Introduction: Why Healthcare Costs Matter for Digital Nomads

Healthcare costs by country for digital nomads can destroy your budget faster than rent or flights combined yet most US nomads don’t realize it until they’re sitting in a Bangkok ER holding a $600 bill for “just a checkup.” The problem isn’t that healthcare abroad is universally expensive it’s that the word “cheap” hides a dangerous trap. A $30 doctor visit can escalate into $2,000 once lab work, imaging, and prescriptions enter the equation, and when you’re paying upfront in cash as a non resident, that financial hit arrives all at once.

Medical expense planning for digital nomads requires answering “how much does healthcare cost for digital nomads” honestly a reality most travel blogs skip you exist in a healthcare gray zone. You’re not a tourist breezing through for two weeks with travel insurance, and you’re not a legal resident with access to subsidized public systems.

You’re somewhere in between, which means healthcare costs abroad for US nomads often default to private tier pricing without the safety net of employer insurance or Medicare (which doesn’t cover care outside the US). According to WTW’s 2026 Global Medical Trends Survey, global medical costs are projected to rise 10.3% in 2026, with Asia Pacific seeing a 14% increase the regions where many digital nomads base themselves.

This guide delivers what you actually need: real healthcare cost comparison by country data, budget scenarios for solo nomads to families, and a planning framework that accounts for routine care, emergency buffers, and insurance strategy. You’ll find embedded links to the complete digital nomad healthcare guide, cost modeling via the NomadWallets Cost of Living Calculator, and actionable checklists you can use before your next move.

Tourists vs Nomads vs Residents: Where You Fall in the Healthcare Gap

Healthcare access for non residents creates three distinct tiers, and understanding where you land determines what you’ll actually pay:

| Status | Public Healthcare Access | Typical Pricing | Upfront Payment Required? |

| Tourist (< 90 days) | Emergency only in most countries | Private clinic rates | Yes, cash or credit card |

| Digital Nomad (3-12 months) | Rarely; depends on visa type | Private hospital tier | Yes, unless insurance pre approved |

| Legal Resident (work permit, residency visa) | Yes, after registration period | Subsidized public + private options | Varies; public often free/low cost |

Most digital nomads live on tourist visas or remote work visas that don’t automatically grant public healthcare eligibility. This means even in countries with “universal healthcare” like Portugal or Spain, you’re routed to private clinics and international hospitals where costs mirror what locals pay privately not what they pay through their national system. Healthcare eligibility by visa type matters more than the country’s reputation a Portuguese D7 visa holder can access public care after registration, but a tourist visa nomad in Lisbon pays €60-€150 per private doctor visit.

This gap explains why healthcare budget for digital nomads must plan for private tier expenses even in “affordable” destinations. For a deeper breakdown of how visa status affects access, see how visa status affects healthcare access abroad.

What This Guide Covers: From Costs to Strategy

Healthcare costs by country for digital nomads aren’t just about knowing that Thailand is cheaper than the US. This guide walks through:

- Cost breakdowns by category: outpatient visits, emergency care, diagnostics, prescriptions, and hospital stays

- Regional cost patterns: Southeast Asia, Latin America, Europe, and Middle East with 2026 data

- Budget scenarios: monthly healthcare costs for solo nomads, couples, families, and those with chronic conditions

- Insurance vs cash strategy: when to pay out of pocket, when coverage is mandatory, and hybrid approaches most nomads use

- Planning tools: access to tracking healthcare expenses as a digital nomad, plus the NomadWallets Free Resource Library for downloadable checklists

The 2026 framing matters because medical inflation is outpacing general inflation in key nomad regions. Aon’s 2026 report projects Vietnam’s medical costs rising 12.2%, Thailand stabilizing but still elevated, and Latin America jumping from 10.5% to 11.9%. Planning with outdated 2024 numbers underestimates what you’ll actually spend in 2026.

How to Read Healthcare Costs as a Nomad

International healthcare costs don’t fit neatly into a single number. A “doctor visit” in one country might include consultation only, while in another it bundles basic diagnostics. Breaking costs into categories shows where money actually goes and where surprise bills hide.

Outpatient Medical Costs

Outpatient medical costs cover anything that doesn’t require an overnight stay: general practitioner visits, specialist consultations, and walk in clinic care. In Southeast Asia, a private GP visit runs $20-$50 in Thailand or Vietnam, but jumps to $60-$90 at international hospitals catering to expats. In Mexico, you’ll pay $30-$80 for a private consultation depending on the city, with Mérida and Oaxaca on the lower end and Mexico City trending higher.

Europe shows wider variation by country and residency status. Portugal’s private GP visits cost €60-€100 ($65-$110), while Spain’s run €50-€90 if you’re paying out of pocket. Specialist visits escalate significantly: expect €150-€250 in Southern Europe and $80-$250 in Mexico.

