My 6-Year Journey to Financial Freedom Abroad

Standing in front of a Bangkok ATM in 2019, watching it eat another $12 in fees just to withdraw my own money, I realized my hometown banking setup was going to destroy my nomad dreams before they even started. That single transaction, combined with the foreign exchange markup my bank quietly added, cost me nearly $20 for the privilege of accessing cash I’d earned.

Six years and 47 countries later, I’ve built what I genuinely believe is the best bank account for digital nomads system possible. My current setup costs me less than $20 monthly in total fees while providing unlimited global access, fair exchange rates, and the kind of financial freedom that makes long-term nomadic life actually sustainable.

This isn’t another generic “travel banking” guide written by someone who took a two-week vacation to Europe. This is the hard-won knowledge from living full-time on the road, making every possible banking mistake, and systematically building a system that finally works. Banking for digital nomads has evolved dramatically, and this guide shows you exactly how to optimize it.

Why Traditional Banks Will Bankrupt Your Dreams

Here’s what most people don’t realize about international banking: traditional banks make serious money off travelers. When Bank of America charges $5 per ATM withdrawal plus 3% foreign transaction fees, they’re not just covering costs – they’re profiting from your mobility.

Over a year of nomadic living, those “small” fees compound into thousands of dollars. Money that could fund months in Southeast Asia or weeks exploring Eastern Europe instead goes straight into bank executives’ bonus pools. It’s fundamentally unfair, and thankfully, completely avoidable.

The whole nomad banking thing has changed so much since I started traveling. Used to be you just suffered through terrible fees and called it part of the lifestyle. Now? There are actually options designed for people like us. The best banks for digital nomads operate on completely different principles than traditional institutions.

My Expensive Education: The $347 Monthly Reality Check

When I first went nomad in early 2019, I thought I was being clever by opening accounts at three different major U.S. banks. Bank of America for their “global presence,” Wells Fargo because they had a branch in my hometown, and Chase because their marketing promised “travel-friendly” features.

My first month in Playa del Carmen was a financial disaster. Between ATM fees, foreign transaction charges, currency conversion markups, and mysterious “international processing fees” I didn’t even know existed, I spent $347 just accessing and using my own money. That’s more than I was paying for my beautiful beachfront Airbnb.

This expensive lesson taught me that I needed to find the best bank for digital nomads that actually understood international lifestyles.

The turning point came when I met Sarah, a developer who’d been nomadic for three years, at a coworking space. She casually mentioned that she never paid ATM fees anywhere in the world. I thought she was exaggerating until I watched her hit three different ATMs on our lunch walk without a care in the world.

“Charles Schwab,” she said simply. “Unlimited global ATM fee rebates, no foreign transaction fees on the debit card. Game changer.”

Two weeks later, I had my Schwab account set up. My banking costs immediately dropped by 70%. But that was just the beginning of building what would eventually become my complete best bank account for digital nomads foundation.

The Evolution: From Disaster to Actually Working

2019-2020: The Schwab Foundation

Schwab solved my ATM problem, but I was still losing money on everyday purchases through terrible exchange rates. A $50 dinner would somehow cost me $55 after currency conversion markups.

2020-2021: Adding Multi-Currency Intelligence

I discovered Wise and their transparent currency conversion. Instead of accepting whatever terrible rate my bank offered, I started getting real mid-market rates with clear, upfront fees. This alone saved me $800-1,200 annually.

2021-2022: Building Redundancy

Nothing teaches you about backup systems like having your primary card blocked in rural Vietnam while trying to pay for a motorbike taxi. I systematically added Fidelity as a second ATM rebate source, Capital One for reliable purchases, and eventually Revolut for their budgeting tools.

2022-2025: Perfecting the System

Through constant testing across dozens of countries, I refined this into a seamless system. Today, my best bank account for digital nomads rarely requires active thought – it just works, everywhere I go.

The Dream Team: Six Accounts That Handle Everything

After testing dozens of options across multiple continents, here are the banks for digital nomads that actually deliver on their promises.

