Introduction

The way we work has fundamentally shifted since 2020, and millions of people now earn their living from anywhere with a decent WiFi connection. But here’s where things get tricky just because you can work remotely, remote work visas vs tourist visas becomes critical here doesn’t mean you’re legally allowed to work from anywhere. One of the biggest misconceptions I see floating around digital nomad communities is the idea that “working remotely on a tourist visa is fine as long as you’re not taking a local job.

Unfortunately, that’s not how immigration law works in most countries, and believing this myth can lead to serious consequences like deportation, fines, or even multi year bans from re entry.

This guide helps you decide which visa between remote work visas vs tourist visas is legally safer based on your work situation. Remote work visas vs tourist visas might sound like a bureaucratic detail, but understanding the difference could be what keeps you legally abroad or gets you escorted to the airport by immigration officers.

According to recent enforcement actions, Indonesian authorities expelled more than 200 foreigners in 2024 for advertising remote work services while on tourist visas, and similar crackdowns happened in Mexico, Thailand, and Portugal. The stakes are real.

In this guide, we’ll break down what remote work visas actually are, how they differ from tourist visas, the legal consequences of getting it wrong, and which countries offer the best options for remote workers in 2025. Whether you’re a freelancer, a corporate remote employee, or someone considering the digital nomad lifestyle, this article will help you make informed, compliant decisions that protect your ability to travel and work internationally.

At a Glance: Remote Work Visas vs Tourist Visas

Key Differences You Need to Know:

✅ Tourist visas prohibit all work – Even remote work for foreign employers is technically illegal on a tourist visa in most countries

✅ Remote work visas authorize legal employment – Specifically designed for digital nomads and remote workers earning foreign income

✅ Duration matters – Tourist visas: 30-90 days | Remote work visas: 6 months-5 years

✅ Getting caught has serious consequences – Deportation, fines up to $2,000+, and multi year entry bans are increasingly common

✅ 70+ countries now offer remote work visas – Income requirements range from $1,000-$4,500/month depending on destination

Bottom line: If you’re working remotely for more than a few weeks, a remote work visa is the legally safe choice.

What Is a Remote Work Visa?

A remote work visa sometimes called a digital nomad visa is a special immigration category designed specifically for people who work remotely for employers or clients outside the country they’re visiting. Unlike traditional work permits that require you to be employed by a local company, remote work visas allow you to legally reside in a country while continuing your foreign-based employment. Think of it as a bridge between being a tourist (who can’t work at all) and being a local worker (who needs employer sponsorship).

These visas emerged as a response to the global shift toward remote work, with countries recognizing they could attract talented professionals, boost local economies, and fill short term housing without creating competition for local jobs. Spain’s Digital Nomad Visa, formally launched in 2023 under its Startup Act, is a perfect example it allows remote workers to reside and work in Spain according to Spain’s official government immigration portal while proving they have remote employment with a qualifying foreign company.

Who Qualifies for a Remote Work Visa?

Generally, you need to fall into one of these categories:

- Remote employees with a contract from a non local employer

- Self employed individuals or freelancers working for international clients

- Business owners running location independent companies

Most remote work visas require proof of stable income, typically ranging from $1,000 to $4,500 per month depending on the country. You’ll also need to show health insurance coverage, a clean criminal record, and in many cases, proof of accommodation.

Here’s what makes remote work visas different from standard digital nomad programs: while the terms are often used interchangeably, some countries distinguish between short term digital nomad permits (usually 6-12 months, non renewable) and longer term remote work residence permits that can lead to permanent residency. For instance, Spain’s remote work visa can extend up to five years and provides access to public services, making it more comprehensive than temporary nomad schemes.

As of 2025, over 70 countries now offer some form of digital nomad or remote work visa, from established programs in Portugal and Estonia to newer options like Turkey’s visa launched in April 2024 for remote workers aged 21–55 from 36 eligible countries.

What Is a Tourist Visa?

A tourist visa is exactly what it sounds like permission to enter a country temporarily for leisure, sightseeing, visiting friends or family, or other non work activities. Tourist visas are nonimmigrant visas designed for temporary stays, and they come with strict restrictions on what you can and cannot do during your visit. The typical validity ranges from 30 to 90 days, though some countries offer longer tourist stays of up to 180 days depending on your nationality and bilateral agreements.

What “Work” Actually Means on a Tourist Visa

Here’s the part that trips people up: tourist visas explicitly prohibit any form of employment or income-generating activity in the host country. This isn’t limited to just taking a local job tourist visas do not entitle the holder to work or engage in any business activities, and continuous stay during each visit typically cannot exceed 90 days.

Immigration authorities interpret work broadly, including:

- Freelance work and commissioned projects

- Unpaid volunteering in some cases

- Working remotely for your foreign employer if you’re generating income while physically present in their country

Countries with Strict Enforcement

Some countries have particularly strict enforcement when it comes to remote work on tourist visas:

- Thailand: Immigration authorities have become stricter in 2025, with increased scrutiny on digital nomads working from cafes without proper visas

- Indonesia: Made global headlines when immigration officers in Bali started checking social media accounts and deporting foreigners who posted about their remote work activities

- Spain and Portugal: Despite being popular nomad destinations, both have increased scrutiny on long term tourists who appear to be working rather than vacationing

Personal observation: When I interviewed digital nomads in Chiang Mai for NomadWallets, several mentioned that Thai immigration officers at the airport specifically asked about their profession and whether they planned to work remotely during their stay. One was denied entry after officers found freelance invoices on his laptop.

