Who Are Digital Nomads

A digital nomad is someone who uses the latest technology to work from anywhere. They often work while traveling or work remotely from various countries. When working from various places, you need to be aware of the tax regulations of each country.

What is US Tax Software for Digital Nomads

US tax software for digital nomads is a specialized tool that helps location-independent Americans manage complex tax filings, including foreign income exclusions and multi-state compliance. It matters because nomads often face unique challenges like dual taxation, shifting residency rules, and limited access to in-person tax support making reliable, intuitive software essential for accurate and stress-free filing.

Why Filing US Taxes Matters for Digital Nomads (Avoid Fines in 2025)

US citizens and residents must file their taxes every year, regardless of where they live. It is important to know which country you are working in and how tax laws apply to you. Failure to file your taxes properly can result in penalties, so it is recommended to use reliable tax software.

Top Recommended Tax Software for Digital Nomads in 2025

My Expat Taxes: Best Tax Software for Americans Abroad

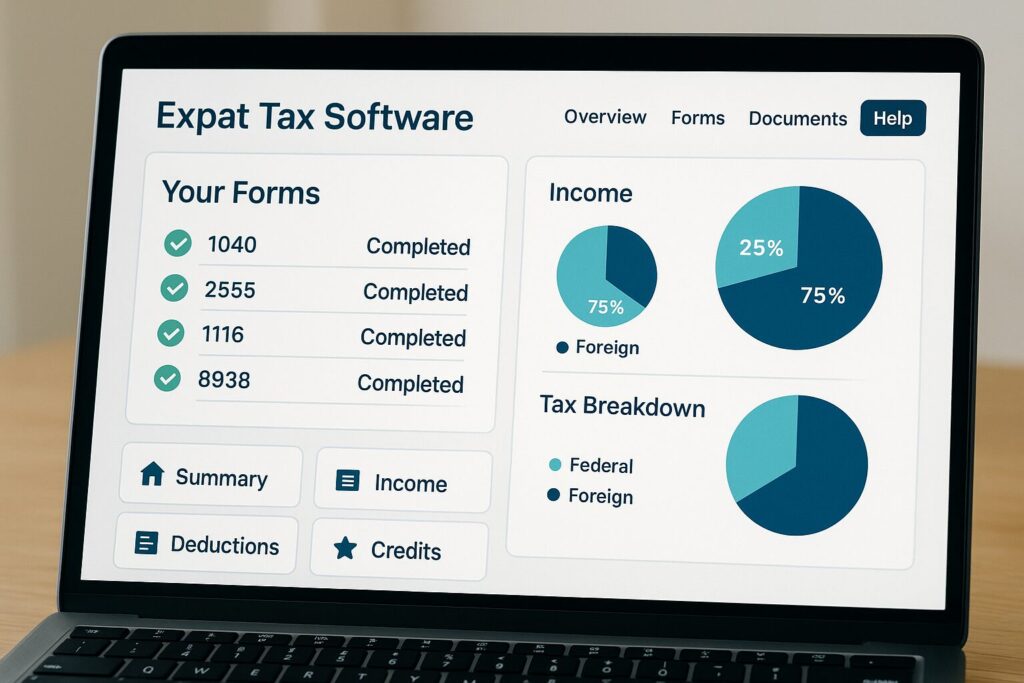

Filing your taxes while living abroad can be quite a complicated task. That’s why many people are opting for a software called My Expat Taxes, and today I’m going to review this software.

My Expat Taxes is a software program developed to help people living abroad file their taxes. It is designed to help U.S. citizens and permanent residents easily resolve tax issues that may arise when earning income abroad.

Key Features of My Expat Taxes Software

This software offers a number of useful features, let’s take a look at a few of them.

1. Easy-to-Use Interface for Hassle-Free Tax Filing

One of the biggest advantages of My Expat Taxes is its user-friendly interface. It is designed to make complex tax terms easy to understand, so even first-time tax filers can use it without any difficulty.

2. Built-In Expert Tax Help for Digital Nomads

This software was developed in collaboration with tax professionals, so you can get professional tax assistance. If you have any questions, you can always contact the customer support team, who are friendly and responsive.