Quick Comparison: Best Banks for Digital Nomads 2025

| Bank | ATM Fees | Foreign Transaction Fees | Multi-Currency | Monthly Cost | Key Strength |

| Charles Schwab High Yield Investor Checking | ✅ Unlimited global rebates | ✅ None | ❌ No | $0 | Best for heavy ATM users |

| Wise Account + Debit | 2 free/month, then $1.50 + 2% | Transparent 0.3-0.8% conversion fee | ✅ 50+ currencies | $0-15 | Best exchange rates |

| Fidelity Cash Management | ✅ Automatic rebates | ✅ None | ❌ No | $0 | Reliable backup option |

| Capital One 360 Checking | ❌ No rebates abroad | ✅ None | ❌ No | $0 | Simple, works everywhere |

| Revolut (U.S.) | Free up to plan limit, then 2% | Plan-based allowances | ✅ 150+ currencies | $0-25 | Best budgeting tools |

| HSBC Premier | Free at HSBC ATMs globally | Varies by market | ✅ Limited | $25+ | Best for cross-border transfers |

Charles Schwab High Yield Investor Checking – The Foundation

This is still the backbone of everything I do and consistently ranks as the best bank for nomads who need reliable ATM access. Schwab doesn’t just reimburse some ATM fees – they reimburse ALL ATM fees worldwide with no caps, no limits, no fine print nonsense.

I’ve tested this relentlessly across 47 countries. Rural Guatemalan ATMs charging $8 per withdrawal? Reimbursed within 24 hours. Expensive Singapore hotel ATMs at $12? Money back in my account. Even sketchy-looking machines in Eastern European train stations (though I don’t recommend those for security reasons) – fully reimbursed.

The account also charges zero foreign transaction fees on debit purchases, which means you can buy groceries, pay for meals, book accommodations – all at the real exchange rate without any markup.

But here’s the crucial detail most people miss: Schwab’s rebates work on ATM operator fees and currency conversion, but NOT on dynamic currency conversion. When an ATM or payment terminal offers to “helpfully” convert your purchase to USD, decline every single time. That’s a 3-6% ripoff disguised as convenience.

The setup requires opening a linked brokerage account, but there’s no minimum balance and you never have to use it. Just buy one share of a low-cost index fund and forget about it.

Perfect for heavy cash users, frequent travelers, anyone who wants to completely forget about ATM fees forever. This is why Schwab consistently appears in every best bank for travel discussion.

Wise Account + Debit Card – The Game Changer

Wise revolutionized how I think about money abroad and became an essential part of my best bank account for digital nomads strategy. Traditional banks hide their profits in currency spreads – they might give you an exchange rate that’s 3-6% worse than the real market rate, then claim they don’t charge fees. Wise flips this model: they charge a small, transparent fee (usually 0.3-0.8%) and give you the actual mid-market exchange rate.

You can hold money in over 50 currencies simultaneously, get local bank details in many countries (incredibly useful for receiving payments from clients), and spend like a local wherever you are. The debit card works everywhere Mastercard is accepted.

For ATM usage, you get two free withdrawals per month up to $100, then modest fees after that. This perfectly complements Schwab’s unlimited rebate system – use Wise for all your card payments and Schwab for cash when needed.

The psychological difference is huge. Instead of every purchase requiring mental math to figure out what it’s really costing with hidden bank markups, you know exactly what you’re spending.

I use Wise for groceries, restaurants, transportation, accommodation – basically all daily spending. The cumulative savings compared to traditional bank foreign exchange rates is significant. Over a typical year, Wise saves me $800-1,200 compared to what I’d pay with traditional bank cards.

Great for daily spending, receiving international payments, holding multiple currencies, transparent fee structure.

Fidelity Cash Management Account – The Reliable Backup

Fidelity’s CMA is like Schwab’s professional cousin – similar ATM fee reimbursement benefits with the backing of a major U.S. financial institution. They automatically reimburse ATM fees charged by other institutions when you use the Fidelity debit card.

I’ve found their international customer support to be excellent, and their mobile app is genuinely well-designed for managing money while traveling. The account also functions as a high-yield savings option, so your emergency fund actually grows while sitting there.

This serves as my secondary ATM card and emergency fund location. When Schwab had a rare system outage in Thailand, Fidelity kept me from being stranded without cash access. That redundancy is worth its weight in gold when you’re thousands of miles from home and proves why backup options are essential for the best bank account for digital nomads.

