Tax Hacks for US Nomads

Tax Saving Strategies for US Nomads: Using FEIE

Tax Hacks for Digital Nomads can help you legally reduce your tax burden while living and working abroad. If you’re someone who travels the world freely, you’ve likely wondered how taxes work. Especially if you are a US citizen or permanent resident, you must file a tax return. But don’t worry! There is a useful tax saving strategy.One of the most powerful is the Foreign Earned Income Exclusion (FEIE). In this guide, I’ll explain how digital nomads can use it effectively.

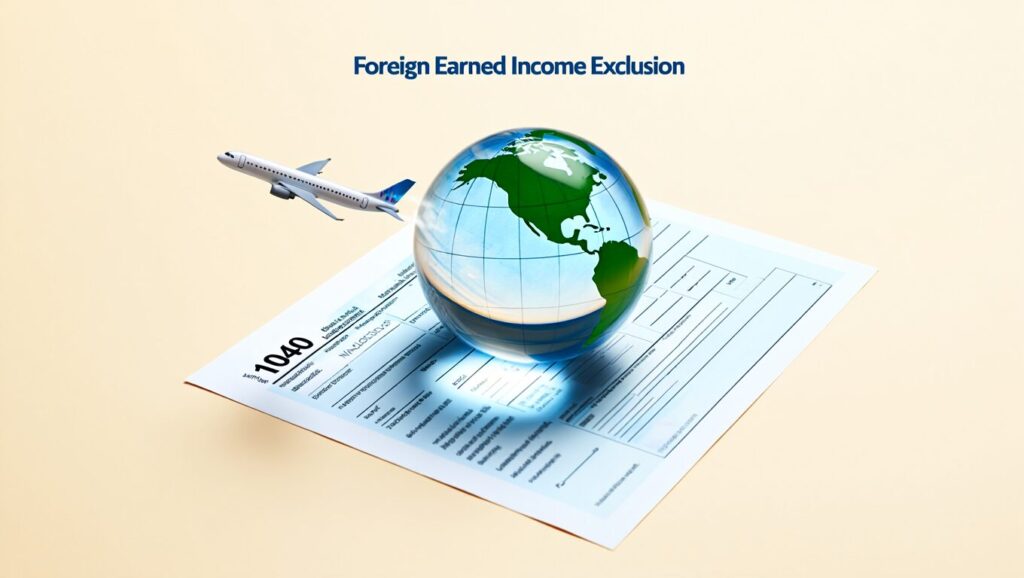

What is the Foreign Earned Income Exclusion (FEIE)?

The FEIE is a system that allows you to exclude foreign-generated income from U.S. taxes if you meet certain conditions. Through this system, you can treat up to about $100,000 of income annually as tax-free. In other words, you do not have to pay taxes in the U.S. on the income you earn while working abroad!

How Form 2555 Helps Claim FEIE Benefits

To apply for FEIE, you must fill out Form 2555. This form contains all the information you need to report foreign income and claim FEIE. How do you fill it out? Simply write down in detail the period of your stay abroad, the source of your income, etc.

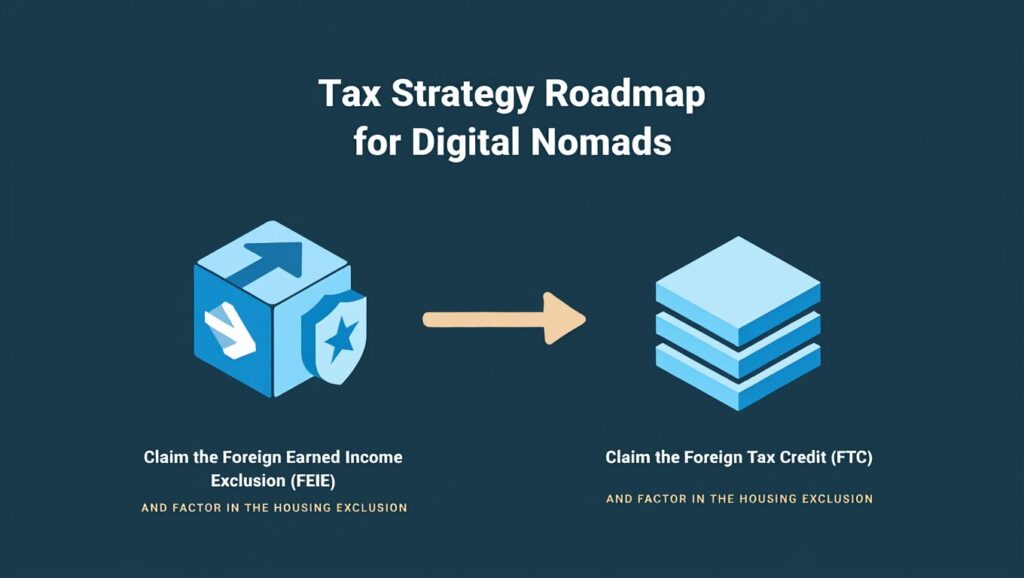

FTC and State Tax Evasion Strategies

In addition to FEIE, there is also a system called FTC (Foreign Tax Credit). This is a system that allows you to deduct taxes paid overseas from your US taxes. Which of the two systems to choose may vary depending on the situation. In general, FEIE is more advantageous, but you should carefully consider your income situation.

