₹21,912. That’s how much less my parents got because I was too lazy to spend ten minutes researching money transfers.

Still bothers me honestly.

First year as a full-time nomad. I’m bouncing between Bangkok and Hanoi actually went back to Bangkok twice because I completely screwed up my Vietnam visa extension, whole different story and every month I’m sending $1,000 home to my parents. Using Western Union because that’s what my dad used. That was it. That was my entire decision-making process.

Zero research. Just “dad uses it so it’s probably fine.”

My mom keeps mentioning the amounts seem low though. Like she’d say “we got 82,500 rupees” and I’m thinking wait, shouldn’t that be more? But I’d just assume maybe their bank was charging fees or something. Never actually checked what exchange rate I was getting.

March 2020 happens. Pandemic. Stuck in this hostel in Chiang Mai with wifi that barely works. Bored out of my mind. So I make a spreadsheet because apparently that’s what I do when bored instead of like, watching Netflix and I calculate what I actually spent on transfers that whole year.

Fees. Exchange rate losses. Everything.

$400. Over four hundred dollars just gone.

I legitimately felt sick looking at that number. And my parents got ₹21,912 less than they should have. That’s their electricity for like half a year.

So I got kind of obsessed after that. Started testing literally every service. Wise, Remitly, Western Union, some random ones I found on Reddit that I don’t even remember names of now. Giant spreadsheets tracking fees, exchange rates, how long things actually took versus what they promised.

My girlfriend Sarah at the time thought I’d completely lost it. “You’re spending your entire Saturday on this?” Yes Sarah, yes I am, because I just lit four hundred dollars on fire for no reason.

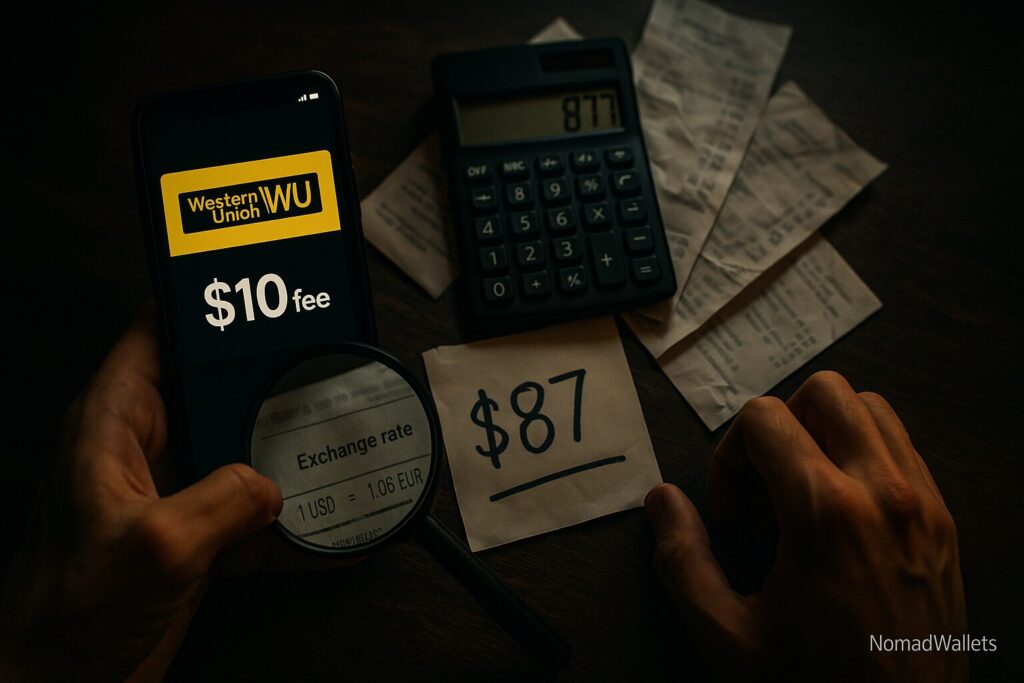

Here’s the thing nobody explains about finding the best money transfer service for digital nomads and I mean nobody, not the services themselves, not the comparison sites, nobody that fee they show you in giant letters? Almost never your real cost.

The exchange rate markup is where they actually get you.

Most people never check it. I didn’t check it for a whole year. Services make it really hard to find too. You have to click through like four screens to see the actual rate they’re giving you versus the real market rate.

Everything I’m about to explain comes from doing this wrong maybe two hundred times. Probably more honestly, I stopped counting. Some transfers worked great. Some were complete disasters.

Bangkok, 2022. I paid Western Union $89 for a transfer. Same exact transfer on Wise would’ve cost $42. Still mad about that one.

Whether you’re supporting family like me, paying contractors overseas, managing freelance income in multiple currencies, or planning some big purchase abroad understanding how cross-border payments actually work saves you real money. Not like $20. Like hundreds or thousands depending on how much you transfer.

One of my readers emailed last year saying he switched from Western Union to Wise after reading my stuff. Saved $1,247 his first year just on regular family transfers. That’s not nothing.

No service is perfect though. What works for my regular $1,000 monthly transfers is terrible if you need $500 cash in Bali in two hours because your wallet got stolen. Which happened to me in 2021 by the way. Terrible day. Do not recommend.

After doing this maybe two hundred times I counted once, got to 187, then stopped counting here’s the pattern: Wise wins on total cost for regular transfers. Not even close on the math. Remitly wins when you actually need speed and you’re willing to pay for it. Western Union wins when your recipient is somewhere really remote or needs physical cash because no bank account.

Most digital nomads though? We’re in that first category. Regular transfers. Family support, contractor payments, moving our own money around. For that probably 85% of cases Wise beats everything on pure numbers.

The exchange rate thing is what cost me the most.

Everyone looks at fees. Just fees. You see “$0 TRANSFER FEE” everywhere and think great, free transfer. Wrong.

Exchange rate markup is usually way bigger. Sometimes like five times bigger than the actual fee. But they hide it really well.

Okay so. Mid market rate also called interbank rate, same thing is the REAL exchange rate. Google “USD to EUR” right now. That number you see? That’s it. Or XE.com shows the same number. It’s what banks use when they trade currencies with each other.

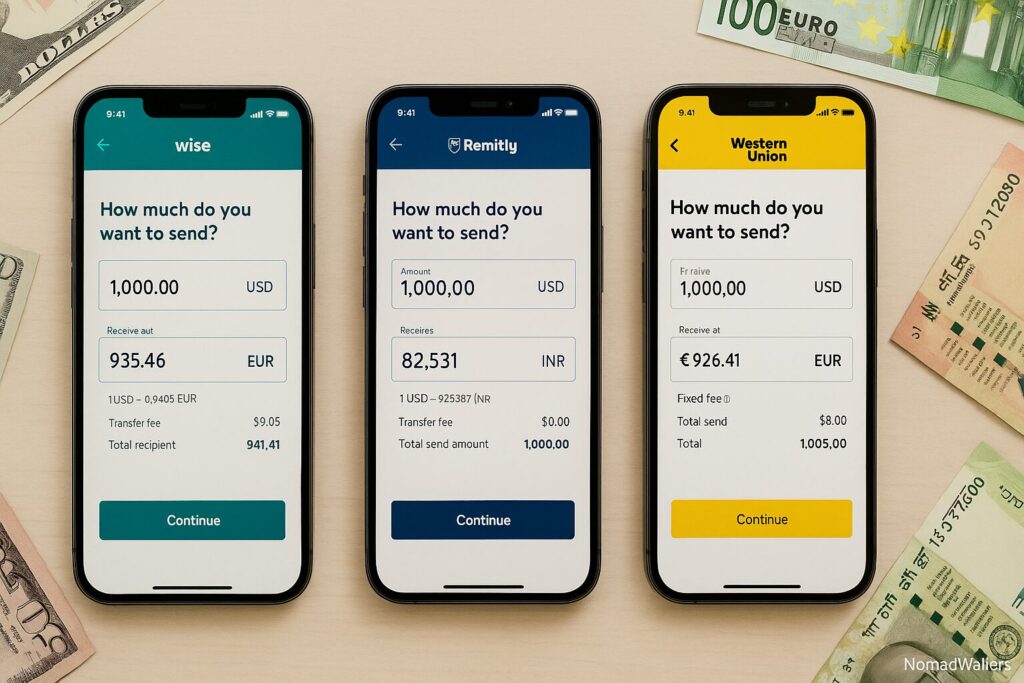

Wise uses mid market rate. No markup at all. Zero. What you see on XE.com is what Wise gives you. They make money from transparent fees usually 1.4% to 1.8% shown upfront. That’s the whole deal.

