This guide reflects current 2026 enforcement patterns observed across major VFS consulates and AIMA processing outcomes.

If you are reading guides that tell you the income requirement for the Portugal Digital Nomad Visa (D8) is €3,040 or €3,280, close them immediately. They are dangerously outdated.

In 2026, the game has changed. As the Portuguese government shifts its strategy from “mass tourism” to “sustainable settlement,” they have significantly raised the financial bar for new residents. The “Gold Rush” of easy entry is over; we are now in the era of compliance, higher thresholds, and stricter enforcement by AIMA (Agência para a Integração, Migrações e Asilo).

For remote workers, the Portugal Digital Nomad Visa (D8) remains the gold standard for entering Europe. It offers a path to EU citizenship, tax benefits under the new IFICI regime, and a lifestyle that is hard to beat. But to get it, you need to understand the new math.

This comprehensive guide clarifies the true cost of the Portugal Digital Nomad Visa (D8) in 2026, breaks down the critical difference between “Temporary Stay” and “Residency,” and provides the exact, “rejection-proof” document checklist you need for your VFS Global appointment.

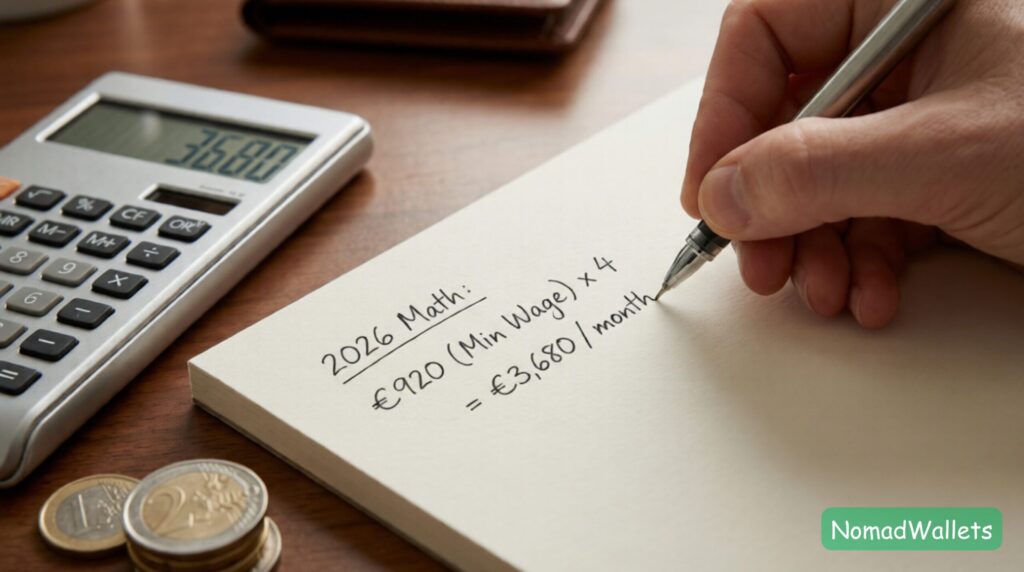

The 2026 Income Requirement (The New Math)

The most critical update for 2026 is the increase in the National Minimum Wage. The Portuguese law for the Portugal Digital Nomad Visa (D8) is specific: you must prove an average monthly income of four times (4x) the national minimum wage.

Many applicants are getting rejected this year because they are calculating their budget based on 2024 numbers. Here is the official calculation based on the Government Decree for 2026:

- 2025 Minimum Wage: €870 (Visa Req: €3,480)

- 2026 Minimum Wage: €920

- Your D8 Requirement: €3,680 per month

Gross vs. Net: The “Safety Margin”

A common point of confusion is whether this €3,680 must be Gross (before tax) or Net (deposited in the bank).

- The Law: Says “earnings,” which usually implies Gross.

- The Reality: Strict consulates (specifically London, San Francisco, and New York) often look for this amount hitting your bank account (Net) to ensure you can actually afford the cost of living.

- Our Advice: If your Net income is borderline (e.g., €3,500), you must bolster your application with significant savings. Do not risk a rejection over €100.

