If you’ve ever stood at a Bangkok street food stall trying to calculate whether 150 baht for pad thai fits your daily budget while your banking app shows dollars and your last purchase was in euros you know digital nomad budget tracking isn’t optional. It’s survival.

Traditional budget apps like Mint assume you live in one place, earn in one currency, and spend predictably. That model collapses the moment you’re paying rent in Mexican pesos, invoicing clients in British pounds, and buying flights in whatever currency gives the best deal.

The real challenge of digital nomad budget tracking isn’t just logging expenses across currencies. It’s understanding your actual burn rate when exchange rates shift daily, foreign transaction fees nibble at every purchase, and you’re managing cash in three countries simultaneously.

During our four years managing finances across Southeast Asia, Europe, and Latin America, we’ve tested every major digital nomad budget tracking app available. The learning curve was expensive we overspent by $2,400 in our first six months abroad simply because we didn’t track multi currency expenses properly.

That painful lesson taught us exactly which systems work in real nomad life versus what sounds good in theory. Beyond budgeting, proper health insurance and healthcare planning form the other critical pillars of nomad financial security.

Why Standard Budget Apps Fail for Digital Nomad Budget Tracking

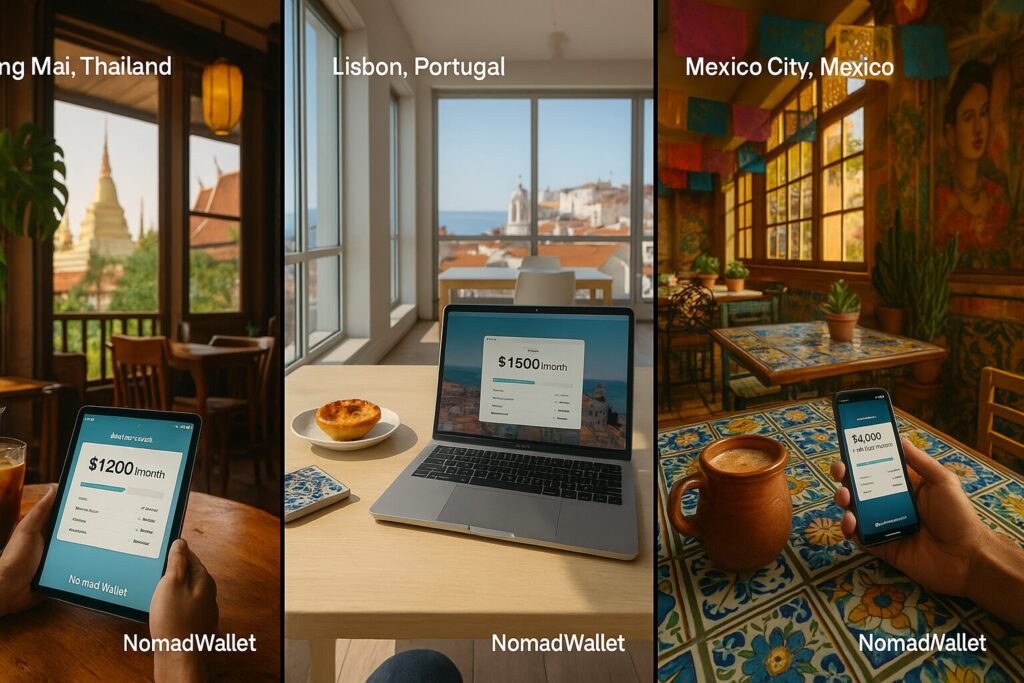

Standard budgeting advice tells you to categorize expenses and stick to limits. Simple enough until you realize your accommodation budget needs to flex from $600/month in Chiang Mai to $1,800/month in Lisbon. Or that coffee costs $1.50 in Vietnam and $6 in Norway, making fixed category budgets meaningless.

According to digital nomad financial planning research, the average location independent worker uses between 3-5 different currencies annually. Some long term travelers juggle even more when they’re moving every few weeks across Southeast Asia, Europe, and Latin America.

Apps designed for traditional households can’t handle the complexity of multi currency expense management. They connect to US bank accounts, track USD transactions, and assume your expenses happen in predictable patterns. But nomad life doesn’t work that way.

