If there’s one constant in a life spent hopping time zones, it’s this: taxes still follow the passport. US digital nomad taxes sound intimidating, but the path gets simple once the habits click—track days abroad, choose the right exclusion, clean up state ties, budget for self-employment, and file on time. The rest is paperwork, not panic. A quick first step is to run a no-surprises check with the NomadWallets Tax Estimator, then decide whether to DIY or bring in a pro for the year’s return.

What “worldwide income” really means

- The US taxes citizens and green card holders on worldwide income, regardless of where work happens. The return is Form 1040, and earned income (from work) is treated differently from passive income (dividends, interest, capital gains, most rentals) for exclusion purposes. Earned income is the part US digital nomad taxes can often reduce with FEIE; passive income is not.

- Keep a running list of all income sources—client invoices, platform payouts, small bank bonuses, and foreign account interest—so nothing gets missed at filing time. A monthly receipt dump into a single folder keeps the Schedule C clean and lowers stress later.

FEIE in plain English (and why it matters)

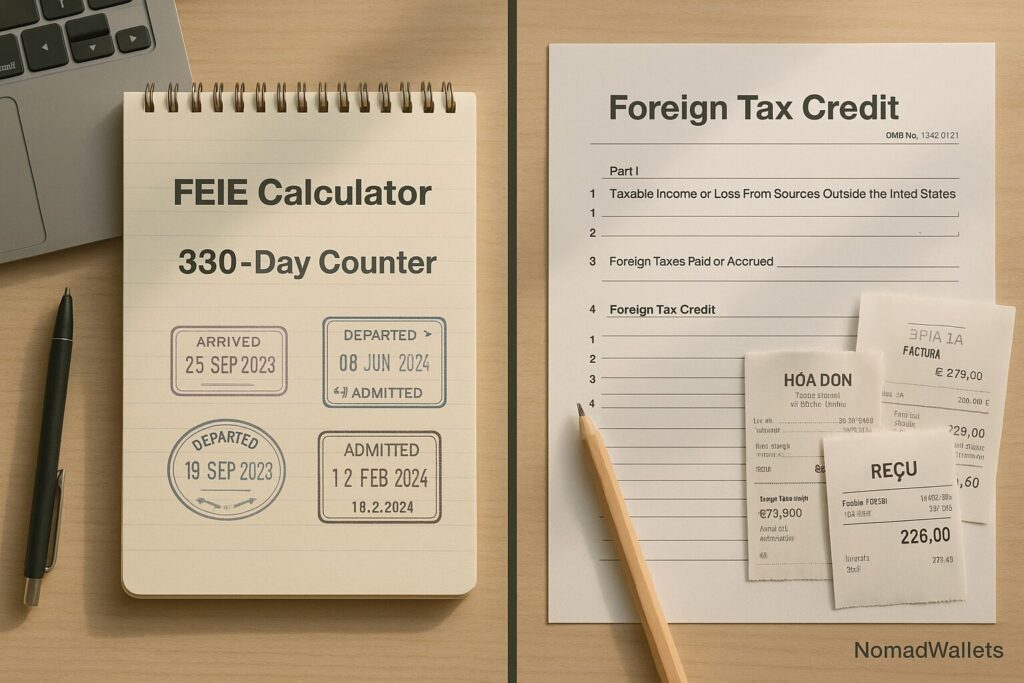

The Foreign Earned Income Exclusion (FEIE) is the workhorse benefit for Americans who live and work abroad. Qualify under one of two tests and a large slice of foreign earned income can be excluded from federal income tax. For 2025, practitioner guidance pegs the exclusion around $130,000, and it’s claimed on Form 2555 attached to the 1040 return.

Two ways to qualify:

- Physical Presence Test: at least 330 full days outside the US during any 12‑month period. It’s a calendar puzzle—count whole days and mind transit days.

- Bona Fide Residence Test: a full tax year resident in a foreign country with deeper ties (think lease, residence permit, local bank).

What FEIE doesn’t do:

- It doesn’t cover passive income (dividends, interest, capital gains, most rentals).

- It doesn’t erase self‑employment tax (Social Security/Medicare); more on that below.

- It requires Form 2555 details and documentation of travel days or residence; keep proofs organized as the IRS can ask for evidence.

Partial-year moves: FEIE can be prorated by the fraction of qualifying days during the year. If relocation happens mid-year, expect a proportionate exclusion based on days.

