Look, I’ll be straight with you. This digital nomad healthcare guide 2025 starts with me being a complete idiot in Thailand. And if you’re reading this, you’re probably smarter than I was, but humor me anyway.

It’s March 2021. I’m in Chiang Mai, feeling pretty damn good about myself. NomadWallets is crushing it – I’m helping clients save tens of thousands on taxes, I’ve got the Foreign Earned Income Exclusion down to a science, and I’m living in this sick co-living space near Nimman Road. Life is good.

Then I ate street food.

Not just any street food. Som tam from this tiny cart at the Saturday Walking Street. The old guy running it looked at me and goes “Farang want Thai spicy?”

My stupid American ego kicks in. “Yeah, make it proper Thai spicy.”

He grins. I should’ve known right then I was screwed.

The som tam was incredible though. Like, legitimately the best thing I’d ever tasted. Sweet, sour, spicy as hell. I posted it on my Instagram story with some caption like “eating like a local” or whatever douchey thing nomads post.

Fast forward to 2:17 AM. I know it was 2:17 because I was staring at my phone, curled up on my bathroom floor, trying to decide if I was dying.

The pain was unreal. Like someone was twisting a knife in my gut while simultaneously lighting my insides on fire. I’m sweating through my clothes, can’t stand up straight, and genuinely thinking “this is how I die – killed by a papaya salad in Thailand.”

And here’s where my complete lack of preparation became obvious.

I had absolutely no clue what to do.

I’m googling “hospital near me Chiang Mai” at 2 AM, reading Google reviews for emergency rooms like I’m choosing a restaurant. How pathetic is that? But that’s what happens when you spend months optimizing every detail of your tax setup and zero minutes thinking about healthcare.

I call a red taxi (yes, I remember it was red because I was focused on weird details while panicking). Tell the driver “hospital” in my terrible Thai. We end up at some local hospital because it was the first one Google Maps showed me.

The place was… fine. But definitely not set up for foreigners. The night staff spoke maybe 10 words of English. I’m trying to explain “food poisoning” through Google Translate while doubled over in pain. They hook me up to an IV, run some tests, keep me overnight for observation.

The doctor was nice enough, but communication was brutal. At one point he’s trying to explain something about my blood work and we’re both just staring at Google Translate hoping it makes sense.

Eight hours later, I’m discharged with some medications I can’t pronounce and a bill for $3,247.

Three thousand two hundred and forty-seven dollars. For food poisoning.

Here’s the part that still makes me want to punch myself: I found out later that Chiang Mai Ram Hospital was literally 12 minutes away. They have an entire international wing, English-speaking doctors, transparent pricing, and deal with dumb tourists who can’t handle spicy food every single day.

Same treatment there? Maybe $1,200-1,500. With proper insurance? Probably free.

But I didn’t know that because I’d done zero research. My “insurance” was some garbage travel policy I bought for like $80 that covered basically nothing beyond catastrophic emergencies.

That night taught me something that changed everything: healthcare for digital nomads isn’t optional. It’s not something you figure out “if you need it.” Because when you need it, you’re not thinking clearly. You’re in pain, you’re scared, and every decision feels like it’s made under pressure.

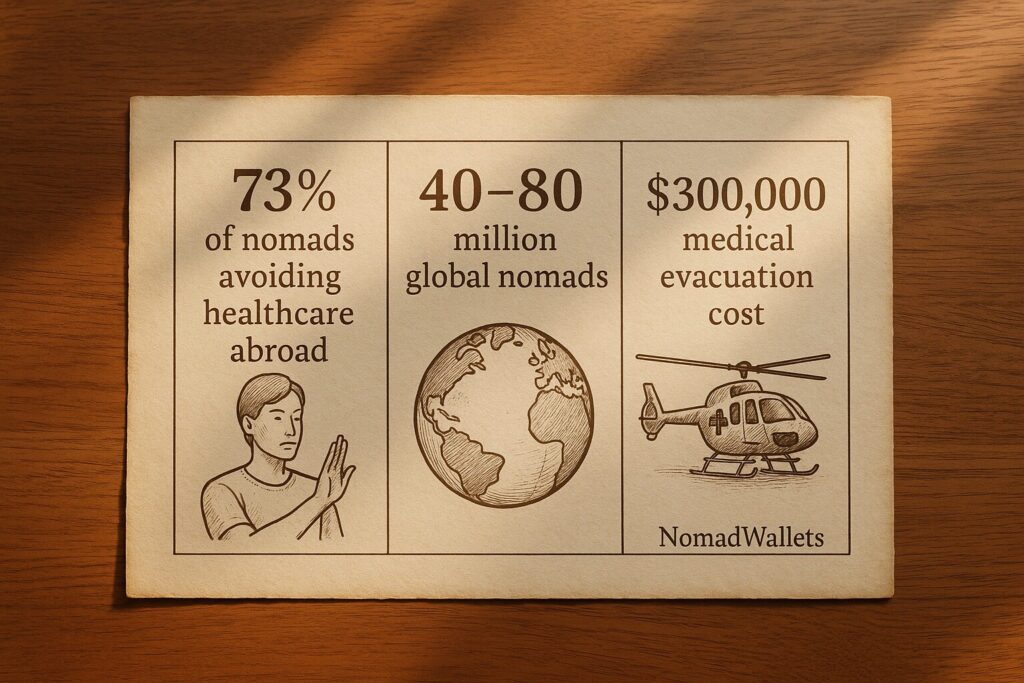

The stats back this up too. Turns out most nomads struggle with healthcare access abroad. Not because they don’t need it, but because they’re unprepared and overwhelmed by foreign systems.

With between 40 million to 80 million nomads worldwide1, this isn’t some rare edge case. This is happening to thousands of people every week.

What I Did Wrong (So You Don’t Have To)

Let me break down exactly where I screwed up, because if I’d known this stuff before, that $3,200 bill never happens.

Mistake 1: No hospital research

I just picked whatever Google showed me first. Now I always save 2-3 hospitals before landing anywhere. In Chiang Mai, Bangkok Hospital is the gold standard for foreigners. They even have a dedicated international desk. Takes 10 minutes of research and saves thousands in overcharges or communication disasters .

Mistake 2: Garbage Insurance

I went for the cheapest option without reading the fine print. Budget travel insurance is designed for basic emergencies, not comprehensive care. The nomad health insurance comparison that matters is what happens when your quick ER visit turns into follow-up appointments or chronic care needs.