3. Affordable Pricing Plans for Global Remote Workers

The price is also very reasonable. Unlike many foreign tax software that offer expensive options, My Expat Taxes offers a variety of services at an economical price. This is also highly praised in user reviews.

User Reviews: Why Expats Love My Expat Taxes

Many users praise My Expat Taxes for its ease of use and fast processing speed. In particular, many people like how it helps them file their taxes quickly and easily. For example, one user left a high rating, saying, “I didn’t know filing taxes could be this easy.”

Limitations and Suggestions for My Expat Taxes

Of course, not all products are perfect. Some users have mentioned long wait times for customer support. But overall, it is a positive experience for users. Others have said they would like the interface to be more intuitive.

How to Use My Expat Taxes: Step-by-Step Guide

To use My Expat Taxes, you must first create an account.

After that, you will be asked a few simple questions and the system will automatically prepare your tax return. The first time you use it, you can easily follow the step-by-step guide.

Also, if you prepare the necessary documents in advance, the process will be faster and easier. For example, it is a good idea to prepare foreign income certificates and previous tax returns.

Final Thoughts: Should Digital Nomads Use My Expat Taxes?

My Expat Taxes is a very useful software for people living abroad. I like the user-friendly interface, professional support, and reasonable price. So I highly recommend it to anyone who has to file their taxes abroad. You should definitely try it out!

Expatfile: A Trusted Tax Software for US Expats

This software has a high rating of 4.8 in user reviews. In particular, more than 2,000 users have shown satisfactory results.

How to File Taxes Using Expatfile

Typically, you’ll follow these steps:

- Sign up and log in to the software.

- Enter your tax situation.

- The software automatically calculates taxes for you.

- Finally, submitting the report is the end of it!

Key Benefits of Using Expatfile for Remote Workers

- Save time : Save time by automatically doing complex tax calculations.

- Accuracy : The software reflects the latest tax regulations, reducing mistakes.

- Convenience : You can file your taxes anytime, anywhere as long as you have internet access.

Final Word: Choose the Right Tax Software in 2025

As a digital nomad working abroad in 2025, it’s important for US citizens to choose a reliable software to file their taxes. Software like My Expat Taxes and Expatfile can help you with the complicated process of filing your taxes. 😊

TurboTax for Digital Nomads (2025)

Let’s take a closer look at how to file your taxes using TurboTax software for those of you who live as digital nomads. In particular, I’m going to explain how to understand the US tax system and how you can easily file your taxes using TurboTax. So, let’s get started.

How to File US Taxes with TurboTax as a Digital Nomad

- Create an account : Go to the TurboTax website and create an account.

- Enter information : Enter your personal information and income information. In this case, you must also include income earned overseas.

- Check Tax Deductions and Credits : Check out tax deductions and credits that are available to you. Don’t miss out on any deductions that are beneficial to digital nomads!

- File your return : Once you’ve entered all the information, file your return. TurboTax automatically checks for errors, so you can file with confidence.

Tax Filing Checklist: What Digital Nomads Should Watch Out For

There are a few things to keep in mind when filing your taxes:

- Filing Deadline : Be sure to check the US tax filing deadline. It’s the same even if you’re overseas.

- Reporting Foreign Income : You must also report any income earned overseas. Failure to do so may result in fines.

- Consult a tax professional : It’s a good idea to consult a professional for complex tax issues, especially if you have to file taxes in multiple countries.

TurboTax Review: Best for DIY Tax Filing (with Expat Features)

TurboTax is one of the most popular tax preparation software in the United States. It is easy to use and offers a variety of features to help you file your taxes easily.

TurboTax Benefits for Remote US Workers Abroad

Filing your taxes with TurboTax can be a huge help to digital nomads. By understanding the complexities of the tax system and organizing the necessary information, you can work abroad without worry.

Filing your taxes is a recurring task, so it’s important to prepare and plan ahead. With TurboTax, you won’t be afraid of filing your taxes anymore.

Additional information : You can check out TurboTax’s various features and updates on its official website.

H&R Block Review: Easy US Tax Filing for Expats & Nomads

H&R Block is one of the most popular tax software in the United States. This software helps users file their taxes easily and offers a variety of features, especially useful if you earn income overseas.

