Choosing the Best Digital Nomad Tax Software in 2025: A Guide from Someone Who’s Been There

The first time I had to file U.S. taxes from abroad, I almost gave up. I was in a small apartment in Medellín, Colombia, with a stack of invoices, a half-empty bag of coffee, and a dozen browser tabs open to IRS pages that made no sense. I remember the feeling of dread, the creeping suspicion that I was about to make a very expensive mistake. The whole dream of being a digital nomad—the freedom, the travel—felt fragile, threatened by a bureaucratic monster I didn’t understand.

That night, I learned a crucial lesson: your freedom is only as good as your systems. And for a U.S. citizen working abroad, your most important system is how you handle your taxes. It’s not about finding a magic loophole; it’s about finding the right tools that bring clarity to the chaos. It’s about finding the best digital nomad tax software for you, not for some generic expat profile.

The Lisbon Café Confessional: A Tale of Two Freelancers

Last spring, I was sitting in a café in Lisbon with a friend, another freelance writer named Chloe. It was early April, and we were both in the thick of our tax prep. We’d both been on the road for a few years and had our processes down, but we were comparing notes.

“I almost messed up big time my first year,” she told me, sipping her galão. “I just Googled ‘expat tax software’ and picked the first one. It helped me claim the Foreign Earned Income Exclusion (FEIE), and I thought I was golden. My U.S. tax bill was zero. I celebrated.”

She leaned in. “But the next year, I was living in Spain and actually paying a good chunk of local income tax. The same software pushed me toward the FEIE again out of habit. I almost clicked ‘file,’ but I had this nagging feeling.”

On a whim, she tried a different platform—one that a fellow nomad had recommended. This new tool prompted her to enter the Spanish taxes she’d paid. It then modeled a different scenario using the Foreign Tax Credit (FTC) instead of the FEIE. The result? It not only wiped out her U.S. tax liability but also gave her a few thousand dollars in FTC carryover credits to use in future years.

“My old software would have cost me thousands in future credits,” she said. “It just wasn’t smart enough to see the bigger picture.”

Chloe’s story is incredibly common. The best digital nomad tax software doesn’t just fill out forms. It acts like a good advisor, asking the right questions and showing you the financial consequences of your choices. It understands that for nomads, the FEIE vs. FTC decision isn’t a one-time choice; it’s a strategic calculation that can change every single year depending on where you live and how much local tax you pay.

The FBAR Panic: More Than Just an Acronym

Another friend, a web developer named Ben, learned a different lesson the hard way. He’d been living in Southeast Asia for five years, diligently filing his U.S. taxes and claiming the FEIE. He thought he had it all figured out. Then he got an email from his bank back home. It was a generic notice about foreign account reporting requirements.

Curious, he did some searching and fell down a rabbit hole of FBAR (Report of Foreign Bank and Financial Accounts). He realized that because his combined balances in his Thai and Vietnamese bank accounts had briefly exceeded $10,000, he was supposed to have been filing a separate form—FinCEN Form 114—with the Treasury Department every year. He had missed it for five years straight.

The panic was real. He read horror stories online about $10,000 penalties per account, per year. For a week, he was convinced his life savings were about to be wiped out by a form he’d never even heard of. taxfairnessabroad

Luckily, he found an expat tax service that helped him use the IRS’s streamlined compliance procedures to get caught up without penalties. But the experience taught him a vital lesson: your tax software has to be about more than just the IRS. It needs to handle the whole alphabet soup of expat compliance, especially FBAR and FATCA (Form 8938).

The best digital nomad tax software doesn’t hide these obligations in the fine print; it puts them front and center, asking you about foreign accounts and making the filing process part of its core workflow. When you’re vetting options, this is a non-negotiable feature.

The Ghost of State Taxes Past

One of the most persistent myths in the nomad community is that the moment you get on a plane, you stop owing state taxes. I once met a graphic designer in Mexico City who was shocked to receive a notice from the California Franchise Tax Board. whatmegdidnext

“But I haven’t lived in California for three years!” he told me, completely bewildered.

The problem was, he never formally cut ties. His driver’s license was still from California. He used his parents’ address in San Diego for his bank statements. He was still registered to vote there. In the eyes of the state, he had never truly left. He had to hire a specialist to sort it out, a costly and stressful process.

This is a trap so many of us can fall into. Many expat-focused tax platforms don’t handle state taxes at all, because their core customer has already severed domicile. But for those of us in a gray area, this is a critical gap. The truly best digital nomad tax software will, at the very least, ask you questions to determine if you might still have a state filing obligation.

Some of the more comprehensive tools, like TurboTax or H&R Block’s expat service, can handle state returns, but often lack the nuance of the expat-specific platforms. It’s a trade-off, and one you need to be aware of. Sometimes, the solution is using two tools: one for your federal/expat return, and another for your state return.

So, What Do I Actually Do? My Personal Vetting Process

After years of trial and error, here’s the process I use every winter to choose my tax software for the year. I treat it like a serious business decision, because it is.

