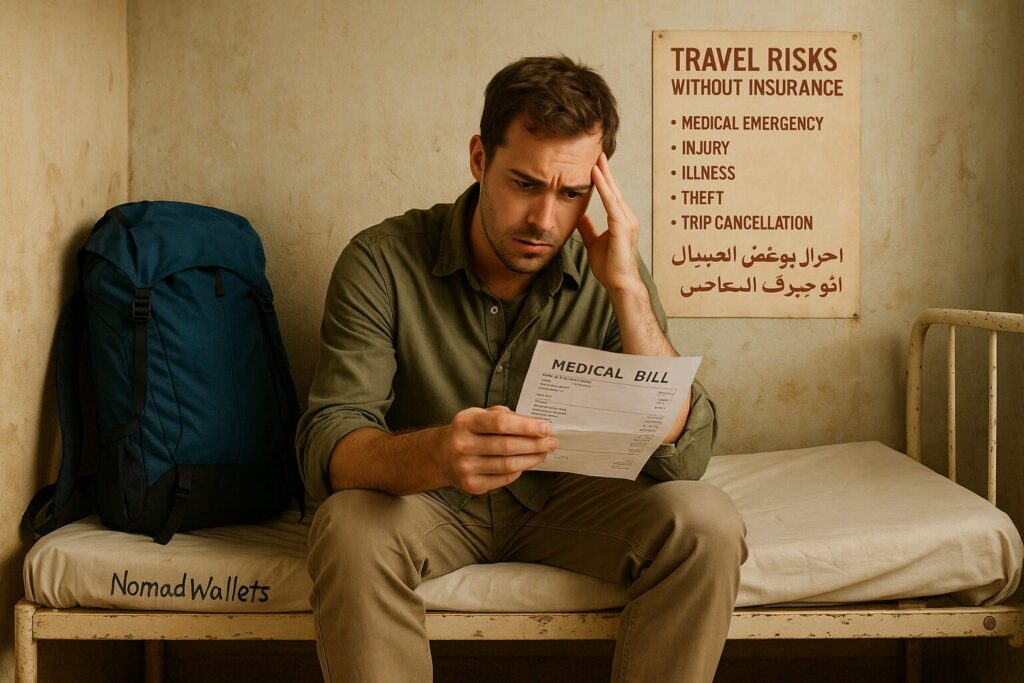

Introduction: Why Digital Nomads Need Health Insurance Across Africa and the Middle East

As 2025 unfolds, more digital nomads are venturing into exciting, less-trodden regions like Africa and the Middle East. From the rich cultures of Morocco and Egypt to the thriving digital hubs of the UAE and Saudi Arabia, this region is becoming a new frontier for remote work.

But along with adventure comes responsibility— Best Digital Nomad Health Insurance for Africa & Middle East isn’t optional anymore. Whether you’re hopping between coasts in Zanzibar or setting up base in Dubai, unexpected illnesses, accidents, or even visa requirements can demand solid international coverage.

This guide breaks down the best options, cost comparisons, key benefits, and what to watch out for when choosing the right digital nomad health insurance.

Why Not All Insurance Plans Work for Nomads

Most local health insurance plans only cover care within a single country—and usually require permanent residency. That’s not ideal for nomads. A flexible plan that works across borders in Africa and the Middle East, includes emergency evacuation, virtual care, and multilingual support is crucial.

Best Health Insurance Providers for Digital Nomads in Africa and the Middle East (2025)

Here are the top providers offering flexible, region-friendly, and globally accepted insurance solutions for digital nomads:

1. SafetyWing (Remote Health)

- Coverage Area: Worldwide including Africa & Middle East

- Monthly Price: ~$45 to $250 depending on age

- Pros:

- Global hospitals and clinics covered

- COVID-19, urgent care, and mental health included

- You can buy after departure

- Cons:

- Limited pre-existing condition coverage

- Best For: Long-term nomads or slow travelers

- Why It Works: SafetyWing is a go-to for nomads who want peace of mind in multiple countries without constantly changing plans.

2. Genki Resident or Genki Explorer

- Coverage Area: Global plans with focus on flexible stays

- Monthly Cost: Starting from $35/month

- Pros:

- 24/7 telemedicine

- Reimbursements via app

- No long contracts

- Cons:

- U.S. excluded unless requested

- Best For: Tech-savvy nomads moving between North Africa and the Gulf

- Why It Works: Affordable, app-driven, and no BS claim process.

3. Cigna Global

- Coverage Area: Worldwide

- Monthly Price: High-tier plans from ~$200+

- Pros:

- Customizable

- Premium hospitals across Africa and GCC

- High claim approval

- Cons:

- Expensive

- Best For: Nomads earning above $4,000/month or those with families

- Why It Works: Cigna’s regional experience in the Middle East, especially in UAE, is a game-changer.