Effective digital nomad budget tracking systems solve three specific problems. First, they convert expenses to your base currency automatically using real-time exchange rates, so you see true costs without manual calculations. Second, they work offline crucial when you’re logging a taxi ride in rural Indonesia with no data connection. Third, they let you set location-specific budgets that adjust as you move between expensive and affordable regions.

The best multi currency expense management apps also account for foreign transaction fees, ATM withdrawal charges, and exchange rate fluctuations that traditional apps ignore. These “hidden costs” can add 3-5% to every purchase if you’re not watching carefully.

Best Multi Currency Budget Tracking Apps for Digital Nomads

Trail Wallet: Manual Control Without Subscriptions

Trail Wallet takes the opposite approach from automated banking apps, and that’s exactly why many nomads prefer it for digital nomad budget tracking. You manually log every expense in the local currency, the app converts it to your base currency using current exchange rates, and you see exactly where your money goes.

The interface is deliberately simple. Set a trip budget and daily spending limit, then tap to add purchases as you make them. After testing Trail Wallet across Thailand, Vietnam, and Indonesia for 8 months, we found the logging speed claim is accurate most transactions take 8-12 seconds to enter while standing in line. During our Chiang Mai stay, we tracked 847 expenses over 90 days, and the offline functionality proved essential when working from rural coffee shops with unreliable Wi-Fi.

What makes Trail Wallet effective for expense tracking:

- Supports over 200 currencies with automatic exchange rate updates every time you open the app

- Works completely offline with zero internet requirement for logging expenses

- One-time purchase of $4.99 means no monthly subscription fees eating into your travel budget

- Shows spending breakdowns by category (accommodation, food, transport) and location

- Color-coded visual alerts when you’re approaching daily or trip budget limits

- Simple export function for downloading expense reports

The main limitations? It’s iOS only, so Android users need alternatives. And manual tracking requires daily discipline if you forget to log purchases for 3-4 days, your tracking data becomes unreliable and you lose track of actual spending patterns.

Trail Wallet works best for nomads who want complete control over their digital nomad budget tracking and don’t mind spending 2-3 minutes daily entering transactions. It’s particularly effective for shorter trips (1-6 months) where you’re moving between 3-4 countries and want straightforward multi currency management without complexity. The app has maintained a 4.7+ star rating since launch.

Spendee: Automated Bank Integration for Expense Tracking

Spendee connects directly to your bank accounts, digital wallets like PayPal and Venmo, and even cryptocurrency wallets like Coinbase to track transactions automatically across multiple currencies. Nearly 3 million users worldwide rely on it for automated expense management and digital nomad budget tracking.

The bank synchronization feature means you don’t manually log most purchases they appear automatically with AI suggested categories based on merchant names. You review transactions, adjust categories when needed, and the app handles currency conversion tracking using real time exchange rates.

Key features for remote workers:

- Automatic bank synchronization eliminates 80% of manual data entry work

- Multiple currency support with automatic conversion to your chosen base currency

- Shared wallets let you track expenses with travel partners or split costs with apartment roommates

- Custom budget alerts notify you via push notification before you exceed category spending limits

- Recurring expense detection automatically categorizes monthly subscriptions

- Photo receipt attachment for important purchases you might need for tax deductions

Nomads who’ve switched from manual to automated tracking report saving 15-20 minutes weekly on expense entry, though they emphasize the importance of still reviewing transactions for accuracy automation catches card purchases but misses 100% of cash spending in markets and street vendors.

Spendee offers a free tier with basic expense tracking and manual entry. Premium plans range from $1.99 to $4.99 monthly and unlock bank synchronization, unlimited wallets, and detailed spending analytics. The app works seamlessly across iOS, Android, and web browsers for desktop tracking.

The main limitation is internet dependency bank syncing requires reliable connectivity, which isn’t always available in remote locations. The app also tends to miss cash transactions, still extremely common in countries like Indonesia, Vietnam, and India where many nomads live. You’ll need to manually add cash expenses to maintain accurate records.

For nomads who use cards for 80-90% of purchases and have consistent internet access, Spendee significantly reduces tracking effort while maintaining detailed financial records.

