, and Canadian dollars. Some clients paid through platforms, others direct. By tax time, his spreadsheet looked like a foreign exchange trading desk gone wrong.

His digital nomad tax accountant didn’t just sort the currency conversions (using proper IRS exchange rates, not whatever random rate Tom had scribbled down). She also structured his business setup to minimize future complexity and showed him how to track everything monthly instead of scrambling at year-end.

“I was spending 2-3 days every month just trying to organize my finances,” Tom said. “Now it’s maybe 30 minutes, and I actually understand what’s happening with my taxes.”

Real-Life Success Stories

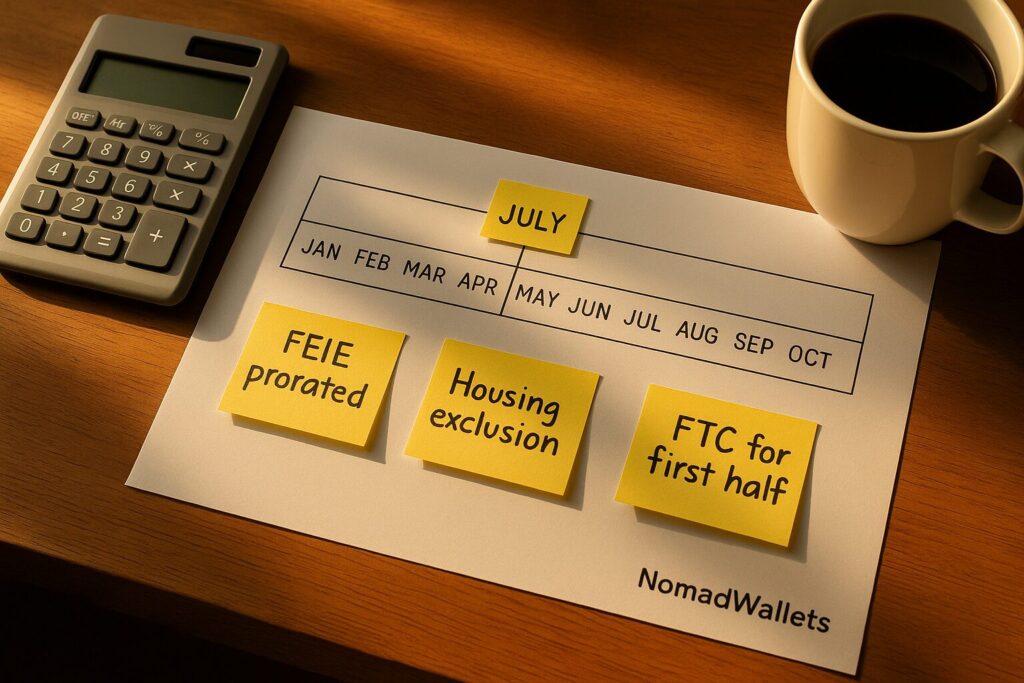

Case Study 1: The Partial-Year FEIE Save

The Situation: Marcus moved from New York to Portugal in July 2024. He started freelancing full-time in September. His tax software calculated his FEIE eligibility from January 1st, giving him a much larger exclusion than he actually qualified for.

The Intervention: His digital nomad tax accountant caught the error during a review. Since Marcus only qualified for FEIE from his move date forward, his exclusion needed to be prorated. But here’s the twist—the accountant also found he could claim the Foreign Tax Credit for his first half of the year when he was still in the U.S. but working for European clients.

The Outcome: Instead of getting a nasty surprise from the IRS later, Marcus got a $1,400 refund he wasn’t expecting. The accountant’s fee? $850. Net gain: $550 plus avoiding potential penalties.

“I thought moving mid-year would complicate everything,” Marcus told me. “Turns out it actually created opportunities I never would’ve found on my own.”

Case Study 2: The State Residency Victory

The Situation: Lisa moved from Virginia to become a nomad but kept her parents’ address for mail and maintained her Virginia voter registration “just in case.” Two years later, Virginia sent her a tax bill claiming she owed state income tax on her entire nomad income.

The Intervention: Her digital nomad tax accountant helped her gather documentation proving she’d established domicile elsewhere (lease agreements from various countries, travel records, even her gym memberships and library cards abroad). More importantly, the accountant knew Virginia’s specific rules and helped craft a response that addressed their exact concerns.

The Outcome: The bill was dismissed completely. Lisa learned to properly document her nomad lifestyle and cut the remaining ties (goodbye, Virginia voter registration). She also got a clear roadmap for maintaining nomad status if Virginia ever questioned it again.

“I was ready to just pay the $2,800 to make it go away,” Lisa said. “My accountant showed me that would’ve been admitting residency and could’ve caused problems for years to come.”

Case Study 3: The FBAR Cleanup

The Situation: Dave realized he’d been required to file FBAR for three years but completely missed it. He had business accounts in the UK and personal accounts in Germany that regularly pushed his combined balances over the $10,000 threshold. He was terrified of the penalties and considering just hoping the IRS wouldn’t notice.