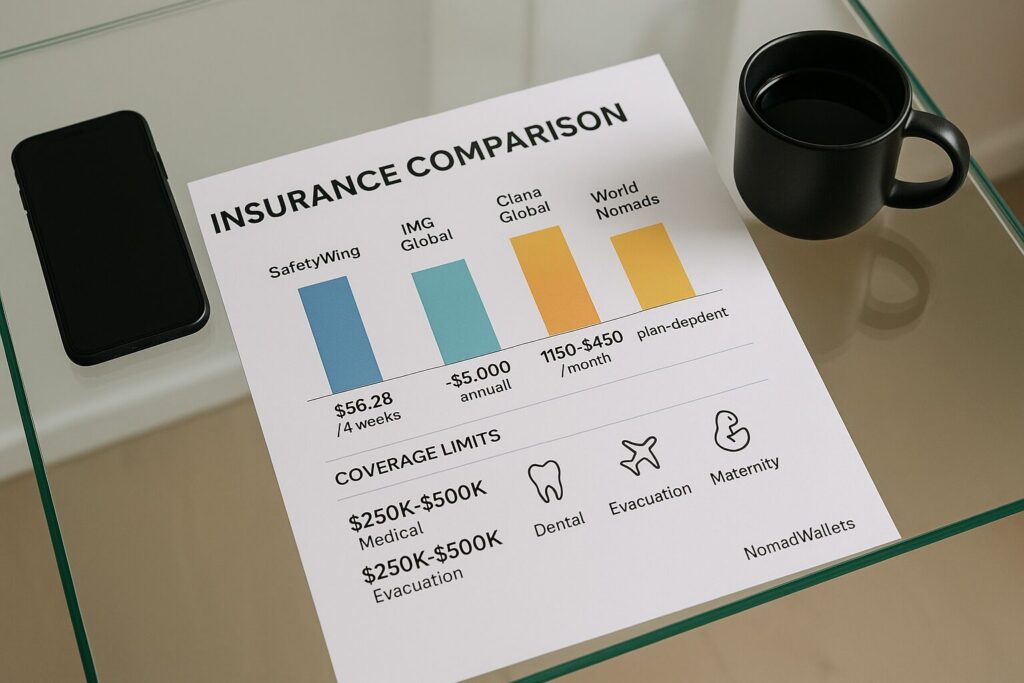

SafetyWing’s Essential plan looks great at $60/month2 until you realize it’s emergency-only coverage. Their Complete plan costs $161/month3 and includes some routine care, but adding US coverage significantly increases costs and still has major limitations. No comprehensive specialist follow-ups, limited chronic condition management, and $5,000 annual caps on outpatient services.

Mistake 3: Zero telemedicine backup

I assumed I could just call a doctor from anywhere if needed. Wrong. Telemedicine for remote workers has licensing restrictions that can block care if your provider is in the wrong jurisdiction. Medicare won’t even reimburse telehealth if providers are outside the US.

Mistake 4: No prescription planning

Didn’t think about meds beyond packing what I had. International prescription management is where nomads either save big or get in big trouble. My ADHD meds cost $300/month in the US but only $12 for three months in India – same active ingredient, just made by a different company.

But controlled substances can get you detained. Singapore4, Japan, UAE – they don’t mess around. Always need proper documentation and permits for transit.

Mistake 5: Ignored evacuation costs

Never even considered worst-case scenarios. Nomad emergency medical evacuation can cost over $300,0006 if you’re in a remote area and things go seriously wrong. That’s bankruptcy territory for most nomads.

The Numbers That Woke Me Up

Three stats that completely changed how I think about nomadic healthcare:

- 73% of nomads avoid care abroad – This digital nomad healthcare guide 2025 exists because most of us are winging it until pain forces bad decisions

- 50+ million nomads globally – With numbers this big, healthcare gaps become predictable disasters3, not rare accidents

- $300,000+ evacuation costs – When you’re far from civilization and things go wrong, the bills can destroy everything you’ve built

Sarah’s Heart Scare (Why Budget Insurance Fails)

Let me tell you about one of my clients – we’ll call her Sarah. UX designer, making great money, been nomading for 3 years. Smart, successful, had her whole digital setup dialed in.

She was using SafetyWing because everyone uses SafetyWing, right? It’s like the default nomad insurance choice.

Everything was fine until she was in Mexico City and started having chest pains. Not “I’m having a heart attack” pains, but weird enough that she got concerned. Smart move – you don’t mess around with heart stuff.

She goes to Hospital Angeles, nice private facility. Gets the full workup – EKG, blood work, stress test. SafetyWing covers the emergency stuff no problem. Claims processed quickly, no hassles.

But then she wants follow-up with her cardiologist back in Chicago. Makes sense – it’s her heart, she trusts her doctors at home.

That’s when she discovers SafetyWing’s dirty secret: their Complete plan costs $161/month for international coverage, but adding US coverage jumps the total to $810/month. And even at $810, it’s still primarily emergency-focused coverage with limited outpatient services capped at $5,000 annually. Want routine follow-up with a specialist? You’re hitting those caps fast and paying significant out-of-pocket.

She ended up canceling SafetyWing, buying short-term insurance just for her US trip, and paying $800 out of pocket for cardiology visits that should’ve been covered.

Classic international health coverage digital nomads trap. The plan that looks affordable overseas becomes expensive when you need care at home.

Marcus and His $45K Autoimmune Situation

Now let me tell you about Marcus. Different story entirely.

Marcus is a marketing consultant, probably pulls $150K annually. He’d been nomading for a few years and got tired of insurance limitations. So he bit the bullet and went with Cigna Global’s premium plan.

$600/month. More than most nomads spend on rent.

He’s living in Lisbon when he develops some autoimmune thing. Fatigue, joint pain, weird rashes. Goes to a local doctor who thinks it might be serious and refers him to a specialist.

With budget insurance, he’d have been screwed. But Cigna? They hook him up with an English-speaking rheumatologist in Lisbon within 48 hours. When his Portuguese doctor wants to coordinate with specialists back in the US, Cigna’s case manager basically becomes his personal healthcare concierge.

Total treatment cost over 6 months: $45,000.

Marcus’s out-of-pocket: Zero, beyond his monthly premiums.

Plus, since he’s self-employed, those premiums are 100% business deductible. His effective after-tax cost was more like $420/month.

That’s the difference between comprehensive international health coverage digital nomads and hoping for the best.

The Telemedicine Reality Check

Here’s another fun story about why telemedicine for remote workers isn’t the magic solution everyone thinks it is.

I’m in Canggu, Bali (yeah, I know, basic nomad destination). Having a rough week – client drama, visa stress, working way too many hours. My anxiety is spiking.

I’d been doing weekly therapy sessions via video for months. Great therapist back in California, really helpful for managing business stress and nomad isolation.

It’s like 2 AM Bali time and I’m having what feels like a panic attack. Can’t sleep, heart racing, the works. I try to log into my therapy platform for an emergency session.

