The era of the “forever tourist” is ending.

While border runs still exist for short term travelers, they are functionally dead for long term residents. In 2026, governments are linking immigration databases and tightening entry rules, meaning a “visa run” is no longer a reliable strategy for building a life abroad.

The landscape of remote work has shifted beneath our feet. Gone are the days when a tourist visa and a smile could get you a year of residency in Southeast Asia or Europe. In 2026, governments have woken up. They want your presence, but more importantly, they want your tax compliance and your proof of funds.With stricter enforcement, nomad visa rejections are becoming more common for unprepared applicants.

This isn’t just a list of countries; this is the NomadWallets 2026 Visa Report. We are breaking down the digital nomad visa 2026 landscape not by “prettiest beaches,” but by ROI (Return on Investment).

We have analyzed over 50 programs to bring you the only three tiers that matter:

- The Inflated Tier (Europe): High taxes, high income requirements, but high quality of life.

- The Elite Tier (Japan & South Korea): Massive income requirements for very short stays.

- The Golden Tier (The Winners): Low barrier to entry, long validity, and tax efficiency.

If you are a US based nomad looking to optimize your change state domicile strategy while living abroad, this is your playbook.

Note: This guide covers global visas. for specific advice on US taxes, banking, and state residency, bookmark our US Digital Nomad Hub.

📌 Quick Summary: The 2026 Visa Landscape

- The “Inflation” Reality: The average income requirement for a European digital nomad visa 2026 has risen by ~20% (e.g., Spain now requires ~€2,763/mo).

- The Best Value: Thailand’s new DTV (Destination Thailand Visa) is the #1 choice for ROI, offering 5 years of validity for just a ~$300 fee and proof of savings (no monthly income requirement).

- The “Elite” Trap: New visas from Japan and South Korea are expensive (~$66k+ income) and offer short stays (6 months) with no path to residency.

- Financial Strategy: Securing a visa is not enough. You must pair your digital nomad visa 2026 with a proper Change State Domicile strategy to avoid getting taxed by “sticky states” like California or New York while abroad.

- The Wildcards: Look out for Kenya’s new “Class N” permit and the finalized South African remote work visa if you crave adventure over European bureaucracy.

The 2026 “Visa Inflation” Index

Before we dive into specific countries, look at how the financial bar has been raised in just 12 months. The “budget” nomad destinations are disappearing.

| Country | 2024/2025 Requirement | 2026 Requirement (New) | The “Inflation” Jump | Renewability / Exit Rules |

| Spain | ~€2,300 / mo | €2,763 / mo | +20% (Pegged to new SMI) | Renewable. Leads to Permanent Residency. |

| Turkey | Unclear / None | $3,000 USD / mo | New Standard (Strict enforcement) | Renewable. No path to citizenship. |

| Italy | N/A (Not Active) | €28,000 / year | New Standard (High barrier to entry) | Renewable. High bureaucracy for extensions. |

| Kenya | Tourist Visa | $55,000 / year | New Standard (Class N Permit) | Renewable. |

| Thailand | Elite ($25k cost) | 500k THB Savings | -90% Cost (The DTV is a price drop) | Exit Required every 180 days. |

NomadWallets Insight: Notice the trend? Europe and Africa are asking for monthly income (cash flow), while Asia (specifically Thailand) is moving toward savings (assets). If you have a lumpy income but good savings, look East.

Tier 1: The European Fortress (High Cost, High Reward)

Europe remains the dream for many, but in 2026, the price of admission has gone up, literally. The European Union has standardized many remote work policies, leading to stricter income thresholds pegged to national minimum wages.

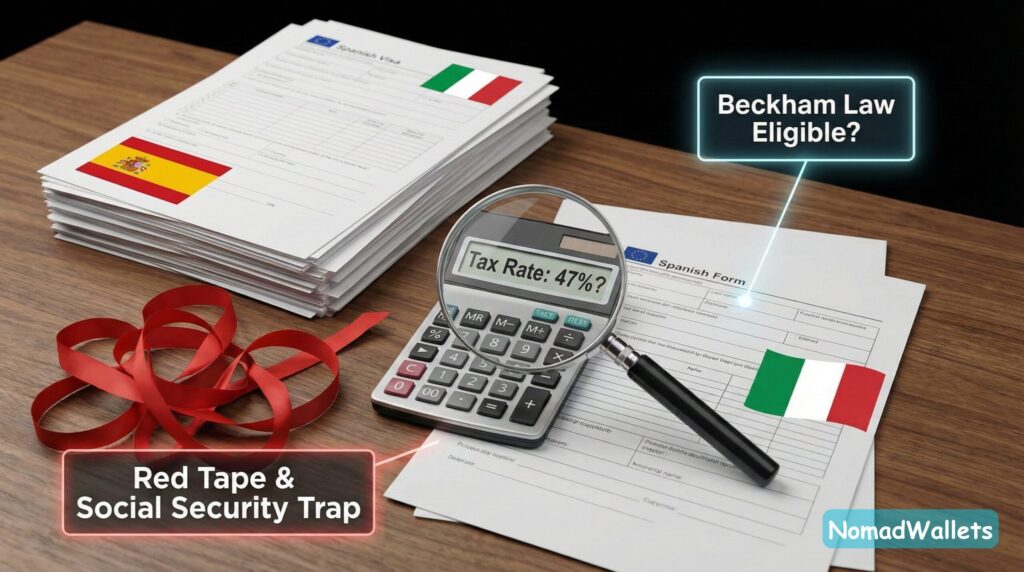

1. Spain: The Most Popular (And Most Expensive) Trap

Spain’s digital nomad visa 2026 program is arguably the most desired in the world. It offers access to the Schengen Zone, incredible lifestyle, and a path to citizenship (eventually). However, 2026 has brought a stinging reality check regarding income.

