Man, I still get this sick feeling in my stomach when I think about that morning in Lisbon. You know how some memories just stick with you? Like you can remember exactly what the coffee tasted like, what song was playing, even the way the light was hitting your laptop screen?

I was sitting in this little café near Príncipe Real – Café A Brasileira, if you want to know – and I’d just ordered my third espresso because Portuguese coffee is basically crack and I have zero self-control. The place smelled like burnt coffee beans and pastéis de nata, and I was feeling pretty damn good about life.

My digital nomad LLC setup was humming along, or so I thought. Had three clients paying me good money to sort out their tax mess, just landed this new project that would cover my rent for another month, and hell, I was living in Portugal drinking amazing coffee and pretending to be sophisticated.

Then I opened my email.

“California Franchise Tax Board – IMMEDIATE ACTION REQUIRED”

I swear to God, my heart just stopped. Like completely stopped. You know that feeling when you’re walking down stairs and you miss a step? That awful moment where your stomach drops and you think you might die? That, but worse.

$2,400 in back taxes. Plus penalties that kept growing every day I ignored it. Plus interest. Plus this vague threat about “further collection action” that sounded like they were gonna send some guy named Bruno to break my kneecaps.

For a business I hadn’t operated in California for over two years.

This is the story of how I screwed up my nomad business structure so badly it almost ended everything, cost me $8,000 to fix, and turned me into that annoying guy who won’t shut up about Wyoming LLCs at nomad meetups.

But seriously, if you’re thinking about starting a business while nomadic, or if you already have an LLC but picked your state the same stupid way I did, this might save you from my expensive disaster.

How I Became California’s Tax Target (And Didn’t Even Know It)

So back in 2019 – God, was I really that naive just six years ago? – I was living in San Diego, planning my great escape from America. You know how it is when you first discover the nomad thing. You read about these people living in Thailand for $500 a month and working from beaches and you think “holy crap, I could do that.”

Everyone kept telling me I needed an LLC to look professional. “Clients won’t take you seriously without proper business structure,” they said. “You need liability protection,” they said. “It’s easy, just register in your home state,” they said.

The digital nomad LLC setup advice online was… well, it was garbage. Complete garbage. These generic articles written by people who’d never actually tried to run a business while nomadic. “Choose your home state for simplicity!” they chirped. “Keep it local!” they suggested.

So I did what seemed logical – registered my LLC in California because that’s where I was living. Makes sense, right? I’m here, my mail comes here, I have a California driver’s license. Simple.

Jesus Christ, I was such an idiot.

Here’s what literally nobody tells you about California LLCs, and I mean nobody: they have this thing called a “franchise tax” that’s basically a protection racket. $800 every single year just for the privilege of having your LLC registered in the state. Doesn’t matter if you make ten dollars or ten million – you owe California $800 annually. armenian-lawyer

But wait, it gets so much worse.

California doesn’t give a damn if you leave. They don’t care if you move to Portugal, Thailand, Mars – if your LLC is registered there, they consider you their property forever. Any connection to California – old clients there, income that came from California sources, even just keeping your LLC registration – they’ll hunt you down like a bloodhound.

I learned this sitting in that Lisbon café, reading an email that made me want to throw my laptop into the Tagus River and become a professional surf instructor.

When Everything Falls Apart Simultaneously

You know how disasters always come in waves? Like when your car breaks down, your phone dies, and you get food poisoning all in the same week? That’s what happened after I got that California tax demand.

First thing I discovered: my registered agent was completely useless. I’d gone with some cheap service I found on Google for like $50 a year. They’d been getting official mail from California – tax notices, compliance demands, all sorts of scary legal documents – and just… stuffing them in a file cabinet somewhere. brighttax

No forwarding. No scanning. No “hey Tushar, California is trying to screw you” phone calls. Nothing.

So while I’m bouncing around Europe thinking everything’s fine, California is building this whole case against my business. Late fees compounding daily. Penalties stacking up like Jenga blocks. Interest growing faster than my anxiety levels.