The bottom line? If you’re earning income whether from a U.S. employer, freelance clients, or your own business while physically present in another country on a tourist visa, you’re technically in violation of your visa conditions in most jurisdictions.

The table below compares remote work visas vs tourist visas across 9 key factors:

Now that we’ve defined both visa types, let’s get specific about how remote work visas vs tourist visas actually compare in practice. The differences go far beyond just the name they affect everything from how long you can stay to whether you can legally open a bank account or sign a rental lease.

Remote Work Visas vs Tourist Visas: Quick Overview

| Aspect | Tourist Visa | Remote Work Visa |

| Primary Purpose | Tourism, leisure, visiting friends/family | Legal remote employment for foreign employer/clients |

| Typical Duration | 30–90 days (sometimes up to 180 days) | 6 months to 5 years (often renewable) citizenremote+1 |

| Work Permitted | None no income generating activities allowed doj | Remote work for non local employers explicitly allowed deel |

| Income Requirements | None (though proof of funds may be required) | Yes typically $1,000-$4,500/month minimum citizenremote+1 |

| Tax Obligations | Generally none for short stays | May trigger tax residency after 183+ days globalcitizensolutions |

| Renewability | Limited or not renewable in most cases | Often renewable if requirements still met citizenremote |

| Path to Residency | No | Sometimes Spain’s visa counts toward permanent residency jobbatical |

| Family/Dependents | Separate tourist visas usually required | Many programs allow dependents jobbatical |

| Risk Level | High if working remotely | Low fully compliant |

Remote Work Visas vs Tourist Visas: Which is Better?

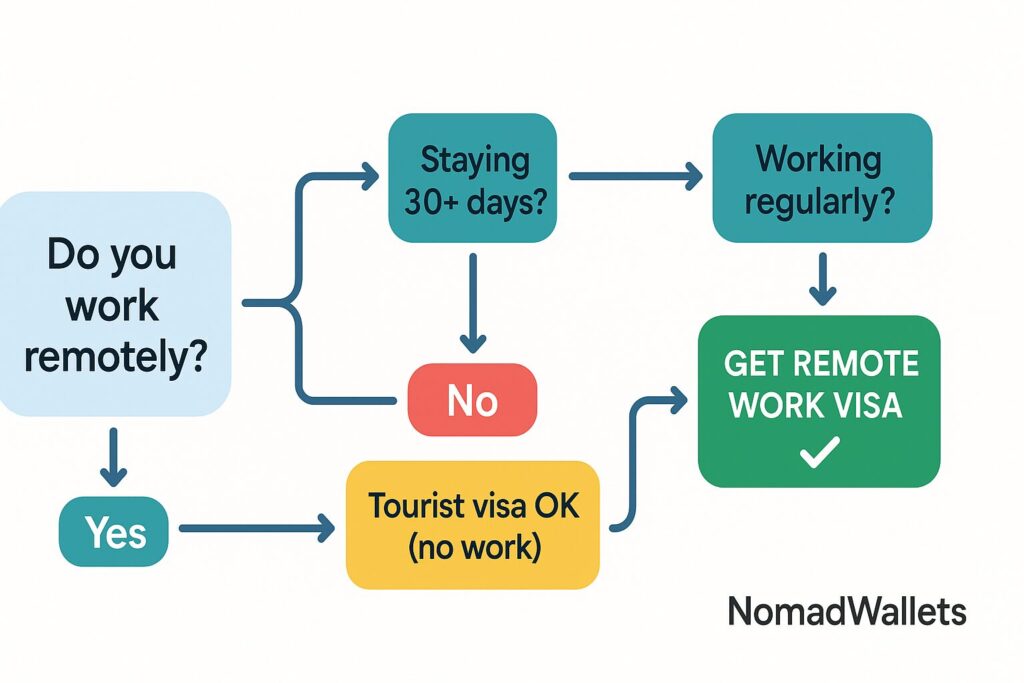

Remote work visas vs tourist visas comes down to legality and time. For any situation where you plan to work remotely and stay more than a few weeks, a remote work visa is almost always better because it provides clear work authorization, longer stays, and fewer legal and tax risks compared to a tourist visa.

Tourist visas are only “better” if you’re truly on a short, non-working vacation and not earning income while in the country.

Quick Decision Guide:

- Working remotely + 30+ days → Remote work visa

- Pure vacation, no income → Tourist visa

- Gray area (occasional emails) → Still risky; remote work visa is safer

Real World Example

Let me give you a real world example to illustrate the difference. Imagine you’re a graphic designer from the U.S. working for clients in New York. You decide to spend three months in Lisbon, Portugal.

If you enter on a standard tourist visa (or visa free tourist entry), you’re legally allowed to explore the city, eat pastel de nata, and visit museums but the moment you open your laptop to finish a client project, you’re technically violating your visa terms, even though your client is in New York and you’re not competing with Portuguese designers.

Now, if you instead apply for Portugal’s digital nomad visa, which allows you to stay for up to one year (renewable), you can legally work on those same client projects while residing in Lisbon.