Emergency Medical Costs Abroad

Emergency medical costs abroad hit differently than routine care because you can’t shop around or negotiate. Emergency room entry fees alone range from $200-$800 in Mexico’s private hospitals, €500 in Thailand for international facilities, and $500-$1,200 in the US (where many nomads maintain nominal residence). These fees cover triage and initial assessmentnot treatment, labs, or imaging.

Lab work and diagnostics ordered in the ER add quickly: bloodwork costs $50-$150, basic imaging (X rays) runs $80-$200, and if the ER doctor orders a CT scan, expect $300-$800 depending on country and facility tier. Medications dispensed in emergency settings carry markup; a prescription that costs $15 at a local pharmacy might be billed at $40-$60 when administered in the ER.

Diagnostic and Imaging Costs

Diagnostic and imaging costs escalate faster than most nomads anticipate. A basic X ray in Thailand costs $30-$60 at local clinics, but $80-$150 at Bangkok’s international hospitals. MRI and CT scans represent the biggest cost jumps: Mexico charges $200-$500 for an MRI compared to $1,000-$3,000 in the US, while Vietnam’s costs sit at $150-$400 depending on the facility.

Ultrasounds, EKGs, and routine bloodwork remain affordable in most nomad hubs $40-$100 total in Southeast Asia and Latin America but specialized testing (hormone panels, allergy testing, genetic screening) can reach $300-$600 even in “cheap” countries when processed at international standard labs.

Prescription Drug Costs Abroad

Prescription drug costs abroad vary wildly based on whether you’re buying generic or brand name medications, and whether the country allows over the counter sales of drugs that require prescriptions in the US. In Mexico and Thailand, many antibiotics, anti inflammatories, and even some controlled substances are available without prescriptions at local pharmacies for $5-$30 per course.

Brand name medications especially newer drugs for chronic conditions like diabetes, hypertension, or mental health cost significantly more and may not be available generically outside the US. A month’s supply of a common SSRI might cost $8-$15 in Mexico but $40-$80 in Europe without insurance. Refill legality also matters: carrying more than a 90 day supply across borders can trigger customs issues, and some countries restrict quantities you can purchase at once without a local prescription.

Hospital Costs by Country

Hospital costs by country create the biggest financial exposure for digital nomads because room rates don’t reflect total costs. A private hospital room in Thailand runs $80-$200 per night, but that’s just the bed doctor visits, nursing care, medications, and procedures are billed separately. In Mexico, a hospital stay averages $300-$1,200 per day in private facilities once all fees are included, while Colombia’s costs sit at $200-$800 per day depending on the city and hospital tier.

Surgical procedures add another layer. Minor outpatient surgery (cyst removal, minor laceration repair) costs €800-€1,500 in Portugal or Italy, while the same procedures in Thailand or Mexico run $400-$1,000 including facility fees. Major surgery appendectomy, orthopedic repair, emergency caesarean can reach $5,000-$15,000 in Southeast Asia’s top international hospitals and $8,000-$25,000 in Latin America, compared to $30,000-$80,000+ in the US.

Public vs Private Healthcare Abroad

Public vs private healthcare abroad determines both access and cost, but the divide isn’t always obvious. Spain, Portugal, and Greece offer robust public systems funded through social security contributions but digital nomads on tourist visas or even some remote work visas don’t qualify until they’ve registered as residents and contributed for a minimum period (often 3-6 months). This means your first few months default to private care regardless of the country’s public healthcare reputation.

Public systems that do allow tourist access like emergency care in EU countries under reciprocal agreements often limit services to stabilization, not ongoing treatment. Private healthcare, which nomads typically use, operates on international hospital standards with English speaking staff, faster appointment times, and direct billing to insurance when arrangements exist.

The trade off private costs in “universal healthcare” countries often match or exceed Southeast Asian private rates. Portugal’s private hospital day costs €150-€300 compared to Thailand’s $80-$200, but both are substantially cheaper than the US.