Everyone else adds extra on top. Remitly adds 0.4% to 1.4% for Economy, 1.5% to 3% for Express. Western Union adds 1% to 4% depending on lots of things which currencies, how you pay, how they receive it.

And they make it super hard to find. Buried in details nobody reads.

Real example. October, last month. I sent $10,000 to my family. Checked all three services because that’s literally my job now.

Wise: ₹83.56 per dollar. I checked XE.com exact mid market rate. Fee $136, shown upfront. Family gets ₹8,24,238. Cost me $136.

Remitly Economy: ₹82.40 per dollar. That’s ₹1.16 less than real rate. But their website says “$0 TRANSFER FEE” with actual confetti animations I’m not joking. Family would get ₹8,24,000. That ₹1.16 markup across ten thousand dollars means they lose ₹11,600 which is $138.80 real cost. Their “$0 fee” cost MORE than Wise’s honest fee.

Wild right?

Western Union: ₹81.10 per dollar. ₹2.46 less than mid-market. Plus $10 fee on top. Family gets ₹8,11,000. Exchange markup alone costs ₹24,600 = $294.40. Plus $10 fee = $304.40 total.

Their “$10 fee” looked cheap. Real cost $304.40. That’s not cheap. That’s the most expensive option by like $168.

See the problem?

Not illegal. Just super misleading. Giant “$0 FEE” grabs attention while real cost hides in exchange rate fine print nobody checks.

I didn’t check for two years.

Now I always ALWAYS open XE.com before any transfer. Takes thirty seconds. Check real rate, compare to what service offers, quick math. Saved me maybe $700 last couple years.

That’s rent for a month in most Southeast Asia. Or a flight home. Or just staying in my pocket instead of corporate profits.

Financial advisors say always check exchange rates separately from fees when looking for cheapest way to send money internationally. Because lowest advertised fee almost never equals lowest total cost.

Almost never.

This is one of those financial mistakes that cost way more than it should. If you’re figuring out the digital nomad lifestyle, the US Digital Nomad Hub has guides on taxes, banking, insurance all the financial stuff nobody warns you about.

QUICK COST COMPARISON

Let me show you actual numbers here because this makes it way clearer.

Here’s what sending $3,000 to India actually costs with each service:

| Service | Advertised Fee | Exchange Rate | Recipient Gets | Real Total Cost |

| Wise | $42.50 | ₹83.56 (real) | ₹2,50,680 | $42.50 |

| Remitly Economy | $0 | ₹82.40 | ₹2,47,200 | $41.65 (hidden) |

| Remitly Express | $3.99 | ₹80.85 | ₹2,42,550 | $101.26 |

| Western Union | $10 | ₹81.10 | ₹2,43,300 | $87.40 |

See what I mean? Remitly’s “$0 fee” actually costs $41.65 hidden in the exchange rate. Western Union’s “$10 fee” actually costs $87.40 total.

Wise : All The Times I’ve Used It and Why

Okay so looking at my Wise account right now while I’m writing this. Shows 187 transfers. But that’s definitely wrong because I scroll down and there’s way more. Maybe 200? Maybe more than 200. I stopped counting after a while.

Most of them going to India. My parents mostly. Usually $1,000 monthly. Sometimes $1,500 if something came up like medical stuff or house repairs or whatever.

The fee thing still confuses me sometimes even after five years using this. They change based on your transfer amount which makes sense mathematically but my brain doesn’t always process it right.

Like I did a $500 transfer last week. Fee was $8.82. I calculated that’s 1.76% of $500.

Then two weeks ago sent $3,000. Fee was $42.50. That’s only 1.42% even though dollar amount is higher.

Same exact service. Same corridors. Just different percentage because amount is bigger. Took me like six months to understand why sometimes I felt like I was paying more percentage and sometimes less.

It’s because bigger transfers get better percentage rates. The actual dollar fee goes up but percentage goes down.

Math.

That $10,000 transfer I keep mentioning the one to my parents in October fee was $136. I remember sitting there staring at that number for like five minutes before hitting confirm.

$136 just feels like so much money. Even though I know percentage-wise it’s only 1.36% which is actually really good for a $10,000 international money transfer. My brain just sees the number $136 and goes “that’s expensive”.

But then I made myself remember Western Union would’ve charged me maybe $10-20 fee but then hidden like $280 in exchange rate markup. Total cost $300. So $136 is actually cheap in comparison.

Still looked expensive at the time though. Numbers are weird.

Hit confirm anyway. Needed to get money to them.

Next day I check and it says “under review” and I completely panicked. Like full panic mode. $10,000 just sitting there in limbo. Not in my account anymore but not in their account yet.

Called my parents immediately. Told them don’t expect the money yet there’s delays. They’re asking what happened and I’m making up excuses about “bank processing times” when really it was just Wise doing their compliance check on my ID.

I didn’t want to say “the money transfer company is investigating me” because that sounds bad even though it’s normal.

About two hours later I was refreshing the app like every five minutes support messaged me through the app. They needed government issued ID and proof of address for verification. Anti money laundering stuff I guess.

Took photos of my passport and a utility bill. Sent it through. Four hours after that got notification it was approved and money went through same day.

Whole thing was maybe eight hours total from “under review” to “completed” but it felt like forever when you’re sitting there watching $10,000 in limbo.

This actually happened to me once before too. I think it was 2022? Or maybe 2023. Can’t remember exactly. Same thing where they needed ID verification. Cleared pretty fast that time too.

At least Wise tells you what’s happening. I used another service once not gonna name them but not one of the big three where my transfer just said “processing” for four days with zero explanation. Called support and they said “we’re investigating” and wouldn’t tell me anything else. Never got my money back. Had to dispute with my bank. Whole mess.

So even when Wise holds something at least they communicate what they need and why.

The multi-currency account feature is honestly the main reason I even signed up for Wise in the first place back in 2020.

Had this US client who wanted to pay me $5,000 for a three month project. They wanted to do international wire transfer. My US bank at the time won’t name them but one of the big ones would’ve charged them probably $45 outgoing fee. Then I’d receive it but they’d give me a terrible exchange rate. Probably 3-4% markup. I’d lose maybe $200-250 total on the exchange rate alone plus whatever my bank charged incoming.

Did the math and realized I’d get maybe $4,750 out of their $5,000 payment. That’s $250 gone just in fees and bad rates.

Instead I opened a Wise USD account. Gave the client those account details. From their perspective they were just doing a domestic US transfer to another US account. ACH transfer. Free for them. Fast for them. Easy for them.

I received the full $5,000 in my Wise USD balance. Then when I needed to send money to India I paid Wise’s fee which was like $68 or something. My parents got $4,932 in rupees.

Same $5,000 payment from client. Bank route would’ve gotten me $4,750. Wise route got me $4,932. That’s $182 difference.

Almost $200 more just from using a better service.

That’s like two months rent in Chiang Mai at the time. Or a flight home.

After that I switched basically everything to Wise for cross border payments. Now most of my US clients pay my Wise USD account. European clients pay my EUR account. UK clients pay GBP account. Everyone’s doing domestic transfers on their end which is cheap and easy for them. I’m receiving the money with no incoming fees. Then I can hold it in those currencies or convert when rates are good or spend it directly with the Wise card.

Works way better than the old system of everyone doing expensive international wires.