Error messages everywhere. “Service not available in your location.”

After an hour of troubleshooting and customer service hell, I find out my therapist is on vacation in Italy and can’t legally provide services from outside the US .

So I’m having a mental health crisis at 2 AM in Indonesia, and my “global” telemedicine is useless because my therapist decided to take a European holiday.

That taught me telemedicine for remote workers needs redundancy. Now I have multiple platforms set up and always test them before traveling.

The Prescription Pricing Scam

Want to hear something that’ll piss you off?

My ADHD medication costs $300/month in the US. Three hundred dollars for stimulant pills that have been around since the 1960s and probably cost $2 to manufacture.

I’m in Mumbai for a conference, running low on meds. Find a local psychiatrist through expat Facebook groups, explain my situation. She writes me a prescription for the generic version.

Walk into the pharmacy expecting to pay maybe $50-100 for a month’s supply.

“800 rupees for three months, sir.”

I’m like “800 rupees for one month, right?”

“No sir, three months.”

800 rupees is $12 USD . Twelve dollars for three months of medication that costs me $900 for three months in America.

Same active ingredient. Same dosage. Same effectiveness. Just made by Cipla in India instead of held hostage by Adderall’s patent monopoly in the US.

That was my introduction to how completely insane American pharmaceutical pricing is.

But here’s where international prescription management gets tricky and dangerous.

Different countries have wildly different rules about controlled substances. I learned this the hard way in Singapore.

I’m just transiting through Changi Airport with my perfectly legal, properly prescribed ADHD medication. Get pulled aside by customs for “random” screening.

Turns out Singapore requires special permits6 for stimulants, even if you’re just passing through for a connecting flight. I spent three hours in a detention room while they verified my prescription with my doctor back in the US.

Three hours. For medication I’ve been legally prescribed for years. Almost missed my connecting flight.

Japan is even worse – they basically don’t allow ADHD medications at all. UAE has similar restrictions. Every country has different rules and nobody tells you until you’re already in trouble.

Mental Health: The Hidden Crisis

Here’s something most digital nomad healthcare guide 2025 content doesn’t talk about: nomad mental health resources aren’t optional.

The lifestyle looks amazing on Instagram, but the reality is isolation, constant decision fatigue, and pressure to always be “living your best life.”

Studies show nearly half of nomads deal with loneliness and depression5 . But most nomad insurance doesn’t cover mental health, and finding good therapy abroad is nearly impossible.

I learned this during a particularly dark period in Mexico City. Visa stress, relationship issues, client problems all hitting at once. I was basically having a breakdown but trying to maintain the “successful nomad entrepreneur” image.

Telehealth therapy literally saved my nomadic career. Having consistent sessions with the same therapist, regardless of time zone, gave me stability when everything else was chaotic.

But even that has limitations. If your therapist can’t practice from certain jurisdictions, you’re stuck. Always have backup nomad mental health resources lined up.

The Tax Connection Nobody Mentions

Here’s where my NomadWallets expertise comes in: healthcare for digital nomads has huge tax implications most people completely miss.

Medical expenses abroad are fully deductible on your US tax return. HSA funds work internationally. Health insurance premiums are business deductible if you’re self-employed.

I’ve helped clients claim $10,000+ in medical deductions by strategically timing procedures in lower-cost countries and documenting everything properly.

That Thailand dental work? Deductible. Mexico prescription refills? Deductible. Premium insurance as a business expense? Also deductible.

Done right, your healthcare strategy can actually reduce your tax burden while improving your care quality.

Building a System That Works

After Chiang Mai, I completely rebuilt my approach to nomadic healthcare. Now I treat it like taxes – systematically, with backups and documentation.

Pre-travel checklist (takes 15 minutes, saves thousands):

- Research 2-3 hospitals near accommodation with English support

- Screenshot insurance emergency contacts and claim procedures

- Download offline maps to medical facilities

- Test telemedicine logins and book baseline sessions

- Print prescription letters and medication documentation

- Check controlled substance rules for every country and transit

- Confirm evacuation coverage and preferred partners

Insurance strategy:

- Match coverage to actual travel patterns, not hypothetical trips

- Budget for US access if you’ll want follow-ups at home

- Layer coverage: primary international + US supplement + evacuation

- Review quarterly and adjust based on destinations and health changes

Prescription management:

- Map legal generic availability along your route

- Build 30-day buffers and never travel with less than 2 weeks supply

- Carry original packaging + physician letters + embassy contacts

- Research import rules for every stop, including day trips

Mental health support:

- Schedule regular sessions before you feel off

- Have 2+ platforms that work from your destinations

- Join local communities and nomad groups for in-person connection

- Don’t romanticize struggle – get help early

Real Client Stories (Names Changed)

Josh’s Bali Infection

Tech freelancer, 6 months in Bali on budget insurance. Skin rash becomes serious infection. $14,000 bill at BIMC Hospital with zero coverage. Had to work from hospital bed to pay bills.

Emma’s Prescription Nightmare

Diabetes management while nomading. Insulin delays at Thai customs because of missing paperwork. $700 emergency insulin purchases plus missed work.

Andre’s Adventure Injury

Photographer injured during volcano hike in Guatemala. Insurance excluded “extreme sports.” $20,000 evacuation bill he’s still paying off.

These aren’t rare stories. They’re predictable outcomes of treating healthcare as an afterthought.

What Changed After Thailand

That $3,200 food poisoning bill was the best money I ever wasted. It taught me that healthcare isn’t separate from nomadic success – it enables it.

Now I pick destinations partly based on healthcare quality. I have a “refill map” for medications. I test telemedicine platforms before traveling. I budget healthcare like infrastructure, not emergency expense.

The small, boring habits – saving hospital contacts, printing prescription letters, scheduling therapy sessions – don’t feel exciting. But they feel like freedom.

When you know you can handle medical emergencies, chronic conditions, and mental health challenges anywhere in the world, you can be more adventurous, take bigger risks, and focus on building your business instead of worrying about “what if I get sick.”

That’s what this digital nomad healthcare guide 2025 is really about: building systems that enable nomadic freedom instead of constraining it.

Insurance Reality Check – What Actually Works When You’re Bleeding Money

Okay, so after that $3,200 som tam nightmare in Chiang Mai, I became completely obsessed with insurance. Like, unhealthily obsessed. I started researching every nomad insurance company like I was preparing for the CPA exam all over again.

And you know what I discovered? Most nomad health insurance comparison articles are written by people who’ve never actually been sick abroad. They just regurgitate marketing materials and call it a day.