The reimbursement policy isn’t quite as universal as Schwab’s – some very unusual ATM situations might not qualify – but for 99% of normal international ATM usage, it works perfectly.

Works great for backup ATM access, emergency funds, secondary account for redundancy.

Capital One 360 – My Boring But Reliable Backup

Okay, so Capital One 360 isn’t going to win any awards for being exciting. But you know what? Sometimes boring is exactly what you need when building the best bank for travelers.

I stumbled onto this account kind of by accident. Was researching travel cards online and kept seeing people mention their 360 checking. No foreign transaction fees on purchases – that caught my attention since I was getting murdered by those 3% charges every time I bought groceries abroad.

So I opened one. And honestly? It just… works.

I use it for the random stuff – paying for coworking memberships online, buying plane tickets, covering Spotify and Netflix. You know, the boring monthly bills that you don’t want to think about. Their fraud detection actually makes sense too. Unlike Bank of America (seriously, screw those guys), Capital One doesn’t have a heart attack every time I buy coffee in a new country.

The app is fine. Not amazing, not terrible. Gets the job done.

Now here’s the thing they don’t advertise much – they won’t reimburse ATM fees when you’re abroad. So if you hit an ATM in Bangkok and get charged $8, that’s coming out of your pocket. That’s why I pair this with Schwab for cash stuff.

But for everything else? Buying dinner, booking hotels, random Amazon purchases when I need something shipped to my Airbnb – Capital One just quietly does its job without any drama.

I keep maybe $2,000 in there. Enough to cover my monthly subscriptions and have some backup buying power if my other cards act up. Which they do sometimes, because technology is wonderful until it isn’t.

The funny thing is, this might be my most-used card just because it’s so… normal. While I’m optimizing exchange rates and tracking ATM rebates with my other accounts, Capital One is just there being reliable. Sometimes that’s exactly what you need when you’re dealing with the chaos of nomad life.

One weird bonus – their customer service people seem to actually understand that some Americans live abroad now. Novel concept, right? When I call with questions, I don’t have to explain what a digital nomad is or why I’m buying things in weird places.

Not fancy. Not optimized. Just works everywhere I need it to.

Revolut (U.S.) – The Feature-Rich Option

Revolut is like the Swiss Army knife of best banks for travel. Depending on which plan you choose, you get fee-free currency exchange up to monthly limits, genuinely useful budgeting tools, spending analytics that actually help, and various travel perks.

I’m currently on their Metal plan, which gives me higher ATM withdrawal limits, better exchange rate allowances, and some nice travel insurance benefits. But you can start with their free plan to test the waters.

The budgeting features alone have helped me stick to my nomad budget much better than generic banking apps. I can see exactly how much I spent on food versus transportation versus accommodation across different countries, which helps optimize my travel spending.

There are some complexity considerations – the plan structure can be confusing, and there are weekend fees on currency exchange for certain tiers. ATM fees kick in after you hit your monthly allowance. But for multi-currency budgeting and spending insights, it’s fantastic.

Perfect for budgeting tools, spending analytics, plan-based perks, multi-currency management.

HSBC Premier – The Global Infrastructure Play (Optional)

This one’s optional and honestly overkill for most nomads. But if you have significant assets or complex international financial needs, HSBC Premier offers something unique: Global View and Global Transfers.

Essentially, you can link your HSBC accounts across different countries and move money between them instantly, often with no fees. If you have property in multiple countries, significant international income streams, or complex cross-border financial needs, HSBC’s truly global presence becomes valuable.

The Premier account typically requires $75,000+ in combined balances and comes with dedicated relationship managers, but for most nomads, this level of service isn’t necessary.

Good fit for high net worth nomads, complex international financial needs, cross-border property ownership.

How I Actually Use This System Day-to-Day

The beauty of the best bank account for digital nomads system is that it operates seamlessly in the background:

Morning coffee in Lisbon: Pay with Wise card, decline dynamic currency conversion, get charged exactly what the menu says in euros.

ATM cash for the Bangkok street market: Use Schwab, withdraw 2000 baht, ignore the $7 ATM fee because I know it’s coming back to my account within 48 hours.

