Introduction: The “Sticky” State Problem (And Why Leaving Isn’t Enough)

You sold your apartment. You packed your luggage. You boarded a one way flight to Lisbon, Bali, or Mexico City. In your mind, you have left the United States. But unless you take specific legal steps to establish a new domicile, you haven’t truly left.

In the eyes of the California Franchise Tax Board (FTB), the New York Department of Taxation, or the Virginia Department of Taxation, you never left.

This is what international tax attorneys call the “Sticky State” problem. High tax US states operate on a legal presumption that you are a resident until proven otherwise. If you simply leave the country without formally executing a plan to abandon your former domicile, your legal home defaults back to your last known address.

The result? You could be living in Thailand for 365 days a year, yet still owe 13.3% California state income tax on your global income plus penalties because you failed to cut state tax residency correctly.

The Only Legal Escape Hatch

The only legal way to sever ties with a sticky state is to change state domicile to a tax friendly jurisdiction. This guide is your procedural playbook for moving your legal existence to one of the “Big Three” zero tax havens: Florida, Texas, or South Dakota.

⚠️ Important Disclaimer: This guide outlines the standard procedures to change state domicile and protect yourself from state tax audits. This is not tax evasion. Every step below is legal, documented, and based on state statutes. If you “fake” this process (e.g., getting a mailbox in Texas but keeping your empty apartment and Tesla in San Francisco), you will likely lose an audit.

Why Trust This Guide?

This guide is based on specific state statutes, published tax authority guidance, and common audit patterns reported by US tax attorneys and enrolled agents who specialize in helping nomads change state domicile. It focuses on “Defensive Domicile” taking steps that create the strongest possible paper trail to withstand scrutiny.

Residence vs. Domicile: The Mistake That Costs Thousands

Before we touch the paperwork, you must understand the single most important concept in US digital nomad taxes: the difference between Residence and Domicile.

Most nomads use these words interchangeably. However, when it comes to domicile determination, state auditors make a sharp distinction.

1. Residence (Where you sleep)

- Definition: A place where you are physically present for a time.

- Quantity: You can have unlimited residences. You can have a residence in an Airbnb in Tokyo, a hotel in London, and a friend’s couch in Austin all in the same month.

- Legal Weight: Low. Establishing a residence does not automatically relocate your tax home.

2. Domicile (Where you belong)

- Definition: Your one, true, fixed, permanent home and principal establishment, and to which, whenever you are absent, you have the intention of returning.

- Quantity: You can have only one domicile at a time.

- Legal Weight: Absolute. Your domicile for tax purposes determines where you vote, where you are summoned for jury duty, and where you pay state taxes.

The Auditor’s Perspective (Domicile vs Residence)

When a California or New York auditor opens a file on you, they are not asking, “Where were you physically located last year?” They are asking: “Did you legally abandon your previous state domicile?”

If you moved to Europe but didn’t establish a new domicile in Florida, Texas, or South Dakota, your domicile remains in your old state by default. It takes a specific, affirmative act to prove non residency and break that chain.

Choosing Your Fighter: Florida vs. Texas vs. South Dakota

Why do US nomads almost exclusively choose these three states for their nomad domicile strategy? Because they have 0% State Income Tax and, crucially, they have established legal infrastructures (like nomad mail forwarding services) specifically designed for full time travelers.

Here is the 2026 Comparison for Digital Nomads planning a domicile change process:

The “Nomad Domicile” Comparison Table

| Feature | 🍊 Florida | 🤠 Texas | ⛰️ South Dakota |

| Nomad “Vibe” | Easy for East Coasters | Texas domicile for RVers | Procedural Minimalism |

| State Income Tax | 0% | 0% | 0% |

| Time Required on Ground | 1-2 Days (For License) | ~1-3 Weeks | 1 Night (Hard Rule) |

| Vehicle Inspection | No (VIN check only) | No (New Law 2025!) | No |

| Health Insurance (ACA) | Excellent Options (PPO) | Good Options | Very Limited |

| Audit Defensibility | Medium-High | High | Very High |

| Best For… | Nomad residency Florida seekers | RVers & Property Owners | South Dakota residency for nomads |

1. South Dakota (The Nomad Favorite)

Verdict: The “Gold Standard” for South Dakota residency for nomads who don’t spend time in the US.