I’ve now helped probably 50+ NomadWallets clients through real medical emergencies over the past few years. I’ve seen which companies actually answer their phones when you’re panicking at 3 AM, and which ones suddenly discover exclusions they conveniently forgot to mention when you signed up.

This digital nomad healthcare guide 2025 is about what actually works when your world is falling apart, not what looks good on a comparison chart.

SafetyWing: The Complicated Relationship Every Nomad Has

Let me be honest about SafetyWing. It’s like that ex you keep going back to – you know it’s not perfect, but it’s familiar and sometimes it actually comes through when you need it.

I’ve probably seen more SafetyWing claims than any tax guy should have to deal with. So I know exactly where it works and where it’ll screw you over completely.

Where SafetyWing Actually Delivers:

Their claims process is surprisingly smooth. My client Jake – this cocky web developer who thought he could handle Vietnamese traffic on a rented Honda – ended up in a Saigon hospital with a broken leg. He submitted his SafetyWing claim literally while lying in the ER, still high on painkillers, and got approval in like 3 hours.

Try getting that kind of response from Blue Cross Blue Shield. You’ll be dead before they finish reviewing your paperwork.

They handle straightforward emergencies without the bureaucratic nightmare that is American healthcare. Broken bones? Covered. Food poisoning? Yep. Need your appendix out? They’ll pay for it without making you prove you didn’t do it on purpose.

The coverage is actually global. Most travel insurance has these weird exclusions where like half of Africa is considered “too dangerous” or whatever. SafetyWing works pretty much everywhere except your home country.

Where SafetyWing Will Leave You Hanging:

Remember Sarah’s story from Part 1? That jump from $161 to $810 for US coverage ? That’s not a bug in their system. That’s literally their entire business model.

They hook you with cheap international coverage, knowing most nomads will eventually want to see their regular doctors back home. Then BAM – your premium quintuples and you still only get emergency coverage.

Even at $810 a month, you can’t see your dermatologist for a routine skin check. Can’t get that physical you’ve been putting off. Can’t see a therapist unless you’re literally having a psychotic breakdown that requires hospitalization.

I had this client – let’s call her Amy – who developed thyroid issues while nomading in Costa Rica. SafetyWing covered the initial ER visit where she got diagnosed. But the ongoing medication? The follow-up appointments with an endocrinologist? The regular blood work? She had to pay for all of that out of pocket.

That’s not healthcare for digital nomads. That’s catastrophic injury insurance with better marketing.

Mental health coverage is basically non-existent. Yeah, they say they cover psychiatric emergencies, but good luck finding a therapist who actually accepts SafetyWing. I’ve watched nomads have complete breakdowns because they couldn’t get consistent mental health care.

The Tax Thing Nobody Mentions:

Here’s something most people don’t know: SafetyWing premiums are fully tax-deductible as medical expenses. If you’re making decent money as a nomad, this can save you $2,000-4,000 annually. I handle this stuff for my clients all the time during tax season.

My Brutally Honest Take:

SafetyWing is starter insurance. It’s perfect for healthy nomads in their 20s and early 30s who mainly need emergency coverage and can handle routine stuff out of pocket. But if you have any ongoing health issues, need regular US healthcare access, or want actual comprehensive coverage, you’ll outgrow it fast.

IMG Global: The Option Everyone Ignores But Shouldn’t

Here’s where this digital nomad healthcare guide 2025 gets interesting. Most nomad bloggers jump straight from SafetyWing to premium options like Cigna. But there’s this sweet spot in the middle that nobody talks about: IMG Global.

IMG costs around $250-350 a month depending on your age . That’s double SafetyWing but way less than the premium plans. And for established nomads who’ve been doing this for more than a year, it hits the perfect balance.

Why IMG Doesn’t Suck:

They actually cover routine care, not just emergencies. Annual checkups, specialist visits, prescription medications – the boring healthcare stuff that actually keeps you healthy instead of just patching you up when you break.

Chronic condition management that works. I have a client – Marcus – who developed high blood pressure while nomading in Portugal. IMG covered his initial diagnosis, ongoing medication, regular check-ups, even nutrition counseling. Try getting that kind of continuity with SafetyWing.

Their prescription coverage works across borders. IMG has partnerships with pharmacy networks in multiple countries, so refilling your meds isn’t a monthly scavenger hunt.

The Downsides:

Provider networks aren’t as extensive as the premium plans. In smaller cities or developing countries, you might have fewer English-speaking options.

Claims processing is slower than SafetyWing’s streamlined approach, though still way faster than dealing with traditional American insurance.

Who Should Consider IMG:

Nomads who’ve hit SafetyWing’s limitations but aren’t making enough money to justify Cigna’s premium costs. Anyone who needs more than emergency-only coverage but doesn’t have super complex chronic conditions.

Cigna Global: The Rolls Royce Option (That Might Actually Be Worth It)

Let me tell you about the absolute top tier of international health coverage digital nomads: Cigna Global.

This is ridiculously expensive. We’re talking $500-800+ per month depending on your age and coverage level . That’s more than most nomads spend on rent. But their network of 1.65 million providers across 200 countries delivers healthcare access that honestly makes me jealous of my own clients.

Why Cigna Justifies Its Insane Cost:

Remember Marcus from my Part 1 story? The guy with the autoimmune condition? When he needed specialist care in Lisbon, Cigna didn’t just find him any rheumatologist. They found him one of the best autoimmune specialists in Portugal and got him an appointment within 48 hours.

Meanwhile, my friends back in California are waiting 3+ months to see specialists in their own cities.

They handle complex medical situations like actual professionals. When Marcus needed coordination between his Portuguese doctors, American specialists, and some experimental treatment in Germany, Cigna’s case managers made it seamless. They literally became his personal healthcare coordination team.

Chronic conditions get real coverage. Instead of abandoning you the moment your health gets complicated, Cigna builds comprehensive care plans that work across multiple countries and healthcare systems.

Mental health coverage that actually functions. Cigna partners with telehealth platforms that work internationally, providing consistent therapy and psychiatric care regardless of your location or timezone.

Preventive care is included. Annual physicals, cancer screenings, vaccinations, dental cleanings – all the routine healthcare that prevents expensive emergencies down the road.

Where Cigna Gets Brutal:

The cost can easily eat 15-20% of your nomad budget, especially if you’re older or have pre-existing conditions. That’s serious money that could be going toward experiences or investments.

US coverage adds another premium tier. Want comprehensive American healthcare access? You’re looking at costs that exceed some nomads’ entire monthly living expenses.

The Tax Advantage:

Here’s where Cigna’s cost becomes more manageable: health insurance premiums are 100% business-deductible for self-employed nomads. A $6,000 annual premium only costs you $4,200 after taxes if you’re in the 30% bracket.