Online coworking space booking: Capital One debit for the reliability and fraud protection.

Monthly budget review: Revolut’s analytics show me I’m spending too much on food and not enough on experiences, helping me adjust.

Emergency backup: Multiple cards stored in different locations, international customer service numbers saved offline on my phone.

The beauty of this system is that it fades into the background. I rarely think about banking mechanics anymore – I just spend money normally and know I’m getting fair rates and minimal fees.

Geographic Realities: What Works Where

The best banks for nomads perform differently across various regions:

Southeast Asia (Thailand, Vietnam, Philippines, Indonesia)

Cash still dominates in many situations. Street food, local transportation, small guesthouses – they often only take cash. Schwab’s unlimited ATM rebates become essential when local ATMs charge $5-8 per withdrawal. Wise works great for card-accepting businesses and online bookings.

Europe (Western and Eastern)

Card acceptance is excellent almost everywhere. Wise becomes the primary daily spender because of fair exchange rates. Revolut’s European heritage shows – their coverage and features work particularly well here. Schwab mainly for occasional cash needs.

Latin America (Mexico, Colombia, Argentina, etc.)

Mixed cash/card economy. You need both strong ATM access (Schwab) for cash-heavy situations and good card rates (Wise) for modern businesses. Currency volatility in some countries makes USD backup important.

Africa (Morocco, South Africa, Kenya)

Infrastructure varies dramatically by country and region. Having multiple backup options isn’t luxury – it’s necessity. Some areas have limited card acceptance, others are surprisingly modern. Schwab essential for reliable cash access.

Middle East (UAE, Qatar, Jordan)

Dubai and Qatar are extremely card-friendly with modern financial infrastructure. Other countries in the region can be more cash-dependent. Research specific country norms before arrival.

The Compliance Side Nobody Talks About

U.S. citizens can’t escape U.S. tax obligations by becoming nomadic. Here’s what you need to know to stay compliant:

FBAR (Report of Foreign Bank and Financial Accounts)

If your foreign financial accounts – including Wise, Revolut, any local country accounts you might open – total more than $10,000 at any point during the tax year, you must file Form 114 by April 15 (with automatic extension to October 15).

Many nomads accidentally trigger this requirement without realizing it. That $8,000 in your Wise account plus $3,000 in a local bank account for rent deposits puts you over the threshold.

FATCA (Foreign Account Tax Compliance Act)

Form 8938 may also be required depending on your total foreign assets. The thresholds are higher than FBAR but can catch high-income nomads or those with investment accounts abroad.

State Tax Considerations

Some U.S. states will aggressively pursue tax claims on nomadic income. Establishing residency in a no-income-tax state (Florida, Texas, Wyoming, Washington, etc.) before going nomadic can save thousands annually.

I handle this with a simple monthly spreadsheet tracking all my account balances. Five minutes of record-keeping each month prevents major headaches at tax time.

The reality is that nomadic tax filing gets complex fast. Between FBAR, FATCA, foreign earned income exclusion, and state residency issues, most nomads benefit from professional help or specialized software. If you’re looking to handle it yourself, our step by step guide to filing expat taxes for US digital nomads walks through the entire process, deadlines, and required forms. For those who prefer software solutions, we’ve also reviewed the best digital nomad tax software options that actually understand international situations.

Pro tip: Set up your banking compliance tracking system before you need it. It’s much easier to maintain records from day one than to reconstruct them during tax season when you’re trying to remember which ATM in Bangkok you used six months ago.

Common Mistakes That Cost New Nomads Thousands

The Single Account Trap

Relying on one bank, then being completely stranded when that card gets blocked, stolen, or the bank has technical issues. I’ve seen nomads stuck in airports unable to pay for food because their only card stopped working. Always have backups from different institutions.

The Dynamic Currency Conversion Disaster

Accepting “convenient” currency conversion at ATMs and payment terminals. This seemingly helpful service typically costs 3-6% extra per transaction. On $50,000 in annual spending, that’s $1,500-3,000 in unnecessary fees.