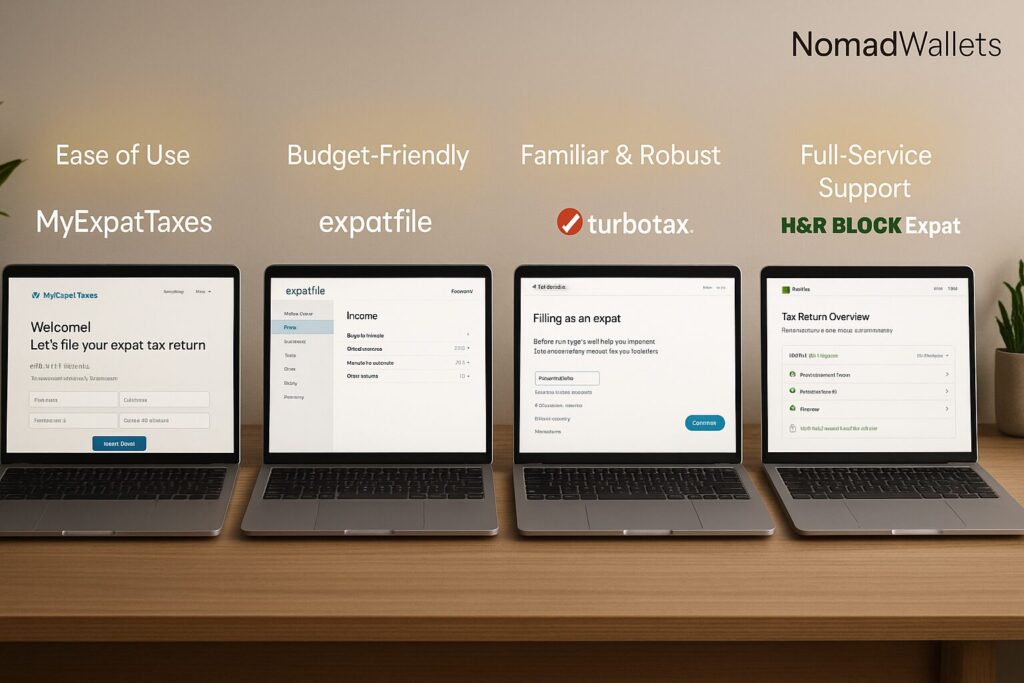

- I Shortlist Two Contenders. I start by reading recent reviews on nomad-focused blogs and forums. I’m looking for platforms that people mention by name in a positive light, especially for situations like mine (self-employed, multiple income streams). My top contenders are usually expat-specific services like MyExpatTaxes or Expatfile, because they are built from the ground up for people like us.

- I Run My Numbers Through Both—for Free. Most platforms let you enter all your information and see the results before you pay to file. I take advantage of this. I spend an afternoon creating accounts on my two top choices. I enter the exact same income and expense data into both.

- I Play the FEIE vs. FTC Game. I run the numbers both ways on each platform. How easy is it to switch between the Foreign Earned Income Exclusion and the Foreign Tax Credit? Does the software clearly show me the bottom-line difference, including any carryover credits? This is where you separate the good from the great. The best digital nomad tax software makes this comparison transparent and easy to understand.

- I Scrutinize the FBAR/FATCA Workflow. I pay close attention to how they handle foreign account reporting. Do they have a dedicated section for it? Is the FBAR filing included in the price, or is it a pricey add-on ? Is the process integrated, or does it just spit out a form and tell you to file it yourself?

- I Pretend I Have a Problem. I’ll dig into their help section or even send a pre-sale question to their support team. Is the information clear? Do I get a response from a real person who seems to understand expat issues? A good support system is worth its weight in gold when you’re in a different time zone and facing a deadline.

After this process, the winner is usually obvious. It’s the platform that gives me the most confidence, the clearest explanations, and the best financial outcome. It’s about empowerment. This process turns tax season from a moment of fear into a moment of control.

Top contenders and where they shine

This snapshot helps you compare the core offerings of each to identify which aligns best with your needs.

| Software | FEIE Support | FTC Support | FBAR Filing | FATCA (8938) | State Returns | Schedule C | Pricing Tiers (Base) | Pro Review Option |

| Expatfile | Yes | Yes | Add-on $59 | Yes | No | Yes | Standard $119 Premier $159 Investor $199 Unlimited $499 | Unlimited tier |

| MyExpatTaxes | Yes | Yes | Add-on $59 | Yes | $139 | Yes | Single plan $169 | N/A |

| TurboTax | Yes | Yes | No | Limited | $39 | Yes | DIY $89 Live Assisted $169 | Live Assisted |

| H&R Block Expat | Yes | Yes | $49 | Yes | $99 | Yes | From $109 | Included via service |

Don’t Trust the Guy at the Hostel

We’ve all met him. The guy at the hostel bar who swears you don’t have to file taxes at all if you use crypto and stay on the move. He’s usually wrong, and his advice is dangerous. The reality of being a U.S. citizen is that our tax obligations follow us wherever we go.