Who Actually Needs Cigna:

Successful nomadic entrepreneurs with solid income who want healthcare that enhances their lifestyle instead of limiting it. Anyone with chronic conditions or complex mental health needs. Nomads who’ve experienced SafetyWing’s limitations and never want to deal with coverage gaps again.

World Nomads: Adventure Insurance Cosplaying as Health Insurance

I need to call out World Nomads because their marketing targets nomads hard, but they’re solving a completely different problem than what most of us actually need.

World Nomads starts around $130 per month , which looks competitive until you dig into the details and realize it’s travel insurance with nomad branding.

Where World Nomads Works:

Adventure activity coverage that other insurers exclude. Planning to go skydiving in New Zealand, rock climbing in Thailand, or surfing in Indonesia? World Nomads covers injuries that SafetyWing might deny due to “high-risk activities.”

Emergency evacuation coverage is solid. If you need helicopter rescue from remote locations, they handle it well.

Where World Nomads Completely Fails:

Coverage periods max out at 12 months. This forces you into annual insurance shopping, which defeats the whole point of building long-term healthcare relationships.

It’s designed for tourists, not long-term nomads. Routine healthcare, chronic condition management, ongoing relationships with doctors – none of that fits their model.

My Take:

Good supplementary coverage for adventure activities. Terrible primary health insurance for nomads building sustainable lifestyles.

The Strategy That Actually Works After Years of Client Disasters

Here’s the framework I recommend to NomadWallets clients based on years of processing insurance claims and watching people make expensive mistakes:

New Nomads (Years 1-2):

Start with SafetyWing for emergency coverage while you figure out your nomadic patterns and healthcare needs. Use the money saved from cheaper insurance to build a dedicated emergency medical fund of $5,000-10,000.

Established Nomads (Years 2+):

Upgrade to IMG Global or Cigna based on your income and health complexity. The improved coverage pays for itself in reduced stress, better health outcomes, and avoided catastrophic bills.

All Nomads:

Layer specific coverage for gaps your primary insurance doesn’t cover. This might mean short-term adventure insurance for excluded activities, regional coverage for areas with limited provider networks, or supplemental evacuation coverage if your primary policy caps are too low.

Tax Optimization Strategy:

Structure your insurance payments to maximize tax deductions. Pay annual premiums in high-income years to get the biggest tax benefit. For nomadic entrepreneurs, health insurance is often your largest legitimate business deduction.

Real-World Testing: The 2 AM Phone Call Test

Here’s how you actually test nomad health insurance comparison options: call them when everything’s going wrong.

Last year, my client Emma had severe abdominal pain in rural Cambodia at 2 AM. Possible appendicitis, needed emergency surgery and potential evacuation to Bangkok. Here’s how different insurers actually performed:

SafetyWing: Answered after 25 minutes (not bad for the middle of the night), approved evacuation to Bangkok immediately, coordinated everything with the local hospital. Actually pretty impressive for budget insurance.

IMG Global: Answered in 8 minutes, case manager called the Cambodian hospital directly, arranged for a medical translator, coordinated with Emma’s regular doctors back home to share medical history. Excellent service.

Cigna Global: Answered immediately, had a case manager physically at the hospital within 10 minutes, arranged consultation with specialists Emma had seen previously in Singapore, coordinated her entire treatment plan. This level of service justified every penny of the premium cost.

World Nomads: Took 75 minutes to reach an actual human, required extensive documentation before approving anything, questioned whether her condition might be a “pre-existing condition” (it wasn’t), generally added stress when Emma needed support most.

This is why real digital nomad healthcare guide 2025 testing matters. Marketing brochures don’t tell you who actually answers the phone during your worst nightmare.

Hidden Costs That Destroy Nomad Budgets

Every nomad health insurance comparison misses the sneaky costs that catch people off guard:

Geographic Exclusions: Budget policies often exclude entire regions without clear disclosure. That amazing beach destination in Myanmar? Suddenly not covered because the insurer classifies it as “high-risk.”

Activity Exclusions: Rode a motorbike in Thailand? Not covered if you crash. Went hiking in Costa Rica? Excluded if the trail isn’t “approved.” These exclusions are buried in fine print and only enforced when you try to file claims.

Pre-existing Condition Traps: Develop any ongoing condition while insured, and budget insurers often exclude it from all future coverage. That anxiety that developed during visa stress? No longer covered for therapy or medication.

Prescription Limitations: Most budget insurance doesn’t cover prescription medications abroad, or only covers them in specific countries. International prescription management becomes entirely out-of-pocket.

Follow-up Care Gaps: Emergency treatment covered, but weeks of physical therapy afterward? Often excluded. This is where budget insurance really fails healthcare for digital nomads.

The Boring Documentation That Saves Your Life

Essential Digital Records:

- Insurance policy documents with emergency contact numbers saved offline

- Prescription records with generic drug names translated into multiple languages

- Vaccination history with official certificates

- Medical summary from your primary care doctor back home

- Emergency contact information accessible even without your phone

Physical Backup Documentation:

- Laminated insurance card with 24/7 emergency numbers

- Prescription letters from your doctors explaining medical necessity

- Medical information translated into languages for common destinations

- Embassy contact information for countries you’ll be visiting

Financial Preparation:

- Credit cards with high limits and no foreign transaction fees

- Emergency fund specifically designated for medical expenses

- Clear understanding of your insurance company’s claim reimbursement process and timeline

Telemedicine and Prescriptions (The Stuff That Actually Matters)

So telemedicine. Everyone talks about how amazing it is for nomads, right? Wrong. Most of it is complete garbage when you actually need it. Found this out the hard way during panic attack in Canggu at 3 AM when my “global” telemedicine app told me “service not available in your region.” Thanks for nothing.

This digital nomad healthcare guide 2025 is gonna tell you the real deal about telemedicine platforms, not the marketing hype. Because when you’re having mental breakdown in Bali and your supposed “24/7 global support” gives you error messages, you realize how screwed most nomads actually are.

The “Global” Telemedicine Lie

Started using telemedicine three years ago thinking I was being smart. Downloaded all the apps – MDLive, Teladoc, Amwell, the whole lineup. Figured I had backup covered for anything. Boy was I wrong.

First reality check came in Thailand. Food poisoning, couldn’t keep anything down for two days, getting seriously dehydrated. Tried MDLive – “sorry, not available in Thailand.” Teladoc – same message. Amwell – you guessed it. So much for global healthcare access.

That’s when I learned the dirty secret about “international” telemedicine – most of it isn’t actually international. They say global but mean “global except where you actually travel.” Learned this lesson while puking my guts out in Bangkok hotel room.

