If you have a portfolio of investments, rental properties, or consistent dividends, you might be making a €30,000 mistake.

Most digital nomads automatically apply for the D8 (Digital Nomad Visa) because of the name. But if you qualify for the Portugal D7 Visa, you can secure the same residency rights in Portugal for a fraction of the income requirement.

The D8 requires you to earn €3,680/month from active work. The legal minimum income threshold for the Portugal D7 Visa in 2026 is €920/month from passive income.

That is a massive difference. The Portugal D7 Visa is governed under Article 58 of the Portuguese Immigration Law and is intended for foreign residents who can support themselves without relying on employment income.

This guide explains why the Portugal D7 Visa is the “cheat code” for crypto investors, landlords, and FIRE (Financial Independence, Retire Early) advocates, and provides the step by step roadmap to getting approved in 2026.

1. D7 vs. D8: Why Choose the Portugal D7 Visa?

The D7 was originally designed for retirees (often called the “Portugal Retirement Visa“), but don’t let the name fool you. It is open to anyone of any age who can prove they don’t need a job to survive.

The “Passive” vs. “Active” Rule

- The D8 Visa is for Active Income. You trade time for money (salary, freelance clients).

- The Portugal D7 Visa is for Passive Income. Your money earns money (dividends, rent, royalties, interest).

Why the D7 Wins

- Lower Barrier to Entry: You only need 25% of the income required for the D8.

- Safety from Job Loss: If you lose your remote job on a D8, your renewal is at risk. On a Portugal D7 Visa, as long as your investments pay out, you are safe.

- Work Freedom: Once you hold a D7 residency permit, residents generally have the right to engage in professional activity, subject to registration and tax compliance after residency is granted. However, the D7 is strictly assessed as a passive income visa at the application stage.

Comparison Guide: Unsure if you qualify as “Active” or “Passive”? Read our breakdown of the D8 Digital Nomad Visa Requirements to see the other side of the coin regarding the D7 vs D8 visa Portugal debate.

2. The 2026 Income Requirement (How It’s Calculated)

Just like the D8, the Portugal D7 Visa is pegged to the Portuguese National Minimum Wage, which rose to €920 in 2026.

The Magic Number: €920

While the D8 requires 4x the minimum wage, the Portugal D7 Visa requirements only ask for 1x. This threshold is based on the Portuguese National Minimum Wage (RMMG), which was officially increased to €920 as of January 1, 2026, under Decree-Law n.º 139/2025.

- 2025 Requirement: €870

- 2026 Requirement: €920 per month

You must prove this income is recurring, stable, and guaranteed for at least 12 months. This assessment is made at the consulate level based on documentation consistency.

Table 1: D7 Income Requirements (Family Size)

One of the D7’s biggest strengths is how cheap it is to bring family members compared to other EU visas.

| Family Member | % of Min Wage | Additional Monthly Income Required | Total Monthly Income Req. |

| Main Applicant | 100% | €920 | €920 |

| Spouse / Partner | 50% | +€460 | €1,380 |

| First Child | 30% | +€276 | €1,656 |

| Dependent Parent | 50% | +€460 | €1,840 |

Pro Tip (Savings): While not explicitly stated in law, most consulates strongly expect Portugal D7 Visa applicants to demonstrate significant savings, typically equivalent to 12–24 months of the minimum wage, to ensure long-term self-sufficiency. This expectation comes from established consular practice rather than written legislation.

- Recommended Savings: €22,080+ (Single) / €33,120+ (Couple).