You’ll need to prove minimum income requirements and have remote employment documentation, but once approved, you’re completely compliant. You can sign a year long apartment lease, register with local authorities, and even access certain public services none of which would be possible on a tourist visa.

Dubai’s Virtual Work Visa works the same way1-year remote work permit with clear income proof vs tourist visa’s 30 day limit. See full details in our Dubai Virtual Work Visa guide.

Legal Consequences of Working on a Tourist Visa

Let’s talk about what actually happens when someone gets caught working remotely on a tourist visa, because the consequences are far more severe than most people realize. Even strong applications get rejected I’ve seen developers with 6 figure incomes denied for missing one document. Learn how to avoid the most common pitfalls in our nomad visa rejection guide. This isn’t just a theoretical risk immigration enforcement has ramped up significantly since 2023, particularly in popular digital nomad destinations.

Immediate Penalties

The most immediate consequence is deportation. If caught working on a tourist visa, authorities can immediately cancel your visa, require you to leave the country, and potentially ban you from re entering for several years. In some jurisdictions, you could face:

- Fines exceeding $2,000 before deportation

- Multi year entry bans (ranging from 3-10 years depending on severity)

- Immigration database flags that get shared internationally

- Work authorization penalties affecting future visa applications globally

Real Case Studies from 2024-2025

Real enforcement actions demonstrate that working on a tourist visa carries genuine risk. Here are documented cases that changed how digital nomads approach visa compliance.

Case Study 1: Indonesia/Bali Mass Deportations (2024)

What Happened:

Over 200 foreigners were expelled from Indonesia after immigration raids in Bali targeted digital nomads working on tourist visas. Officials found evidence including:

- Social media posts advertising freelance services

- Client meetings at coworking spaces like Dojo Bali and Outpost

- Zoom calls overheard in cafes

- LinkedIn profiles listing “Bali-based” work

Consequences:

Immediate deportation with five year entry bans to Indonesia. Some individuals were detained for 48-72 hours before flights.

Why This Matters Legally:

Indonesia’s enforcement demonstrates that authorities now actively monitor digital nomad communities and use social media as evidence. Advertising work activities online while on a tourist visa constitutes proof of unauthorized employment, making deportation straightforward under immigration law.

Case Study 2: Portugal SEF Airport Screening (2023-2024)

What Happened:

Portugal’s immigration service (SEF, now AIMA) began intensive questioning of arriving passengers at Lisbon Portela Airport who showed patterns of extended stays. Border officers specifically targeted individuals with:

- Multiple 90 day Schengen entries within 12 months

- One-way tickets with vague travel plans

- Accommodation booked in popular digital nomad neighborhoods (Alfama, Príncipe Real)

- Luggage suggesting long term residence rather than tourism

Consequences:

Several remote workers were denied entry and sent back on return flights. Others were admitted but flagged for follow up compliance checks.

Why This Matters Legally:

Portugal has an official digital nomad visa program, giving authorities clear legal grounds to distinguish between tourists and remote workers. Immigration officers now actively enforce visa categories, and visa exempt entries don’t protect you from scrutiny when your behavior suggests work rather than tourism.

A NomadWallets community member shared: “I was working from a café in Lisbon on a tourist visa when immigration officers conducted a random check. They asked to see my laptop, found client emails, and I was given 48 hours to leave Portugal. I now have a flag on my Schengen record.”

Case Study 3: Thailand Long Stay Tourist Crackdowns (2025)

What Happened:

Thailand’s immigration authorities intensified enforcement in 2025, particularly targeting “visa run” patterns where tourists repeatedly exit and re enter to reset their 30-day tourist stamps. Officers at airports and land borders began:

- Asking specific questions about employment and income sources

- Checking laptop files and email during device inspections

- Reviewing bank statements for regular foreign deposits suggesting employment

Consequences:

Operating without proper work authorization in Thailand can result in fines and entry bans of up to ten years for prolonged violations under the Alien Working Act.

Why This Matters Legally:

Thailand explicitly treats “online activities for income” as work requiring proper authorization. Even remote work for foreign employers requires a work permit or the new LTR visa under Thai law. Tourist visa exemptions don’t create legal protection for any income-generating activities.

Case Study 4: Spain Social Security Investigation (2024)

What Happened:

Spanish tax authorities (Agencia Tributaria) cross referenced rental contracts in Barcelona and Valencia with immigration records, identifying long term “tourists” who were actually working remotely. Several individuals received:

- Retroactive tax bills for undeclared income

- Fines for working without proper authorization

- Requirements to leave Spain within 30 days

Consequences:

Tax penalties ranging from €3,000–€10,000 plus deportation and Schengen area flags.

Why This Matters Legally:

Spain now has robust data sharing between housing registries, immigration databases, and tax authorities. Signing a long term rental contract while on a tourist visa can trigger automatic compliance reviews, especially in cities with established digital nomad visa programs.

Key Enforcement Trends

These cases reveal three critical enforcement patterns:

- Social media is evidence – Public posts about work, location, or services are admissible proof of unauthorized employment

- Data integration is increasing – Immigration, tax, and housing databases are now interconnected in many countries

- Penalties are escalating – What once resulted in warnings now leads to immediate deportation and multi year bans

The lesson: enforcement is real, consequences are severe, and the risk continues to increase as countries formalize digital nomad visa programs.