What Actually Works (From Real Experience)

But here’s what actually works for nomad telemedicine needs. Doctor on Demand has decent international coverage if you keep US phone number. Costs more but works from most countries I’ve tried. Used it in Mexico, Portugal, Thailand, Ecuador. Not perfect but way better than others.

For mental health stuff, BetterHelp works internationally if you set it up right. Had panic attacks in Lisbon, therapist was available via video call. Saved my ass during rough patch last year when work stress hit hard while dealing with visa issues.

The key with telemedicine for digital nomads is setting everything up before you travel. Don’t wait until crisis hits to figure out which platforms work where. Test video calls, confirm prescription capabilities, understand billing with international cards.

The Prescription Border Nightmare

Prescription management though – that’s where things get really complicated for nomad healthcare planning. Border guards don’t care about your telemedicine setup when they find controlled substances in your bag. Learned this during terrifying experience at Singapore airport.

Had legitimate Adderall prescription from US doctor. All proper documentation, original bottles, physician letters. Singapore customs officer looks at me like I’m drug smuggler. Detained for three hours while they verified everything. Apparently Adderall is banned there. Almost missed connecting flight.

That’s when I started researching international prescription laws seriously. Turns out tons of common US medications are illegal in different countries. Adderall banned in Japan, Singapore, UAE. Codeine restricted across Europe. Even basic pain meds can land you in trouble if you don’t research properly.

International prescription management requires way more planning than most nomads realize. Can’t just carry medications and hope for best. Need country-specific research, proper documentation, sometimes alternative medications for certain destinations.

Generic Names Save Your Life

Generic names become survival knowledge for prescription refills abroad. Lisinopril is same everywhere but goes by different brand names. Metformin available globally under various names. Learning generic names lets you get refills without brand confusion.

But here’s the nightmare scenario most guides don’t mention – prescription delays that derail entire trips. Happened to me in Colombia when pharmacy couldn’t verify my US prescription. Needed blood pressure medication, local doctors wouldn’t prescribe without seeing full medical history.

Ended up paying $300 for emergency consultation with Colombian doctor who spoke broken English. Had to get blood work done, wait three days for results, then finally got prescription. Meanwhile, blood pressure spiking from stress of whole situation. Could’ve been dangerous.

When Technology Fails You at 2 AM

Technology failures happen at worst possible moments with telemedicine platforms. Internet cuts out during important consultation. Video calls drop during prescription discussion. App crashes when you’re trying to reach crisis support. Always need backup plans for when technology fails.

Keep offline copies of all medical records on phone. Screenshot important prescriptions. Download medical translation apps that work without internet. Carry physical copies of prescription information in multiple languages. Technology fails, paper backups save you.

Mental health crisis support through telemedicine gets tricky internationally. BetterHelp therapist helped during anxiety episode in Portugal, but time zones make scheduling difficult. Crisis hotlines often don’t work from international numbers. Need multiple backup options for mental health emergencies.

Insurance Companies Love Screwing Nomads

Insurance exclusions for telemedicine vary wildly by provider and location. Some plans cover domestic telemedicine but not international usage. Others cover international but limit which platforms qualify. Read fine print carefully – insurance companies love finding reasons to deny claims.

Had insurance deny telemedicine claim because I used “non-approved” platform while traveling. Fought with them for six months to get $200 consultation fee covered. Eventually paid out of pocket because hassle wasn’t worth it. Factor these potential costs into nomad healthcare budgeting.

Telemedicine prescription refills work sometimes but depends on local pharmacy cooperation. MDLive prescribed antibiotic for throat infection while I was in Costa Rica. Local pharmacy accepted electronic prescription, filled same day. But tried same thing in rural Guatemala – pharmacy wanted paper prescription from local doctor.

The Money Game Nobody Talks About

Prescription costs vary dramatically between countries for same medications. Blood pressure medication costs $80 monthly in US, $12 in Mexico, $6 in Thailand. Smart prescription management means timing refills in cheaper countries when possible.

But be careful with prescription shopping across borders. Some countries track controlled substance purchases. Others have import limits on certain medications. Research local laws before attempting to fill prescriptions internationally.

Time zone challenges make telemedicine scheduling nightmare for nomads. US doctor available 9-5 Eastern when you’re in Asia means middle-of-night consultations. European doctors don’t align with Latin American travel schedules. Need flexible scheduling or doctors willing to work odd hours.

Building Your Backup Systems

That’s why building relationships with nomad-friendly doctors in key locations becomes crucial for prescription management. Dr. Patel in Bangkok knows my medical history, can prescribe refills quickly. Dr. Rodriguez in Mexico City same thing. Takes years to build these relationships but pays off huge when problems arise.

Some platforms offer 24/7 access but quality drops significantly during off-peak hours. Get less experienced doctors, rushed consultations, limited prescription capabilities. For non-urgent issues, worth waiting for regular hours to get better care.

Backup communication methods essential when primary telemedicine fails. WhatsApp video calls work globally if you have doctor’s personal number. Signal messaging for sensitive health discussions. Telegram for file sharing medical documents. Don’t rely solely on official telemedicine apps.

Language barriers complicate telemedicine internationally even with English-speaking platforms. Medical terminology gets lost in translation. Pronunciation issues with video calls. Cultural differences in describing symptoms. Having medical translation resources ready helps communicate effectively.

The Reality Check

Prescription authority maintenance while nomadic requires ongoing relationship management with US physicians. Regular check-ins even when healthy. Updated contact information. Proof of travel itineraries when requesting extended prescriptions. Maintaining medical relationships from distance takes effort but prevents crises.

Emergency protocols for telemedicine failures need multiple layers. Primary platform backup options. Alternative prescription sources. Local emergency contact numbers. Embassy medical services information. Cash reserves for unexpected medical expenses when insurance fails.

This digital nomad healthcare guide 2025 reality check – telemedicine can help but isn’t magic solution for nomadic healthcare challenges. Works best as part of comprehensive healthcare strategy, not standalone solution. Plan for failures, have backups, research local laws, build relationships with international physicians.

Most important lesson from three years using telemedicine as nomad – the platforms that work aren’t necessarily the ones with best marketing. Found reliable services through trial and error, nomad community recommendations, and unfortunately some expensive mistakes along the way.

Emergency Protocols and Prevention (Building Systems That Actually Work)

Emergency medical evacuation. Sounds dramatic, right? Like something that happens to other people who do reckless stuff in dangerous places. Wrong. Almost happened to me twice, and both times weren’t from anything crazy – just regular nomad life gone sideways.

This digital nomad healthcare guide 2025 final section is about building prevention systems that keep you healthy long-term, not just surviving month to month. Because after four years of nomadic disasters, I’ve learned that prevention beats emergency response every single time.