TravelSpend: Built for Long-Term Nomad Financial Planning

TravelSpend combines the simplicity of manual digital nomad budget tracking with features designed specifically for extended travel and group expense management. The standout feature is integrated cost-splitting functionality that automatically calculates who owes what for shared expenses essential when you’re renting an apartment with other remote workers or traveling with a partner.

Why experienced travelers choose TravelSpend for multi-currency expense management:

- Real-time multi currency expense tracking with full offline functionality

- Group expense splitting with automatic calculation and running settlement balances

- GPS location tagging automatically records where each transaction occurred

- Detailed spending analytics reveal patterns across countries, cities, and expense categories

- Trip comparison features show how spending in different locations compares

- CSV export downloads complete expense data for tax filing or financial analysis

- Budget forecasting predicts when you’ll run out of money based on current spending

We’ve used TravelSpend’s trip comparison feature to analyze spending across 12 countries over 2 years. The data revealed we spent 43% less in Southeast Asia compared to Europe, which directly informed our decision to base in Bali for 6 months instead of Lisbon. The GPS location tagging also caught an error where we’d been overpaying for taxis in Bangkok by 30% switching to metered rides based on that insight saved $180 monthly.

The paid version includes automatic currency conversion features and costs slightly more than Trail Wallet, but the added analytics, group management, and forecasting capabilities justify the price for families or long term travelers managing complex scenarios.

TravelSpend particularly shines when you’re moving frequently between countries. The location tagging creates a visual map of your spending, making it easy to see exactly how much you spent in each city. This feature proves invaluable when planning future trips and deciding which locations fit your nomad financial planning goals best.

The app maintains separate trip records, so you can compare your spending in Southeast Asia versus Europe versus Latin America over multiple years. These historical comparisons help refine budget estimates for future destinations.

YNAB: Complete Financial Planning System

You Need A Budget isn’t travel specific, but experienced digital nomads often use it for comprehensive financial management that extends beyond simple expense tracking. YNAB follows zero based budgeting methodology you assign every dollar a specific job, whether that’s rent, investments, emergency fund contributions, debt payoff, or travel experiences.

The philosophy differs fundamentally from other budget apps. Instead of tracking where money went, YNAB forces you to decide where money will go before you spend it. This proactive approach helps nomads balance current travel experiences with long term nomad financial planning goals like retirement savings or buying property.

Multi currency management approaches in YNAB:

Option 1: Separate budgets per currency. Create individual YNAB budgets for each major currency you use regularly one for USD, another for EUR if you spend extended time in Europe, and a third for Thai baht if you’re based in Thailand. When you exchange money between currencies, record matching transactions in each budget.

Option 2: Single budget with manual conversion. Track all expenses in your home currency (USD for US nomads) and manually convert foreign purchases using the actual exchange rate you received. More daily work, but maintains everything in one unified budget.

Option 3: Third-party API integration. Use the Multi Currency for YNAB API to automate currency conversion within a single budget. This requires technical setup involving API keys and third party services, but works smoothly once configured for tech comfortable users.

YNAB costs $14.99 monthly or $109 annually with a 34 day free trial. The learning curve is noticeably steeper than travel specific apps expect to spend 2-3 hours learning the system and another few weeks adapting to the zero based budgeting methodology.

However, if you want to simultaneously manage debt payoff, investment contributions, tax savings, and travel budgets in one integrated system, YNAB delivers capabilities other apps can’t match. Many long term nomads report that YNAB helped them become location independent by forcing disciplined saving before they left traditional jobs.

Banking Apps with Integrated Budget Tracking

Several digital banking platforms designed for international use include built in budget tracking features that eliminate the need for separate apps.

Wise (formerly TransferWise) offers multi-currency expense management and monthly budget setting across 50+ currencies. For a detailed comparison of international transfer options, see our complete guide to money transfer services for digital nomads. The multi currency account lets you hold money in multiple currencies simultaneously and spend with a debit card at real mid-market exchange rates without markup. Transaction categorization happens automatically, and the app shows spending summaries by category and currency.