The Wise debit card is actually pretty good too. I use it basically everywhere now in Thailand. Sometimes when I’m in Bali. Tried it once in Vietnam but Vietnamese ATMs are weird and kept rejecting it for some reason.

Hanoi 2021 I pulled out $100 from an ATM. The ATM itself charged me $3.50 as their fee that’s the ATM owner’s fee not Wise. But then Wise reimbursed that $3.50 automatically without me even asking. Just showed up as a credit in my account.

If you do that every month for a year that’s like $42 saved just from ATM fee reimbursements.

Plus there’s no foreign transaction fees when you spend with the card. I’m at 7 Eleven in Bangkok buying something for 450 baht the card just works. Uses the real mid market exchange rate. No 3% markup or whatever banks charge.

My old bank the US one I don’t use anymore charged 3% on every single foreign transaction. Every coffee, every meal, every 7 Eleven purchase. 3% gone. That adds up so fast when you’re living abroad and buying stuff every day.

Price alerts are another feature I use that’s actually saved me real money. Set it once and forget about it until it hits.

January 2024 I had €10,000 sitting in my EUR balance. Knew I’d need to convert it to USD eventually but the exchange rate at the time was bad. Like 1.08 or something. I wanted to wait for it to get better.

Set a price alert in the Wise app for 1.10. Then completely forgot about it. Went on with my life.

Three days later I’m in Bangkok sleeping and my phone buzzes at like 3am. Price alert notification. Rate hit 1.104. I’m half asleep but I opened the app and converted the whole €10,000 right then.

Got $11,040 instead of the $10,800 I would’ve gotten at 1.08.

That’s $240 difference just from waiting three days and setting an automated alert.

Then I set another alert for 1.12 thinking maybe it’ll keep going up. Still waiting on that one. Might never hit who knows. But if it does I’ll get the notification and can convert then.

Auto transfer feature I tried exactly once. April 2024. Thought I’d be smart and automate my monthly $1,000 payment to my parents. Set it up to send automatically on the 5th of every month.

First month worked perfectly fine. Money went through automatically. Great.

Second month I completely forgot I’d set up the auto transfer and I also manually initiated a $1,000 transfer because that’s my normal routine. So $2,000 went out. One auto and one manual.

Had to cancel one of them which took two days and caused a bunch of confusion with my parents who saw money coming in stages.

Turned off the auto transfer feature after that. I know it defeats the whole purpose of having automatic transfers but I just like having manual control over when money moves. Even if it means I have to remember to do it myself every month.

Old habits I guess.

Okay so when do I NOT use Wise for international money transfer?

Speed emergencies. Real emergencies not fake ones.

Bali 2021 my wallet got stolen. Phone, cards, cash, everything. My friend needed to lend me $500 but needed it in cash like within the next hour or two because I had to pay for accommodation and the place only took cash.

Wise can’t do that. Even their fastest transfers take at minimum a few hours and usually a day or two. Can’t get someone physical cash in an hour through Wise.

Used Remitly Express instead. Paid way more. Think I lost like $15 on the exchange rate markup. But my friend was able to pick up cash at a local agent within 20 minutes.

Definitely worth paying extra for a genuine emergency situation.

Another situation family member in rural India needed money and they don’t have a bank account. No smartphone either. Just need physical cash.

Only way to get them cash is Western Union with their cash pickup service. They have agents everywhere including tiny villages.

Paid the $10 fee plus Western Union’s exchange rate markup which was bad. But they were able to walk to the local Western Union agent and pick up physical cash same day.

Sometimes you just need cash pickup and there’s no other option that reaches remote areas.

Very small amounts are dumb to send through Wise. The fees don’t make sense percentage-wise.

Sent $30 once to test a new recipient or something I can’t remember why. Fee was $4. That’s like 13.3% which is terrible.

Should’ve just used PayPal or Venmo or something for amounts that small.

Also some countries Wise just doesn’t support. Tried sending money to Uzbekistan once for a contractor. Wise doesn’t cover that corridor. Had to use traditional bank wire instead. $45 fee plus 3% exchange rate markup from my bank. Painful but only option.

But yeah for like 90% of the international money transfer stuff I do and I do a lot because of supporting family monthly plus paying contractors plus moving my own money between countries Wise is what I use now.

Saves me probably $80-100 every single month compared to what I used to pay with Western Union and bank wires back in 2019-2020.

That’s $960 to $1,200 per year in savings. Which is basically a month of living expenses in Thailand. Or two round-trip flights home to visit family.

Real money that stays in my pocket instead of going to banks and remittance services as profit.

I still have this habit though where I check XE.com in another browser tab before confirming any Wise transfer. Takes literally 30 seconds. Just to verify I’m actually getting the mid market exchange rate they claim.

Every single time it matches. They really do use the real rate with zero markup.

For regular cross border payments and remittance services that digital nomads actually do on a regular basis supporting family back home, paying international contractors, moving your own money between countries for tax or investment purposes Wise is usually the best option and the cheapest way to send money internationally.

Not for every single situation. Emergency speed situations no. Cash pickup situations no. Weird unsupported countries no. Very tiny amounts no.

But for regular recurring remittance services? Yeah Wise wins most of the time.

Usually anyway.

Remitly : When You Actually Need Speed (And What It Costs)

Okay Remitly. This one’s complicated for me because I don’t use it often but when I do use it there’s usually a good reason.

First time I used Remitly was Bali 2021. That wallet situation I keep mentioning. Everything stolen including my Wise card so I couldn’t even use that. Friend needed to lend me $500 but I needed it fast. Like really fast. Within a couple hours because I had to pay for accommodation and they only took cash.

Wise couldn’t do it. Their fastest transfers are same day but even that’s not guaranteed and it was already evening. Didn’t have time to wait until the next day maybe.

Used Remitly Express. Paid their markup which I think was around 3% or something. Lost maybe $15 on the exchange rate. But friend picked up cash at a local agent in like 20 minutes. Literally 20 minutes from when I hit send to when she had physical cash in hand.

Worth every penny in that situation.

But would I use Remitly for my regular monthly transfers to my parents? No. Absolutely not. Way too expensive compared to Wise.

Remitly has two tiers Economy and Express. Economy is slower and cheaper. Express is faster and more expensive.

The confusing part is how they present their fees. They show you this big “$0 TRANSFER FEE” banner on Economy transfers which looks amazing until you check the actual exchange rate they’re giving you.

Let me show you real numbers because this confused me for like six months when I first started comparing services.

Checked Remitly yesterday for sending $3,000 to India. Just as a comparison test.

Economy option showed:

- Transfer fee: $0 (big letters, confetti animation, whole thing)

- Exchange rate: ₹82.40 per dollar

- Recipient gets: ₹2,47,200

- Delivery: 3-5 business days

Express option showed:

- Transfer fee: $3.99

- Exchange rate: ₹80.85 per dollar

- Recipient gets: ₹2,42,550

- Delivery: Minutes to hours

Okay so. The Economy “$0 fee” thing. Went to XE.com to check mid market rate. Was ₹83.56 at that exact moment.

Remitly Economy offering ₹82.40. That’s ₹1.16 less per dollar than the real rate. Across $3,000 that’s ₹3,480 lost which equals about $41.65 in hidden markup.

Their “$0 fee” actually costs $41.65. Not zero. Forty one dollars and sixty five cents.

Wise charges $42.50 upfront fee for $3,000 but gives you the exact mid market rate of ₹83.56. Recipient gets ₹2,50,680. Total cost $42.50.

Almost the same total cost but Wise is honest about it being $42.50 while Remitly hides it in exchange rate and says “$0”.

The Express option is even worse cost wise. ₹80.85 rate versus ₹83.56 real rate. That’s ₹2.71 less per dollar. Across $3,000 that’s ₹8,130 lost which is $97.27 in markup. Plus the $3.99 fee makes it $101.26 total cost.

Over $100 to send $3,000. More than double what Wise charges.

But you get speed. Minutes to hours instead of 3-5 days. Sometimes speed is worth paying for.