The Intervention: His digital nomad tax accountant walked him through the Delinquent FBAR Submission procedures. Instead of waiting for the IRS to find the missing FBARs, they proactively filed them with a reasonable cause explanation.

The Outcome: Zero penalties. The IRS accepted the reasonable cause explanation (he genuinely didn’t know about FBAR as a new nomad), and Dave was completely caught up. He also learned about other filing requirements he’d been missing and got everything straightened out.

“I thought I was looking at tens of thousands in penalties,” Dave said. “My accountant turned a potential nightmare into just paperwork. Worth every penny.”

How Tax Accountants Handle the Complex Stuff

FEIE Optimization That Software Misses

Most tax software treats FEIE like a checkbox. Qualify? Check yes. Don’t qualify? Check no. But digital nomad tax accountants know it’s way more nuanced.

They’ll run scenarios: What if you use the physical presence test versus bona fide residence? What if you move mid-year? Can you combine FEIE with Foreign Tax Credits for different types of income? Should you elect out of FEIE in a high-tax country year to preserve credits for later?

My accountant once saved me $2,100 by suggesting I delay an FEIE election for one year because I was moving to a higher-tax country and the credits would be more valuable. That kind of multi-year tax planning is worth its weight in gold.

State Tax Strategy

Here’s what most nomads don’t realize: every state has different rules for what constitutes residency. New York looks at your “permanent place of abode.” California cares about your intentions to return. Texas has no income tax but might still want franchise taxes if you have business activities there.

A digital nomad tax accountant who specializes in expats knows these nuances. They can help you cleanly establish domicile in a tax-friendly state before you leave, or guide you through the process of breaking ties with an aggressive state.

More importantly, they know how to document everything properly. It’s not enough to just move—you need a paper trail that proves you moved.

Multi-Jurisdiction Nightmares Made Simple

When you’re earning money across multiple countries, the tax implications get complex fast. Which country has the right to tax what? How do tax treaties affect your situation? What about social security taxes in different countries?

A specialized digital nomad tax accountant doesn’t just file your U.S. return—they understand how it fits into your global tax picture. They can coordinate with local tax advisors in your various countries of residence and make sure you’re not double-paying or missing opportunities for savings.

Finding the Right Digital Nomad Tax Accountant

What to Look For

Not all tax professionals understand nomad life. I learned this the hard way when my first accountant asked me why I didn’t just “pick one country and stay there.” Here’s what to look for:

Expat Specialization: They should regularly work with Americans abroad. Ask about their experience with FEIE, FBAR, and FATCA. If they seem confused by any of these acronyms, keep looking.

Nomad Understanding: The best digital nomad tax accountants get the lifestyle. They understand that your “tax home” might be a concept rather than a place, and they know how to document an itinerant lifestyle for IRS purposes.

Technology-Forward: You’re not going to meet in person, so they better be comfortable with secure document sharing, video calls, and electronic signatures. Bonus points if they’re in a compatible time zone for at least part of the year.

Clear Communication: Tax jargon is confusing enough without language barriers. You want someone who can explain complex concepts in plain English and respond to questions promptly.

Red Flags to Avoid

One-Size-Fits-All Advice: If they immediately recommend the same strategy for every nomad without asking detailed questions about your situation, that’s a problem.

No Questions About State Ties: A good accountant will drill down on your domicile situation because it’s such a common problem area.

Unclear Pricing: You should know upfront what everything costs. Surprise bills kill the value proposition quickly.

No FBAR Experience: This is basic stuff for nomads. If they’re not familiar with FBAR requirements, they’re not the right fit.

The Cost-Benefit Reality Check

What You’ll Actually Pay

Here’s what I’ve seen in terms of pricing for digital nomad tax accountants:

Initial Consultation: $150-400 for an hour-long strategy session. Worth it even if you end up filing yourself.

Standard Expat Return: $800-2,500 depending on complexity. This usually includes federal return with FEIE or Foreign Tax Credits, FBAR filing, and basic consultation.

Add-Ons: State returns add $200-500. FATCA forms (8938) add $100-300. Multiple foreign countries can add $300-800 per country.

Ongoing Support: Many offer packages that include quarterly check-ins, estimated tax guidance, and email support for $1,200-3,000 annually.

What You’ll Actually Save

The returns vary wildly depending on your situation, but here are some real examples from my network:

FEIE vs Credit Optimization: $1,500-8,000 annually is common when someone’s been using the wrong election.

State Tax Prevention: Avoiding one state tax audit or residency dispute easily saves $2,000-10,000 in taxes, penalties, and your own time.

FBAR Penalty Avoidance: Willful FBAR penalties can be $12,921 per account per year. Even non-willful penalties are $2,500 per account.

Business Structure Optimization: Proper S-Corp elections or foreign entity elections can save $3,000-15,000 annually for higher earners.

When the Math Works

Here’s my simple formula: If your potential tax savings or penalty avoidance is more than 3x the accountant’s fee, it’s usually worth it.