Revolut functions as both digital bank and comprehensive budget tracker with automatic expense categorization, monthly budget alerts, and detailed spending analytics. Premium tiers ($9.99-$45 monthly) include additional features like travel insurance, airport lounge access, and cryptocurrency trading. The app’s strength lies in seamless integration all spending automatically appears in budget tracking without manual entry or third party app syncing. citizenremote

N26 provides basic budget tracking with transaction categorization and spending insights through its mobile banking interface. The free plan works well for nomads based primarily in Europe, though international transaction features are more limited than Wise or Revolut. Premium plans add better currency exchange rates and international ATM withdrawal allowances.

The primary advantage of banking apps with built in tracking is consolidation one fewer app to manage, no syncing delays, and spending data appears instantly after each transaction. The disadvantage is less sophisticated budgeting features compared to dedicated apps like YNAB or detailed reporting like TravelSpend offers.

App Comparison Table

| Feature | Trail Wallet | TravelSpend | Spendee | YNAB | Wise | Revolut |

| Pricing | $4.99 one-time | $4.99+ one-time | Free-$4.99/mo | $14.99/mo | Free | Free-$45/mo |

| Multi-Currency | 200+ currencies | 150+ currencies | Unlimited | Manual setup | 50+ currencies | 40+ currencies |

| Offline Mode | Full offline | Full offline | Limited | Sync required | Requires internet | Requires internet |

| Bank Sync | No | No | Yes (Premium) | Yes | Built-in | Built-in |

| Group Splitting | No | Yes | Yes | No | No | Yes |

| Platform | iOS only | iOS & Android | iOS, Android, Web | iOS, Android, Web | iOS, Android, Web | iOS, Android, Web |

| Best For | Solo travelers | Groups & families | Automated tracking | Full financial planning | Banking + tracking | Banking + budgeting |

Digital Nomad Budget Tracking by Location: Cost Breakdown

| Region | Monthly Budget (Low) | Monthly Budget (Mid) | Monthly Budget (High) | Primary Currency | Accommodation % | Food % | Coworking % |

| Southeast Asia | $1,200 | $1,800 | $2,500 | THB, VND, IDR | 30% | 25% | 10% |

| Eastern Europe | $1,500 | $2,200 | $3,200 | EUR, RON, HUF | 35% | 25% | 12% |

| Latin America | $1,400 | $2,000 | $3,000 | MXN, COP, ARS | 32% | 28% | 10% |

| Western Europe | $2,500 | $3,500 | $5,000 | EUR, GBP | 40% | 22% | 15% |

| North America | $2,800 | $4,000 | $6,000 | USD, CAD | 42% | 20% | 12% |

| Middle East | $2,000 | $3,000 | $4,500 | AED, TRY | 38% | 23% | 10% |

These regional budget estimates align with detailed cost breakdowns in our location specific guides. For Southeast Asia specifically, see our comprehensive analysis of living costs in Thailand. Budget travelers can explore our guides to destinations under $500/month, $750/month, and $1,000/month.

Setting Up Your Digital Nomad Budget Tracking System

Step 1: Choose Your Base Currency

Select the currency you earn income in or pay taxes in as your base currency for all financial tracking and reporting. For US digital nomads, this should be USD since you’re required to file US taxes annually regardless of where you physically live or which currencies you spend daily.

All other currencies should convert back to this base currency in your tracking system so year end financial reports, tax calculations, and long term financial planning use consistent numbers. Switching base currencies mid year creates confusion and makes accurate financial analysis nearly impossible.

Step 2: Decide Between Manual and Automatic Expense Tracking

Manual tracking systems (Trail Wallet, TravelSpend) give you complete control over every data point and work perfectly offline, but they require daily discipline to log every expense. Plan to spend 2-3 minutes each evening reviewing receipts and entering the day’s purchases for maximum accuracy.

Manual tracking works best when you’re aware of every purchase and want granular control over categorization. The act of manually logging expenses also increases spending awareness many nomads report they naturally spend less when they’re manually tracking because they’re more conscious of each purchase.

Automatic tracking systems (Spendee, Revolut, Wise) sync bank and card transactions automatically, eliminating most data entry work. However, they require reliable internet connectivity and almost always miss cash purchases, which remain common in many countries where nomads live.

The hybrid approach many experienced nomads use: automatic tracking for card purchases (70-80% of transactions) combined with manual entry for cash spending. This balances convenience with completeness.