Like that Bali emergency. The extra $60 or whatever I paid versus Wise? Worth it to get cash in 20 minutes when I was stuck without money.

Or another time I think this was 2023, maybe early 2024 my dad needed money for a medical thing. Not life threatening but needed to pay hospital deposit quickly. Used Remitly Express. Money arrived in maybe 45 minutes. Cost more but got there fast.

Sometimes the situation justifies paying extra for speed. That’s what Remitly Express is for.

But I see people using Remitly for regular monthly transfers and I’m like why though? You’re paying double the cost for speed you don’t need.

Unless you’re getting their first time user promo. That’s actually really good.

First time I used Remitly they had this promotion I think it was $15 off your first transfer or something. Maybe it was $20. Can’t remember exactly. But it made that first transfer way cheaper than normal.

If you’re sending like $500-1,000 for the first time and you get $15-20 off, that’s a significant percentage discount. Could make Remitly cheaper than Wise for that one transfer.

But then second transfer onwards you’re paying full price and Wise becomes cheaper again.

I’ve seen people sign up for Remitly just to use the first time promo then switch back to Wise for regular transfers. Smart honestly. Get the discount, use it once, then go back to cheaper service.

The app interface is pretty clean. Easy to use. Maybe even easier than Wise in some ways. Very straightforward. Pick amount, pick recipient, see two options Economy or Express, choose one, send. Done.

They support more countries than Wise too. Like 170 countries versus Wise’s 70 or something. So if you’re sending somewhere obscure that Wise doesn’t cover, Remitly might work.

But most digital nomads are sending to major countries. India, Philippines, Mexico, Thailand, Vietnam, whatever. Both services cover those fine.

Customer service I’ve only contacted once. That Bali emergency transfer. Wanted to confirm it went through because I was paranoid. Got response pretty quickly. Maybe 30 minutes. They confirmed it was picked up. That was fine.

Not better or worse than Wise really. Just normal customer service.

Security seems okay. They’re regulated, licensed, all that stuff. Never worried about money disappearing. Been around since 2011 I think so not a new sketchy service.

The delivery speed on Express is legit though. I’ve used it maybe five or six times total over the years and it’s always been fast. Fastest was that Bali one at 20 minutes. Slowest was maybe two hours. Average probably 45 minutes to an hour.

That’s genuinely impressive for international money transfer. Wise can’t compete with that speed.

Economy speed is whatever. 3-5 days they say. I tested it once just to see. Took four days. Not faster than Wise really. Maybe same speed, maybe slightly slower.

So Economy you’re paying similar total cost to Wise but getting similar or slower speed. Doesn’t make sense to me unless you just prefer their app interface or something.

Express is when Remitly makes sense. Paying premium for premium speed.

One thing that annoys me and this is petty but still annoying is how they market the “$0 FEE” so aggressively. Like they know most people won’t check the exchange rate. They’re counting on it.

It works too. I talk to other nomads and so many of them use Remitly thinking it’s free or cheap because of the “$0 fee” marketing. Then I show them the exchange rate math and they’re like oh wow I’ve been overpaying.

The marketing is intentionally misleading. Not illegal. Just misleading. Shows “$0 fee” in huge letters while hiding the real cost in exchange rate fine print.

At least Wise shows you “your fee is $42.50” upfront. Honest about what you’re paying.

That transparency matters to me. Maybe I’m weird about that. But I’d rather see “$42.50 fee” than “$0 fee” that actually costs $41.65 hidden in exchange rate.

When would I recommend Remitly?

Genuine emergencies where you need money delivered in under an hour or two. Remitly Express wins that category. No competition.

First time transfers where you can use their promotional discount. If they’re offering $15-20 off and your transfer is $500-1,000, take advantage of that promo. Good deal.

Sending to countries Wise doesn’t support. Check both services first but if Wise doesn’t cover that corridor, Remitly might.

Situations where recipient specifically wants cash pickup and Remitly has more convenient agent locations in their area than Western Union.

When would I NOT recommend Remitly?

Regular recurring monthly transfers. Too expensive compared to Wise. You’ll overpay hundreds per year using Remitly Economy for regular transfers.

Large amounts where the percentage markup gets huge. That 1.4% markup on $10,000 is $140. On Wise it would be $136. But Remitly hides their markup in exchange rate while Wise shows transparent fee.

Situations where you have time. If transfer can wait 1-3 days, Wise is cheaper and just as reliable.

I keep Remitly installed on my phone but I rarely use it. Maybe once every few months when something urgent comes up.

Most of my transfers probably 95% still go through Wise because I’m usually planning ahead and don’t need emergency speed. The 5% that are urgent or unexpected, that’s when Remitly Express is worth the premium.

It’s a good service for what it does. Fast money transfers when you need speed. Just expensive if you use it for everything.

Know what you’re paying. Check the exchange rate against XE.com. Don’t fall for the “$0 fee” marketing. Calculate total cost including exchange markup. Then decide if speed is worth the premium.

Sometimes it is. Sometimes it isn’t.

Usually isn’t for me.

Western Union : The $400 I Lost Because I Was Lazy

Western Union. This is where everything started going wrong for me with money transfers. Or right I guess because it made me learn about all this stuff eventually but wrong at the time definitely.

2019 I’m in Bangkok. First year doing the full time nomad thing. Every month sending $1,000 home to my parents. Using Western Union. Why Western Union? Because that’s what my dad always used when he was working in Dubai in the 90s or whenever that was. So I just assumed that’s what you use.

Zero research on my part. Just “dad used Western Union, Western Union must be good, done.”

My entire decision making process right there.

Except I was losing so much money. Like so much. And didn’t even know it for over a year.

My mom kept mentioning she’d say like “we got 82,000 rupees” and I’m thinking wait that seems low shouldn’t $1,000 be more than that? But then I’d just assume maybe her bank was charging some fee on the receiving end or the exchange rate moved or something. Never occurred to me to actually check what rate I was getting versus the real market rate.

This went on for months. Maybe ten months? Eleven months? Basically my whole first year.

March 2020 pandemic hits I’m stuck in Chiang Mai. Bored in a hostel with wifi that barely worked most days. Made a spreadsheet because apparently that’s what I do when I’m bored instead of normal things and calculated all my actual transfer costs from the previous year. Every single one. Fees plus what I lost on exchange rates. Everything.

$400.

That’s what I came up with. Over four hundred dollars just completely gone. Wasted. For nothing.

I felt genuinely sick staring at that number in my spreadsheet. Like physically sick. That’s almost $450 that could’ve gone to my parents. Or stayed in my pocket. Instead it went to Western Union as profit from fees I didn’t even know I was paying.

And my parents got ₹21,912 less than they should have gotten if I’d used a service with better rates. That’s their electricity for like six months. Maybe more depending on usage.

So I got kind of obsessed after that. Started testing literally every service I could find. Wise Remitly Western Union some random ones I found on Reddit that I don’t even remember the names of now. Made these massive comparison spreadsheets. Tracked fees, exchange rates, delivery speeds, everything.

My girlfriend Sarah at the time thought I’d completely lost my mind. “You’re really spending your entire Saturday making spreadsheets about money transfers?” Yes Sarah yes I am because I just lit four hundred and twenty seven dollars on fire for absolutely no reason except being lazy about research.

Anyway. Western Union. The thing that cost me $400 my first year.

Here’s what’s weird though and I hate admitting this after they took my money sometimes Western Union is actually the right choice. Not often. Like really not often. But sometimes it’s the only thing that works.

That family member I mentioned before. Rural India. No bank account. No smartphone. Nothing electronic. Just needs physical cash in hand. How do you get money to someone like that?

Western Union cash pickup. That’s literally the only way. They walk to the local Western Union agent and there’s always an agent even in tiny villages show their ID, pick up cash. Done.

Wise can’t do that. Wise only does bank transfers and in some countries mobile wallet deposits. If recipient doesn’t have a bank account Wise won’t work. Remitly has some cash pickup but their agent network isn’t nearly as big especially in remote areas. Western Union though? They have agents everywhere. Like literally everywhere.