How to Use H&R Block to File Taxes Remotely

Using the H&R Block software is very simple. First, you need to download and install the software, then create an account. Then, you can proceed with the following steps:

- Enter Income : Enter income earned abroad. H&R Block supports a variety of income types, so you don’t have to worry.

- Check your deductions : Check and enter your deductions. H&R Block can help you get the most out of your deductions.

- Tax Calculation : Automatically calculates taxes based on the information you enter.

- Submit your return : If all information is correct, you can file your taxes directly through the software.

You can complete your tax return in these simple steps!

Filing Tips for H&R Block Users (Avoid Common Mistakes)

There are a few things to keep in mind when filing your tax return.

- First, you must accurately enter all your income.

- Second, you must be careful not to miss any deductions.

- Lastly, you must meet the filing deadline. If you miss the deadline, you may be subject to a penalty, so it is a good idea to prepare in advance.

H&R Block Benefits: Why Nomads Trust It

The best part about H&R Block software is its user-friendly interface and its many support features. It helps you find the information you need, especially if you earn money overseas. Also, the customer support service is excellent, so you can contact us at any time if you have any questions.

Should You Use H&R Block as a Digital Nomad?

As a digital nomad living abroad, filing taxes is a must. H&R Block software makes the complicated tax filing process easy. Don’t delay filing your taxes, start using H&R Block today.😊

FreeFile Software Review: IRS Free Filing for Digital Nomads

Now let me introduce you to FreeFile software. FreeFile is a free tax filing software provided by the Internal Revenue Service (IRS) in the United States, and is especially useful for digital nomads who work abroad. This software helps users file their taxes according to their own tax situation and provides various options.

How Digital Nomads Can Use FreeFile in 2025

Here’s how to file your taxes using FreeFile:

- Sign up and log in : Go to the FreeFile website, sign up, and then log in.

- Select your tax situation : Select the option that best suits your tax situation. For example, if you work abroad, you should select that option.

- Enter information : Enter the required information. Be sure to accurately enter your income, deductions, etc.

- Review and Submit : After you have entered all the information, do a final review and submit. It is important to check for any errors during this process.

You can complete your tax return in these simple steps!

Important Reminders for FreeFile Users Abroad

There are a few things to keep in mind when filing your tax return. First, you must meet the filing deadline. Second, you must understand the tax regulations for foreign income. Lastly, it is a good idea to prepare the necessary documents in advance.