Step 3: Create Location-Based Budget Categories

Set separate budget limits for each country or region you visit rather than trying to maintain one universal budget across all locations. Your accommodation costs $1,200 monthly in Bali, $800 monthly in Mexico City, and $1,800 monthly in Lisbon because rental markets vary dramatically.

Create location specific budgets for major expense categories:

- Accommodation: Rent, utilities, cleaning fees

- Food & Dining: Groceries, restaurants, coffee shops, street food

- Coworking: Monthly memberships, daily passes, coffee shop working

- Transportation: Taxis, scooter rentals, public transit, ride sharing

- Entertainment: Activities, tours, nightlife, hobbies

- Health: Gym memberships, doctor visits, medications, supplements

After 2-3 months in each location, you’ll identify clear spending patterns in your multi currency expense management data. Maybe you always overspend on food in cities with incredible restaurant scenes, or underspend on transportation in highly walkable neighborhoods. These patterns inform smarter budget planning for future destinations.

Step 4: Account for Hidden Currency Costs

Exchange rate fluctuations affect your spending power daily. Track the actual exchange rate you received for each major transaction don’t rely on average rates. A favorable rate shift of 5% means your budget effectively stretches 5% further that month.

Foreign transaction fees typically range from 0-3% per purchase depending on your card. Cards with 3% fees cost you $30 on every $1,000 spent $360 annually on $12,000 spending. Using zero foreign transaction fee cards saves hundreds of dollars annually in your nomad financial planning.

ATM withdrawal fees combine two charges: your bank’s fee ($3-5 per withdrawal) plus the foreign ATM’s fee ($2-8 per withdrawal). Minimize these by withdrawing larger amounts less frequently, though balance this against the risk of carrying significant cash.

Step 5: Set Up Tax-Ready Expense Categories

Create categories in your budget app that match tax deduction categories you’ll need for filing. US digital nomads running businesses can deduct numerous expenses if properly documented.

Common deductible categories for nomad business owners:

- Coworking space memberships and daily passes

- Business travel (flights, accommodation for work-related trips)

- Professional development (courses, conferences, certifications)

- Equipment and supplies (laptop, phone, software subscriptions)

- Internet and phone service

- Professional services (accountants, lawyers, business consultants)

Tag these expenses in your budget app with labels like “Business” or “Tax Deductible” so you can export them separately during tax season. This organization saves hours of receipt sorting in March and April. For comprehensive guidance on maximizing deductions, read our US digital nomad tax guide and explore specialized tax software options.

Monthly Budget Template for Digital Nomads

| Category | Southeast Asia | Eastern Europe | Western Europe | Latin America | Percentage of Total |

| Accommodation | $500 | $700 | $1,400 | $600 | 30-40% |

| Food & Dining | $400 | $500 | $800 | $500 | 20-25% |

| Coworking/Internet | $150 | $200 | $300 | $150 | 8-12% |

| Transportation | $150 | $250 | $400 | $200 | 8-12% |

| Entertainment | $200 | $250 | $400 | $250 | 10-15% |

| Health/Fitness | $100 | $150 | $200 | $120 | 5-8% |

| Miscellaneous | $150 | $200 | $300 | $180 | 8-10% |

| TOTAL | $1,650 | $2,250 | $3,800 | $2,000 | 100% |

Advanced Multi Currency Management Strategies

Separate Travel Wallets from Operating Expenses

Create dedicated budget categories or separate wallet accounts for one-time travel expenses (flights, visa fees, travel insurance) versus recurring monthly operating costs (rent, food, utilities, coworking). This separation clarifies your true baseline monthly burn rate versus temporary travel costs.

Your burn rate is the recurring amount you need monthly to maintain your lifestyle typically $1,500-3,500 for most digital nomads depending on location. Travel expenses are additional one time costs that don’t repeat monthly. Mixing these numbers in your multi currency expense management obscures your real financial picture and makes budgeting for future months difficult.

Use Multiple Currencies Strategically

Hold money in currencies you’ll spend soon to avoid exchange rate risk. If you’re spending three months in Europe, convert enough money to euros for that period rather than converting small amounts weekly. This strategy locks in one exchange rate and eliminates repeated conversion fees.

However, don’t over convert holding large amounts in currencies you might not spend creates risk if exchange rates shift unfavorably or your plans change. The balanced approach for nomad financial planning: convert 60-70% of your expected spending for the next 4-6 weeks, keeping the rest in your home currency for flexibility.