They claim 200 countries. Half a million agent locations worldwide. Some tiny village in the middle of nowhere with like 500 people? Probably has a Western Union agent. That reach is valuable.

Worth paying for in specific situations.

But using Western Union for regular bank to bank transfers when you have other options? When recipient has a bank account and Wise or Remitly work fine? That’s where people lose money. That’s where I lost $400.

The fee structure confuses me even now after using them on and off for years. It changes based on literally everything. How much you’re sending which countries you’re using how you’re paying how they’re receiving whether you’re using the website or the app or walking into a physical location.

I tested this once. Bangkok 2022 I think. Or maybe early 2023. Can’t remember exactly. Set up an $800 transfer to Philippines on the Western Union website. Fee showed $4.99. I thought okay that’s not too bad actually.

Then the next day I’m walking around and I pass by a Western Union store location. Physical store. And I thought you know what I’ll just do the transfer in person instead. Why not. More official feeling or something.

Same exact transfer. $800 to Philippines. Same recipient. Same everything.

The guy at the counter types it all in and says the fee is $18.

Wait what? $18? The website said $4.99 yesterday.

He’s like yeah that’s the fee for in store transfers.

Same transfer same service same everything. 3.6 times more expensive just because I walked into a physical location instead of clicking a button on their website.

That’s when I realized their whole pricing system is completely arbitrary. They charge whatever they think they can get away with depending on how you’re accessing the service. Want convenience of a store? Pay triple. Don’t mind using website? Pay less.

And they don’t tell you this anywhere. No warning that says “hey by the way if you do this online instead of in person you’ll save $13.” You’re just supposed to figure it out yourself or pay the higher fee.

Online is almost always cheaper than in person. Sometimes dramatically cheaper. But most people don’t know that. They walk into stores because that feels more trustworthy or official or whatever. And they pay 3x to 5x more than they need to.

The exchange rate markup though. That’s the real problem. That’s where they actually get you. The fee is almost a distraction from the exchange rate markup.

Western Union adds anywhere from 1% to 4% markup on the exchange rate depending on which currency corridor you’re using. Sometimes even more for less common currencies.

Let me show you real numbers because this is what cost me so much money and I want to make it really clear.

Sending $10,000 to India. Just tested this last month as a comparison. Western Union website showed:

- Transfer fee: $10

- Exchange rate: ₹81.10 per dollar

- Recipient gets: ₹8,11,000

- Delivery time: Same day to 7 days (super helpful range there guys thanks for narrowing it down)

Okay so. Went to XE.com to check the real mid market exchange rate at that exact moment. It was ₹83.56 per dollar.

Western Union was offering ₹81.10. That’s ₹2.46 less per dollar than the real market rate.

Across $10,000 that means you’re losing ₹2.46 times 10,000 which equals ₹24,600. Convert that back to dollars at the real rate and it’s $294.40 you lost in exchange rate markup.

Plus their $10 fee makes the total cost $304.40.

For comparison Wise charges $136 all in for that same transfer and gives you the exact mid market rate. Western Union is charging $304.40. That’s $168.40 more than Wise. Over double the cost.

But Western Union’s marketing shows you that “$10 fee” in huge letters and most people think oh okay $10 that’s reasonable that’s the cost. They don’t realize the real cost is $304 because of the exchange rate markup they hide.

The fee is just the visible part. The exchange rate markup is the hidden part that’s 30 times bigger than the fee.

I fell for this for an entire year. Never checked the exchange rate once. Just paid the fee whatever it was, usually $5 to $15 and thought that was my total cost. Meanwhile I was losing $30 to $50 every single transfer in exchange rate markup I didn’t even know existed.

My mom kept saying the rupee amounts seemed lower than expected. I kept blaming her bank. “Probably your bank is charging a receiving fee, Ma.” It wasn’t her bank. It was Western Union’s terrible exchange rate the entire time.

Took me twelve months to figure it out. A full year. That’s embarrassing honestly.

But it also shows how well they hide it. If someone who’s now completely obsessed with comparing international money transfer services and writes articles about it for a living took a full year to notice the exchange rate problem, how many regular people never notice at all?

Probably millions of people.

Speed is all over the place with Western Union. They give you ranges like “minutes to days” which doesn’t tell you anything useful. Thanks for the precision there.

Cash pickup can genuinely be within minutes though. I’ve tested this multiple times. Send the money, recipient walks to the agent location ten minutes later, money is available for pickup. That part actually works when it works.

Bank transfers take way longer though. Sometimes same day, sometimes three days, sometimes a full week. Seems pretty random honestly. Or maybe it depends on factors they don’t explain clearly anywhere.

Wise is way more consistent about timing. They tell you 1-3 business days and it usually arrives in 1-2 days. You can count on it. Western Union tells you “up to 7 business days” and you’re just guessing when it’ll actually show up.

Customer service is terrible. Like genuinely terrible. Tried calling them once I think this was 2021, maybe 2022 about a transfer that was delayed. On hold for 45 minutes. Actually timed it. 45 minutes of hold music.

Finally got someone on the phone. Asked why my transfer was delayed. They said “it’s processing, sir” and couldn’t explain anything beyond that. Couldn’t tell me why it was delayed, when it would arrive, what the holdup was. Just “it’s processing.”

Transfer finally arrived two days later with zero explanation of what the delay was about or why it got held up.

Wise and Remitly both have in app chat support that responds within an hour usually. Western Union has phone support that puts you on hold forever and doesn’t actually help when you finally get through.

Maybe their in person store locations have better customer service. Never tried honestly. Always use the website because the fees are lower online.

The app interface is okay. Not as clean or intuitive as Wise or Remitly but it’s functional. You can set up transfers, track them, save recipients for future transfers. Basic stuff that works fine. Nothing fancy but gets the job done.

They’ve been around forever. Since like 1851 or something. Over 170 years. So they’re incredibly established and licensed and regulated in basically every country. Not worried about them stealing my money or the company disappearing or anything like that.

I just really don’t like their pricing model. It feels predatory to me. Hiding the real costs in exchange rate markups while advertising low fees. That $10 fee that actually costs $304. That kind of thing.

When does Western Union actually make sense though?

Recipient needs cash pickup and doesn’t have a bank account. This is the main legitimate use case. Wise and Remitly primarily do bank transfers and sometimes mobile wallet deposits. Western Union does physical cash at agent locations. If your recipient specifically needs to pick up physical cash, Western Union is often your only real option.

Sending to super remote areas where other services don’t reach. Their agent network is massive. 200 countries, half a million locations. If Wise or Remitly don’t support that specific corridor or that specific small town, Western Union probably does.

Emergency situations where recipient needs cash immediately and can’t wait for a bank transfer. Cash pickup can happen within minutes if the agent has cash on hand. Bank transfers take at minimum several hours, usually 1-3 days. Sometimes you genuinely need money in someone’s hands within an hour.

Very small amounts where their minimum fee happens to be lower than percentage based fees. This is pretty rare but sometimes Western Union’s minimum fee of like $0.99 or $1.99 beats Wise’s percentage based fee on really tiny amounts like $20 or $30.

When does Western Union NOT make sense?

Regular recurring monthly transfers. Like what I was doing. Supporting family every month, paying contractors regularly, whatever. You’re overpaying by double or triple what Wise charges. Over the course of a year that adds up to hundreds or thousands of dollars wasted.

Large transfers where the exchange rate markup becomes huge in absolute terms. That 2-3% markup on $10,000 is $200-300 lost. On $20,000 it’s $400-600 lost. On $50,000 it’s over $1,000. The bigger your transfer the more you lose to their markup.

Situations where your recipient has a bank account and other services work fine for that corridor. There’s just no reason to use Western Union if Wise or Remitly support that currency pair and your recipient can receive a bank transfer or mobile wallet deposit.