The goal isn’t tax evasion; it’s tax optimization and compliance. It’s about using the rules, like the FEIE and FTC, that were created for us. Doing it right protects the lifestyle we love. It means you can sleep at night, renew your passport without fear, and build a sustainable, long-term life of travel and freedom.

Finding the best digital nomad tax software is your first and most important step in that process. It’s the professional tool that replaces the bad advice from the guy at the bar.

Ready to find your tool? Start by test-driving a couple of the highly-rated expat platforms. Use the free versions to run your own numbers. See which one feels right. The beauty of most tax software today is that you can enter everything, see your results, and compare outcomes before committing to file with any platform.

Don’t rush this decision—take the time to run those FEIE vs FTC scenarios, check how they handle your foreign accounts, and get a feel for their support quality. If you need a helpful primer, consult US Digital Nomad Taxes: Comprehensive and Helpful Beginner’s Guide 2025. Your future self will thank you for doing the homework now. Take control of your taxes, and protect your nomadic dream.

Frequently Asked Questions : (best digital nomad tax software)

Q1. I’m completely new to expat taxes. Should I just hire a CPA instead of using software?

A: I get this question a lot, especially from people who are overwhelmed by all the acronyms (FEIE, FTC, FBAR, FATCA). Here’s my honest take: if your situation is straightforward—you’re earning wages or freelance income, living in one country for most of the year, and don’t have complex investments—the best digital nomad tax software can absolutely handle your needs. It’s also a great way to learn the ropes. However, if you’re dealing with foreign partnerships, complex treaty positions, or you moved countries multiple times during the tax year, a specialized expat CPA might be worth the investment, at least for your first filing.

Q2. Can I really trust software to get the FEIE vs FTC decision right?

A: This is where my friend Chloe’s story from the Lisbon café comes in handy. The software doesn’t make the decision for you—it shows you the numbers for both scenarios. The best digital nomad tax software will clearly display your tax liability under the Foreign Earned Income Exclusion versus the Foreign Tax Credit, including any carryover benefits. You’re still the decision-maker, but you’re making an informed choice instead of a guess. I always recommend running both scenarios before filing, regardless of what you did the previous year.

Q3. What if I forgot to file FBARs for previous years? Am I in serious trouble?

A: Take a deep breath. You’re not alone—this is incredibly common, as my friend Ben discovered. The IRS has streamlined procedures specifically for people in your situation. If you haven’t received any notices and your non-compliance was non-willful (you genuinely didn’t know), you can often get caught up without penalties. Don’t panic and don’t ignore it. Either work with an expat tax professional or use one of the compliance programs. The worst thing you can do is nothing.

Q4. My state is claiming I still owe taxes even though I’ve been traveling for two years. How is this possible?

A: States can be sticky about domicile, as that graphic designer in Mexico City learned the hard way. Physical presence abroad doesn’t automatically break state tax residency. They look at things like where your driver’s license is issued, voter registration, bank address, where you store belongings, and where you maintain professional licenses. Some states (looking at you, California) are particularly aggressive about this. The best digital nomad tax software should at least flag potential state issues, but you might need to take proactive steps to properly establish non-residency.

Q5. Is it worth paying extra for FBAR filing within my tax software?

A: In my experience, yes, especially if you’re not comfortable with the FinCEN portal. The FBAR has different filing requirements and deadlines than your tax return, and it’s easy to miss if you’re handling it separately. Most expat tax platforms charge between $49-$79 for FBAR preparation and filing. When you consider that FBAR penalties can be $10,000 per account for non-willful violations, the software fee is pretty reasonable insurance.

Q6. Can I switch tax software mid-year if I’m not happy with my choice?

A: Absolutely. Most platforms let you enter all your information before you pay to file, so you can test-drive multiple options. I’ve done this myself when my situation changed mid-year. The key is to start early enough in tax season that you have time to switch if needed. Don’t wait until April 14th to discover your software can’t handle your particular situation.

Q7. What’s the deal with cryptocurrency? Do I need special software for that?

A: Crypto adds complexity, no doubt about it. You’ll need to report it properly, and the IRS is paying more attention to crypto compliance these days. Some expat tax platforms have added crypto modules, while others haven’t caught up yet. If crypto is a significant part of your income or if you’re actively trading, make sure your chosen platform can handle it properly. And definitely don’t listen to the guy at the hostel who says crypto makes you invisible to the IRS—that’s not how any of this works.

Q8. I live in a country with a tax treaty with the U.S. Does that change which software I should use?

A: Tax treaties can provide benefits, but they also add complexity. Treaties might affect which income is taxable where, and some require additional forms (like Form 8833). Not all software handles treaty positions well. If you’re claiming treaty benefits, make sure your chosen platform supports the relevant forms, or consider getting professional help for at least your first filing under the treaty.

Q9. How do I know if my chosen software is actually the best digital nomad tax software for my situation?

A: Here’s my test: after you’ve entered all your information but before you file, can you clearly explain to a friend why the software chose FEIE or FTC for your situation? Do you understand what forms are being filed and why? If the software feels like a black box, it’s probably not the right choice. The best tools educate you as they work, so you understand your own tax situation better by the end of the process.

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.