Leverage Credit Card Rewards

Many digital nomads use travel rewards credit cards for all possible purchases, then pay off the balance weekly or monthly from their budget tracking app data. This approach earns 2-5% back in points while maintaining accurate expense tracking through bank synchronization.

The key discipline: treat credit cards like debit cards by checking your budget app before purchases to ensure money is available. Credit cards should be a tracking and rewards tool, not a way to spend money you don’t have.

Common Multi Currency Budgeting Mistakes

Mistake 1: Forgetting transaction fees in tracked amounts. That $25 restaurant meal actually cost $25.75 after a 3% foreign transaction fee hit your card. Track the final charged amount from your bank statement, not the merchant’s price, or your budget won’t reconcile with actual bank balances. ynab

Mistake 2: Using outdated exchange rates for manual tracking. If you’re logging expenses manually in local currency, update conversion rates at least weekly. Exchange rates shift constantly 35 Thai baht per dollar last month might be 33 baht today, changing your actual spending by 6%. play.google

Mistake 3: Mixing currencies within single accounts. Keep separate tracking accounts for each currency you hold to avoid conversion confusion. If you have €1,000 in one account and ฿30,000 in another, track them separately in your budget app and convert only when calculating total net worth. ynab

Mistake 4: Not tracking ATM withdrawals as transfers. Log cash withdrawals as transfers from your bank account to a “Cash Wallet” category in your app, then track cash spending from that wallet. Otherwise you’ll have mysterious gaps where $200 disappeared without recorded expenses.

Mistake 5: Skipping small purchases. Coffee, snacks, tuk tuk rides, 7 Eleven runs individually small but collectively significant. Track everything over $2-3 for accurate spending data. Those daily $3 coffees become $90 monthly, $1,080 annually meaningful money that affects your budget.

Mistake 6: Failing to reconcile weekly. Compare your budget app totals to actual bank balances weekly to catch errors early. Small tracking mistakes compound over time, and by month end you might have $300+ discrepancies that are impossible to trace.

Mistake 7: Not accounting for seasonal cost variations. High season in popular destinations can increase accommodation and activity costs by 30-50%. Budget tracking should account for these seasonal fluctuations when planning extended stays.

Frequently Asked Questions

Q1. What’s the best budget app for digital nomads just starting out?

A. Trail Wallet or TravelSpend work best for beginners because they’re simple, affordable ($5 one time), and teach budget awareness through manual tracking. Start with manual tracking for 2-3 months to understand your spending patterns, then consider automated options like Spendee if manual entry becomes burdensome.

Q2. Can I use multiple budget apps simultaneously?

A. Yes, and many experienced nomads do exactly this. Common combinations include using Wise or Revolut for banking and currency exchange while using Trail Wallet or TravelSpend for detailed expense tracking and budgeting. The apps serve different purposes and complement each other well.

Q3. How do I handle fluctuating exchange rates in my budget?

A. Track expenses using the actual exchange rate you received for each transaction, not theoretical mid market rates. Most budget apps update exchange rates automatically, but if you’re manually tracking, record the rate shown on your bank statement or currency exchange receipt for accuracy.

Q4. Should I set my budget in USD or the local currency?

A. Set your overall budget in your home/tax currency (USD for Americans), but create location specific sub budgets in local currencies for daily spending awareness. This dual approach maintains consistent long term financial planning while giving you practical spending limits in the currency you’re actually using.

Q5. How much should I budget monthly as a digital nomad?

A. Budget varies dramatically by location and lifestyle. Low cost destinations (Southeast Asia, parts of Latin America, Eastern Europe) support comfortable nomad lifestyles for $1,500-2,000 monthly. Mid range locations (Portugal, Spain, Mexico cities) typically require $2,000-3,000 monthly. High cost cities (Western Europe, Singapore, Tokyo) often demand $3,000-5,000+ monthly.

Q6. What percentage should I allocate to each budget category?

A. Typical budget breakdowns for multi-currency expense management: 30-40% accommodation, 25-30% food and dining, 10-15% coworking and internet, 10-15% transportation, 5-10% entertainment, 5-10% health and fitness, with 5-10% buffer for unexpected expenses. Adjust based on your priorities some nomads spend more on activities and less on accommodation by choosing budget housing. freakingnomads

Q7. Do I need to track expenses for tax purposes?