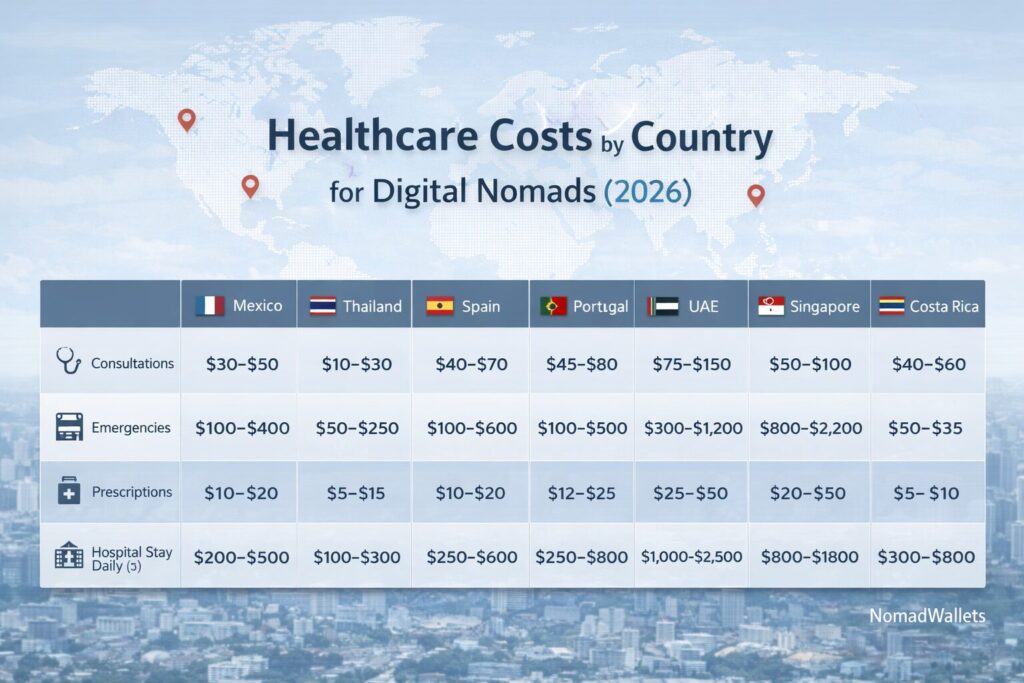

Healthcare Cost Comparison by Country for Digital Nomads (2026)

Healthcare costs by country for digital nomads 2026 reflect medical inflation adjustments and post pandemic pricing stabilization across all regions.

Healthcare cost comparison by country for digital nomads requires looking beyond single visit prices to understand total healthcare exposure across routine care, emergencies, and insurance. The table below reflects 2026 private tier pricing that most nomads encounter, drawn from international cost surveys and regional healthcare inflation data.

| Country | Private Doctor Visit | ER Visit (Entry + Basic Care) | Hospital Stay (Per Day, Private) | Prescription (Monthly Generic) | Private Insurance (Annual, Age 30-40) | Public Access for Nomads? | Nomad Notes |

| Thailand | $25-$50 | $500-$800 | $80-$200 | $10-$30 | $1,200-$2,400 | Emergency only | International hospitals charge 2-3x local clinics; Bangkok Phuket Samui highest nomads |

| Vietnam | $20-$40 | $400-$700 | $60-$150 | $8-$25 | $1,000-$2,000 | Emergency only | Medical inflation rising 12.2% in 2026; Hanoi/HCMC pricier aon |

| Indonesia (Bali) | $30-$60 | $600-$1,000 | $100-$250 | $12-$35 | $1,500-$2,800 | Emergency only | Bali’s expat hospitals expensive; mainland cheaper nomadexpenses |

| Mexico | $30-$80 | $200-$800 | $300-$1,200 | $10-$40 | $1,800-$3,500 | Emergency stabilization | Border cities cheaper; Playa/Tulum tourist priced nomadoc |

| Colombia | $25-$70 | $300-$900 | $200-$800 | $8-$30 | $1,200-$2,600 | Emergency only | Medellín best value; private quality high expats-realty |

| Portugal | €60-€100 ($65-$110) | €500-€900 ($550-$990) | €150-€300 ($165-$330) | €15-€50 ($16-$55) | €2,400-€4,200 ($2,640-$4,620) | After residency registration (3-6 mo) | D7/D8 visa holders qualify for public after bureaucracy heniam |

| Spain | €50-€90 ($55-$99) | €600-€1,100 ($660-$1,210) | €200-€400 ($220-$440) | €10-€45 ($11-$50) | €2,000-€3,800 ($2,200-$4,180) | After residency/work permit | Digital nomad visa doesn’t guarantee public access immediately heniam |

| UAE (Dubai) | $80-$150 | $800-$1,500 | $400-$900 | $20-$60 | $3,000-$6,000 | No; insurance mandatory for visa | Employer insurance typical; private only for freelancers nomads |

| Turkey (Istanbul) | $30-$70 | $300-$700 | $150-$350 | $8-$35 | $1,500-$3,200 | Emergency only | Private quality high; language barrier in public facilities nomads |

| United States | $150-$300 | $500-$2,500 | $1,500-$4,000 | $30-$200 | $6,000-$12,000+ | Depends on state residency | Nomads without state ties face coverage gaps nomads |

*All costs reflect private tier healthcare most digital nomads actually use. Local citizens may access lower cost public options based on residency status.

Key Insights:

- Southeast Asia remains the lowest absolute cost but faces double digit medical inflation through 2026

- Latin America offers middle ground pricing with high private quality in major cities

- Europe requires residency for public access; private costs approach US levels in major cities

- Insurance costs reflect age 30-40 healthy adults; chronic conditions or age 50+ can double premiums

For detailed city by city cost modeling that factors in housing, transportation, and healthcare together, use the NomadWallets Cost of Living Calculator.

Regional Healthcare Cost Patterns

International healthcare costs don’t distribute evenly across regions. Cultural norms, government subsidies, medical infrastructure quality, and expat population density all shape what you’ll actually pay and whether you’ll get care that meets US standards.