Table 1: Income Requirements by Family Size (2026)

If you are bringing a family, the Portugal Digital Nomad Visa (D8) requires you to prove additional income or savings.

| Family Member | % of Min Wage | Monthly Add-On | Total Monthly Income Req. |

| Main Applicant | 400% | €3,680 | €3,680 |

| Spouse / Partner | 50% | +€460 | €4,140 |

| First Child | 30% | +€276 | €4,416 |

| Second Child | 30% | +€276 | €4,692 |

| Parent (Dependent) | 50% | +€460 | €5,152 |

Pro Tip: While the law allows you to cover dependents with income, most lawyers recommend covering dependents with savings instead. This simplifies the monthly cash flow proof. Example: Keep your monthly income at €3,700, but put €15,000 in a savings account to “cover” your spouse.

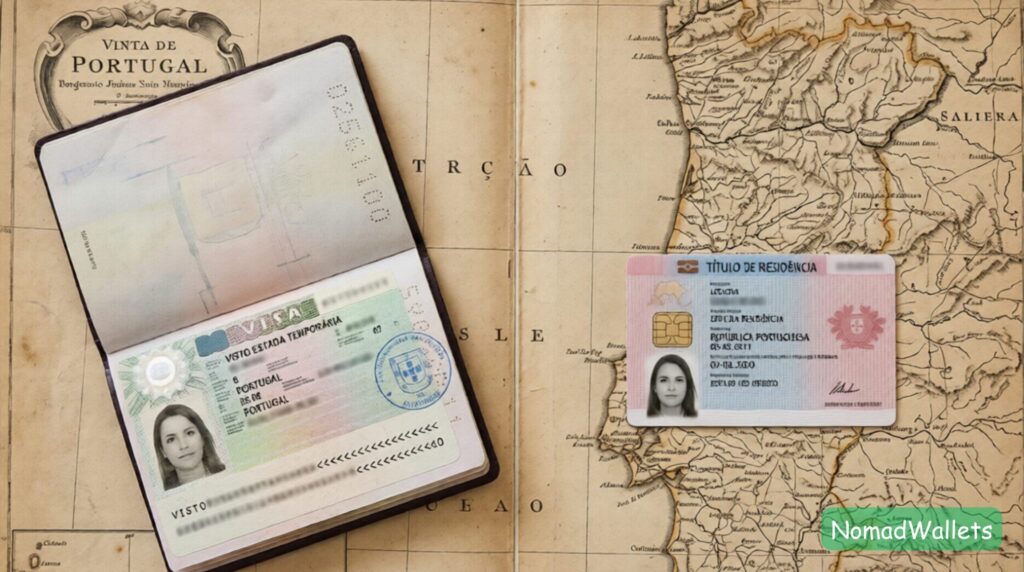

The Fork in the Road: Temporary Stay vs. Residency

When you fill out your application form for the Portugal Digital Nomad Visa (D8), you will face a critical choice. You must check one of two boxes. Choosing the wrong one is a disaster because you cannot easily swap them later without leaving the country.

Option A: Temporary Stay Visa (Visto de Estada Temporária)

The “Test Drive”

This visa is designed for digital nomads who want to experience Portugal for a year without fully committing to the tax system or bureaucracy.

- Duration: Valid for 1 year.

- Entries: Multiple entry (you can travel in and out).

- Renewal: Renewable for up to 4 years (subject to current law interpretation).

- Residency Card: No. You do not get a plastic ID card; you get a sticker in your passport.

- Path to Citizenship: No. Time spent on this visa does not count toward the 5-year citizenship clock.

- Bureaucracy: Lighter. You generally do not need to become a tax resident.

- Best For: Nomads who want to spend a “gap year” in Europe or those avoiding tax residency in Portugal.

Option B: Residency Visa (Visto de Residência)

The “Move”

This is the standard Portugal Digital Nomad Visa (D8) path for those looking to emigrate.

- Duration: You get a 4-month visa to enter Portugal. During those 4 months, you visit AIMA to get your 2-Year Residency Card.

- Residency Card: Yes. You get a plastic ID card (Título de Residência).