When I tried calling the California Franchise Tax Board from Portugal – and let me tell you, international hold music is the seventh circle of hell – I spent three hours on the phone trying to explain that I hadn’t lived in California for two years.

“Sir,” the representative said in that special tone government employees use when they think you’re lying, “your LLC is registered in California. That creates tax nexus regardless of your physical location.” armenian-lawyer

Remote business registration suddenly became way more complicated than those YouTube videos made it sound.

Then – and this is where I started having actual panic attacks – my business bank account got frozen.

Frozen. As in, can’t access my money. Can’t pay contractors. Can’t pay rent. Can’t buy food. Nothing.

Turns out when you owe money to a state tax authority, they can send notices to banks, and banks panic and freeze first, ask questions later. I had $12,000 sitting in that account – money I’d earned working 60-hour weeks, money I needed to live on, money for a client project I was in the middle of. nomadgate

Gone. Just like that.

Picture this: I’m sitting in Portugal, dealing with California bureaucracy, trying to unfreeze a business account in Kansas (because it was one of those online banks), all while explaining to three different clients why their projects just got delayed indefinitely.

Not exactly the laptop-on-the-beach nomad dream Instagram sells you.

Why Most Digital Nomad LLC Setup Guides Miss the Mark

After my disaster, I started researching LLC for digital nomads more seriously. And you know what I found? Most of the advice online is either written by people who’ve never actually tried to run a business while traveling, or it’s so outdated it might as well be carved on stone tablets.

The biggest lie – and I mean the biggest damn lie – is “just register where you live.”

That might work if you’re planning to stay put forever. But if you’re nomadic? If you’re planning to bounce around the world working from different countries? Your “home state” might be the absolute worst choice for your nomad business structure.

California, New York, Massachusetts – they’re like financial quicksand for nomads. High minimum taxes, aggressive collection policies, compliance requirements that assume you’ll be physically present in the state to handle paperwork.

Miss one filing deadline while you’re in Thailand with bad internet? Boom – hundreds of dollars in penalties. Try to explain that you were trekking in rural Myanmar when their notice arrived? They don’t give a damn.

But here’s the real problem with most digital nomad LLC setup guides: they focus on the easy part – the initial registration – and completely ignore the nightmare of ongoing compliance.

They’ll walk you through picking a business name and filing papers, but they won’t tell you about the things that actually matters:

Annual reports with deadlines that’ll screw you over if you miss them by even one day.

Registered agent services – and holy crap, this matters way more than I realized. Pick some cheap-ass service and you’ll be sitting in Bali while important legal documents pile up in some filing cabinet in Delaware that nobody checks.

Those state tax bastards who will hunt you down internationally. California tax collectors don’t give a damn that you’re living in Portugal – they’ll find you and demand their money.

The virtual address thing that’s way more complicated than anyone tells you. Mess this up and banks won’t work with you, clients think you’re sketchy, and government agencies treat you like a fraud.

Banking gets weird as hell when your business address doesn’t match where you actually are. Try explaining to some banker in Kansas why your Wyoming LLC is being managed from a café in Lisbon.

I learned all this through the expensive-as-hell school of hard knocks while trying to fix my California disaster.

The $8,000 Recovery Operation (Or: How I Spent Four Months in Bureaucratic Hell)

Fixing a bad digital nomad LLC setup is like performing surgery on yourself while running a marathon. Technically possible, but you’re probably gonna mess something up.

First thing I had to do: hire a California tax attorney. Not just any attorney – one who specialized in helping businesses escape California’s tax system. Because apparently that’s a thing. There are lawyers who make their entire living helping people get away from California’s aggressive tax policies. armenian-lawyer

$3,500 just for the consultation and initial paperwork. Thirty-five hundred dollars. That’s more than I spent on rent in three months in Portugal.