Southeast Asia: Two Tier Pricing and International Clinics

Southeast Asia’s healthcare costs by country for digital nomads operate on a strict two tier system. Local clinics and public hospitals serve Thai, Vietnamese, and Indonesian populations at ultra low prices ($5-$15 doctor visits, $30-$60 hospital days), but language barriers, long wait times, and equipment standards push most Western nomads toward international hospitals. These facilities Bangkok Hospital, Bumrungrad, Vinmec in Vietnam deliver US trained doctors, English speaking staff, and modern equipment, but charge 3-5x local rates.

According to Travel and Tour World’s 2026 analysis, Vietnam, Indonesia, and Thailand are investing heavily in medical tourism infrastructure, which improves quality but raises costs for non residents. A consultation at Bangkok’s Bumrungrad costs $60-$90 versus $25-$35 at a local clinic, and that premium extends to every service imaging, lab work, prescriptions dispensed on site.

These patterns show how healthcare costs by country for digital nomads fluctuate even within the same region based on facility tier and expat infrastructure.

Medical inflation adds pressure. WTW’s Asia-Pacific forecast projects Vietnam at 12.2% medical cost growth in 2026, Thailand stabilizing around 10%, and Indonesia at 13.5%. For nomads budgeting long term, these aren’t one time jumps they compound annually, meaning a $1,500/year healthcare budget in 2025 becomes $1,680 in 2026 and $1,848 in 2027 without changing your usage.

Latin America: Cash Plus Insurance Hybrid

Latin America’s healthcare costs overseas for US digital nomads hit a sweet spot for quality to cost ratio, especially in Mexico and Colombia. Private hospitals in Medellín, Mexico City, and Playa del Carmen employ US trained specialists, offer same day appointments, and accept direct billing from international insurers like Cigna Global and SafetyWing.

Mexico’s pricing advantage shows clearly in elective and semi urgent care. A dental crown costs $300-$500 in Mexico versus $1,200-$1,800 in the US; knee MRI runs $250-$400 versus $1,000-$2,500. Colombia mirrors these savings with slightly lower costs in Medellín and Bogotá compared to coastal tourist zones. However, expat healthcare analyses note that Mexico’s northern cities (Monterrey, Guadalajara) and Colombia’s smaller cities offer 20-30% better value than capital regions.

The hybrid strategy most nomads use in Latin America: pay cash for routine visits and prescriptions ($30-$80 total per month for minor issues), maintain catastrophic insurance for emergencies and hospitalizations ($1,500-$2,500 annual premium), and self fund diagnostic work that insurance wouldn’t cover until deductibles are met. This approach keeps monthly costs low while protecting against the $10,000-$25,000 exposure of major surgery or multi day hospital stays.

This regional flexibility demonstrates why healthcare costs by country for digital nomads require city level analysis, not just national averages.

Europe: Residency Requirements and Bureaucracy

Europe’s healthcare planning for digital nomads abroad collides with residency bureaucracy that delays or blocks public system access. Portugal’s National Health Service (SNS) theoretically covers residents, but digital nomads on D7 visas face 3-6 month waiting periods, require proof of social security registration (número de utente), and must navigate Portuguese language paperwork to activate coverage. Spain’s system operates similarly the digital nomad visa launched in 2023 doesn’t automatically grant public healthcare you must separately register with the seguridad social and wait for approval.

Private healthcare in Southern Europe costs significantly more than Southeast Asia but remains cheaper than Northern Europe or the US. According to healthcare access research by Deel, Portugal and Spain’s private doctor visits run €50-€100, specialist consultations €120-€250, and comprehensive private insurance €2,000-€4,200 annually for healthy adults under 45.

Understanding these residency barriers clarifies why healthcare costs by country for digital nomads in Europe often exceed expectations despite universal healthcare reputations.

Northern Europe (Germany, Netherlands, Nordic countries) mandates health insurance for visa approval and offers little cost advantage over private US insurance premiums run €300-€600/month with similar deductibles and co pays. The value proposition shifts: you’re paying for quality, universal emergency coverage, and integration with public systems if you transition to full residency, not for cost savings.

Middle East: Insurance Heavy Systems

Middle East healthcare costs for digital nomads particularly in UAE, Qatar, and Saudi Arabia operate on mandatory insurance models tied to visa sponsorship. The UAE requires proof of health insurance for residence visa approval, with minimum coverage standards enforced by immigration authorities. Employer sponsored insurance covers most expats on work visas, but digital nomads on freelance visas must purchase private plans costing $3,000-$6,000 annually for baseline coverage.

Out of pocket costs without insurance are prohibitively high. A private consultation in Dubai runs $80-$150, ER visits start at $800-$1,500, and hospital stays reach $400-$900 per day before procedures or medications. The system assumes insurance; direct cash payment triggers administrative hurdles and sometimes premium “self pay” rates that exceed insured costs due to negotiated discounts between insurers and hospitals.

Turkey presents a more nomad friendly Middle East option. Istanbul’s private hospitals charge $30-$70 for consultations, $300-$700 for ER visits, and maintain English speaking international departments. Private insurance costs $1,500-$3,200 annually, and the quality rivals European standards in major cities. The trade off public hospitals are overcrowded and primarily Turkish language, making them impractical for most nomads despite low costs.