When you’re using their in person store locations instead of their website. Online fees are way lower. If you’re walking into physical stores you’re paying 3x to 5x more than you need to. Just use the website.

I still have Western Union installed on my phone. But I think I’ve only used it maybe twice in the last two years. Both times were for cash pickup situations where the recipient was in a location that no other service could reach.

Most of my international money transfers don’t need cash. Recipients have bank accounts. Wise works fine and costs literally half or a third as much as Western Union for the same transfer.

But for that small percentage of situations where cash pickup is genuinely necessary maybe 2% of my transfers over the years Western Union has been useful. Just really expensive.

The biggest mistake I see other digital nomads making is using Western Union purely out of habit. “My parents always used Western Union so I use Western Union.” That’s exactly what I did. Cost me over $400 my first year.

Check if your recipient can actually receive bank transfers. Most people in most countries can these days. If yes, switch to Wise for your regular transfers. You’ll save hundreds of dollars per year minimum. If no, if they genuinely specifically need physical cash and have no bank account, then okay Western Union makes sense.

But don’t use Western Union just because it’s familiar or because you’ve always used it or because your parents used it. That’s expensive nostalgia. That’s literally paying triple for the comfort of familiarity.

Always compare the total cost. Not just the fee they show you in big letters. The fee plus the exchange rate markup. Pull up XE.com in another browser tab, check what the real mid market exchange rate is, compare it to what Western Union is offering you, calculate the difference. That difference times your transfer amount is money coming out of your pocket.

That difference is your real cost. And it’s usually way way higher than their advertised fee.

For the cheapest way to send money internationally when you specifically need cash pickup? Western Union probably wins by default because they’re basically the only major service offering a really wide cash pickup network. But “only option” definitely doesn’t mean “cheap option.” Know what you’re actually paying.

Choose deliberately based on your actual needs. Don’t just use them out of habit or familiarity.

Most of the time you don’t need cash. Most of the time your recipient has a bank account. Most of the time Wise is the better option and the cheaper option.

Not always though. Sometimes Western Union really is the right choice despite the higher cost. When cash pickup is necessary. When reaching remote locations. When emergency speed matters.

Just not very often.

Rarely actually.

Which Service Should You Actually Use? (It Depends)

Okay so after testing all three services probably 200+ times total over the last five years here’s what I actually think you should do.

And I hate that the answer is “it depends” because that’s the most annoying non answer ever. But it really does depend on your specific situation. There’s no one best money transfer service for digital nomads that works for everyone every time.

Let me try to break this down by actual use cases instead of just listing features because features don’t matter if they don’t match what you actually need.

Regular monthly family support like $500 to $3,000 every month:

Use Wise. Just use Wise. This is what I do. This is what most nomads should do. The math isn’t even close.

That mid market exchange rate with zero markup saves you so much money over time. My $1,000 monthly transfer costs $14-18 on Wise depending on exact amount. Same transfer on Remitly Economy costs $35-40 hidden in exchange rate even though they show “$0 fee.” Western Union costs $50-80 depending on how you send it and their current exchange rate.

Over a year that’s $168-216 on Wise versus $420-480 on Remitly versus $600-960 on Western Union.

Saving $252-744 per year just from using Wise instead of the others. That’s real money. That’s flights home to visit family. That’s a month of rent in Southeast Asia.

Unless your recipient specifically can’t receive bank transfers no bank account, needs physical cash there’s just no reason to use anything else for regular recurring transfers.

I’ve been doing this since 2020. Five years now. Probably saved $3,000-4,000 total compared to if I’d kept using Western Union. That’s a lot of money.

One-time large transfer like $10,000+ for property, investment, emergency:

Still Wise for me. The percentage based fee actually gets better as amount increases. That 1.36% on $10,000 is $136. On $20,000 it might be 1.28% which is $256. Still way cheaper than Western Union or Remitly.

Plus for large amounts you really want that mid market exchange rate with no markup. A 2-3% exchange rate markup on $20,000 is $400-600 lost. On $50,000 it’s $1,000-1,500 lost. That adds up fast.

Wise gives you the exact real rate every time. I’ve never had them try to sneak in exchange rate markup. What XE.com shows is what Wise gives you.

For really huge amounts over like $100,000 you might want to talk to Wise support about their batch payment service or whatever they call it. They have options for very large transfers that regular interface doesn’t show. Never done this myself but I’ve read about it.

Emergency situation need money in someone’s hands within 1-2 hours:

Remitly Express if they have an agent near recipient. Western Union cash pickup if Remitly doesn’t reach that area.

This is the only time I’d pay the premium for these services. When speed genuinely matters. When someone’s stuck somewhere and needs cash now not tomorrow.

That Bali situation I keep mentioning. Wallet stolen. Needed $500 cash within an hour or two. Remitly Express got it done in 20 minutes. Cost me maybe $15 extra compared to Wise but totally worth it for the situation.

If I’d tried to use Wise it would’ve taken at minimum several hours probably next day. Wasn’t fast enough for what I needed.

But I only use Remitly Express or Western Union maybe once or twice per year for genuine emergencies. Not for regular transfers where I’m planning ahead and have time.

Recipient needs physical cash no bank account, remote area:

Western Union first choice. Their agent network is massive. Half a million locations in 200 countries. Some village in middle of nowhere? Probably has Western Union agent.

Remitly has cash pickup too but not as many locations especially in rural areas. Check both but Western Union usually wins on reach.

This is maybe 2-3% of my transfers. Most people I send money to have bank accounts these days. But for that small percentage who need cash, Western Union has been necessary despite the higher cost.

Just know you’re paying premium for that service. The $10 fee plus 2-3% exchange markup means you’re paying double or triple what Wise costs. But if cash pickup is necessary then it’s necessary.

First time sending to new recipient testing with $100-500:

If Remitly has a first time user promo, use that. They often give $15-20 off your first transfer. On a $500 transfer that’s 3-4% discount which actually makes them cheaper than Wise for that one transaction.

Then switch to Wise for your second transfer onwards when you’re not getting the discount anymore.

I’ve seen people create accounts on all three services just to use each one’s first time promo then settle on Wise for regular use. Smart strategy honestly. Save $30-40 total from the promos.

Paying international contractors or freelancers:

Wise multi currency account. Give them your USD or EUR or GBP account details depending on their location. They do domestic transfer on their end cheap and fast. You receive it with zero incoming fees.

This is huge for me. Most my US clients pay my Wise USD account. European clients pay EUR account. Everyone’s happy because they’re doing local transfers not expensive international wires.

Then I can hold those currencies, convert when rates are good, or spend directly with Wise debit card. Way more flexible than receiving expensive bank wires.

Remitly and Western Union don’t have anything comparable to Wise’s multi currency account system. It’s a Wise specific feature that’s really valuable if you’re receiving money from multiple countries.

Very small amounts under $50:

Honestly just use PayPal or Venmo or whatever if recipient has it. The percentage fees on money transfer services don’t make sense for tiny amounts.

I sent $30 through Wise once. Fee was $4. That’s 13.3%. Terrible percentage even though dollar amount is small.

Western Union might have lower minimum fee for very small amounts sometimes but their exchange rate markup makes it expensive anyway.

For anything under $50 try to use regular payment apps if possible. Save the international money transfer services for larger amounts where their fees make more sense percentage wise.

Sending to countries with currency restrictions or complicated banking:

This gets complicated. Some countries have weird rules about foreign currency or receiving international transfers. Argentina had issues for a while. Venezuela. Some African countries. Iran obviously.

Western Union sometimes works when banks don’t because they have special licenses and relationships. Might be your only option for certain restricted countries.

Check if Wise and Remitly even support that corridor first. If not, Western Union might be your only choice despite higher cost.

I’ve never had to deal with this personally but I’ve heard stories from other nomads. Always research the specific country’s rules before trying to send money there.