Foreign housing and the Foreign Tax Credit

- Beyond FEIE, a foreign housing exclusion or deduction can help if housing costs are high relative to base thresholds in the host city. This is coordinated with FEIE on Form 2555 and can further reduce taxable income for qualifying workers abroad.

- In higher-tax countries, the Foreign Tax Credit (Form 1116) can sometimes beat FEIE or pair strategically, especially when passive income is present. Modeling both options before filing can save money and headaches.

State tax for nomads: the quiet tripwire

Federal and state are separate games. Many states still consider someone a resident if certain ties remain: driver’s license, voter registration, a vehicle, property, bank accounts, frequent days spent back home. That’s why state tax for nomads creates surprise bills even when federal looks clean under FEIE.

The fix is paperwork and intent documented in advance—move domicile to a tax-friendly state (e.g., Florida or Texas), change IDs, update voter registration, and keep copies of leases and accounts as proof of the change.

- High-friction states are known for aggressive residency enforcement, and they weigh day counts and ties differently. Plan the move before departure, not after a notice arrives. A short check-in with a digital nomad tax accountant pays for itself if it prevents a residency fight later.

Self-employment tax still applies

FEIE can reduce income tax to zero for many, but it doesn’t eliminate self-employment tax. If work is self-employed (freelancing, consulting, single-member LLC), the self-employment tax of roughly 15.3% applies to net profit over $400 even when FEIE zeroes out income tax.

Separate business banking, track recurring software and coworking costs, and pay quarterlies to avoid penalties. A totalization agreement with the host country can sometimes shift social contributions abroad, but that’s specific to the country pairing and needs confirmation before assuming relief.

- Practical habit stack: weekly expense logging to keep Schedule C tight; quarterlies marked on the calendar so cash flow isn’t surprised; annual refresh of travel day logs and residency proofs in the same folder used for Form 2555.

The essential forms (and what they actually do)

- Form 1040: the main return; all paths lead here.

- Form 2555: claims FEIE; where the Physical Presence or Bona Fide Residence details live; also coordinates foreign housing.

- Schedule C: business income and expenses; clean records reduce tax and audit friction.

- Schedule SE: calculates self-employment tax owed.

- Form 1116: claims Foreign Tax Credit on eligible foreign taxes paid; useful in higher-tax countries or for passive income. taxact

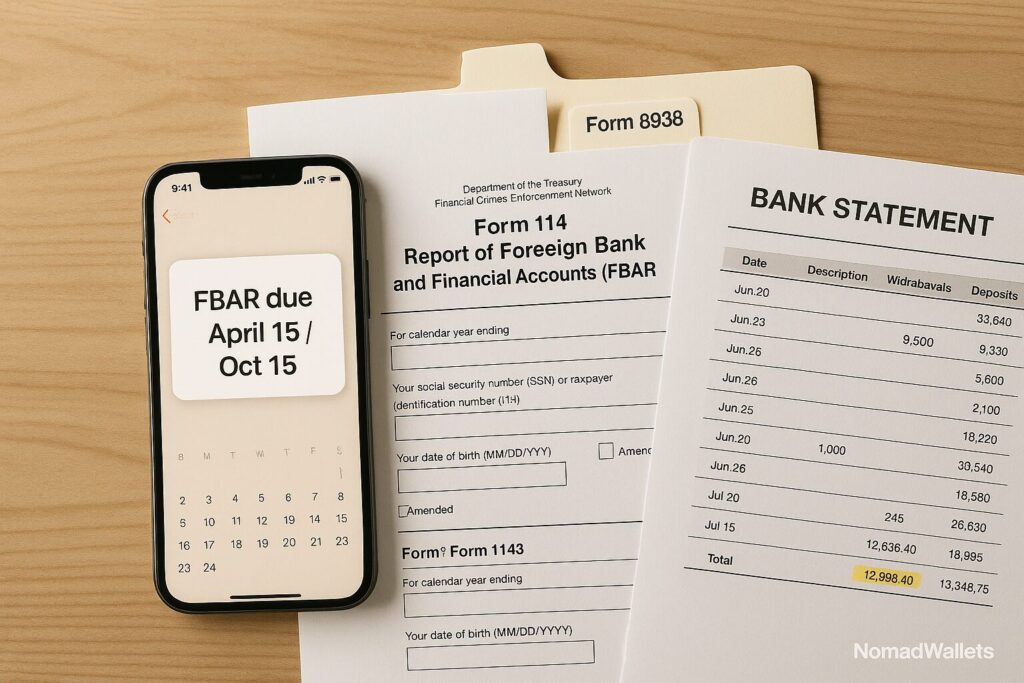

- FBAR (FinCEN 114): foreign bank and financial accounts over $10,000 aggregate at any time in the year; filed separately from the tax return.