Long Term Impact

The impact extends beyond just the country where you get caught. Being flagged for visa violations can jeopardize future travel plans globally, as immigration officers in other countries may view you as a higher risk applicant. If you’re applying for a U.S., Canadian, or UK visa after being deported elsewhere, you’ll need to disclose that violation on your application, which significantly reduces your approval chances.

Common Myths About Remote Work Visas vs Tourist Visas

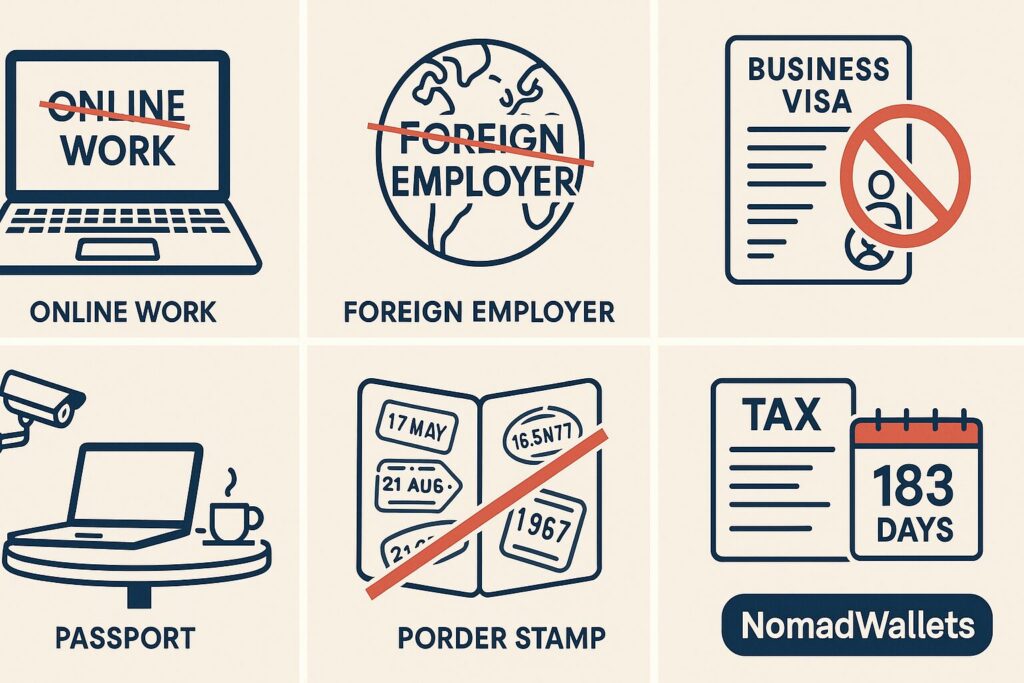

Myth 1: “Online work isn’t real work”

Reality: Immigration authorities treat any income generating activity as work. Remote freelancing, Zoom client calls, and even checking work emails while earning income violate tourist visa terms.

Myth 2: “It’s fine as long as I don’t work for a local employer”

Reality: Tourist visas prohibit all employment regardless of employer location. Your U.S. boss doesn’t protect you legally when you’re physically in Thailand on a tourist visa.

Myth 3: “Business visas allow remote work”

Reality: Business visas are for meetings, conferences, and market research (max 30-90 days). They explicitly prohibit ongoing remote employment or regular client work.

Myth 4: “No one checks what I do on my laptop”

Reality: Immigration can and does inspect devices at borders. Indonesia checked social media during 2024 Bali raids; Portugal screens laptops at Lisbon airport.

Myth 5: “Visa runs make it legal”

Reality: Repeatedly exiting/re entering (Thailand-Cambodia runs) flags you as a work evader. Countries now track patterns across 6-12 months and deny entry.

Myth 6: “Digital nomad visas tax residency”

Reality: Most programs explicitly exempt holders from local income tax for 1-2 years. Tax residency triggers at 183+ days physical presence, not visa type.

Takeaway: These myths lead to real deportations. Use proper remote work visas for legal protection.

Bottom line: the convenience of skipping a visa application isn’t worth the risk of deportation, financial penalties, and long term damage to your ability to travel internationally. The legal pathways exist use them.

Benefits of Getting a Remote Work Visa

Now for the good news remote work visas vs tourist visas isn’t just about avoiding problems; getting the proper visa actually opens up significant advantages that make your location independent lifestyle far more stable and enjoyable.

Legal Peace of Mind

First and most importantly, you get legal clarity. Remote work visas explicitly authorize you to work remotely while residing in the host country, eliminating any ambiguity about whether that client call or freelance project violates your visa terms. You can work openly from cafes, coworking spaces, or your apartment without constantly looking over your shoulder or hiding your laptop screen when someone walks by.