But there’s also the peace of mind factor. I sleep better knowing someone who does this for a living has reviewed my return. The cost of anxiety and second-guessing is harder to quantify but very real.

When You Definitely Need Professional Help

Based on watching dozens of nomads navigate these waters, here are the situations where hiring a digital nomad tax accountant is almost always worth it:

First Year Abroad: The transition year is complex, and mistakes are expensive to fix.

State Tax Issues: If there’s any question about residency, get professional help immediately.

Multiple Countries: Once you’re earning in more than two countries, complexity scales quickly.

High Income: If you’re earning over $150,000, the potential savings from optimization usually exceed the cost of professional help.

Prior Year Problems: Missed FBARs, incorrect FEIE elections, or state residency issues need professional remediation.

Business Income: Self-employment across multiple countries requires expertise most nomads don’t have.

Major Life Changes: Getting married, divorced, having kids, or buying property while nomadic creates new tax implications.

Making the Decision

Here’s how I’d approach it if I were starting over:

Year 1: Hire a digital nomad tax accountant for the transition. Consider it education. Learn what they do and why.

Years 2-3: If your situation is stable and straightforward, you might be able to DIY with occasional consultations.

Ongoing: As complexity increases (more countries, higher income, business growth), professional help becomes more valuable.

The key is being honest about your situation’s complexity and your own comfort level with tax law. I know nomads who’ve DIY’d successfully for years, and others who’ve hired help from day one and never regretted it.

Ready to Make the Call?

If you’re reading this while stressed about an upcoming filing deadline, or if any of the scenarios I’ve described sound familiar, it might be time to talk to a digital nomad tax accountant. Most offer initial consultations where they can assess your situation and give you a clear picture of what professional help would look like.

The best ones won’t pressure you into ongoing services if your situation is simple enough to handle yourself. But they’ll also be honest about the risks you’re taking by going solo if your situation is complex.

If you’re not quite ready to book an accountant, start by reading US Digital Nomad Taxes: Comprehensive and Helpful Beginner’s Guide 2025. It’s a solid resource for understanding the basics before you decide whether to DIY or hire help.

Remember, the goal isn’t just to file your taxes—it’s to optimize your global tax situation while staying compliant and reducing stress. Sometimes that means learning to do it yourself. Sometimes it means hiring someone who’s dedicated their career to helping people like us navigate this maze.

Either way, make sure you’re making an informed decision based on your actual situation, not just trying to save a few hundred dollars that could end up costing thousands later.

Frequently Asked Questions (FAQs)

Q1. What does a digital nomad tax accountant do?

A digital nomad tax accountant specializes in managing the unique tax challenges of remote workers who frequently move between countries. They help navigate FEIE claims, Foreign Tax Credit optimization, FBAR reporting, and state tax filings to ensure compliance and maximize savings.

Q2. When should I hire a digital nomad tax accountant?

It’s wise to hire a digital nomad tax accountant if you have multi-country income, state residencies to manage, complex FEIE vs Foreign Tax Credit decisions, or FBAR reporting requirements. Also, if you had mid-year moves, self-employment, or prior missed filings, professional help prevents costly mistakes.

Q3. How much does hiring a digital nomad tax accountant cost?

Costs vary but typically range from $150-$400 for consultations, $600-$1,500 for standard expat returns including FEIE, Foreign Tax Credit, and FBAR, plus additional fees for state returns or FATCA filings. The savings from optimized filing and penalty avoidance often justify the expense.

Q4. Can a digital nomad tax accountant help with FBAR and FATCA filings?

Yes. These professionals guide you through FBAR (FinCEN Form 114) reporting and FATCA (Form 8938) requirements, including handling delinquent filings and penalty mitigations if prior years were missed.

Q5. Do I still need to pay state taxes if I’m living abroad?

Possibly. Many states have residency rules that may require you to file even if living abroad, especially if you maintain ties like a driver’s license, voter registration, or property. A digital nomad tax accountant can assess your state obligations and help plan accordingly.

Q6. How does a tax accountant help with FEIE vs Foreign Tax Credit decisions?

They run detailed scenarios comparing your actual tax paid abroad and income exclusions to find the most tax-efficient path. Some software can only model one at a time, but a professional accountant ensures a full, accurate, and compliant strategy.

Q7. Can a digital nomad tax accountant assist with multi-currency income?

Absolutely. They understand how to translate multiple foreign currencies into IRS-compliant dollar amounts, apply proper exchange rates, and manage the complexities of international reporting.

Q8. Where can I find a trustworthy digital nomad tax accountant?

Look for professionals specializing in expat tax filings with experience on FEIE, FBAR, state tax for nomads, and multi-country coordination. Ask for references, check pricing transparency, and ensure they offer virtual consultations compatible with your time zone.

Looking for a digital nomad tax accountant who understands the complexities of nomad life? Consider reaching out to specialists who regularly work with Americans abroad and understand FEIE, FBAR, state residency, and multi-country tax situations. A consultation could save you thousands and help you sleep better at night.

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.