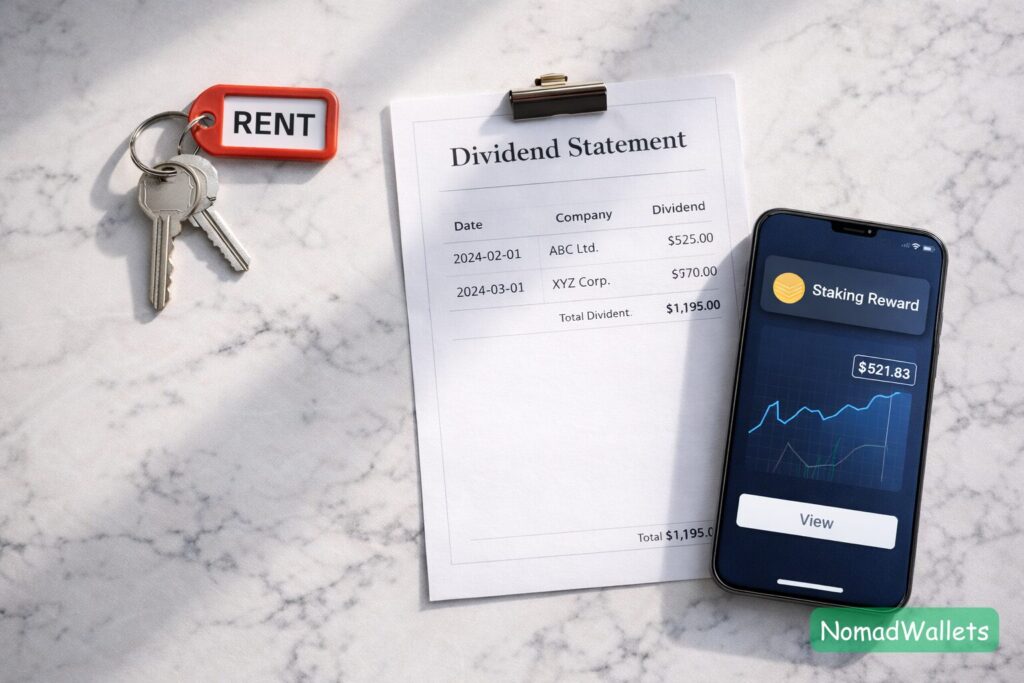

3. What Counts as “Passive Income”?

This is where 50% of applicants fail. You cannot just show a large savings account and get approved for the Portugal D7 Visa. You must show cash flow.

✅ Accepted Income Sources

- Rental Income: A lease agreement showing you receive rent from a property you own (Airbnb income is riskier; long-term leases are preferred).

- Dividends: Payouts from a company you own (or stocks).

- Note for Business Owners: If you pay yourself a “Salary,” apply for the D8. If you pay yourself “Dividends,” apply for the Portugal D7 Visa.

- Pensions: Social Security, 401k distributions, or private pensions.

- Intellectual Property: Royalties from books, music, or patents.

- Interest/Trust Funds: Regular payouts from a trust or high-yield savings.

⚠️ The Crypto Question: Can I use Staking?

In 2026, Portuguese consulates are becoming more tech-savvy, but they remain conservative.

- Sometimes accepted: Verified staking rewards appearing as consistent monthly deposits, depending on the consulate and supporting documentation.

- Rejected: “Trading Profits.” If you sell Bitcoin to pay bills, that is capital gains, not passive income for D7. It is volatile and usually rejected.

- Compliance Note: Final acceptance of crypto-derived income remains discretionary and varies by consulate.

🇺🇸 Special Note for Americans: Using investment income for a visa triggers complex tax reporting (PFIC rules). Before you move to Portugal from the U.S., check our US Digital Nomad Hub for tax optimization strategies.

4. The “Approved” Document Checklist

The paperwork for the Portugal D7 Visa is heavy on financial proof.

A. Personal & Legal

- Passport: Valid for 2+ years.

- NIF (Tax ID): Mandatory.

- Portuguese Bank Account: Commonly required by consulates. Most applicants are expected to deposit a meaningful portion of their savings into a Portuguese bank account prior to the appointment, though exact amounts are not legally defined.

- FBI Background Check (USA): Apostilled by the US Dept of State.

B. The “Passive” Proof

You need a paper trail to meet Portugal D7 Visa requirements.

- For Landlords: Property deed + Rental Contract + Bank statements showing rent deposits.

- For Investors: Statement from your brokerage (Vanguard, Fidelity, etc.) confirming the portfolio value + a letter confirming “Recurring Dividend Payments.”

- For Retirees: Official pension letter stating the monthly amount for life.