The insurance-mandate model illustrates how healthcare costs by country for digital nomads depend heavily on visa and employment structures, not just facility pricing.

For detailed breakdowns of how visa type affects insurance requirements and healthcare access, see how visa status affects healthcare access abroad.

Healthcare Budget Scenarios

Healthcare budget for digital nomads varies dramatically based on household size, age, chronic conditions, and risk tolerance. These scenarios model 2026 costs using regional averages and include routine care, emergency buffers, and insurance strategy.

Scenario A: Solo Nomad (Age 30-40, Healthy)

Base location: Rotating between Southeast Asia and Latin America

Monthly routine costs:

- Doctor visits (2-3x/year average): $10-$15/month

- Prescriptions (minor issues, supplements): $10-$20/month

- Dental cleaning (2x/year): $8/month

- Total routine: $28-$43/month

Insurance: Catastrophic travel insurance (SafetyWing, World Nomads): $150-$200/month

Emergency buffer: $2,000-$3,000 cash reserve for upfront hospital payments

Annual total: $2,136-$2,916 (routine + insurance)

Strategy: Pay cash for all routine care and minor emergencies under $500 use insurance only for hospitalizations, major diagnostics, or medical evacuation. Monitor healthcare costs using the digital nomad budget tracker monthly to catch cost creep.

Scenario B: Couple (Both Age 30-45, Healthy)

Base location: Split between Mexico and Portugal

Monthly routine costs:

- Combined doctor visits: $20-$30/month

- Prescriptions (birth control, minor meds): $15-$30/month

- Dental/optical (annual exams): $15/month

- Total routine: $50-$75/month

Insurance: Two individual travel insurance policies or couples plan: $300-$400/month

Emergency buffer: $4,000-$5,000 (covers one partner’s hospitalization)

Annual total: $4,200-$5,700 (routine + insurance)

Strategy: One partner maintains US based high deductible plan for catastrophic coverage stateside; both carry travel insurance abroad. Use Mexico’s cash pay system for routine visits; Portugal’s private clinics for specialist care. Calculate combined living costs and compare healthcare quality ratings by country using the cost of living calculator before choosing base cities.

Scenario C: Family with Child (Age 6-12)

Base location: Primarily Mexico or Colombia (school stability)

Monthly routine costs:

- Parent visits (3-4x/year combined): $15-$25/month

- Child pediatric visits (4-6x/year): $20-$35/month

- Prescriptions and supplements: $20-$40/month

- Dental (family cleanings): $25/month

- Total routine: $80-$125/month

Insurance: Family travel/expat insurance plan: $500-$800/month

Emergency buffer: $6,000-$8,000 (pediatric ER visits more common)

Annual total: $6,960-$10,500 (routine + insurance)

Strategy: Maintain international health insurance with pediatric coverage and direct billing to major hospitals. Children have higher routine care frequency (growth checks, vaccinations, minor injuries), making cash only approaches riskier. Budget an additional $1,200-$2,000/year for dental/orthodontic work if needed. Use accommodations planning to ensure proximity to quality hospitals.

Scenario D: Chronic Condition Management (Any Age)

Base location: Europe or established Latin America city (consistent pharmacy access)

Monthly routine costs:

- Specialist visits (monthly or quarterly): $50-$150/month

- Prescription medications (branded, ongoing): $100-$300/month

- Lab work and monitoring (quarterly average): $40-$80/month

- Total routine: $190-$530/month

Insurance: Comprehensive expat insurance with pre existing condition coverage: $400-$900/month

Emergency buffer: $8,000-$12,000 (complications or hospitalization)

Annual total: $7,080-$17,160 (routine + insurance)

Strategy: Chronic conditions (diabetes, autoimmune disorders, mental health management) eliminate pure cash pay approaches. Pre screen countries for medication availability some diabetes meds, biologics, and psychiatric drugs aren’t available generically outside the US or require specialist import permissions. Portugal and Spain offer best European access; Mexico and Colombia work if you establish care with specific specialists. Budget 40-60% more than healthy nomad scenarios and maintain 6-month medication reserves when possible.

For condition specific guidance and insurance recommendations, see the complete digital nomad healthcare planning guide.

Insurance vs Paying Out of Pocket

Travel insurance vs expat insurance represents one of the biggest strategic decisions for healthcare costs by country for digital nomads, and the right answer depends on your age, health status, base regions, and financial reserves. Neither extreme full comprehensive insurance nor complete self pay works optimally for most nomads.

When Insurance Is Mandatory

Medical evacuation insurance becomes non negotiable once you’re spending significant time in countries where advanced care (trauma surgery, cardiac intervention, stroke treatment) isn’t available locally. According to medical evacuation cost data, air ambulance transport from Southeast Asia to Singapore or Bangkok costs $15,000-$50,000, and medevac from rural Latin America to Miami reaches $25,000-$80,000. No emergency fund realistically covers this exposure, making evacuation riders essential even if you self pay for routine care.