SIDE-BY-SIDE COMPARISON

Let me try to actually make this clearer with a proper comparison.

| Feature | Wise | Remitly | Western Union |

| Cost ($1,000 to India) | $14-18 total | Economy: $35-42 / Express: $95-105 | $50-80 |

| Exchange Rate | Real mid-market (0% markup) | 0.4-3% markup | 1-4% markup |

| Speed | 1-3 days (usually 1-2) | Economy: 3-5 days / Express: Minutes-hours | Minutes (cash) to 7 days (bank) |

| Best For | Regular transfers, Large amounts, Multi-currency | Emergency speed, First-time promos | Cash pickup, Remote areas |

| Transfer Methods | Bank only | Bank, mobile wallet, limited cash | Bank, cash pickup, mobile wallet |

| Countries Supported | 70+ | 170+ | 200+ |

| Transparency | ⭐⭐⭐⭐⭐ Excellent | ⭐⭐⭐ Good (“$0 fee” misleading) | ⭐⭐ Poor (hidden markups) |

| My Usage | 94 transfers (97%) | 2 transfers (2%) | 1 transfer (1%) |

That 97% Wise usage isn’t random. It’s just way cheaper for regular international money transfers.

Cost for $1,000 transfer to India (approximate):

- Wise: $14-18 total all in

- Remitly Economy: $35-42 hidden in exchange rate

- Remitly Express: $95-105 hidden in exchange rate plus small fee

- Western Union: $50-80 depending on payment and delivery method

Speed:

- Wise: 1-3 days usually 1-2 days

- Remitly Economy: 3-5 days

- Remitly Express: Minutes to hours

- Western Union: Minutes (cash) to 7 days (bank transfer)

Exchange rate:

- Wise: Real mid market rate, zero markup

- Remitly: 0.4-3% markup depending on economy vs express

- Western Union: 1-4% markup

Best for:

- Wise: Regular transfers, large amounts, multi currency receiving

- Remitly: Emergency speed when you need it fast

- Western Union: Cash pickup, remote areas, restricted countries

That’s probably oversimplified but gives you general idea.

DECISION GUIDE :

Okay here’s how to actually decide which one to use based on your situation.

| Your Situation | Best Choice | Why |

| Regular monthly family support ($500-3,000) | Wise | Lowest total cost, transparent fees, reliable |

| Large one-time transfer ($10,000+) | Wise | Best exchange rate saves hundreds on large amounts |

| Emergency – need money in 1-2 hours | Remitly Express | Fastest delivery, worth the premium for urgency |

| Recipient has no bank account | Western Union | Cash pickup network reaches everywhere |

| Remote village/rural area | Western Union | 500k agent locations worldwide |

| First-time transfer (testing) | Remitly | Use first-time promo ($15-20 off) |

| Receiving payments from clients | Wise | Multi-currency accounts, zero incoming fees |

| Very small amounts (under $50) | PayPal/Venmo | Avoid money transfer fees for tiny amounts |

| Restricted countries | Western Union | Broadest country support, special licenses |

Most digital nomads fall into that first category though. Regular transfers. That’s where Wise wins as the best money transfer service for digital nomads.

My actual usage over the last year I checked my apps to see:

Wise: 94 transfers

Remitly: 2 transfers

Western Union: 1 transfer

That’s 97% Wise, 3% everything else.

The two Remitly transfers were both emergency situations where I needed speed. The one Western Union transfer was cash pickup to someone in rural area with no bank.

Everything else went through Wise because for normal planned ahead transfers where recipient has bank account, Wise is just better on cost.

The transparency matters to me too. Wise shows you exactly what you’re paying upfront. “Your fee is $16.50, recipient gets ₹83,560 at rate ₹83.56.” Clear and honest.

Remitly and Western Union hide costs in exchange rates and market it as “$0 fee” which feels dishonest even if it’s technically legal. I don’t like that approach.

For cheapest way to send money internationally on a regular basis, Wise wins. Not even close on the math. Unless you have specific reasons to use others emergency speed, cash pickup, unsupported countries just use Wise and save the money.

That’s my honest recommendation after five years and 200+ transfers testing all of them.

Your situation might be different. Maybe you send cash to remote areas every month. Then Western Union makes more sense despite cost. Maybe you’re always doing emergency transfers. Then keep Remitly Express handy.

But for most digital nomads doing regular family support or contractor payments or moving their own money around, Wise is the best money transfer service for digital nomads. Save hundreds per year minimum, sometimes thousands depending on volume.

Start there. Install Wise first. Use it for most things. Keep Remitly and Western Union installed as backups for specific situations where Wise doesn’t work.

That’s what I do. Works well.

FEE STRUCTURE BREAKDOWN :

Here’s how the fees actually scale based on how much you’re sending. Makes a big difference.

| Transfer Amount | Wise Fee | Wise % | Remitly Economy (Hidden Markup) | Western Union (Fee + Markup) |

| $500 | $8.82 | 1.76% | ~$17-20 | ~$25-40 |

| $1,000 | $14-18 | 1.4-1.8% | ~$35-42 | ~$50-80 |

| $3,000 | $42.50 | 1.42% | ~$95-120 | ~$150-240 |

| $10,000 | $136 | 1.36% | ~$320-450 | ~$300-500 |

Note: Remitly and Western Union costs include hidden exchange rate markup.

See how Wise’s percentage actually goes DOWN as amount goes up? That’s good for the cheapest way to send money internationally when you’re moving larger amounts.

FAQ : Questions I Keep Getting Asked About This Stuff

Okay so I’ve written about money transfers on NomadWallets before and I get emails about this constantly. Same questions over and over. Let me try to answer the common ones here so I can just link people to this section.

Q1 . Can I trust Wise with large amounts like $20,000 or $50,000?

A. I mean I’ve sent $10,000 through them multiple times and it’s always worked fine. Never had money disappear or anything sketchy happen.

They’re regulated by like every financial authority that exists. FCA in UK, FinCEN in US, bunch of others in different countries. Money is held in segregated accounts which means if Wise went bankrupt tomorrow your money wouldn’t be part of their assets that creditors could take.

For really large amounts though like over $50,000 or $100,000 I’d probably break it into multiple transfers just to be safe. Not because I don’t trust Wise but because I’m paranoid about having that much money in transit at once. Spread it over a few days maybe. Also for very large amounts you might want to contact Wise support directly. They have services for big transfers that aren’t shown in the regular app interface. Better rates sometimes for volume. I haven’t done this personally but I’ve read about it.

Q2 . Why does my Wise transfer say ‘under review’ and what should I do?

A. Compliance check. They’re verifying your identity for anti money laundering regulations. Happens randomly especially on larger transfers or if you’re new to the service. Just wait for them to contact you. Usually happens within a few hours. They’ll ask for government ID and proof of address. Take photos send them through the app. Gets approved usually same day. I’ve had this happen twice. Both times resolved within 8 hours or so. Annoying but not a huge deal. Don’t panic when you see “under review.” Your money isn’t gone. They’re just checking paperwork.

Q3 . Is the Wise debit card worth getting?

A. If you travel a lot yeah definitely. I use mine constantly in Thailand and other countries. No foreign transaction fees. Real mid market exchange rate when you spend. Free ATM withdrawals up to $100-200 monthly depending on your account type. Way better than using regular bank cards that charge 3% on every foreign purchase plus terrible exchange rates plus ATM fees. The card itself is free. No monthly fee. You just pay a small fee to order it initially like $10 or something. Worth it if you’re living abroad or traveling frequently. I’ve replaced my regular US bank card with the Wise card for most everyday spending when I’m outside the US.

Q4 . Can I receive money in Wise from clients or employers?

A. Yes that’s what the multi-currency account is for. You get real bank account details for like 10+ currencies. USD, EUR, GBP, AUD, and a bunch of others. Give those details to whoever’s paying you. From their perspective they’re doing a domestic transfer in their own country. Fast cheap easy for them. You receive it in Wise with no incoming fees. This is huge for freelancers and contractors. I use it for probably 80% of my client payments now. Way better than expensive international wires or PayPal’s fees.

Q5 . Why is Remitly showing $0 fee but Wise is showing $15 fee? Isn’t Remitly cheaper?