C. Accommodation (The Hard Part)

Just like the D8, the Portugal D7 Visa requires a 12-month registered lease or a property deed (Caderneta Predial) if you bought a home.

- Warning: “Hotel bookings” or “Short-term Airbnbs” result in instant rejection for the D7 residency path.

5. Step by Step Application Roadmap

Phase 1: Preparation (Months 1-3)

- Step 1: Get your NIF and open a Portuguese Bank Account.

- Step 2: “Season” your funds. Ensure your passive income lands in your main bank account visibly for 3 months.

- Step 3: Secure housing. (Many Portugal D7 Visa applicants choose to buy property to skip the rental market, but renting is fine).

Phase 2: The Appointment (Month 4)

- Step 4: Book at VFS Global Portugal.

- Step 5: Submit your “Motivation Letter.” Explain clearly: “I have stable income, I do not need to take jobs from Portuguese locals, and I wish to reside in Portugal.”

Phase 3: Residency (Month 6+)

- Step 6: Enter Portugal on your 4-month visa.

- Step 7: Attend your AIMA appointment (usually scheduled automatically).

- Step 8: Receive your Portuguese residency permit (valid for 2 years).

6. Common Pitfalls & Rejection Reasons

1. The “Lump Sum” Mistake Applicants show €50,000 in savings but €0 in monthly income.

- Result: Rejection. The law requires income flow, not just wealth.

2. The “Remote Worker” Trap Applicants mention in their interview: “I manage my rental properties actively” or “I trade stocks daily.”

- Result: The officer may tell you to apply for a D8 or D2 (Entrepreneur) visa instead.

- Fix: Emphasize the passive nature of your income.

3. Inconsistent Deposits Your rental income comes in as cash or irregular dates.

- Result: Doubt.

- Fix: Formalize everything. Make sure deposits match the lease amount exactly and arrive on the same day.

FAQ: D7 Visa 2026

Q1: Can I work remotely for a US company on a D7?

A: Your application should remain fully aligned with the passive income basis of the Portugal D7 Visa. Introducing active employment during assessment may result in the application being redirected to a different visa category. However, once approved, residents have work rights.

Q2: Do I have to pay taxes on my foreign pension?

A: Usually, yes. Portugal residents are taxed on worldwide income. However, the NHR 2.0 / IFICI Regime may offer a flat tax rate of 20% if you qualify, though pensions are treated differently than salaries. (Always consult a tax pro).

Q3: What if I don’t meet the €920 requirement?

A: If you are close, you can bolster your application with massive savings (e.g., €50k+). However, VFS officers have a checklist. If you don’t tick the income box, it is risky.

Q4: How long do I have to stay in Portugal?

A: To keep the Portugal D7 Visa renewable, you must spend 6 consecutive months or 8 non-consecutive months per year in Portugal. It is a residency visa, not a travel visa.

Final Verdict: D7 or D8?

- Choose the D8 if you have a high-salary remote job (€3,680+) and want a straightforward path based on your employment.

- Choose the Portugal D7 Visa if you have investments, real estate, or a pension bringing in €920+. It is cheaper, safer, and offers the same path to European citizenship.

Both visas lead to the same residency rights, renewal structure, and five-year path to permanent residency or citizenship.

Ready to start? The first step for both visas is understanding the tax landscape. You don’t want to move here and lose 48% of your income to the IRS.

Moving to Portugal? Securing your D7 visa is a massive milestone, but it’s just the beginning of the journey. For the full roadmap on finding a home, setting up your NIF, and navigating your first 90 days, head over to our Digital Nomad Portugal 2026 Master Guide.

- Disclaimer: The information provided in this article regarding the Portugal D7 Visa, income thresholds, and immigration requirements is for general informational and educational purposes only and does not constitute legal, financial, or tax advice.

- Immigration rules, minimum wage decrees, and consular practices in Portugal change frequently and may be interpreted differently by individual authorities and VFS offices. While this guide is updated for 2026 based on current government data (including the €920 minimum wage), you should always consult a qualified Portuguese immigration lawyer or licensed advisor before making relocation or application decisions. We accept no liability for actions taken based on this content.

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.