Visa requirements force insurance in specific countries. The UAE mandates proof of coverage for residence visa approval, and several European digital nomad visas (Portugal D8, Spain digital nomad visa) require minimum insurance coverage as part of application documentation. If you’re applying for these visas, budget $2,000-$4,500 annually for compliant policies regardless of whether you’d otherwise carry insurance.

Chronic conditions shift the calculation entirely. Pre existing condition coverage through travel insurance typically excludes or severely limits claims, meaning comprehensive expat insurance ($4,800-$10,800/year) becomes the only way to avoid $50,000+ annual out of pocket exposure for specialist care, medications, and monitoring. For chronic condition management, see best health insurance options for US digital nomads.

When Cash Works

Paying cash for healthcare costs abroad makes financial sense when you’re young (under 40), healthy, based in low cost regions, and maintain emergency reserves of $5,000-$10,000. In Southeast Asia and Latin America, healthcare costs abroad without insurance for routine doctor visits ($20-$80), basic diagnostics ($50-$200), and prescriptions ($10-$40 monthly) total $500-$1,500 annually for healthy nomads with occasional minor issues.

The math if you’re spending $1,200/year on routine care and paying $2,400/year for travel insurance with a $1,000 deductible, you’re effectively paying $3,600 total to insurance companies while receiving minimal benefit (the deductible means you self pay the first $1,000 anyway). Dropping to catastrophic only coverage ($150-$200/month, high deductibles) and self funding routine care saves $1,200-$1,800 annually while maintaining protection against the real financial risk: multi day hospitalizations and major surgery.

Cash payment also unlocks negotiation leverage in many countries. Hospitals in Mexico, Thailand, and Colombia often discount 10-25% for immediate cash payment versus insurance billing, which involves administrative overhead and delayed payment. Ask for the “cash price” (precio en efectivo in Spanish, ราคาเงินสด in Thai) before accepting quoted rates.

Hybrid Strategy (Most Nomads)

The hybrid approach combines catastrophic insurance coverage with cash payment for routine care, balancing cost efficiency with financial protection. Typical structure:

- Catastrophic travel insurance: $1,800-$2,400/year ($150-$200/month) with $2,500-$5,000 deductibles covering hospitalization, surgery, and emergency evacuation

- Cash fund routine care: Budget $800-$1,500/year for doctor visits, prescriptions, dental, and minor diagnostics

- Emergency cash reserve: Maintain $3,000-$5,000 in accessible savings for upfront hospital payments (credit cards work but carry FX fees)

- Annual total: $5,600-$8,900 including emergency buffer build

This strategy works because it addresses the actual risk distribution. According to digital nomad healthcare research, 80% of nomads use healthcare for minor issues (respiratory infections, minor injuries, prescription refills) that cost under $200 per incident. The financial catastrophe comes from the 5-10% who experience major illness, accidents, or emergency surgery events that can generate $10,000-$50,000 bills even in “cheap” countries when hospitalization, surgery, and recovery are totaled.

Use tracking healthcare expenses as a digital nomad tools to monitor whether your actual spending justifies insurance premiums, and adjust coverage annually based on health changes and base location shifts.

Hidden Healthcare Risks Nomads Miss

Healthcare costs overseas for US digital nomads hide several traps that rarely appear in “cost of living” blog posts but destroy budgets and create dangerous care delays.

Upfront Medical Payments

Upfront medical payments represent the single biggest cash flow shock for nomads accustomed to US insurance systems where you’re billed weeks after treatment. In Thailand, Mexico, Colombia, Portugal, and most countries where nomads operate, hospitals and clinics require payment before or immediately after treatment not 30-60 days later. This means a $2,500 ER visit that results in overnight observation requires $2,500 in available credit or cash that night, even if your insurance will reimburse you later.

International hospitals and clinics serving expats may offer direct billing arrangements with major insurers (Cigna Global, Allianz, Bupa), but these must be pre arranged you can’t assume coverage at intake. If your insurance isn’t on the hospital’s direct billing list, you pay upfront and file reimbursement claims that can take 30-90 days to process. Keep $3,000-$5,000 in emergency accessible funds (high limit credit card, liquid savings) separate from your general travel budget.

Language Based Tier Switching

Language based tier switching happens when healthcare facilities route you to international wings or English speaking doctors that cost 2-4x the local language equivalent service. A Thai national visiting Bangkok Hospital for a consultation pays ฿600-฿900 ($17-$25) and sees a Thai speaking doctor in the general outpatient wing. A Western nomad requesting English speaking care gets routed to the international patient services floor where the same consultation costs ฿2,200-฿3,200 ($60-$90).

This isn’t price gouging it reflects real staffing costs for multilingual doctors and international patient coordinators but it means “Thailand healthcare costs $20 per visit” claims are technically true yet practically irrelevant for nomads. The same dynamic appears in Mexico (English speaking doctors in tourist zones charge double), Vietnam (Vinmec’s international departments vs local wings), and Portugal (private hospitals’ expat services vs standard Portuguese language care).