Best Tax Filing Apps for Digital Nomads in 2025

Filing taxes can be complicated, but there are a variety of tax apps available these days that can help. For example, apps like H&R Block and TurboTax offer user-friendly interfaces that make filing your taxes easy. These apps are also helpful because they provide guidance for a variety of situations, including the FEIE and the FTC.

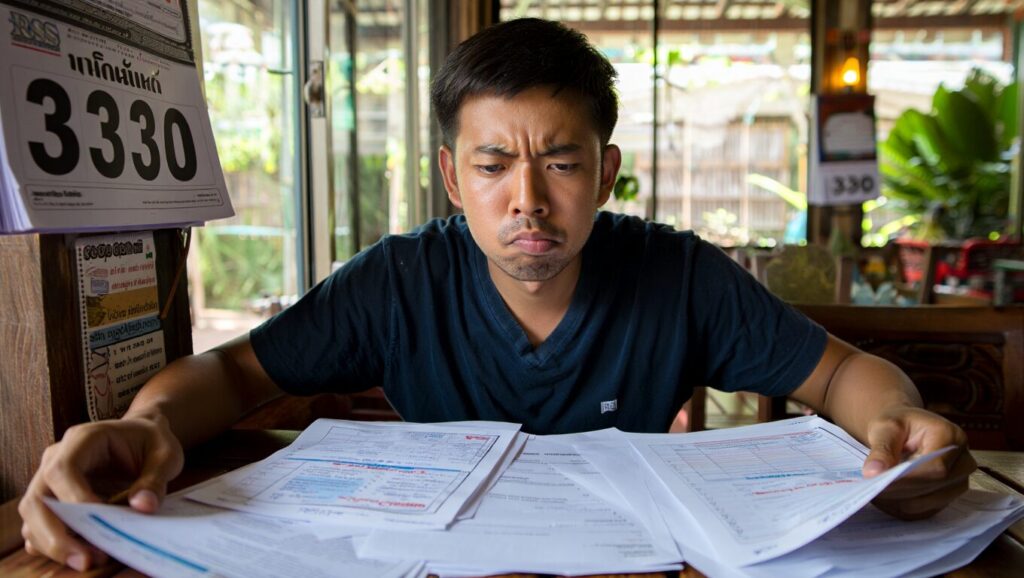

Real-Life Case: FEIE Confusion for a US Nomad in Chiang Mai

Let me tell you about a case of a nomad who lived in Chiang Mai and tried to apply for FEIE. At first, he tried to file FEIE, but he made a mistake because he misunderstood the residency requirement. He ended up paying taxes, and through this experience, he realized how important the residency requirement is.

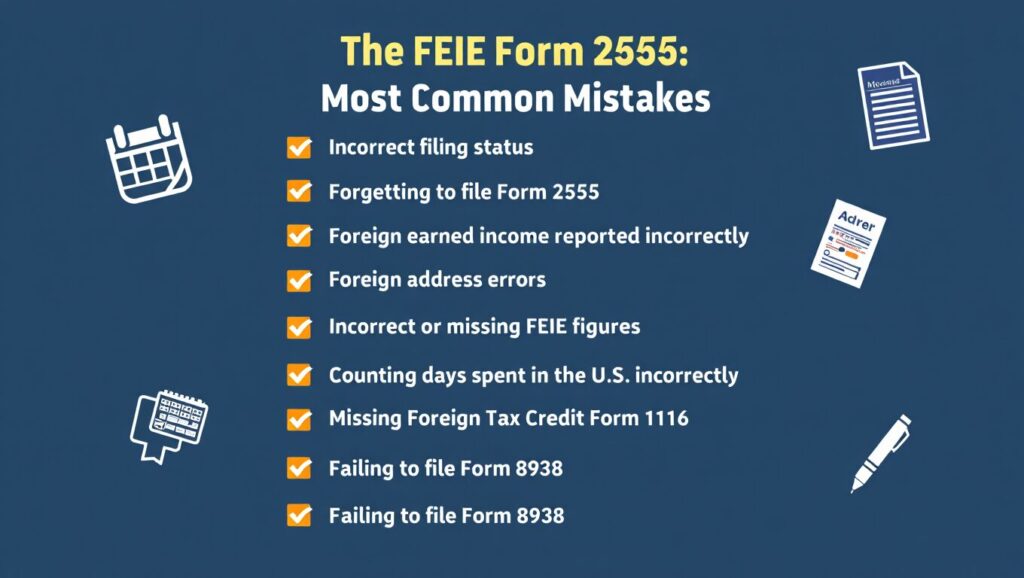

Common Tax Mistakes Digital Nomads Should Avoid

The most common mistake that nomads make when applying for FEIE is misunderstanding the 330-day rule. They overlook the requirement that they must reside abroad for more than 330 consecutive days, and even if they return to their home country temporarily, it becomes difficult to apply for FEIE. Therefore, it is important to always check and manage the schedule well.