The Cash Hoarding Problem

Withdrawing huge amounts of cash at once due to ATM anxiety, then carrying thousands in various currencies. With unlimited ATM rebates through Schwab, you can withdraw smaller amounts more frequently and safely.

The Weekend Conversion Error

Converting large amounts of money on weekends when some services (like Revolut) charge extra fees. Plan ahead and handle major currency conversions on weekdays.

The Compliance Blind Spot

Not tracking foreign account balances throughout the year, then being surprised by FBAR requirements at tax time. The penalties for non-compliance can be severe – up to 50% of the account balance in extreme cases.

Real Numbers: What This System Actually Costs

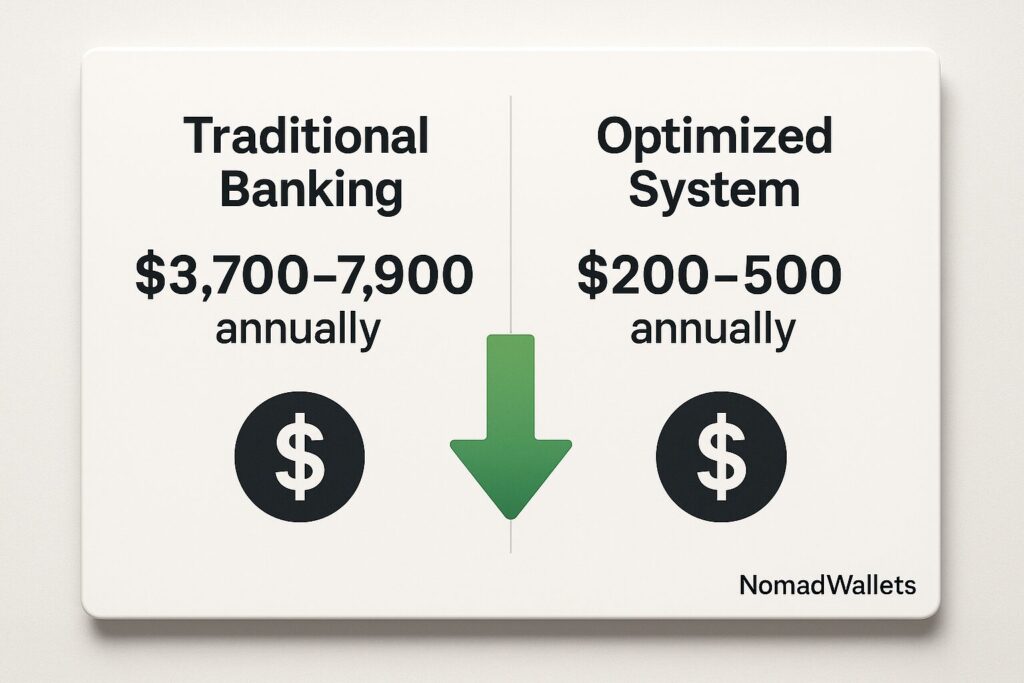

Annual Cost Comparison: Traditional vs. Optimized Banking

| Banking Approach | ATM Costs | FX Markups | Transaction Fees | Total Annual Cost |

| Traditional Big Bank | $1,200-2,400 | $1,500-3,000 | $500-1,000 | $3,200-6,400 |

| Optimized Nomad Setup | $0 | $200-400 | $0-100 | $200-500 |

| Annual Savings | $1,200-2,400 | $1,100-2,600 | $400-900 | $2,700-5,900 |

The best bank account for digital nomads system delivers massive savings:

Traditional Big Bank Annual Costs:

- ATM fees: $1,200-2,400 (assuming 2-4 international withdrawals weekly)

- Foreign transaction fees: $1,500-3,000 (3% on $50,000-100,000 annual spending)

- Currency conversion markups: $1,000-2,500 (hidden spreads vs. real market rates)

- Total: $3,700-7,900 annually

My Optimized System Annual Costs:

- Schwab: $0 (no fees)

- Wise: $180-300 (conversion fees on typical usage)

- Fidelity: $0 (no fees)

- Capital One: $0 (no fees)

- Revolut: $0-180 (depending on plan)

- Total: $180-480 annually

Annual savings: $3,200-7,400

The time investment to set this up (about 3 weeks of applications and setup) pays for itself within the first month of international travel.