If you speak the local language or travel with a translator, request standard pricing explicitly. Some facilities will honor it; others enforce language based routing regardless.

Medical Tourism Myths

Medical tourism myths convince nomads that elective procedures abroad are universally cheaper and safer, leading to under budgeted procedures and quality risks. While dental work, cosmetic surgery, and orthopedic procedures are genuinely 40-70% cheaper in Thailand, Mexico, and Turkey than in the US, the “all in” cost must include:

- Pre procedure diagnostics: Bloodwork, imaging, consultations often billed separately and can add $500-$1,500

- Post op recovery time: Factor 7-14 days of accommodation, meals, and reduced activity budget $600-$1,400 depending on city

- Complication coverage: If something goes wrong, follow up surgery or extended hospitalization may not be covered by travel insurance, creating $5,000-$20,000 exposure

- Travel timing: You can’t fly immediately after major surgery; budget 10-21 days of immobility depending on procedure

Medical tourism works best when you’re already based in the country, have researched specific surgeons and facilities (not just Googling “cheap dental work Thailand”), and maintain insurance that covers complications. The US Digital Nomad Hub includes vetted facility lists for common procedures.

Healthcare Planning Checklist for Digital Nomads

Healthcare planning for digital nomads abroad requires advance research and ongoing tracking, not reactive scrambling when sick. Use this checklist before moving to a new country and review quarterly as your health status or base location changes.

Before You Move

- Research visa healthcare rules: Determine if your visa type grants public access, requires insurance proof, or defaults you to private only care

- Map hospital locations: Identify 2-3 quality hospitals/clinics within 30 minutes of your planned accommodation using accommodations planning tools

- Verify insurance coverage: Confirm your travel/expat insurance covers your destination country and download digital insurance cards with 24/7 helpline numbers

- Stock prescriptions: Bring 90-day supplies of any ongoing medications and research local availability of brand/generic equivalents

- Budget modeling: Use cost of living to model total living costs and healthcare quality ratings alongside housing and visa requirements for complete city comparison

First Week in Country

- Visit local pharmacy: Confirm prescription medication availability and pricing before you run out of US supplies

- Scout clinics: Walk or drive to your mapped hospitals during non emergency times to verify locations and assess quality/language services

- Download apps: Install local healthcare apps (Thailand’s Bangkok Hospital app, Mexico’s Doctoralia) for appointment booking and teleconsultation

- Set emergency contacts: Save hospital numbers, insurance helpline, and embassy contact in phone under “ICE” (In Case of Emergency)

Monthly Maintenance

- Track spending: Log all healthcare expenses in budget tracking system to identify cost trends

- Review insurance: Compare actual spending vs premiums every 3-6 months to optimize coverage level

- Medication refills: Order prescription refills 30 days before running out to account for shipping delays or local prescription requirements

- Emergency fund check: Verify your cash reserve remains at target level ($3,000-$8,000 depending on scenario) after monthly expenses

When Changing Countries

- Insurance notification: Some policies require advance notice of country changes; verify continued coverage before crossing borders

- Prescription legality: Research if your medications are legal/available in the new country; some controlled substances require import permits

- Hospital reset: Repeat the hospital scouting process in your new base city within the first week

- Cost recalibration: Expect 20-50% cost swings when moving between regions (Southeast Asia → Europe, Latin America → Middle East)

Download the full planning checklist from the NomadWallets Free Resource Library as a printable PDF.

FAQs: Healthcare Costs by Country for Digital Nomads

Q1. What’s the cheapest country for healthcare costs for digital nomads?

A. Vietnam and Colombia currently offer the lowest healthcare costs by country for digital nomads when balancing quality and price, with private doctor visits running $20-$40, ER visits $300-$700, and comprehensive annual insurance $1,000-$2,600 for healthy adults under 45. However, “cheapest” doesn’t account for quality variation, language barriers, or specific medication availability factors that matter more than price alone for chronic conditions or complex care.

Q2. Is healthcare free in Europe for digital nomads?

A. No. Public healthcare in European countries requires residency registration, social security contributions, and often 3-6 month waiting periods before coverage activates. Digital nomads on tourist visas or even remote work visas default to private healthcare at costs comparable to Southeast Asia’s international hospitals (€50-€100 per visit, €2,000-€4,200 annual insurance) until they establish legal residency and navigate local bureaucracy.

Q3. Do digital nomads need health insurance?

A. Yes, for catastrophic and evacuation coverage, even if you self pay routine care. Medical evacuation from remote locations costs $15,000-$80,000, and major surgery or multi day hospitalization can reach $10,000-$50,000 even in “cheap” countries. The optimal approach: catastrophic insurance ($150-$250/month) covering hospitalization and evacuation, plus cash reserves for routine visits and minor emergencies under $500.

Q4. Does Medicare cover healthcare costs abroad?