- Path to Citizenship: Yes. After 5 years of legal residency, you can apply for an EU passport.

- Bureaucracy: Heavy. You become a tax resident (hello NIF and IRS) and must deal with the backlog at AIMA.

- Best For: Families, people seeking EU citizenship, and those fully relocating their life.

Table 2: Feature Comparison

| Feature | Temporary Stay Visa | Residency Visa (D8) |

| Validity | 1 Year (Renewable) | 2 Years (Renewable for 3) |

| Entry Type | Multiple Entry | 2 Entries (then Residency Card) |

| Tax Residency | Generally No (unless >183 days) | Yes (Mandatory) |

| Bank Account | Not always required | Mandatory |

| NIF Required | Recommended | Mandatory |

| Lease Requirement | 4-6 Months (varies) | 12 Months (Registered) |

| Citizenship Path | No | Yes (Year 5) |

The Eligibility Checklist: Do You Qualify?

Before gathering documents, ensure you meet the core criteria for the Portugal Digital Nomad Visa (D8).

1. Nationality

You must be a citizen of a non-EU/EEA/Swiss country. (EU citizens do not need a visa; they simply register at the local town hall).

2. Employment Status

You must fall into one of two buckets:

- Remote Employee: You have a permanent contract with a company outside Portugal.

- Freelancer/Contractor: You have service agreements or invoices from clients outside Portugal.

Warning: You cannot work for a Portuguese company on the D8. If you are hired by a Lisbon startup, you need a D1 Work Visa, not a Digital Nomad Visa. The D8 is strictly for foreign income.

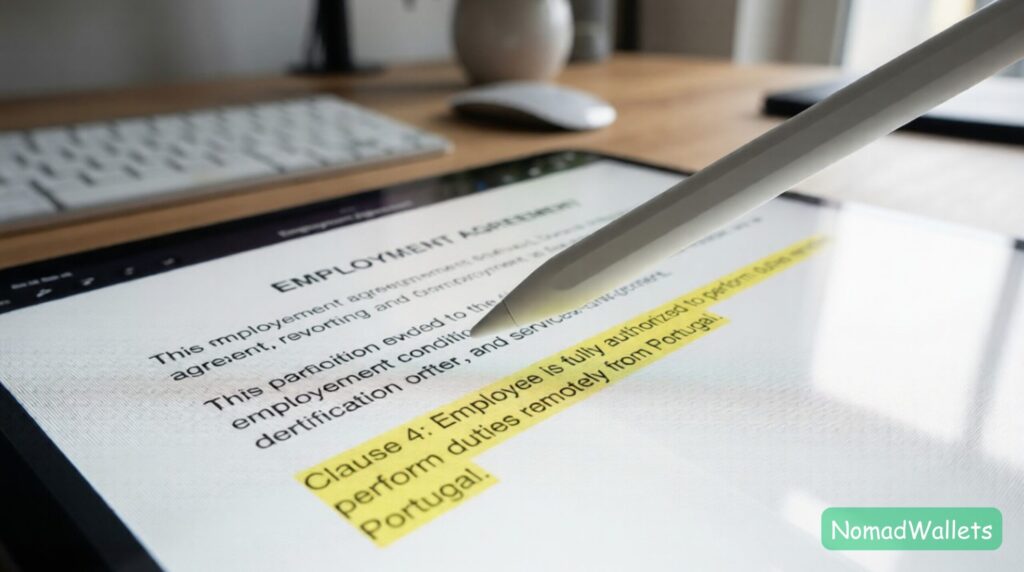

3. The “Remote” Clause

Your employment contract must explicitly state that you are allowed to work remotely.

- Bad: “Employee is based in New York.”

- Good: “Employee is authorized to perform their duties remotely from Portugal or any location of their choice.”

- The Fix: If your contract doesn’t say this, ask HR to sign a simple 1-page addendum confirming your remote status.

4. The “Approved” Document Checklist (2026)

To get your Portugal Digital Nomad Visa (D8) approved, you need a “perfect” application folder. AIMA and VFS Global are rejecting incomplete applications instantly. Do not give them a reason to say no.