First evacuation scare hit me in rural Guatemala two years back. Simple hiking accident turned into potential spinal injury because I was being an idiot and hiking alone without telling anyone. Slipped on wet rocks, couldn’t move my legs for twenty minutes. Thought I was paralyzed. Turns out just severe muscle spasm, but those twenty minutes made me realize how screwed I’d be if something serious happened.

No cell service. No GPS beacon. Nearest hospital three hours away by terrible roads. If that had been actual spinal damage, I’d have been completely screwed. That’s when I started taking emergency protocols seriously instead of just talking about them.

Evacuation Insurance That’s Not Complete Garbage

Most evacuation insurance is marketing hype designed to make you feel safe without actually helping when you need it. Found this out researching coverage after Guatemala incident. Read through dozens of policies – half have exclusions that eliminate most real scenarios nomads face.

“Adventure sports” exclusions knock out motorcycling, hiking, even swimming in some policies. “Pre-existing condition” clauses can disqualify you for anything from allergies to previous injuries. Some require “nearest adequate facility” which sounds good until you realize “adequate” means very different things in rural areas.

But here’s what actually works for nomad evacuation coverage. Global Rescue provides real evacuation services, not just insurance reimbursement. They coordinate actual helicopters, medical flights, ground transport. Used to think that was overkill until buddy Jake needed evacuation from Peru. Altitude sickness turned into pulmonary edema at 14,000 feet. Global Rescue had him in Lima ICU within six hours.

SkyAlert offers good coverage for less dramatic evacuations. When I got severe food poisoning in rural Mexico, they arranged medical transport to decent hospital in Guadalajara instead of sketchy local clinic. Paid for everything upfront, no reimbursement hassles later.

The key with evacuation insurance for digital nomads is understanding coverage limitations before you need it. Test their phone systems. Understand activation procedures. Know exactly what triggers coverage and what gets excluded.

Prevention Strategies That Actually Work

Prevention sounds boring compared to emergency protocols, but it’s way more important. Most nomad health problems are preventable if you build proper systems instead of winging everything and hoping for best.

Preventive healthcare for nomads requires completely different approach than sedentary people. Can’t rely on annual checkups and regular doctors when you’re constantly moving. Need systems that travel with you and provide continuous monitoring instead of periodic assessments.

Started using continuous glucose monitor even though I’m not diabetic. Tracks how different foods affect energy levels, helps identify problems before they become serious. Caught early signs of insulin resistance while still reversible through diet changes. Would’ve missed this completely with traditional annual bloodwork.

Blood pressure monitoring became daily routine after hypertension scare in Colombia. Portable cuff takes two minutes, reveals patterns that single doctor visits miss. Caught stress-related spikes during visa problems, adjusted medication before things got dangerous.

Building Your Early Warning System

Sleep tracking through wearables provides incredible insights into health trends. Recovery scores drop consistently before getting sick. REM sleep disruption signals stress problems before conscious symptoms appear. Heart rate variability predicts overtraining and burnout weeks before you feel it.

But data means nothing without systems to act on it. Built automated alerts when metrics hit concerning levels. Recovery score below 30% means mandatory rest day. Heart rate elevated for three consecutive days triggers doctor consultation. Sleep quality drops trigger stress management protocols.

Regular blood panels every six months regardless of location. Use international lab networks like Quest Global or local equivalents in major nomad destinations. Track trends in vitamin D, inflammation markers, liver function, metabolic health. Catch problems early when still easily fixable.

Dental preventive care requires different strategy for nomads. Can’t rely on twice-yearly cleanings when constantly moving. Learned to do proper dental hygiene maintenance between professional visits. Water flosser, sonic toothbrush, antiseptic mouth rinses. Prevent problems instead of treating them later.

Finding Quality Healthcare Anywhere

Quality healthcare exists everywhere if you know how to identify it. Problem is most nomads use terrible criteria for choosing medical providers. They go with whatever’s closest, cheapest, or recommended by other nomads who don’t know any better.

International hospital accreditation matters more than location or cost. JCI accreditation means global standards regardless of country. Found excellent care in Malaysia, Thailand, Mexico at JCI hospitals that exceeded US quality. Meanwhile, expensive private clinics in Europe without accreditation provided terrible service.

Research physicians’ training backgrounds before trusting them with serious issues. Many international doctors trained at top US or European medical schools. Dr. Patel in Bangkok studied at Johns Hopkins. Dr. Rodriguez in Mexico City trained at Mayo Clinic. Better credentials than most US doctors I’ve used.

Language barriers create dangerous communication gaps in healthcare. Even when doctors speak English, medical terminology gets lost in translation. Always bring medical translation apps, written symptom descriptions, translated medication lists. Miscommunication kills people in healthcare settings.

Emergency Response Systems That Work

Emergency protocols need multiple redundancy layers because single points of failure kill people. Can’t rely on cell phone working, credit card processing, or insurance company responding quickly. Need backup systems for your backup systems.

Satellite emergency beacons work when everything else fails. Garmin InReach provides two-way communication from anywhere with GPS coordinates for rescuers. Saved my ass in Patagonia when weather turned dangerous and cell towers went down. $400 device potentially worth millions in rescue costs.

Emergency cash reserves in multiple currencies prevent payment problems during crises. Keep $5,000 cash accessible in major currencies – USD, EUR, local currency where traveling. Medical emergencies don’t wait for wire transfers or card authorization issues.

Medical information cards in multiple languages prevent dangerous misunderstandings during emergencies. Include medication lists, allergy information, emergency contacts, insurance details. Laminate cards and keep copies in wallet, luggage, cloud storage. When unconscious, cards speak for you.

Mental Health Prevention Systems

Mental health emergencies happen more often than physical ones for nomads. Isolation, stress, constant uncertainty take psychological tolls that build up over time. Prevention means building support systems before crises hit.

Regular video calls with family and close friends prevent dangerous isolation. Schedule weekly calls regardless of time zones or travel schedules. Human connection requirements don’t disappear because you’re nomadic. Maintain relationships that ground you psychologically.

Professional mental health support through international platforms becomes essential for long-term nomads. BetterHelp, Talkspace, local therapists in base locations. Address stress, anxiety, depression proactively instead of waiting for breakdowns.

Community connections in nomad destinations provide immediate support networks. Join coworking spaces, nomad groups, local expat communities. Having people who understand your situation prevents dangerous psychological isolation during difficult periods.

Preventive Healthcare While Moving

Exercise routines that travel prevent physical deterioration from constant sitting and irregular schedules. Bodyweight exercises, resistance bands, running work anywhere. Gym memberships through international chains like Anytime Fitness provide equipment access globally.