This attorney – let’s call him Steve because that was actually his name and forget protecting his privacy, he charged me enough – explained that dissolving a California LLC while owing back taxes is like trying to break up with a psychotic ex-girlfriend. There are specific procedures you have to follow, and if you do it wrong, they can come after you for even more money.

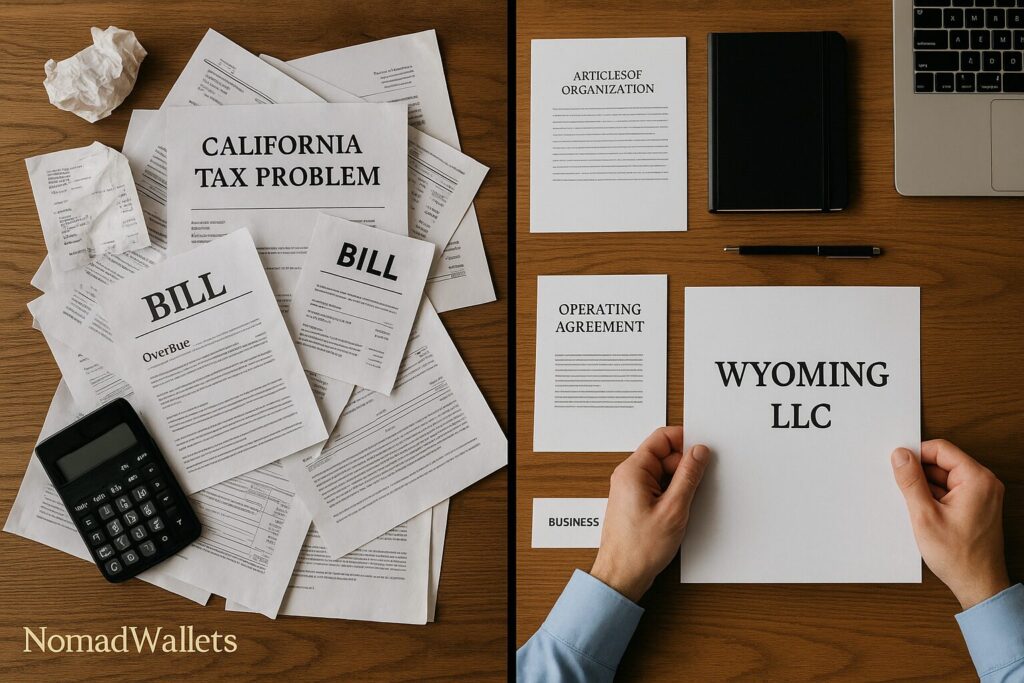

Meanwhile, I needed to set up a new nomad business structure somewhere that wouldn’t try to financially destroy me. Steve recommended Wyoming, Delaware, or Nevada – states that actually understand that businesses exist outside their borders.

I chose Wyoming because it felt like the opposite of California in every way. No state income tax. Low annual fees. Minimal reporting requirements. Business-friendly environment that doesn’t treat entrepreneurs like criminals.

Setting up the Wyoming digital nomad LLC setup was so much simpler it made me want to cry. Wyoming wanted a hundred bucks to file the paperwork. I found a decent registered agent service for about $150 a year – this time one that actually sends me scanned documents when they arrive. And I got a virtual address that forwards my mail and lets me access everything online for another $150 annually.

But transferring my business wasn’t like flipping a switch. I had to:

Open new business bank accounts under the Wyoming LLC. Try explaining to a banker why you need to change your business entity while you’re physically in Portugal. Fun times.

Update every single client contract. Some clients got confused and thought I was trying to scam them with a “new” business entity.

Transfer all my business assets – domain names, trademarks, contracts, everything.

Notify the IRS about the entity change. The IRS loves paperwork almost as much as they love auditing people.

Handle all the US tax obligations for nomads across multiple tax years. Because apparently changing your business structure creates tax complications that ripple forward and backward through time.

Deal with business entity abroad reporting requirements that nobody warned me about.