A. Personal Identification

- Passport: Valid for at least 6 months beyond your intended stay. (Ideally 2+ years).

- Photos: Two recent passport-sized photos (European standard).

- Personal Statement: A signed letter explaining why you want to live in Portugal. Mention community, culture, and safety. Do not just say “low taxes.”

B. Financial Proof

- Bank Statements: The last 3 months of full statements. Highlight your income deposits with a neon marker so the consular officer can’t miss them.

- Payslips/Invoices: These must match the bank deposits exactly.

- Savings: Proof of the €11,040+ buffer (12x min wage).

- Tax Returns: Your most recent tax return from your home country (e.g., IRS 1040 for Americans, P60 for Brits). This proves you are a legal taxpayer.

C. The “Holy Trinity” of Portuguese Bureaucracy

You cannot skip these three items.

- NIF (Número de Identificação Fiscal): You need a Portuguese Tax ID. You can get this online via services like Bordr or Anchorless for ~$150.

- Portuguese Bank Account: Mandatory for the Residency path.

- How to open remotely: Many traditional banks (Millennium BCP, Novobanco) allow remote opening via power of attorney, or you can use Bison Bank (fully digital but expensive).

- Note: Revolut/Wise IBANs are sometimes accepted, but a traditional Portuguese PT50 IBAN is much safer for visa approval.

- Proof of Accommodation: This is the #1 cause of rejection in 2026.

- Requirement: A 12-month lease agreement.

- The Trap: The lease must be registered with Finanças (Tax Authority). You need to upload the “recibo” or contract registration code. A simple Airbnb receipt or a handshake deal is not valid.

- Alternative: If you own property, submit the deed (Caderneta Predial).

D. The Background Check

- FBI Background Check (Americans): Must be issued within 90 days of your appointment.

- Apostille: It must have the Hague Apostille stamp. A standard PDF download is not valid; the physical apostille or verifiable digital apostille is required.

- Validity: Criminal records expire after 90 days. Timing is everything.

🇺🇸 Special Note for US Applicants: Getting your FBI Background Check is the biggest bottleneck for Americans. You must order an “Identity History Summary” and get it apostilled by the US Department of State, which can take 8-12 weeks.

Need help with the FBI timeline, Social Security forms, or US-specific tax forms? Visit our US Digital Nomad Hub for a complete Americans in Portugal checklist.

Your Step by Step Application Roadmap (2026)

Step 1: The Gathering (Months 1-2)

Start collecting documents. The FBI background check and Apostille take the longest (up to 8 weeks). Secure your NIF and open your bank account.

Step 2: The Accommodation Hunt (Month 2)

Find a landlord willing to sign a 12-month lease and register it. This is difficult from abroad. Use platforms like Flatio (specifically designed for nomads) or work with a relocation scout.

Step 3: The VFS Appointment (Month 3)

Book an appointment at VFS Global in your home country (e.g., San Francisco, DC, London, Dubai).

- Rule: You must apply from your country of legal residence. You cannot fly to Portugal on a tourist visa and apply for the D8 from there (the “Manifestation of Interest” loophole is closed).

- Action: Bring two full copies of your application stack. One for them, one for you.

Step 4: The Wait (Months 3-4)

Processing times in 2026 are averaging 45-60 days.

- Status: VFS keeps your passport.

- Outcome: You receive your passport back with a D8 Visa vignette (sticker) valid for 4 months.

Step 5: The AIMA Appointment (Month 5)

Your visa sticker will usually have a pre-scheduled date for your AIMA appointment printed on it (a URL or a date).

- Action: Fly to Portugal. Go to the AIMA office on your date. Give biometrics (fingerprints/photo). Pay the card fee.

- Result: Your residency card arrives in the mail 2-8 weeks later.