Extended Stay Duration

The duration advantage is massive. While tourist visas typically max out at 90 days, remote work visas generally allow stays of 6 months to 5 years, with many programs offering straightforward renewal processes:

- Costa Rica: up to 2 years (renewable)

- Spain: up to 5 years with permanent residency pathway

- Estonia: 1 year with Schengen Area freedom of movement

Practical Life Benefits

Practical benefits extend beyond just legal work authorization. With a proper remote work visa, you can:

- Sign long term rental agreements (landlords often refuse to rent to tourists)

- Open local bank accounts (many banks require residence permits)

- Register with local healthcare systems

- Access services unavailable to short-term visitors

- Access public services and eventually qualify for permanent residency in countries like Spain

Family Flexibility

Many remote work visa programs explicitly allow dependents spouses, minor children, and in some cases even aging parents to accompany the primary visa holder. Costa Rica’s program allows family members but increases the income requirement to $4,000 per month when bringing dependents.

Tax Clarity

Tax clarity is surprisingly beneficial, even if it sounds counterintuitive. Many digital nomad visa programs explicitly state that visa holders are not considered tax residents during their first year, meaning you won’t face local income tax obligations. Barbados Welcome Stamp holders don’t pay income tax for twelve months, though they still pay 17.5% VAT on purchases.

Community Integration

Finally, there’s the intangible benefit of legitimacy. When you have a proper visa, you can fully integrate into local communities, attend networking events, join professional organizations, and build meaningful connections without constantly explaining your ambiguous tourist status. You’re not just passing through you’re a legitimate temporary resident contributing to the local economy while pursuing your remote career.

Country Examples: Where to Get Remote Work Visas

As of 2025, more than 70 countries offer digital nomad or remote work visa programs, each with its own requirements, benefits, and quirks. Let’s break down some of the most popular and practical options by region.

Europe:

Spain

Processing Time: 1–3 months

Cost: €73–€80 application fee + approximately €1,250 for legal assistance (optional)

Income Requirement: €2,160/month (~$2,340 USD)

The visa allows remote workers to stay up to five years and includes a path toward permanent residency. You’ll need a clean criminal record, valid health insurance, and proof of remote work arrangements. Spain’s program also offers tax benefits with a flat 24% income tax rate instead of standard progressive rates, though this applies for a limited period.

Common rejection reason: One applicant reported their Spain digital nomad visa was initially delayed because they submitted a generic employment letter instead of one explicitly stating they were authorized to work remotely from Spain. Always ensure your employer letter specifically mentions remote work authorization.

Estonia

Processing Time: 15-30 days

Cost: €80-€100

Income Requirement: €3,504 gross/month for past 6 months

Estonia’s Digital Nomad Visa allows you to live and work remotely for up to one year while enjoying free movement within the Schengen Area. Don’t confuse this with Estonia’s e Residency program e Residency allows you to manage an Estonian registered business remotely but doesn’t grant physical residency rights, while the Digital Nomad Visa is specifically for living in Estonia.

Croatia

Processing Time: 30-60 days

Cost: ~€100

Income Requirement: ~$2,700/month

The Mediterranean lifestyle, EU membership, and reasonable cost of living make Croatia increasingly attractive for remote workers.

Latin America:

Costa Rica

Processing Time: 14 days (online application)

Cost: ~$100 application fee

Income Requirement: $3,000/month ($4,000 with family)

The Costa Rica digital nomad visa allows stays of up to two years and processes applications in just 14 days through Costa Rica’s official immigration portal, with the entire application completed online. To renew beyond the first year, you must have spent at least 180 days physically in Costa Rica during that initial period. The visa doesn’t impose local income taxes.

Mexico

Processing Time: 2-4 weeks

Cost: ~$180-$200

Income Requirement: ~$3,200/month

Mexico doesn’t have a specific “digital nomad visa” but offers a Temporary Residence Visa that functions similarly, allowing stays of up to four years. Mexico’s proximity to the U.S., extensive coworking infrastructure, and vibrant expat communities make it a top choice for North American remote workers.

Asia:

Thailand

Processing Time: 7-14 days

Cost: ~$600 for 5 years

Income Requirement: $80,000/year

Thailand recently launched its Long Term Resident (LTR) Visa for remote workers. While the income threshold is high, it offers five year validity and streamlined re entry privileges.

Caribbean & Other Regions:

Barbados

Processing Time: 3-5 business days

Cost: ~$2,000 USD for individuals, ~$3,000 for families

Income Requirement: $50,000/year

The Welcome Stamp is valid for 12 months with renewal possibility. Barbados doesn’t impose income tax on Welcome Stamp holders during their stay, though you’ll pay 17.5% VAT on purchases.

Before choosing your destination, use NomadWallets’ cost of living calculator to compare actual living costs across cities and ensure your remote income will comfortably cover expenses while meeting visa requirements.

Taxes and Financial Obligations

This is where remote work visas vs tourist visas gets genuinely complex, because tax obligations depend on multiple overlapping factors: your visa type, how long you physically stay in a country, where your income originates, and existing tax treaties between nations.

The 183 Day Tax Residency Rule

The foundational concept is tax residency. Most countries apply the 183 day rule if you’re physically present for 183 days or more in a calendar year, you typically become a tax resident and must pay local taxes on worldwide income according to OECD tax residency guidelines.