FEIE vs. FTC: Which Tax Strategy is Better for US Nomads?

| Item | FEIE | FTC |

| Tax exemption scope | Foreign income tax exemption of up to approximately $100,000 | You can deduct the amount of taxes you paid abroad from your US taxes. |

| Application form | Form 2555 | Form 1116 |

| Conditions of application | Living abroad for more than 330 days | If you actually paid taxes abroad |

| In case of advantage | If your income is not high abroad | If foreign taxes are higher than US taxes |

Introducing the H&R Block App

H&R Block is one of the most popular tax filing services in the U.S. The app is user-friendly and guides you through the tax filing process. It includes many features that digital nomads need when filing taxes abroad.

How to Use the H&R Block App to File US Taxes Remotely

After you download the app and sign up, you’ll need to enter basic information on the screen.

This screen will ask you whether you are a U.S. citizen, additional citizenship, and the date you moved abroad. Select “Yes” or “No” for each item and select a date on the calendar. With this information, H&R Block can help you prepare a personalized tax return.

- Enter basic information : Enter your personal information and set basic information for tax reporting.

- Entering Income : Let’s move on to the step of entering income earned overseas. At this time, you must accurately enter the type and amount of income.

- Check Your Tax Credits and Benefits : H&R Block can help you understand the various tax credits and benefits you may be eligible for.

- File your tax return : Once all your entries are complete, you can review and file your tax return.

Key Tips for Filing Taxes with H&R Block as a Nomad

There are a few things to keep in mind when filing your taxes as a digital nomad. First, you must report any income earned overseas. Also, some income may be exempt from tax, so it’s important to check this carefully.

As a digital nomad, you need to have some strategies in place to efficiently file your taxes while working abroad.

For example, you can consider ways to deduct expenses incurred while working abroad or take advantage of tax exemptions offered in certain countries. In particular, resources such as the “US Tax Guide for Digital Nomads” can be very helpful.

Conclusion

Life as a digital nomad is fascinating, but tax issues are something you can never overlook. With the H&R Block app, you can easily file your taxes and use the information and strategies you need to make your tax filing easier.

Introducing the TurboTax App

TurboTax is one of the most popular tax preparation software in the United States. The app helps users easily file their taxes, especially for those with complex tax situations, such as digital nomads. TurboTax automatically calculates various tax deductions and credits, making tax preparation much easier.

How to Use TurboTax

Using TurboTax is very simple.

- First, download the app.

- Create an account.

- Enter the required information.

- Enter your income, deductions, and credits.

TurboTax will help you file your taxes optimally based on the information you enter. In particular, it guides you through filing taxes on income earned overseas, making it an essential tool for digital nomads.

Things to keep in mind when filing taxes

There are a few things to keep in mind when filing your taxes. First, don’t forget to report your income from overseas. Second, you can reduce your tax burden by using tax strategies such as the Foreign Earned Income Exclusion and the Foreign Tax Credit. These strategies can be easily applied in TurboTax.

Tax Strategies for Digital Nomads

There are a few strategies you need to employ to manage your taxes effectively as a digital nomad. First, you can use the Foreign Earned Income Exclusion to exclude a certain amount of income from your taxes. Second, you can use the Foreign Tax Credit to deduct taxes paid abroad from your US taxes. Finally, you can also use the Foreign Housing Exclusion to exclude housing expenses from your taxes. These strategies can be easily applied through TurboTax.

Conclusion

Tax issues can be complicated as a digital nomad, but tools like TurboTax can make it a lot easier to manage. Always make sure you have the latest information when filing your taxes, and if necessary, get professional help. You should be careful not to neglect your taxes while enjoying your life as a digital nomad.

Tip for Nomads: Consult a Tax Professional

Tax issues are really complicated, so if possible, it is a good idea to consult with a tax professional. Especially if you are dealing with multinational income, professional advice can be very helpful. Leave the final touches to the professionals and focus on your trip!

Managing your taxes while traveling is an important part of the nomadic lifestyle. FEIE can save you a lot of money, so be sure to take advantage of this opportunity.

You may also like :- Best VPNs for Secure Online Banking for Digital Nomads (2025 Guide)

Tags:-

#AmericanNomad #TaxSavings #FEIE #DigitalNomad #TaxReporting #Form2555 #FTC #TaxExpert #TravelSavings

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.