The whole process took four months. Four months of paperwork, phone calls, legal fees, and general misery. I lost three clients during the transition because they got tired of the confusion and delays.

One client – this e-commerce guy who was paying me $2,500 a month – just said “figure your crap out and call me when you’re ready to work professionally again.” Never heard from him after that.

What I’d Do Differently: Lessons From My $8,000 LLC Mistake

After going through this nightmare and talking to dozens of other nomadic entrepreneurs, here’s what I should have done from the beginning:

Research nomad-friendly states

Wyoming, Delaware, Nevada consistently rank as the best for LLC for digital nomads. Wyoming became my choice because it’s basically the anti-California. No income tax that’ll chase you around the world. Annual fees that won’t bankrupt you. Privacy protections so your personal info doesn’t end up plastered all over government websites. Reporting requirements that a human being can actually handle. And business-friendly courts that understand modern companies. businessanywhere

Stop being cheap about professional services

I upgraded to services actually designed for remote business registration. Northwest Registered Agent handles my documents for $125 a year and actually emails me when something arrives instead of letting it rot in a filing cabinet. Anytime Mailbox gives me a real address for $180 annually and lets me see my mail online 24/7. Mercury Bank was built specifically for online businesses like mine.

Build a compliance system that works when you’re bouncing around time zones

I set up calendar reminders for every filing deadline because missing dates costs money I can’t afford to lose. Everything gets stored in the cloud with backups because I learned the hard way that you can’t rely on having access to physical documents. I track all my international business structure stuff across multiple countries because operating globally creates paperwork obligations most people don’t know about. And I found an accountant who actually understands nomad businesses instead of looking confused every time I mention working from different countries.

The funny thing is, all of this would have cost less than $500 to set up properly from the beginning. Instead, I paid $8,000 to fix my mistakes.

Your Digital Nomad LLC Setup Action Plan (Don’t Be Me)

If you’re starting your nomadic business or you need to fix your current structure like I did, here’s what to actually do:

Before you register anything, research states that won’t financially destroy you. Wyoming, Delaware, Nevada are your friends. California, New York, Massachusetts will destroy you so hard you’ll question your life choices. Don’t register in high-tax states unless you truly plan to operate there permanently and enjoy giving government bureaucrats your hard-earned money.

Stop being cheap about the services that actually matter. Real registered agents cost more than $50 a year, but they’ll save your ass when important legal documents arrive. Virtual addresses that look professional matter more than you think. Some banks and clients won’t work with obvious mail drops.

During registration, pick a business name that doesn’t sound stupid internationally. Don’t use location-specific names that’ll confuse clients when you’re operating from Thailand. Get your EIN immediately after LLC approval because you’ll need it for everything. Open business accounts before you start traveling because banking relationships are way easier to establish when you’re physically in the US.

After registration, create a compliance calendar with every deadline that matters. Missing filing dates costs money you don’t have. Test your mail forwarding system before you need it – make sure you can actually access documents when you’re in rural Guatemala with terrible internet.

Find nomad-specialized tax professionals who understand international business operations, not some local accountant who’s never heard of the Foreign Earned Income Exclusion. Set up your nomad tax planning systems before you start earning serious money because fixing tax problems later is expensive and stressful.

Watch out for red flags that’ll screw you over. Cheap registered agents who don’t notify you when documents arrive will cost you way more than you save. Business addresses that obviously look fake will make banks and clients suspicious.

Don’t ignore how your state registration choice affects your taxes because some states are aggressive about chasing down money from former residents. And don’t assume you can handle legal compliance while traveling without proper systems – that’s how you end up like me, dealing with frozen bank accounts from a café in Portugal.

The Mental Health Cost Nobody Talks About

One thing nobody mentions about digital nomad LLC setup disasters is how they mess with your head. Dealing with tax authorities, legal compliance, and frozen bank accounts while you’re trying to work and travel is incredibly stressful.