However, having a remote work visa doesn’t automatically trigger tax residency it’s about your actual physical presence combined with other factors like:

- Maintaining a permanent home address

- Having significant economic ties to the country

- Where your “center of vital interests” is located

Digital Nomad Visa Tax Exemptions

Here’s where it gets interesting: many digital nomad visa programs explicitly structure their terms to avoid triggering immediate tax residency:

- Costa Rica: No local income taxes during your stay, even beyond 183 days

- Barbados: No tax on foreign earned income for twelve months

- Portugal: Special tax regime with reduced rates for certain visa holders

U.S. Citizens and Worldwide Taxation

But there’s a catch you still owe taxes somewhere. If you’re a U.S. citizen, you’re subject to worldwide taxation regardless of where you live or what visa you hold. U.S. digital nomads must report global income and may owe U.S. taxes even while residing abroad on a remote work visa.

The Foreign Earned Income Exclusion (FEIE) can exclude up to $130,000 of foreign earned income for 2025 according to IRS tax code Section 911 if you meet physical presence or bona fide residence tests, but you still need to file returns using Form 2555.

Tax Treaties and Double Taxation

Tax treaties between countries can prevent double taxation. If your home country has a tax treaty with the country where you hold a remote work visa, you may be able to claim foreign tax credits or exemptions to avoid paying taxes twice on the same income.

Practical Tax Advice

The practical advice: maintain detailed records of everywhere you’ve been, how long you stayed, where your income originated, and any taxes paid locally. Use accounting software designed for international remote workers, and consider working with a tax professional who specializes in digital nomad situations. The cost of proper tax compliance is far less than the penalties for getting it wrong.

For comprehensive tax planning resources specifically designed for digital nomads, check out the free downloadable guides at NomadWallets, including tax residency worksheets and compliance checklists.

How to Choose the Right Visa for You

Choosing between remote work visas vs tourist visas or more accurately, choosing which remote work visa program makes the most sense for your situation comes down to evaluating several key factors specific to your circumstances.

Who Should Use Which Visa?

✔ Remote work visa is best for:

- Anyone planning to work remotely for 90+ days

- Digital nomads earning income from foreign employers/clients

- Remote workers seeking long term stability and community integration

- Families traveling together who need dependent visas

- Professionals wanting access to local services and banking

✔ Tourist visa is best for:

- Genuine tourists taking vacation time (no work)

- Short exploratory trips under 30 days to scout locations

- People on sabbatical without income generating activities

- Visiting friends/family without any work obligations

Which Visa Is Safest for Your Situation?

Below is a clear decision table showing the safest visa choice for different types of remote workers. This helps readers instantly understand what applies to them.

| Worker Type | Safest Visa Option | Why This Visa Is Safest | Key Documents Needed |

| Remote Employee (Full-time) | Digital Nomad Visa / Remote Work Visa | Your income comes from a foreign employer, which satisfies most countries’ “no local economic activity” rule. | Employment contract, remote-work confirmation letter, last 3-6 pay stubs. |

| Freelancer / Contractor | Digital Nomad Visa | You earn from foreign clients, which avoids local business classification. | Client contracts, invoices, portfolio, payment history. |

| Business Owner / Solo Founder | Remote Work Visa or Entrepreneur Visa | You can show your business is registered abroad with no local operations. | Business registration, bank statements, company tax filings, revenue proof. |

Quick Guidance

For stays longer than 30-60 days, all three worker types should avoid relying on tourist visas.

Tourist visas are not designed for regular remote work, and many countries now enforce this strictly.

Remote work visas remove 95% of legal risk and give:

- longer stays

- legal working status

- multiple-entry permissions

- predictable renewals

Key Decision Factors

Stay Duration: If you’re planning to stay somewhere for less than 90 days and genuinely want to explore as a tourist without working, a tourist visa works fine. But the moment you need to take client calls, finish projects, or maintain your remote job, you need proper work authorization.

For stays of 3-12 months: Estonia (1 year) or Costa Rica (2 years)

For long-term with permanent residency goals: Spain’s 5-year visa

Income Requirements: Greece requires just $37,000 annually (one of the easiest), while Thailand requires $80,000/year. Match your documented income to programs where you comfortably exceed the threshold by 10-15%.

Cost of Living Alignment: A country might have a low visa income threshold, but if actual living costs exceed what you earn, you’ll struggle financially. Use NomadWallets’ cost of living calculator to compare actual expenses across cities and find locations where your remote income goes furthest while still qualifying for legal residence.

Family Considerations: Costa Rica increases income requirements to $4,000 monthly for families. Spain explicitly accommodates family members with clear dependent visa pathways.

Employer Policies: If you’re a W-2 employee, confirm your company allows international remote work and whether they have country restrictions due to tax or legal compliance concerns.

For U.S. based remote workers navigating these decisions, the NomadWallets Digital Nomad Hub provides comprehensive breakdowns of visa options, tax considerations, and practical relocation logistics.

Practical Tips: Applying for a Remote Work Visa

Once you’ve chosen your target country, the application process for remote work visas follows predictable patterns, though specific requirements vary. Here’s how to maximize your approval chances and avoid common mistakes.