4. Allianz Worldwide Care

- Coverage Area: Global, strong in expat zones

- Monthly Price: From $175+

- Pros:

- Multilingual support

- Includes maternity and chronic care

- Cons:

- High deductibles if not adjusted

- Best For: Experienced nomads staying longer in one country

- Why It Works: With trusted local partners across Africa and the Middle East, Allianz is built for mobility and reputation.

5. GeoBlue Xplorer

- Coverage Area: U.S. and abroad

- Monthly Price: Premium-tier; starts at ~$250+

- Pros:

- U.S. coverage if needed

- Blue Cross Blue Shield network

- Cons:

- U.S. address or citizenship required

- Best For: U.S. digital nomads based in Dubai or Cape Town

- Why It Works: If you travel back to the States often, GeoBlue blends local and home-country care.

What Should Your Policy Include?

No matter what provider you choose, here are must-have features in your Best Digital Nomad Health Insurance for Africa & Middle East:

- ✅ Emergency medical evacuation

- ✅ Hospitalization & outpatient care

- ✅ Accident & injury coverage

- ✅ COVID-19 & infectious disease treatment

- ✅ Telemedicine access

- ✅ Mental health support

- ✅ Dental & vision (optional but useful)

Some providers also offer trip interruption, baggage loss, and legal support—nice extras if you’re often on the move.

Cost of Health Insurance in Africa & the Middle East for Nomads

| Plan Type | Monthly Cost (USD) | Coverage Level |

| Basic Travel (SafetyWing) | $45–$80 | Emergency, short-term |

| Mid-range (Genki, World Nomads) | $85–$150 | Outpatient, mental health, telemedicine |

| Premium (Cigna, Allianz) | $200–$400+ | Long-term, full hospital, maternity |

For most digital nomads earning around $2,500 to $4,000/month, mid-range plans offer the best mix of coverage and value.

Common Travel Destinations Covered

A good insurance plan should cover these popular digital nomad spots:

- Africa: Cape Town, Nairobi, Zanzibar, Lagos, Marrakech

- Middle East: Dubai, Abu Dhabi, Muscat, Riyadh, Amman

Always double-check regional exclusions or travel advisories for areas like Sudan, Gaza, or Syria.

Are Visas Linked to Health Insurance?

Yes, increasingly. For example:

- UAE Remote Work Visa requires proof of international health insurance.

- Morocco and Kenya may ask for coverage for visa extension.

- Saudi Arabia’s eVisa includes mandatory insurance, but it’s limited.

Having your own policy gives you control—not just meeting entry rules, but choosing better doctors and hospitals.

Real Nomad Tip: Combine Health + Travel Insurance

Some companies like Heymondo or World Nomads offer hybrid policies. If you’re doing short stints or bouncing between 3-4 countries, it can save money and effort.

Important Advice Before You Buy

- Check if claims can be submitted online.

- Read fine print on exclusions—pre-existing conditions, extreme sports, or terrorism may be excluded.

- Confirm your plan includes emergency evacuation—crucial in remote African regions.

- Compare plans annually as your travel pattern or income changes.

(FAQs)

Q1. Is health insurance mandatory for digital nomads in Africa and the Middle East?

While not always mandatory, several countries like the UAE and Morocco require proof of insurance for visa extensions or digital nomad visas.

Q2. What is the Best Digital Nomad Health Insurance for Africa & Middle East in 2025?

SafetyWing, Genki, and Cigna Global are top-rated choices based on flexibility, price, and coverage.

Q3. Can I get coverage after I’ve left my home country?

Yes, providers like SafetyWing and Genki let you enroll even after you’re abroad.

Q4. How much should I budget monthly for nomad health insurance?

Expect to spend between $45 and $250/month depending on age, coverage, and regions included.

Q5. Does travel insurance count as health insurance for nomads?

Not always. Travel insurance is usually short-term and may not cover long-term hospitalization or chronic illness. Always check coverage limits.

Final Thoughts

Getting the Best Digital Nomad Health Insurance for Africa & Middle East isn’t just about ticking a box for border agents. It’s about giving yourself the safety net to explore boldly, connect deeply, and work freely without worrying what happens if you fall sick or get injured in a foreign country.

Pick a plan that matches your mobility, income, and lifestyle. And remember—adventure is fun, but being prepared is smart.

You may also like :

- 50 Best Apps for Digital Nomads 2025: Websites & Tools You Need

- 101 Things That Happen When You Become a Digital Nomad

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.