- Why it wins: Procedural simplicity. You only need to stay one night in a hotel to become a resident. The entire process to formalize your domicile (License + Registration) can be done in 24 hours at the Spearfish or Sioux Falls DMV.

- The Downside: It is cold, hard to get to, and the health insurance options on the ACA marketplace are terrible for nomads.

2. Florida (The Flexible Choice)

Verdict: Best for nomad residency Florida seekers who need good health insurance or travel often to Europe/LatAm.

- Why it wins: Florida has robust PPO health insurance plans. It is also a major travel hub.

- The “Mail” Trick: You can technically begin the process by filing a Declaration of Domicile by mail before physically moving to Florida.

- Compliance Warning: In 2026, filing by mail without taking in-person steps, like obtaining a Florida driver’s license and establishing a residence is a major audit red flag. To legally abandon your previous state of domicile, you must eventually establish clear, tangible ties to Florida, including a physical residence and in-person documentation.

3. Texas (The “Tex-Pats”)

Verdict: Perfect for Texas domicile for RVers or those who plan to spend time in the US.

- The 2025 Update: Texas used to have a “Vehicle Inspection Trap” that forced nomads to drive back every year. Good News: As of Jan 1, 2025, Texas eliminated safety inspections for non-commercial vehicles, making it easier to establish tax residency in a new state to Texas without constant return trips.

Phase 1: The “Severing Ties” Checklist (Don’t Skip This)

Before you build your new life, you must burn the bridge to the old one. The first step to sever your old state ties is to give your old state zero reasons to claim you. This is how you avoid state income tax legally.

1. The “Abode” Rule (Real Estate)

If you keep a house or apartment in your old state that is “available for your use,” you will likely fail the facts and circumstances test.

- Best Move: Sell the property.

- Acceptable Move: Rent it out on a long term lease (12+ months) to a non-relative. This proves you cannot return there at will, reinforcing your intent to reside elsewhere.

- Fatal Move: Listing it on Airbnb but blocking out dates for yourself, or leaving it empty.

2. The Storage Unit Trap

Do not keep a storage unit full of furniture, winter clothes, or heirlooms in your old state.

- Why? Auditors view storage units as “intent to return.” It implies your state tax domicile change is temporary.

- Solution: Move your items to a storage facility in your new state, or sell them.

3. The “Closer” List

You must systematically close your local accounts to prove you truly want to exit California tax residency.

- Notify the Tax Board: File a “Part Year Resident” final return.

- Financials: Update your business bank account and credit card billing addresses immediately.

- Medical: Find a new Doctor and Dentist in your new state.

- Memberships: Cancel your local gym, library, and country club memberships.

Phase 2: The “Holy Trinity” of Establishing Domicile

To audit proof your domicile is real, you need the “Holy Trinity” of physical evidence. You must obtain these three items in your new state immediately.

Step 1: The Address (Nomad Mail Forwarding Service)

You cannot use a P.O. Box for domicile for digital nomads. You need a physical address that is recognized as a legal residence for DMV and banking purposes.

- The Solution: Use a professional nomad mail forwarding service that provides a “PMB” (Personal Mailbox) designed for domicile. These services act as your legal “leasing agent.”

- Recommended Services:

- South Dakota/Texas/Florida: Escapees RV Club (Escapees RV club domicile services are the industry leader).

- Florida: St. Brendan’s Isle (Perfect for nomad residency Florida).

- Texas: Texas Home Base.

Step 2: The Driver’s License

This is the single most important card in your wallet for your paper trail of domicile. It is the primary ID you will use for federal purposes (TSA, Passport).

- The Rule: You must physically go to the DMV in your new state.

- The Proof: Bring your nomad mail forwarding service contract and your receipt from staying at a local hotel/campground.