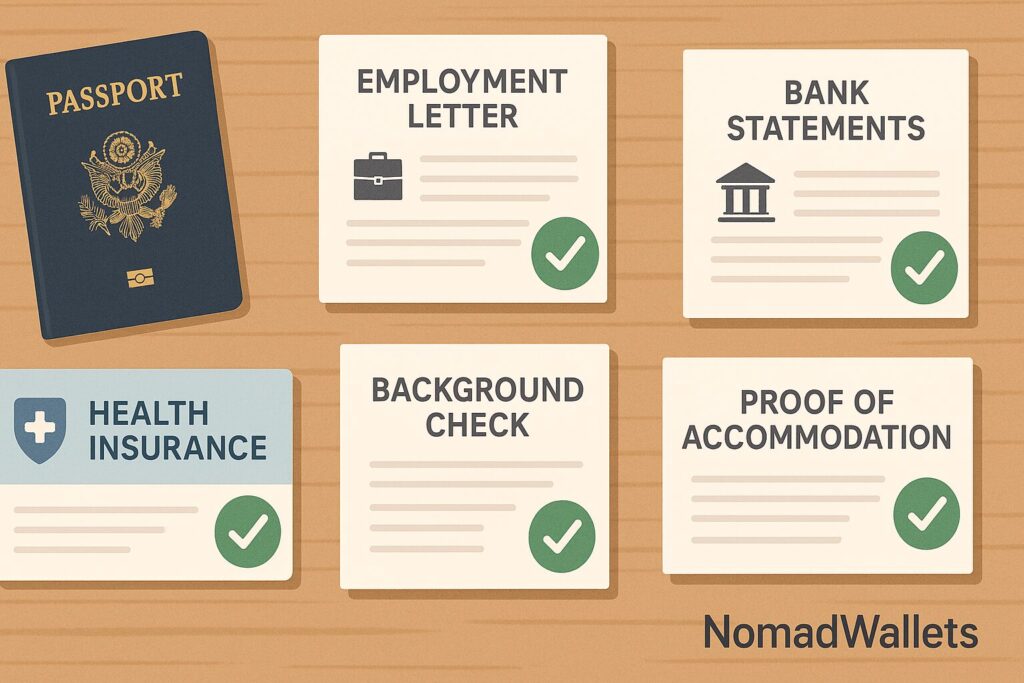

Before Applying: Essential Checklist

Before applying for a remote work visa, verify you have:

✓ Valid passport (6+ months remaining validity)

✓ Proof of remote employment (contracts, client agreements, business ownership docs)

✓ Bank statements (3-6 months showing consistent deposits exceeding minimum income)

✓ Health insurance with international coverage meeting country minimums

✓ Clean criminal background check (apostilled if required)

✓ Proof of accommodation in destination country

✓ All documents translated and certified where required

Document Preparation Strategy

Document preparation is everything. The most frequent visa application mistakes involve incomplete forms and insufficient supporting documentation.

Income proof requires strategy: Don’t just submit random bank statements you need to clearly demonstrate consistent income from foreign sources:

- Freelancers: Provide tax returns, invoices from multiple clients, and signed contracts for ongoing work

- Remote employees: Get official employment letters on company letterhead explicitly stating your position, salary, and that you’re authorized to work remotely internationally

- Business owners: Include incorporation documents, business bank statements, and client contracts

A NomadWallets reader shared: “My first Portugal visa application was rejected because I submitted PDF bank statements downloaded from my online banking. SEF required original stamped statements from the bank. I had to reapply with proper documentation, which delayed my move by two months.”

Common Mistakes to Avoid

Even small errors or inconsistencies can trigger delays or denials:

- Waiting until the last minute – Processing times range from 2 weeks (Costa Rica) to 3+ months (European programs)

- Wrong language/missing translations – All documents must be in the official language or officially translated

- Underestimating income requirements – Always exceed minimum by 10-15%

- Failing to disclose previous visa issues – Immigration systems share data; omissions get flagged

- Inconsistent information – Dates, addresses, and employment details must match across all documents

Processing Times and Costs

Processing times and costs vary widely:

- Costa Rica: ~14 days, ~$100 application fee

- Spain: 1–3 months, €73–€80 + optional legal fees of €1,000–€1,500

- Barbados: 3–5 days, ~$2,000 USD

- Estonia: 15–30 days, €80–€100

Budget both time and money accordingly applying during peak seasons (summer, year end holidays) typically means longer processing.

Consider Professional Assistance

Consider using visa assistance services if the application seems overwhelming or you want to maximize approval chances. Many specialized immigration firms handle digital nomad visa applications for fees ranging from $500-$2,000 depending on complexity.

Post Approval Requirements

Once your visa is approved, you’ll typically need to:

- Register with local authorities within 7–30 days after arrival

- Obtain a local tax identification number (even if you won’t owe taxes)

- Register your accommodation with immigration

- Enroll in approved health insurance if not done pre-arrival

For step by step application guides, downloadable document checklists, and visa timeline planners, access the free resource library at NomadWallets.

Remote Work Visas vs Tourist Visas FAQ (2025)

Q1. Can I work remotely on a tourist visa in 2025?

A. No tourist visas explicitly prohibit all work, including remote work for foreign employers. Enforcement has intensified in 2025 with countries like Thailand, Indonesia, and Portugal actively screening digital nomads at borders and airports. Even “occasional” Zoom calls or freelance emails while on a tourist visa technically violate visa terms and can lead to deportation if discovered.

Q2. What happens if I get caught working on a tourist visa?

A. Immediate consequences include:

1. Visa cancellation and deportation (24-72 hours notice)

2. Fines ranging from $500-$2,000+

3. Entry bans of 3-10 years depending on country

4. Immigration database flags shared internationally, affecting future visas

Real 2024-2025 cases: Indonesia deported 200+ digital nomads from Bali; Portugal denied entry at Lisbon airport after laptop checks.