A. Medicare does not cover healthcare costs overseas except in extremely limited circumstances (emergency care during travel through Canada between Alaska and the continental US). US digital nomads on Medicare must either pay entirely out of pocket abroad, purchase private travel/expat insurance, or return to the US for coverage. For tax and residency implications, see the US Digital Nomad Hub.

Q5. How much does emergency surgery cost for digital nomads overseas?

A. Emergency surgery costs overseas vary dramatically by country, procedure complexity, and hospital tier. Appendectomy runs $3,000-$8,000 in Thailand or Mexico versus $30,000-$80,000 in the US; orthopedic surgery (broken bone repair) costs $4,000-$12,000 in Southeast Asia or Latin America versus $20,000-$60,000 in the US. However, complications, extended ICU stays, or rare procedures can exceed these ranges quickly, making catastrophic insurance essential regardless of base country.

Conclusion: Healthcare Costs in 2026 and Beyond

Healthcare costs by country for digital nomads in 2026 demand strategic planning, not wishful thinking that “cheap healthcare abroad” will automatically work out. The cheapest countries aren’t always the safest, the countries with universal healthcare don’t grant automatic access to nomads, and paying cash for everything works only until it catastrophically doesn’t.

The sustainable formula: routine care budget + comprehensive or catastrophic insurance + emergency cash reserve. For healthy solo nomads in Southeast Asia or Latin America, that might mean $500/year routine + $2,400/year catastrophic insurance + $3,000 emergency fund. For families or those with chronic conditions in Europe, it scales to $1,500/year routine + $7,200/year comprehensive insurance + $8,000 emergency fund. Use the Cost of Living Calculator to model your specific scenario against real 2026 pricing data.

Medical inflation through 2026 and beyond 10.3% globally, 14% in Asia Pacific, 11.9% in Latin America means healthcare costs by country for digital nomads today become inadequate within 18-24 months without adjustment. Track your actual spending quarterly using digital nomad budget tracking tools, adjust insurance coverage as you age or change regions, and maintain location flexibility to shift to lower cost countries if healthcare expenses spike unexpectedly.

The nomads who avoid healthcare financial disasters in 2026 aren’t the ones who found the single cheapest country they’re the ones who built systems hospital scouting routines, insurance optimization reviews, emergency funds that don’t get raided for flights or gear, and willingness to relocate when costs or quality no longer align with their needs. Download the full planning toolkit from the Free Resource Library, and start with the first checklist item today.

Glossary

Outpatient care: Medical services that don’t require overnight hospitalization, including doctor consultations, diagnostic tests, minor procedures, and prescription pickups.

Inpatient care: Treatment requiring admission and overnight hospital stay, billed separately for room, nursing, doctor visits, procedures, and medications.

Deductible: The amount you must pay out of pocket before insurance begins covering costs; common ranges are $1,000-$5,000 for travel insurance and $500-$2,500 for expat insurance.

Co pay: Fixed fee paid per service (e.g., $25 per doctor visit) regardless of total cost; common in US insurance but rare in international travel insurance.

Medical evacuation (medevac): Emergency transport via air ambulance to the nearest facility capable of treating serious injury or illness; costs $15,000-$80,000 depending on origin and destination.

Direct billing: Arrangement where hospitals bill insurance companies directly rather than requiring patients to pay upfront and seek reimbursement; only available when pre arranged between specific insurers and facilities.

Travel insurance: Short term coverage (typically up to 12 months) designed for tourists and nomads, covering emergency care, evacuation, and trip interruption; usually excludes pre existing conditions and routine care.

Expat insurance: Long term international health insurance (12+ months, often renewable indefinitely) covering routine care, specialist visits, and pre existing conditions; costs 2-4x travel insurance but provides comprehensive coverage.

Public vs private healthcare: Public systems are government funded, subsidized, and typically require residency/citizenship; private systems operate independently, charge market rates, and accept international patients without restrictions.

Upfront payment: Hospital requirement to pay in full before or immediately after treatment rather than receiving bills 30-60 days later; standard practice in most countries outside the US.

Sources & References

This article draws on 2026 medical cost projections, regional healthcare inflation data, and digital nomad specific insurance research to provide accurate planning guidance for US nomads.

- WTW 2026 Global Medical Trends Survey – October 2025

- Aon APAC Medical Plan Costs 2026 – October 2025

- Asia-Pacific Medical Inflation 2026 – WTW Vietnam, December 2025

- Understanding Healthcare Costs for Digital Nomads and Expats – Nomads Insurance, October 2024

- Cheapest Countries for Digital Nomads in 2026 – Nomad Expenses, December 2025

- Best Expat Health Insurance Mexico: Cost Guide – Nomadoc Mexico, January 2025

- Healthcare for Digital Nomads in Spain – Heniam, November 2024

- Colombia vs Mexico for Expats: Healthcare Comparison – Expats Realty, October 2025

- Digital Nomad Visas Offering the Best Healthcare Access – Deel, February 2024

- 2026 Medical Revolution Hits Southeast Asia – Travel and Tour World, December 2025

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.