- Surrender the Old One: You will physically hand over your California/NY license to the clerk. This physical act is powerful legal evidence that you did indeed change tax residency.

Step 3: Voter Registration

Registering to vote is the ultimate statement of “intent” to demonstrate domicile intent. It says, “I plan to shape the future of this community.”

- When to do it: Register at the DMV at the exact same time you get your license.

- The Follow Through: You should request an absentee ballot and actually vote. It solidifies your paper trail to prove intent to change domicile.

State by Step Instructions to Change State Domicile

Option A: How to Get Nomad Residency Florida 🍊

- Sign up with St. Brendan’s Isle or Escapees to get your nomad residency Florida address.

- File the “Declaration of Domicile” (Statute 222.17):

- Download the form from your new county’s Clerk of Court website.

- Notarize it.

- Mail it to the court. This puts your intent to change state domicile on the public record before you even arrive.

- Fly to Florida: Go to the Tax Collector’s office (DMV).

- Bring: Your Declaration of Domicile, Passport, Old License, and 2 proofs of address.

- Receive: Your new Florida REAL ID.

Option B: How to Get South Dakota Residency for Nomads ⛰️

- Sign up with Americas Mailbox or Escapees.

- Travel to South Dakota: You must physically be there to successfully change state domicile.

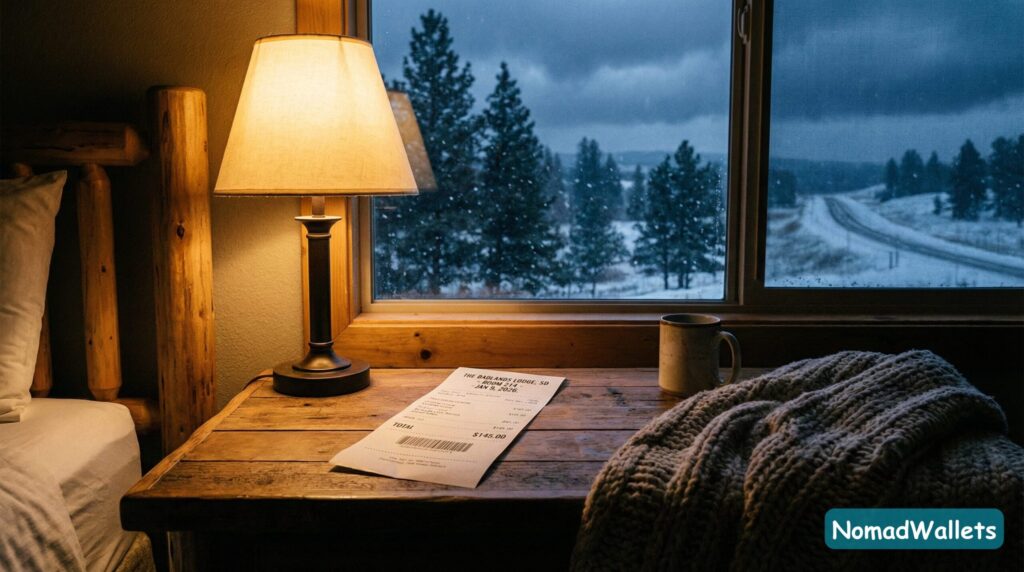

- The “One Night” Rule: Stay at least one night in a hotel or campground.

- Crucial: Ask for a receipt that lists YOUR NAME and YOUR NEW SD ADDRESS. This is critical for South Dakota residency for nomads.

- Go to the DMV:

- Complete the South Dakota affidavit of domicile (Residency Affidavit).

- Show your Hotel Receipt + Mail Service Contract + Passport.

- Receive: Your South Dakota Driver’s License.

Option C: How to Get Texas Domicile for RVers 🤠

- Sign up with Escapees (Livingston, Polk County) or Texas Home Base.

- Travel to Texas: Go to the county where your mail service is located.

- Register Your Vehicle:

- Visit the County Tax Assessor. This is a key step for Texas domicile for RVers.

- Note: As of 2025, no safety inspection is needed for non-commercial vehicles, removing the vehicle inspection Texas nomads pain point.