Q3. Which country has the easiest remote work visa?

A. Greece tops the list for 2025 with:

1. Income requirement: $37,000/year (lowest among EU countries)

2. Processing: 1-2 months

3. Duration: 1 year (renewable)

4. Approval rate: 90%+ for complete applications

Runners up: Costa Rica (14-day processing), Georgia (no minimum income), Barbados (3-5 day approval).

Q4. How long can I stay on a digital nomad visa?

A. Duration varies by country:

1. Short-term (6-12 months): Estonia, Croatia, Greece, Portugal

2. Medium-term (1-2 years): Costa Rica, Mexico, Thailand LTR

3. Long-term (3-5+ years): Spain (path to permanent residency), Malta

Most programs allow renewal if you meet ongoing income and physical presence requirements. Always check specific renewal rules.

Q5. Do remote work visas trigger tax residency?

A. Not automatically tax residency depends on physical presence (typically 183+ days/year), not visa type.

Key distinctions:

1. Many digital nomad visas explicitly exempt holders from local income tax for 1-2 years (Costa Rica, Barbados)

2. 183 day rule still applies stay longer than this and you may become a tax resident regardless of visa

3. U.S. citizens: Worldwide taxation applies regardless of visa or location

Pro tip: Structure stays to avoid 183 day thresholds across multiple countries while maintaining tax non resident status everywhere.

Q6. Can immigration check your laptop for work?

A. Yes, immigration officers have the legal authority to inspect your electronic devices during entry, exit, or visa compliance checks.

While routine inspections of laptops and phones are relatively uncommon, they do occur particularly in countries actively enforcing digital nomad visa requirements. Officers may check:

1. Recent emails and Slack messages

2. Calendar entries showing client meetings

3. Social media posts about work activities

4. Open documents or browser history

Indonesian immigration officers specifically looked for evidence of remote work during their 2024 enforcement actions in Bali, including checking Instagram posts and LinkedIn profiles.

The best protection? Having proper visa authorization so device inspections don’t reveal anything problematic. With a legitimate remote work visa, you can confidently show your work activities because they’re fully legal.

Remote work visas vs tourist visas: Choose compliance over convenience

Understanding the distinction between remote work visas vs tourist visas isn’t just about legal compliance it’s about building a sustainable, stress free location independent lifestyle. Tourist visas serve a specific purpose for genuine short term visits, but they’re not a viable solution for remote workers who want to live and work abroad for extended periods.

In nearly every case where you plan to work remotely longer than a few weeks, a remote work visa is the legally correct choice.

The legal difference is clear: tourist visas prohibit all forms of work including remote employment for foreign companies, while remote work visas explicitly authorize remote employment and provide legal residency for extended periods. With over 70 countries now offering digital nomad and remote work visa programs ranging from $37,000 to $80,000 annual income requirements, there are legitimate pathways available for most income levels and lifestyle preferences.

The Bottom Line

The risks of working on a tourist visa deportation, fines, multi year entry bans, and damaged future visa prospects far outweigh the inconvenience of applying for proper authorization. Meanwhile, the benefits of remote work visas extend beyond just legal compliance:

- Longer stay durations (6 months to 5 years vs. 90 days)

- Ability to sign leases and open bank accounts

- Family visa options for dependents

- Tax clarity and sometimes tax benefits

- Paths to permanent residency in select countries

Take Action

As you plan your digital nomad journey, choose compliance and sustainability over convenience:

- Research programs that match your income level and stay duration needs

- Use NomadWallets’ cost of living comparison tool to evaluate where your income goes furthest

- Explore the comprehensive U.S. Digital Nomad Hub for visa guides and tax planning resources

- Download free checklists and planning templates to organize your application

- Apply early allow 2–4 months for processing in most countries

The future of remote work is global, but it needs to be legal. With the right visa in place, you can focus on what matters exploring new cultures, building your career, and living your location independent dream without constantly looking over your shoulder. Start your research today, choose your destination wisely, and do it the right way from day one.

If you want country-wise remote work visa breakdowns, cost of living comparisons, or practical tax checklists, explore NomadWallets’ free tools. Check the [U.S. Digital Nomad Hub], run numbers with the [cost of living app], and grab the free visa/tax checklists in the [resource library] to plan your move step by step.

Author Note

Research Sources: This guide draws from official government immigration portals (.gov/.gob sites), OECD tax residency guidelines, IRS publications, and verified enforcement cases from Indonesia (2024 Bali deportations), Portugal (SEF/AIMA screening), Thailand (2025 LTR enforcement), and Spain (2024 tax investigations).

NomadWallets tracks global digital nomad visa programs and immigration enforcement trends across 70+ countries.

⚠️ Disclaimer: This guide provides general information about remote work visas and tourist visas globally and is not legal, immigration, or tax advice. Immigration rules, visa requirements, and tax regulations change frequently and vary by nationality and individual circumstances. Always verify current requirements on official government websites or consult with a qualified immigration attorney or tax professional before making decisions. NomadWallets is not responsible for any actions taken based on this information.

Last Updated: December 2025

Immigration rules change frequently. Always verify with official government sources.

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.