A. Yes, if you’re running a business as a digital nomad. The IRS allows deductions for legitimate business expenses including coworking, business travel, professional development, equipment, and internet service. If you’re considering structuring your nomad work as a business, review our complete LLC setup guide for digital nomads. Detailed expense tracking throughout the year makes tax filing significantly easier and often reduces tax liability by thousands of dollars. reddit

Q8. How often should I review my budget?

A. Review spending weekly to catch errors and stay aware of patterns, and conduct comprehensive monthly reviews to adjust budgets based on actual spending. When moving to new locations, review and adjust location-specific budgets based on research and early spending patterns. ynab

Choosing Your Budget Tracking System

Most digital nomads don’t use just one tool. The most common approach combines a digital banking solution (Wise or Revolut) for currency exchange and international spending with a dedicated digital nomad budget tracking app (Trail Wallet, TravelSpend, or Spendee) for detailed expense tracking and budget management. freakingnomads

Choose Trail Wallet if: You want simple manual tracking without subscriptions, prefer one time purchases over ongoing fees, and primarily travel solo for shorter periods (1-6 months). thetraveler

Choose TravelSpend if: You need group expense splitting functionality, want detailed location based analytics, and plan long-term travel (6+ months) across multiple countries with comprehensive management. adamandlinds

Choose Spendee if: You want automated bank syncing to eliminate manual entry, use credit/debit cards for 90%+ of purchases, and have consistent internet access.

Choose YNAB if: You want comprehensive financial management including debt payoff, retirement savings, and investment tracking alongside travel expense monitoring for complete planning. ynab

Choose Wise or Revolut if: You want banking and budget tracking combined in one platform with minimal app switching and no third-party synchronization. citizenremote

The best recommendation? Test different combinations during your first 2-3 months as a digital nomad. Your tracking system should feel natural and sustainable, not like homework you’re constantly avoiding. If you’re not checking your budget app at least weekly and adjusting spending based on what you see, something about your setup isn’t working for your personal style.

Budget tracking isn’t about restriction it’s about awareness and optimization. The goal is understanding where your money goes so you can make informed decisions about spending more on experiences you value and less on things that don’t matter to you. Good systems enable the freedom to travel sustainably for years, not just months before running out of money.

About the Author

This guide was created by the NomadWallets.com team, which has been helping US digital nomads navigate international finance, taxes, and budget management since 2019. Our expertise comes from real world experience managing finances across 50+ countries and working with hundreds of location independent professionals. We combine practical travel experience with financial research to provide actionable guidance for remote workers living abroad.

Disclaimer: This article is for informational purposes only and should not be considered legal or financial advice. Consult with qualified professionals for your specific situation.

Further Reading & Reference Links

The following resources provided background information and data verification for this guide. All content has been independently researched and rewritten in our own words to provide unique value to digital nomads.

- Best Budgeting and Expense Tracking Apps for Digital Nomads – Freaking Nomads

- Best Expense Tracker/Budget app with multi-currency – Reddit – r/solotravel Discussion

- How to Handle Multiple Currencies in YNAB – You Need A Budget

- Multi Currency Expense Tracker – Google Play – Android App

- The Best Banks for Digital Nomads: Managing Finances on the Go – Andy Sto

- Spendee: Money Manager & Budget Planner – Official Website

- Daily budget planner: Spendee – Google Play – Android App

- Spendee Budget App & Planner – App Store – iOS App

- Spendee Pricing – Subscription Plans

- TravelSpend Review: The Best Budget App for Long-Term Travelers – The Traveler

- What is Spendee? – Spendee Help Center

- TravelSpend Review: How We Track Every Dollar – Adam and Linds

- Using Multiple Currencies in YNAB: A Guide – YNAB Support

- Digital Nomad Essentials 2025: The Best Apps, Tools & Resources – Citizen Remote

- Best Budgeting Apps of 2025 – Forbes Advisor

All pricing, features, and app capabilities were verified as of November 2025. Budget ranges reflect 2025 cost of living data from multiple nomad communities and financial platforms.

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.