- Go to the DPS (DMV):

- Apply for your Driver’s License to finalize your plan to change state domicile.

- Bring your Residency Affidavit provided by Escapees.

Phase 3: The “Paper Trail” Defense (Audit Proofing)

You have done the work. Now, you need to prepare for the “Audit Letter” (which usually arrives 1-2 years after you relocate your tax home). If California sends you a letter, you need a state tax audit defense.

1. File the “Affidavit of Domicile”

- Florida: This is the Declaration of Domicile.

- South Dakota: Ensure you have your copy of the South Dakota affidavit of domicile signed at the DMV.

- General: Having a notarized affidavit stating you meet the burden of proof for domicile is powerful evidence.

2. Update Federal Records

- IRS Form 8822: File IRS Form 8822 (Change of Address) immediately. This alerts the IRS that you have established a nomad tax home.

- Passport: Next time you renew your passport, use your new address.

💡 Pro Tip: If you haven’t yet, see our US Digital Nomad Tax Guide for how your decision to change state domicile interacts with the Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credits.

3. The “Day Count” Discipline

For the first year after you change your domicile, you must be aggressive about not returning to your old state.

- The Rule of Thumb: Do not spend more than 30 days in your old state during the first year after you change state domicile.

- New York Rule: If you spend more than 183 days there, you are a “Statutory Resident” and cannot avoid state income tax, even if your domicile is Florida.

4. Move Your LLC

If you have a Digital Nomad LLC, you should Foreign Qualify it in your new state. Having your business registered in Wyoming but your personal address in Florida is fine, but having your business still registered in California after you leave New York tax residency (or CA residency) is a major sticky state tax audit risk.

Frequently Asked Questions (FAQ)

Q1: Do I actually have to step foot in South Dakota to change state domicile?

A: Yes. You need to stay at least one night to generate a receipt to show the DMV. You cannot change state domicile to South Dakota entirely online.

Q2: Can I use a relative’s address to change state domicile?

A: You can, but it is risky. Professional nomad mail forwarding services like St Brendans Isle or Escapees RV club domicile are cleaner because they provide a standardized commercial contract that auditors are used to seeing when you change state domicile.

Q3: What if I don’t own a car?

A: You still need a Driver’s License (or State ID) to change state domicile.

1. South Dakota: You sign an affidavit stating you are a full time traveler.

2. Florida/Texas: You simply apply for the license. You do not need to own a car to change state domicile.

Q4: How long should I wait before claiming non resident status in my old state?

A: Immediate. The day you leave and establish your new domicile (the “Holy Trinity” date) is the day you successfully change state domicile.

Q5: Does this affect my BOI Report?

A: Yes. Once you change state domicile and get your new driver’s license, you must update your BOI Report within 30 days.

Q6: I am already abroad. Do I have to fly back to the US to change state domicile?

A: Unfortunately, yes. You physically need to be at the DMV to get your photo taken. You cannot change state domicile from California to Florida remotely. Plan a “Admin Trip” back to the US to handle this.

Conclusion: Compliance is Freedom

Deciding to change state domicile is a hassle. It involves flights, DMVs, and paperwork. But compared to the alternative paying 13% of your income to a state you don’t live in learning how to change state domicile is the highest ROI trip you will ever take.

Once you have your Florida, Texas, or South Dakota ID in hand, you have legally severed the chain and can successfully avoid state income tax.

Next Steps for You:

- Select your state: (Florida for travel hubs, SD for simplicity).

- Book your “Admin Trip”: Plan 3-5 days on the ground to change state domicile.

- Download our Nomad Banking Guide to set up your financial life in your new home.

Sources & Citations (For Your Reference)

- Florida Statute 222.17: Manifesting and Evidencing Domicile. Link to Statute

- California FTB Pub 1031: Guidelines for Determining Resident Status. Link to FTB

- South Dakota Dept of Public Safety: Residency Affidavit. Link to SD DPS

- Texas DMV: New 2025 Inspection Rules. Link to TxDMV

- IRS Form 8822: Change of Address. Link to IRS PDF

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.