I spent weeks in Portugal barely sleeping, constantly worried about what other legal surprises might be lurking in my email. Every notification sound made my heart race. I wasn’t enjoying travel, wasn’t focusing on client work, wasn’t living the nomadic dream – I was just constantly anxious about my business problems.

This is why getting your nomad business structure right from the beginning matters so much. It’s not just about saving money – though the money matters. It’s about peace of mind. When you know your business is properly structured and compliant, you can focus on what actually matters: building your business and enjoying the lifestyle you worked so hard to create.

The Tax Nightmare That Followed

The LLC disaster also taught me about nomad tax planning in the worst possible way. Where you register your LLC affects way more than just your annual fees:

California and other aggressive states will chase you around the world for taxes you didn’t know you owed. I’m still dealing with California bureaucracy years after leaving the state.

Your federal tax options get limited by your state registration choice. Some tax strategies are only available to businesses in certain states.

Operating a US business while living abroad creates reporting requirements that’ll make your head spin. International business structure compliance is way more complex than anyone tells you.

Banking and payment processing gets complicated when your business doesn’t fit traditional models. Some services are only available to businesses in specific states.

Client perceptions matter more than you think. A Wyoming LLC sounds more professional than a Delaware mail drop address.

Working with a tax professional who understands digital nomad LLC setup has saved me thousands annually in legitimate tax strategies that my California disaster prevented me from using.

Operating Your Business Entity Abroad

Running a US LLC while living internationally creates complications that most guides completely ignore:

Portugal has rules about businesses managed from their territory that could have created additional tax headaches for me. Some countries might consider your LLC a local tax resident if you manage it from there.

Banking gets weird when your business address and personal location don’t match across continents. Try explaining to a risk-averse banker why your Wyoming LLC is being managed from various European cafés.

Client contracts need specific language about international operations because some clients get nervous about working with businesses that operate across borders.

Virtual address services become absolutely critical for establishing legitimate US business presence when you’re not physically there.

I now keep detailed documentation proving my LLC’s US management to avoid creating tax obligations in countries where I temporarily live. This requires having solid registered agent and virtual address services that can demonstrate consistent US business operations.

The Tools That Actually Work

After testing dozens of services while fixing my disaster, here are the digital nomad LLC setup tools I actually recommend:

For LLC formation, Northwest Registered Agent handles documents reliably instead of letting them pile up unread. LegalZoom costs more but gets the job done properly for straightforward formations. If your situation is complex, bite the bullet and hire a local attorney.

For virtual services, Anytime Mailbox gives you international mail forwarding that actually works. Mercury and Relay understand nomad-friendly business banking better than traditional banks. Wise handles international payment processing without treating you like a money laundering suspect.

For staying compliant, Google Calendar works across time zones for deadline tracking. Dropbox Business lets you access documents from anywhere with decent internet. QuickBooks Online handles bookkeeping that travels with you.

The key is choosing services designed for remote management instead of trying to force traditional business services to work for nomadic situations.

Lessons Learned: What Really Matters

My expensive digital nomad LLC setup education taught me that successful nomadic business structure isn’t about finding the cheapest options or following generic advice. It’s about building systems that work reliably when you’re thousands of miles away from traditional business support.

The $8,000 I spent fixing my California mistake was the best business education I’ve ever received. It taught me to invest in proper professional services from day one instead of cutting corners. I learned to research state-specific implications before making business decisions that’ll affect me for years. Building compliance systems before you need them is way cheaper than emergency fixes. Traditional business advice often doesn’t apply to nomadic situations, so find advisors who understand international operations.

Most importantly, proper nomad business structure enables freedom rather than limiting it. My Wyoming LLC now handles international operations smoothly, provides solid asset protection, and gives me the professional credibility I need to work with serious clients.

Your Next Steps

If you’re reading this and realizing your current digital nomad LLC setup might have problems, don’t wait until you get your own California Franchise Tax Board email.