Table 3: Estimated Application Budget (Single Applicant)

| Item | Estimated Cost | Notes |

| Visa Fee (VFS) | €90 | Paid at appointment |

| VFS Service Fee | €40 | Processing fee |

| Travel Insurance | €200 – €400 | Required for application |

| NIF Service | €150 | Legal representative fee |

| Bank Account Opening | €250 – €350 | If using a lawyer/service |

| AIMA Card Fee | €170 | Paid in Portugal |

| Background Check/Apostille | €100 | Varies by country |

| TOTAL | ~€1,200 | Excluding rent/flights |

Common Rejection Reasons (The “Anti-Fail” Guide)

Why do people get rejected for the Portugal Digital Nomad Visa (D8)? It is rarely the income, it is usually the paperwork.

1. The “Modelo 2” Failure

- The Issue: You submit a rental contract, but the landlord didn’t register it with the tax office.

- The Fix: Demand the Modelo 2 (Stamp Duty) receipt from your landlord before paying the deposit. Submit this receipt with your lease.

2. Active vs. Passive Confusion

- The Issue: Applying for the D7 (Passive) visa with D8 (Active) income, or vice versa.

- The Fix: If you work, apply for D8. If you retire/invest, apply for D7. Do not mix them.

3. Short Savings History

- The Issue: You deposit €12,000 into your account one day before printing the statement.

- The Fix: Consulates want to see “seasoned funds.” The money should be in your account for at least 3 months, or you need a letter explaining the transfer (e.g., “Transfer from my savings account X to checking account Y”).

Final Verdict: Is the D8 Visa Right for You?

The Portugal Digital Nomad Visa (D8) in 2026 is harder to get than it used to be, but it is also more valuable. It filters out the tourists and builds a community of serious, long-term residents.

If you earn over €3,680 and are ready to make Portugal your home base, this visa is your golden ticket to the EU.

Ready to start? Here is your immediate action plan:

- Check your average income (Last 3 months > €3,680).

- Get your FBI/Police Background Check immediately (it takes the longest).

- Secure your NIF online.

Once you have your visa sorted, your next hurdle is taxes. The D8 gets you in, but the NHR 2.0 (IFICI) keeps your money yours.

Getting the visa is just the first step. To plan your actual move, find apartments, and understand the lifestyle, read our full Digital Nomad Portugal 2026 Master Guide.

- Disclaimer: The information provided in this article regarding the Portugal Digital Nomad Visa (D8), immigration requirements, and financial thresholds is for general informational and educational purposes only and does not constitute legal, financial, or tax advice.

Immigration rules, enforcement practices, and minimum wage decrees in Portugal change frequently and may be interpreted or applied differently by individual consulates (for example, VFS London versus VFS New York). Although this guide is updated for 2026 using the latest publicly available government data, including the €920 minimum wage, you should not make relocation or visa decisions without consulting a qualified Portuguese immigration professional who can assess your specific circumstances. We accept no responsibility or liability for actions taken based on this content.

FAQ: Portugal Digital Nomad Visa (D8) 2026

Q1: My income fluctuates. Can I still apply?

A: Yes, but the average of the last 3-6 months must meet the €3,680 threshold. If one month is low (e.g., €2,000) and the next is high (€6,000), write a cover letter explaining your freelance nature and highlight the average.

Q2: Can I apply with a spouse who doesn’t work?

A: Yes. This is called “Family Reunification.” You must show +50% income (an extra €1,840/month) or, better yet, substantial savings (an extra €6,000+) to cover them. They will apply as your dependent.

Q3: I read that the requirement is €3,280. Why do you say €3,680?

A: €3,280 was the 2024/2025 requirement (based on the old €820 minimum wage). The minimum wage increased to €920 in 2026. Applying with the old math is the fastest way to get rejected or asked for additional documents.

Q4: Can I use a Revolut or Wise account for the “Portuguese Bank Account” requirement?

A: It is risky. While some consulates accept Wise, others (like Lisbon AIMA) insist on a physical Portuguese bank (Millennium, CGD, Novobanco). For the D8 Residency path, we strongly recommend opening a real Portuguese account to avoid delays. For Temporary Stay, Wise is often fine.

Q5: How long do I have to stay in Portugal?

A: Residency Visa: You must not be absent for more than 6 consecutive months or 8 non-consecutive months per year.

Temporary Stay: The stay requirements are looser, but you generally need to be in the country to renew it.

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.