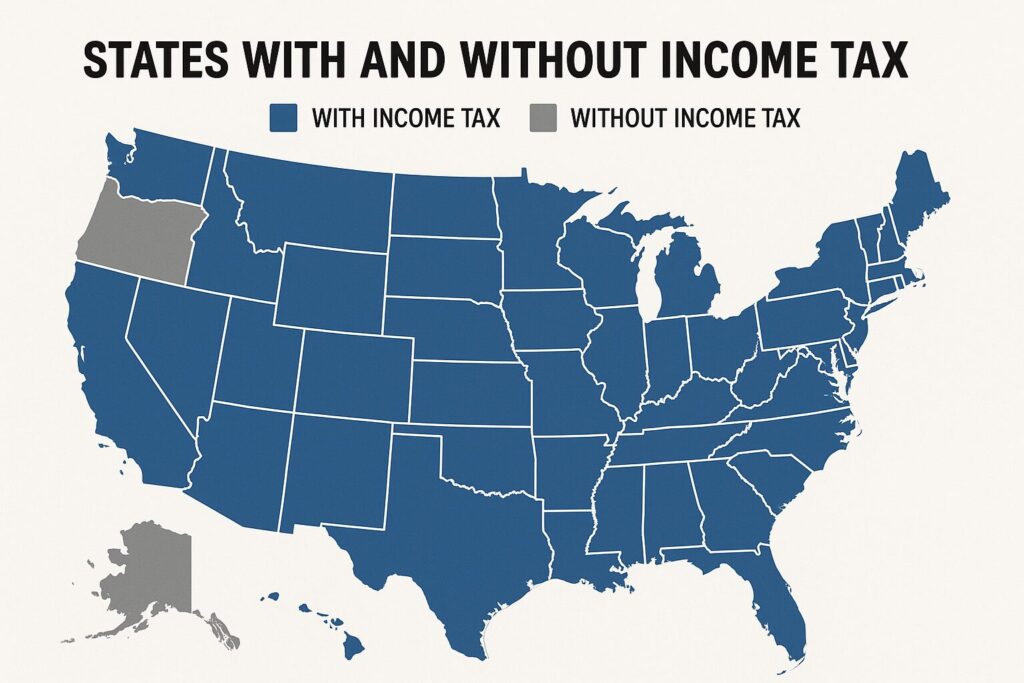

State-by-State Tax Residency Guide for US Digital Nomads

Tax and residency requirements vary widely across states in the United States. For example, Florida and Texas do not have state income taxes, but other states may have income taxes. Compare the tax and residency requirements for each state in the table below.

| State | Income Tax | Residency Basis | Notes for Digital Nomads |

| Alaska | No | Domicile | No income or sales tax. Ideal for full-time nomads. |

| Florida | No | Domicile | Must show intent (DL, voter reg). Very popular for nomads. |

| Nevada | No | Domicile | No income tax; common choice for mail forwarding. |

| South Dakota | No | Domicile | Minimal interaction needed; easy to establish residency. |

| Texas | No | Domicile | No income tax; robust nomad infrastructure. |

| Washington | No (except capital gains) | Domicile + presence | No wage tax; capital gains tax applies for high-income investors. |

| Wyoming | No | Domicile | Tax-friendly and low regulations. |

| Tennessee | No | Domicile + ties | Income tax repealed; high sales tax. |

| New Hampshire | Yes (investment income only) | Domicile + ties | Taxes interest/dividends; good for W-2 or freelance earners. |

| California | Yes | Presence + intent | Aggressive enforcement. Even short stays may be taxed. |

| New York | Yes | Statutory + domicile | Avoid lengthy stays; dual residency risk is high. |

| Massachusetts | Yes | Domicile + 183-day rule | Time-based rules; be cautious on length of stay. |

| Illinois | Yes | Domicile + ties | Severing ties (lease, DL, etc.) required to end tax obligations. |

| Oregon | Yes | Domicile + 200-day rule | Income tax applies with extended presence. No sales tax. |

| Colorado | Yes | Domicile + intent | Must clearly move and prove intent to leave. |

| North Carolina | Yes | Domicile + presence | Income earned in-state is taxable. |

| Georgia | Yes | Domicile | Must formally declare non-residency if moving. |

| Pennsylvania | Yes | Domicile + ties | Dual-residency risk without clear documentation. |

| Arizona | Yes | Domicile + 9-month rule | Over 9 months may trigger residency. |

| Hawaii | Yes | Domicile + 200-day rule | Over 200 days presumed resident unless rebutted. |

| Virginia | Yes | Domicile + 183-day rule | Be proactive about severing ties when leaving. |

| Montana | Yes | Domicile + ties | No sales tax; income tax applies. |

| Utah | Yes | Domicile | Update address and records when leaving. |

| North Dakota | Yes | Domicile + 210-day rule | Over 210 days may result in taxation. |

| Michigan | Yes | Domicile | Important to remove old ties to avoid being taxed. |

| Indiana | Yes | Domicile | DL and voter reg. may trigger tax if not updated. |

| Missouri | Yes | Domicile + 183-day rule | Avoid staying longer than 183 days. |

| Other States | Yes | Varies | Rules depend on domicile, time, and intent. |

Bonus Tools for Digital Nomads

It’s also good to know about the various financial tools that digital nomads need. For example, a security tool like NordVPN can help you use online banking safely. A temporary email service like Emailnator can also be useful. Soon I will come up with an article on these tools too!

So that’s all for US tax software for digital nomads in 2025. I hope you find it helpful when you file your taxes in the future.

Leave a comment below — we’d love to hear your thoughts, experiences, or questions!

You mau also like :- The Complete Guide to Travel Insurance for Digital Nomads

Tags: #digitalnomad #taxsoftware #TurboTax #H&RBlock #MyExpatTaxes #FreeFile #taxfiling #remotework #2025taxes

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.