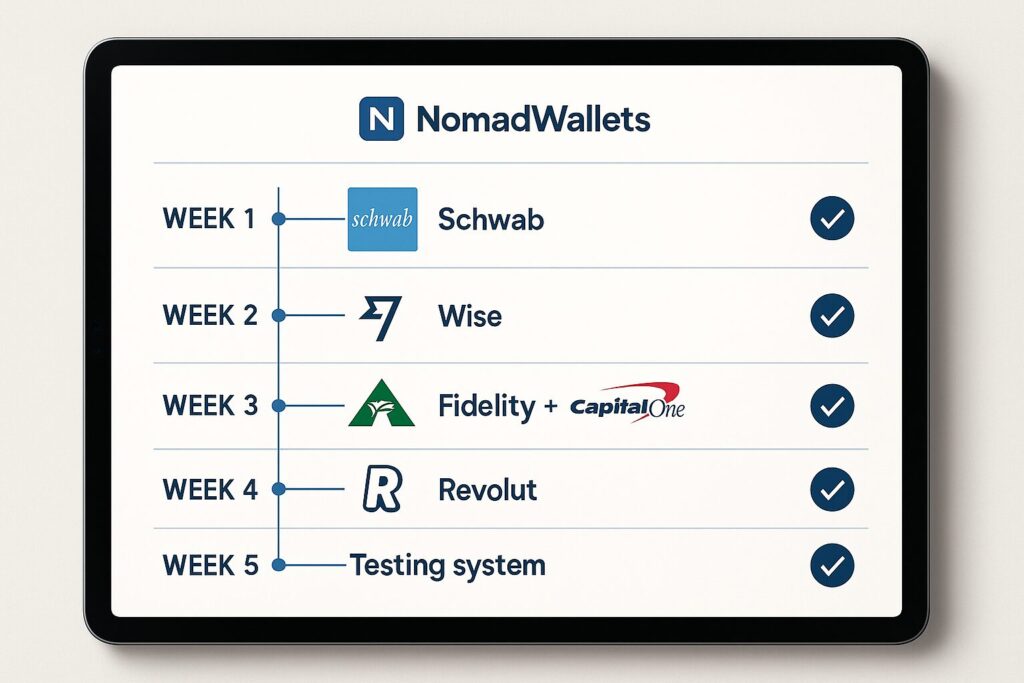

Building Your System: Step-by-Step Implementation

Creating the best bank account for digital nomads requires patience and systematic setup:

Week 1: Foundation

Apply for Charles Schwab High Yield Investor Checking and the required linked brokerage account. This takes 7-10 days for approval and card delivery. Fund with 2-3 months of living expenses.

Week 2: Multi-Currency

Set up Wise account and order their debit card. Start with $1,000-2,000 to test the system. Learn their app and conversion process.

Week 3: Backup Systems

Open Fidelity Cash Management Account as your ATM backup and emergency fund location. Add Capital One 360 for subscription payments and online purchases.

Week 4: Advanced Features

If you want budgeting tools and analytics, add Revolut. Start with their free plan to see if you like the interface and features.

Week 5: Testing and Optimization

Test all cards domestically before traveling. Set up travel notifications, card controls, and emergency contact information. Create your balance tracking system for tax compliance.

This gradual approach lets you test each component without overwhelming complexity. You can stop at Schwab + Wise if that covers your needs, or build the full system for maximum resilience.

Advanced Strategies for Experienced Nomads

Currency Arbitrage Opportunities

With Wise’s ability to hold multiple currencies, you can sometimes benefit from favorable exchange rate movements. If you know you’ll be in Europe in six months and the euro is currently weak, convert some dollars early and hold euros in your Wise account.

Regional Banking Optimization

Some nomads open local bank accounts in countries where they spend significant time. This can provide better local payment options and sometimes better interest rates, but adds complexity to tax compliance.

Credit Card Integration

While this guide focuses on checking accounts and debit cards, integrating nomad-friendly credit cards can provide additional benefits like travel insurance, purchase protection, and rewards points. Cards like Chase Sapphire Reserve or Capital One Venture work well internationally.