- Form 8938 (FATCA): additional foreign asset reporting for higher thresholds; thresholds vary by filing status and residency.

Deadlines and extensions that matter

- Standard deadline: April 15.

- Automatic expat extension: to June 15 if living abroad and with a foreign tax home; in 2025, since June 15 falls on a Sunday, the effective date is June 16, and interest on unpaid balances still runs from April 15.

- Additional extension: file Form 4868 to extend to mid-October; it extends time to file, not time to pay.

File digital nomad taxes: DIY software or expat tax filing service?

- When software is enough: one or two income streams, a clear FEIE path, one or two countries, tidy records. This is where the best digital nomad tax software can be efficient and cost-effective.

- When a digital nomad tax accountant makes sense: multi-country income, lingering state ties, foreign company or rental property, or a year when FEIE vs Foreign Tax Credit modeling might change the math. Paying for the right hour of advice can prevent costly amendments.

- A practical workflow: run the NomadWallets Tax Estimator first to understand how income, FEIE, and residency shape the bottom line; if the estimate surprises expectations, compare FEIE to the Foreign Tax Credit with a professional before filing.

Step-by-step plan for the year

- Decide the FEIE path in January—Physical Presence or Bona Fide Residence—and plan travel accordingly if taking the 330-day route. Build a cushion for life events so last-minute trips don’t break qualification.

- Track days as you go. Calendar entries, boarding passes, and phone location history back up Form 2555 if ever questioned. It’s much easier to keep than to recreate.

- Fix state ties before departure. Domicile moves are persuasive when backed by license, voter, bank, vehicle, mail, and a real address in a tax-friendly state. Save PDFs of every change. This is the core of state tax for nomads planning.

- Keep business money clean. Separate account, recurring expenses visible, receipts in a monthly folder, and quarterlies paid. Boring beats expensive.

- Sanity-check the year with the NomadWallets Tax Estimator, then choose the path—file solo or hire an expat tax filing service for edge cases. Adjust early rather than amending late.

Common mistakes (and easy fixes)

- Missing FEIE by a few days because the 12-month window wasn’t shifted to capture 330 days. Fix: slide the window before filing; use a day log habit to prevent this.

- Assuming FEIE covers everything and forgetting self-employment tax. Fix: budget for SE tax and verify totalization rules before relying on them.

- Ignoring state ties until a letter arrives. Fix: change domicile deliberately and save documentation that proves intent and presence elsewhere.

- Not reporting foreign accounts via FBAR/FATCA. Fix: know the thresholds and file even if no tax is due; penalties are about reporting, not just tax. irs

- Waiting until April to make decisions. Fix: make the plan in January; filing becomes mostly data entry instead of a scramble. taxforexpats

Quick FAQ

Q1. Can US digital nomad taxes be reduced if clients are US-based?

Yes. FEIE hinges on where the work is performed, not who pays, assuming qualification under Physical Presence or Bona Fide Residence and a foreign tax home.

Q2. Is FEIE better than the Foreign Tax Credit?

It depends. Model both. In high-tax countries, credits can outperform the exclusion for certain income types or years, especially when passive income is involved.

Q3. Do expats automatically get more time to file?

Yes. Living abroad with a foreign tax home gives an automatic extension to June 15 (June 16 in 2025). Payment is still due by April 15 to avoid interest.

Q4. What documents matter most for Form 2555?

Travel day logs, proof of residence or day counts, foreign income documents, and prior-year 2555 if continuing an election.

A practical close (and next step)

US digital nomad taxes don’t need to be mysterious. With a clear plan, a few consistent habits, and honest math, the annual routine becomes manageable: decide the FEIE route, track days, tidy business books, handle state ties, and file on time. Start with one action now: open the NomadWallets Tax Estimator and run this year’s numbers.

If the estimate matches expectations, proceed with confidence. If it doesn’t, that’s the early warning to tweak travel timing, documentation, or strategy—or to bring in a professional for a targeted review before the deadline clock gets loud.

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.