This week, check if your current business registration state is going to screw you over long-term. Look up your annual filing requirements and make sure you haven’t missed any deadlines because some states pursue delinquent businesses more aggressively than others. Test whether your registered agent service actually works – try calling them and see if they can find your documents.

This month, talk to someone who understands nomad business structure implications instead of guessing about complex legal stuff. Consider whether your current state registration serves your nomadic goals or just creates problems. Start building proper systems for managing business compliance remotely before you need them.

Before you travel again, make sure you can actually handle your business management from abroad. Test all your systems with crappy international internet. Establish relationships with service providers who understand nomadic operations instead of getting confused every time you call from a different country.

Don’t learn this lesson the expensive way like I did. A few hundred dollars spent on proper digital nomad LLC setup from the beginning beats spending thousands to fix problems later while dealing with frozen bank accounts and angry tax authorities.

The nomadic lifestyle is amazing, but it requires more careful business planning than traditional entrepreneurs need. Get your foundation right, and you can focus on building the location-independent life you’ve always wanted instead of dealing with bureaucratic disasters from poorly chosen business structures.

FAQ: Digital Nomad LLC Setup

Q1: What’s the biggest mistake in digital nomad LLC setup?

A: Registering in high-tax states like California without understanding long-term implications. A proper digital nomad LLC setup should prioritize nomad-friendly states like Wyoming that don’t chase you internationally with $800+ annual fees and aggressive collection policies. businessanywhere

Q2: What’s the complete digital nomad LLC setup process?

A: The entire digital nomad LLC setup can be completed remotely: choose a nomad-friendly state (Wyoming/Delaware), hire a registered agent ($100-300), file articles of organization, obtain EIN, open business banking, and establish compliance systems. Total setup costs typically range $500-1,000. brighttax

Q3: How do I avoid expensive digital nomad LLC setup mistakes?

A: Research state implications before registering, invest in quality registered agent services, establish compliance systems before traveling, and avoid states like California that aggressively pursue international tax obligations. Learning from others’ digital nomad LLC setup disasters can save thousands in legal fees. entity

Q4: Which states are best for digital nomads forming an LLC?

A: Wyoming consistently ranks #1 for nomads due to no state income tax, no franchise tax, strong privacy protections, and annual fees under $100. Delaware offers excellent legal framework but charges higher fees. Nevada provides tax benefits but with more compliance requirements. businessglobalizer

Q5: What ongoing costs should I expect?

A: Annual registered agent fees ($100-300), state annual reports ($0-200 depending on state), virtual address services ($150-300), and professional services for tax compliance. Total annual maintenance typically costs $500-800 for a well-structured setup.

Q6: How does an LLC affect my taxes as a US citizen nomad?

A: LLCs provide pass-through taxation and enable strategies like the Foreign Earned Income Exclusion (up to $130,000 in 2025). You can deduct business expenses and potentially qualify for Section 199A deductions, but US citizens pay taxes on worldwide income regardless of LLC location. savvynomad

Q7: Can non-US citizens form American LLCs?

A: Yes, anyone of legal age can form a US LLC regardless of nationality. Non-US residents typically only pay US taxes on US-source income, potentially creating tax advantages depending on business model and tax treaties. armenian-lawyer

Q8: What happens if I choose the wrong state initially?

A: You’ll need to dissolve the existing LLC and form a new one in a better state, potentially facing dissolution fees, transfer costs, and compliance complications. This process can cost $3,000-8,000+ in legal fees, banking changes, and client contract updates.

Q9: How do I handle compliance while traveling?

A: Invest in digital systems: cloud-based document storage, automated deadline reminders, reliable registered agent services with scanning/forwarding, and banking designed for remote management. Missing filing deadlines costs hundreds in penalties.

Q10: Should I use cheap registered agent services?

A: No – cheap services often fail to properly notify you of important documents, leading to missed deadlines and penalties. Quality registered agents ($125-300 annually) provide document scanning, email notifications, and compliance monitoring that prevent costly disasters.

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.