Nutrition becomes challenging with constant restaurant meals and unfamiliar foods. Portable supplements fill nutritional gaps. Vitamin D, B12, omega-3, probiotics address common deficiencies in nomadic lifestyles. Regular blood testing confirms supplementation effectiveness.

Stress management systems prevent psychological and physical health problems. Meditation apps, breathing exercises, yoga routines travel easily. Stress kills more nomads than accidents or infectious diseases. Managing stress prevents cascade of health problems.

Building Long-Term Health Systems

Sustainable nomadic lifestyle requires treating health as seriously as business operations. Can’t wing health decisions and expect long-term success. Need systematic approaches that enhance rather than constrain nomadic freedom.

Medical records management in cloud storage provides access from anywhere. Scan and upload all medical documents, test results, prescription information. Organized digital records prevent dangerous information gaps during emergencies or consultations.

Relationship management with healthcare providers in key locations creates medical safety nets. Maintain contacts with trusted doctors in major nomad hubs. Regular check-ins even when healthy preserve relationships for when serious problems arise.

Insurance portfolio optimization for nomadic lifestyle requires multiple coverage types. Travel medical, evacuation, major medical, disability income. No single policy covers all nomadic scenarios. Build comprehensive coverage through multiple specialized providers.

The Prevention Mindset

Successful long-term nomads think prevention first, treatment second. Every health decision considers long-term consequences and systematic approaches. Emergency protocols exist as backups, not primary strategies.

This digital nomad healthcare guide 2025 concludes with most important lesson – sustainable nomadic lifestyle depends on building health systems that work anywhere, not just surviving individual crises. Prevention, preparation, and systematic thinking keep successful nomads healthy for decades, not just months.

Most nomads fail at healthcare because they treat it reactively instead of systematically. They deal with problems after they happen instead of building systems that prevent most problems entirely. Smart nomads invest time and money in prevention because it’s infinitely cheaper and safer than emergency response.

Four years of nomadic healthcare experiences taught me that successful digital nomads aren’t lucky – they’re prepared. They build redundant systems, maintain multiple backup plans, and treat health as seriously as their business operations. That’s the difference between nomads who thrive long-term and those who burn out or get forced home by preventable health crises.

Frequently Asked Questions

Q1. What’s the best health insurance for new digital nomads?

A. Look, if you’re just starting out and healthy, SafetyWing’s Essential plan at $60/month is fine for emergencies. But understand its limitations – emergency-only care, $250,000 coverage cap, no routine care, limited mental health support, and minimal US coverage (15-30 days max).

Their Complete plan costs $161/month and includes routine care, but caps outpatient services at $5,000 annually – still restrictive for chronic conditions. Once you’re established (after year 2), upgrade to IMG Global ($250-350/month) or Cigna Global ($500-800/month) for comprehensive coverage. I’ve processed claims for all of these – you get what you pay for.

Q2. Can I actually use telemedicine from anywhere as a nomad?

A. Nope, this is marketing hype. Most “global” telemedicine platforms have licensing restrictions. MDLive doesn’t work from Thailand. BetterHelp works internationally but has scheduling nightmares across time zones. Doctor on Demand has been most reliable in my experience if you keep a US phone number. Always test platforms before traveling.

Q3. How do I avoid prescription disasters when crossing borders?

A. Three critical steps: 1) Research controlled substance laws for every country (Adderall is banned in Japan, Singapore, UAE), 2) Carry generic name cards in multiple languages, 3) Get physician letters explaining medical necessity. I got detained at Singapore airport for 3 hours with legitimate prescriptions because I didn’t have proper documentation.

Q4. Is evacuation insurance actually worth the cost?

A. After seeing my client Jake need helicopter evacuation from Peru for altitude sickness, absolutely yes. Global Rescue and SkyAlert provide real evacuation services, not just reimbursement. Costs can hit $300K+ if you’re remote and things go wrong. Budget $100-200/month for proper evacuation coverage – bankruptcy protection for worst-case scenarios.

Q5. What’s the real cost difference for medical tourism?

A. Massive savings if you plan properly. My root canal in Bangkok cost $1,200 vs $6,000 in California. Same dentist credentials, better equipment, more time spent on care. But research quality – JCI accreditation matters more than location. Mexico, Thailand, India offer excellent care at 30-70% US costs.

Q6. Do nomad visas actually require health insurance?

A. Most do now. Spain’s 2023 nomad visa requires proof of full medical coverage. Portugal, Estonia, others have similar requirements. Budget travel insurance won’t cut it – they want comprehensive coverage without co-payments. Check specific visa requirements because they change frequently.

Q7. Can I deduct nomad health expenses on US taxes?

A. Yes, if you do it right. Medical expenses abroad are fully deductible. HSA funds work internationally. Health insurance premiums are business deductible if self-employed. I help clients claim $10K+ annually in medical deductions through strategic planning and proper documentation.

Q8. What happens if I have a mental health crisis abroad?

A. Most nomad insurance has terrible mental health coverage. BetterHelp works internationally with scheduling challenges. Build backup support systems – local expat communities, multiple telemedicine platforms, emergency contacts who understand your situation. Don’t rely on single solutions for mental health emergencies.

Q9. Should I time medical procedures around travel plans?

A. Smart strategy if done carefully. Bangkok dental work during visa runs, prescription refills in cheaper countries, routine care in places with JCI-accredited hospitals. But don’t compromise on urgent care timing. I’ve seen nomads delay necessary treatment to save money and end up with bigger problems.

Q10. How do I build long-term healthcare relationships as a nomad?

A. Geographic consistency beats constantly moving. I maintain relationships with Dr. Patel in Bangkok, Dr. Rodriguez in Mexico City, Dr. Santos in Lisbon. Takes 2-3 years to build trust but pays off huge when problems arise. Focus on fewer destinations, deeper relationships instead of constant movement.

This digital nomad healthcare guide 2025 FAQ covers the real questions I get from clients after they’ve tried implementing comprehensive nomadic healthcare strategies. The boring preparation work – documentation, relationship building, system testing – makes all the difference when emergencies hit.

Ready to get your nomad finances bulletproof?

Check out my other guides:

- Digital Nomad Tax Guide 2025

- Best Bank Account for Digital Nomads 2025

- 20 Life-Changing Trips for Digital Nomad Couples in 2025

Questions about nomad healthcare or taxes? Email me directly: nomadswallets@gmail.com

References :

[1] Digital Nomad Statistics You Should Know 2025 – Pumble

[2] SafetyWing – Nomad Insurance Essential Policy

[3] SafetyWing – Nomad Insurance Complete

[4] Singapore Health Sciences Authority – Personal Medication Requirements

[5] The Digital Nomad Boom: 2025 Recap – Localyze

[6] Global Rescue – Medical Evacuation Services

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.