Business Banking Considerations

Nomadic entrepreneurs need separate business banking. Options like Mercury, Relay, and Brex offer business accounts designed for location-independent operations.

The Psychology of Nomadic Banking

One underestimated aspect is the mental energy that poor banking systems consume. When you’re constantly calculating real costs, worrying about fees, or dealing with blocked cards, it drains cognitive resources you could be using for work, experiences, or relationships.

The best bank for travelers system I’ve outlined eliminates this mental overhead. You stop thinking about banking mechanics and focus on living your nomadic dreams. That psychological freedom is worth more than the money saved, though the money saved is substantial too.

Looking Forward: 2025 and Beyond

The banks for digital nomads landscape continues evolving rapidly. Wise is expanding their global coverage and adding new features. Revolut is launching in additional countries. Even traditional banks are slowly improving their international services to compete with fintech innovations.

But the fundamental principles remain constant: you need global ATM access without penalties, fair exchange rates, no foreign transaction fees, and reliable digital banking infrastructure. The institutions that deliver these basics will always be the top choice for nomads.

Cryptocurrency is also worth mentioning. While not suitable as primary nomadic banking infrastructure due to volatility and regulatory uncertainty, crypto can be useful for large transfers and in certain jurisdictions. Consider it a supplementary tool, not a replacement for traditional banking.

Frequently Asked Questions from Fellow Nomads

Q1. Is building the best bank account for digital nomads really worth the setup complexity?

Ans : Absolutely. The 3-4 weeks of initial setup saves $3,000-7,000 annually while eliminating 90% of banking friction abroad. Most nomads recoup the time investment within their first month overseas.

Q2. “What happens if Schwab closes my account?”

Ans : Rare but possible if you never use the brokerage side. Keep a small investment position – even $100 in an index fund shows engagement. Fidelity CMA provides equivalent ATM reimbursement as immediate backup.

Q3. “Can I use just Wise and skip traditional U.S. banks?”

Ans : Not recommended for U.S. citizens. Wise excels at multi-currency spending but lacks unlimited ATM reimbursements. You also want U.S. banking relationships for credit history, tax compliance, and regulatory protection.

Q4. “Do I really need to track account balances for FBAR?”

Ans : Yes, it’s legally required and penalties are severe. A simple monthly spreadsheet prevents tax season nightmares. Track Wise, Revolut, any local accounts, and foreign e-wallets.

Q5. “What about travel insurance and purchase protection?”

Ans : Some accounts offer these benefits (Revolut’s higher tiers, certain credit cards), but dedicated travel insurance is usually better value. Don’t choose banking products primarily for insurance benefits.

Final Thoughts: Your Money Should Enable Adventure

Six years ago, I spent more on banking fees in my first nomadic month than I did on an amazing beachfront Airbnb in Mexico. Today, my optimized best bank account for digital nomads system costs less than a nice dinner and provides unlimited global financial access.

The best banks for digital nomads aren’t about finding one perfect account – they’re about building a system that fades into the background so you can focus on experiences, relationships, and building the location-independent life you’ve always wanted.

The accounts and strategies I’ve outlined have supported me through pandemic lockdowns, currency crises, bank technical failures, and countless adventures across 47 countries. They’ve handled everything from street food purchases in Bangkok to apartment deposits in Lisbon without drama or excessive fees.

This isn’t theoretical advice from someone who took a two-week European vacation. This is battle-tested wisdom from living full-time nomadically, making every possible banking mistake, and systematically building the best bank account for digital nomads that actually works everywhere.

Your banking setup should be the boring foundation that enables exciting adventures, not a constant source of stress and unexpected expenses. The best banks for nomads make financial management invisible so you can focus on what matters most. Build it right once, then forget about it and focus on living the nomadic dream.

Stop researching and start applying. Open that Schwab account today, set up Wise next week, and begin building the financial foundation that supports true location independence. Your future nomadic self will thank you for taking the time to build the best bank account for digital nomads system properly.

Found this guide helpful?

Leave a comment below — we’d love to hear your thoughts, experiences, or questions!

Tags : #digital nomad #overseas bank #international bank #travel #financial freedom #charles schwab #revolut #HSBC #Fidelity #Wise

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.