A. No. Check the exchange rate not just the fee. Remitly hides their cost in the exchange rate markup. Go to XE.com. Check the real mid market rate. Compare it to what Remitly is offering you. Calculate the difference times your transfer amount. That’s your hidden cost. Remitly’s “$0 fee” usually costs more total than Wise’s transparent upfront fee when you factor in the exchange rate difference. I explain this in detail earlier in the article with actual numbers. Go back and read that part. The “$0 fee” is marketing BS.

Q6 . Should I use my bank’s international wire service or use Wise?

A. Wise unless your bank is giving you the actual mid market rate with no markup which they probably aren’t. Most banks charge $25-50 outgoing wire fee plus 3-4% hidden in exchange rate markup. On a $3,000 transfer that’s $45 fee plus $90-120 exchange markup equals $135-165 total cost. Wise charges $42 all-in for same transfer. Check your bank’s exchange rate carefully. Compare it to XE.com. Calculate total cost including exchange markup. Then compare to Wise. Wise wins like 95% of the time.

Q7 . Is Western Union ever cheaper than Wise?

A. For very small amounts under $30 sometimes their minimum fee is lower than Wise’s percentage-based fee. But their exchange rate markup still makes it expensive. For cash pickup when recipient has no bank account, Western Union is often your only option so “cheaper” doesn’t matter. It’s the only option. For regular bank transfers where recipient has account? Never seen Western Union be cheaper total cost than Wise when you factor in exchange markup.

Q8 . What if Wise doesn’t support the country I’m sending to?

A. Try Remitly first. They support some countries Wise doesn’t. Check their website. If Remitly doesn’t support it either, then Western Union probably does. They support like 200 countries versus Wise’s 70. Or look into regional services specific to that country. Some corridors have local companies that are cheaper than the big three international services.

Q9 . Can I use Wise if I don’t have a US bank account?

A. Yeah Wise works with bank accounts from tons of countries. You don’t need to be American to use it. I think they support like 50+ countries for funding. Just check their website to see if your country is supported for both sending and receiving. Most major countries are covered.

Q10 . Why do transfer times vary so much? Sometimes same day sometimes 3 days

A. Depends on the payment method you’re using to fund the transfer and the banking hours in both countries. If you fund with debit card or Apple Pay it’s usually faster because money reaches Wise immediately. If you fund with bank transfer it takes 1-2 days for your bank to actually send the money to Wise first, then Wise sends it to recipient. Also weekends and holidays delay things. Banks don’t process on weekends in most countries. So if you initiate Friday evening it might not actually process until Monday. Fastest way is funding with card during business hours on weekdays. Slowest way is bank transfer initiated on Friday before a holiday weekend.

Q11 . Is my money insured or protected somehow?

A. Wise money is held in segregated accounts and regulated by financial authorities in multiple countries. Different from traditional banking insurance but still protected. Remitly and Western Union are also regulated and licensed everywhere they operate. Your money isn’t going to disappear.

I’ve never heard of anyone losing money with any of these three major services due to company problems. The bigger risk is user error like sending to wrong recipient or falling for scams.

Q12 . What’s the difference between remittance services and regular money transfers?

A. Honestly they’re basically the same thing. “Remittance services” usually refers to sending money to family or individuals in another country – like my monthly transfers to my parents. “Money transfers” is more general and includes business payments, contractor payments, moving your own money around. But most services like Wise, Remitly, and Western Union handle both types. Marketing term differences mostly.

Q13 . Should I tell my recipient to expect slightly less because of fees?

A. With Wise you can choose who pays the fee. You can pay it yourself so recipient gets exact amount you want them to receive. Or you can have them pay it which means they receive slightly less. I always pay the fee myself. Easier. I know exactly what I’m paying and they know exactly what they’re receiving. With Western Union and Remitly it depends on the specific transfer but usually you’re paying the fee on the sending side.

PROS & CONS SUMMARY :

Let me break down the actual pros and cons based on five years using all three for remittance services and cross-border payments.

| Service | Pros | Cons |

| Wise | – Real mid-market rate (0% markup) – Transparent pricing – Multi-currency accounts – Reliable delivery times – Great debit card | – Bank transfers only (no cash) – Limited country coverage (70+) – Takes 1-3 days minimum |

| Remitly | – Very fast Express option (minutes) – Good first-time promos – More countries than Wise (170+) – Easy app interface | – “$0 fee” is misleading marketing – Hidden exchange rate markup – Expensive for regular use – Economy speed not faster than Wise |

| Western Union | – Huge cash pickup network – Reaches 200+ countries – Can be very fast (minutes) – Established since 1851 | – Highest costs overall – 1-4% exchange rate markup – Inconsistent pricing (varies by method) – Poor transparency – Terrible customer service |

That’s my honest take after doing this hundreds of times.

Final Thoughts After Years of Doing This

That $400 I lost my first year using Western Union without checking rates? Still annoys me when I think about it. But at least it made me obsessive about finding better ways to send money internationally.

Five years later I’ve probably done 200+ international money transfers. Maybe more. Lost count honestly. Most through Wise. Some through Remitly for emergencies. A few through Western Union when cash pickup was necessary.

Saved probably $3,000-4,000 total compared to if I’d kept using Western Union or my bank’s wire service for everything. That’s real money. That’s multiple flights home. That’s months of rent in Southeast Asia.

For most digital nomads most of the time, Wise is the best money transfer service for digital nomads and the cheapest way to send money internationally. Not always. But usually.

Keep Remitly installed for genuine emergencies where you need speed. Keep Western Union available for cash pickup situations.

But do your regular recurring transfers through Wise. Support your family through Wise. Pay your contractors through Wise. Move your own money between countries through Wise. You’ll save hundreds per year minimum.

Always check the exchange rate separately from the fee. Pull up XE.com before confirming any transfer. Takes 30 seconds. Make sure you’re getting the real mid market rate or at least knowing what markup you’re paying.

That one habit checking XE.com before every transfer has probably saved me more money than anything else I do for managing finances as a nomad.

Don’t use services out of habit or because your parents used them. Don’t trust “$0 fee” marketing without checking the exchange rate. Don’t assume your bank’s wire service is fine without comparing total cost to other options.

Do the math. Compare total cost including fees and exchange rate markup. Choose deliberately based on your specific situation.

Most times that means Wise for regular international money transfers. Sometimes that means Remitly for emergency speed. Occasionally that means Western Union for cash pickup.

But know why you’re choosing what you’re choosing. Know what you’re actually paying. Make informed decisions instead of just going with whatever’s familiar.

That’s it. That’s what I learned from losing $400 my first year and getting obsessive about this stuff for five years after.

Hope it helps you avoid the same expensive mistakes I made.

Sources

- Wise – International Money Transfer Service

- Wise Pricing & Fees

- Wise Multi-Currency Account Features

- Wise Transfer Limits & Account Verification

- Wise Debit Card Information

- Remitly – Money Transfer Service

- Remitly Pricing: Economy vs Express Options

- Remitly Supported Countries & Corridors

- Western Union – Global Money Transfer

- Western Union Agent Locations Finder

- Western Union Pricing & Fee Structure

- XE Currency Converter – Real-Time Mid-Market Rates

- Consumer Financial Protection Bureau – International Money Transfers Guide

- Federal Trade Commission – Wire Transfer Fraud Prevention

- World Bank – Remittance Prices Worldwide Database

- Monito – Money Transfer Comparison Platform

- NerdWallet – International Money Transfer Guide

- Forbes – Best International Money Transfer Services

- Investopedia – How Currency Exchange Works

- CNBC – Digital Nomad Financial Services Report 2025

All information accurate as of October 2025. Exchange rates, pricing, and features subject to change. Always verify current rates and terms on provider websites before initiating international money transfers.

Need more guides? Head to the US Digital Nomad Hub for everything on banking, taxes, insurance, cryptocurrency, and remote work all based on real experience helping hundreds of nomads navigate this lifestyle.

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.