The 2026 Financial Requirement

Spain pegs its visa income requirement to 200% of the Salario Mínimo Interprofesional (SMI). As of January 2026, the inflation adjustments have pushed this number higher.

- Minimum Monthly Income (Single): ~€2,763 (approx. $2,950 USD).

- Spouse (+75%): Add ~€1,035/month.

- Child (+25%): Add ~€345/month.

- Total for a Family of 3: You now need to prove roughly €4,143/month ($4,400 USD) in stable, remote income.

The “Holy Trinity” Pain Point: Social Security & Taxes

Getting the visa is step one. Paying for it is step two.

- Social Security: If you are a US nomad, you must provide a “Certificate of Coverage” from the SSA to avoid paying into the Spanish system (which costs nearly €300/month minimum).

- The Tax Trap: You become a tax resident if you stay >183 days. Unless you qualify for the Beckham Law (a special reduced flat tax of 24%), you will face progressive Spanish taxes up to 47%.

- NomadWallets Warning: Do not assume your US LLC automatically qualifies you for this. Eligibility often depends on your specific employment structure (e.g., having a corporate employer vs. being a pass through entity owner). Many freelancers find themselves ineligible upon arrival. Consult a Spanish tax attorney before you move, not after.

2. Italy: La Dolce Vita with a Bureaucratic Twist

Italy’s program, fully operational in 2026, is the direct competitor to Spain. It has a lower financial barrier but a much higher “hassle” barrier.

The 2026 Financial Requirement

Italy requires applicants to earn €28,000 per year (approx. €2,333/month). On paper, this is significantly cheaper than Spain. However, Italy introduces a unique hurdle: “Highly Skilled” Verification.

To qualify for the Italian digital nomad visa 2026, you must prove you are “highly skilled” by showing:

- A University Degree (Bachelor’s or higher).

- OR at least 3 years of documented professional experience in your field.

The Hidden Cost: The “Permesso di Soggiorno”

The visa only gets you into Italy. Within 8 days of arrival, you must apply for the Permesso di Soggiorno (Residence Permit). In 2026, appointment backlogs in cities like Milan and Rome are averaging 4-6 months.

- Tax Note: Italy offers a flat tax regime for new residents, but it requires a commitment to stay for multiple years. If you leave early, they claw back the tax savings.

3. Portugal: The D8 Visa (Still the King?)

Portugal’s “D8” Digital Nomad Visa has split into two distinct paths for 2026, making it flexible but pricey.

The Two Streams

- Temporary Stay Visa: Valid for 1 year. Non renewable (you must leave or switch). Great for testing the waters.

- Residence Visa: Valid for 2 years + renewable for 3 years. Leads to citizenship after 5 years.

The 2026 Financial Requirement

Portugal requires 4x the Portuguese minimum wage.

- Monthly Income: €3,680 (approx. $3,950 USD).

- Savings: You must also show a bank balance of roughly €10,000 to cover initial setup costs.

4. Slovenia: The New “Hidden Gem” (Launched Late 2025)

While everyone fights for appointments in Spain, Slovenia quietly launched one of the most straightforward digital nomad visa 2026 programs in November 2025.

- The Deal: A temporary residence permit valid for up to 1 year (non renewable, you must re-apply or leave).

- The Requirement: You must earn 2x the average Slovenian salary (~€3,200 per month).

- Why Choose It? It puts you in the heart of Europe (Schengen) without the 6-month backlog of Spain or Portugal. It is perfect for nomads who want a “gap year” in Europe without the intention of permanent immigration.

5. Turkey: The Eurasian Bridge (Now $3,000)

Turkey (Türkiye) has finally formalized its digital nomad route, ending the gray area of “tourist residence permits” that many nomads abused for years.

- The Hard Number: You must show a monthly income of $3,000 USD (approx. €2,800).

- The Catch: This is a pure “Digital Nomad” status. It does not automatically lead to citizenship.

- The Location Strategy: Most nomads are flocking to Istanbul or Antalya. With the Lira still volatile, your $3,000/month buys a luxury lifestyle here that would barely get you a studio apartment in Dublin or Amsterdam.

Tier 2: The “Golden” Tier (The Winners)

While Europe builds a fortress of high income requirements and slow bureaucracy, Asia has split into two very different directions in 2026.

On one side, you have the Elite Tier: Japan & South Korea – what many nomads now call the “Elite Tease” – demanding high western salaries for very short stays. On the other side, you have the Golden Tier (Thailand & Malaysia), which offers the best ROI (Return on Investment) for digital nomads in the world right now.

1. Thailand: The Destination Thailand Visa (DTV)

(The 5-Year Miracle)

If there is one digital nomad visa 2026 that changed the game, it is the Thailand DTV. It has effectively killed the expensive “Elite Visa” (which costs $25,000+) for most under 50 nomads.

Why It Wins: It creates a legal, long term bridge for nomads without demanding an absurd monthly income. It focuses on assets (savings) rather than cash flow (salary).

- Validity: 5 Years.

- Stay Duration: 180 days per entry (extendable once per entry +180 days).

- The Cost: 10,000 THB (~$300 USD) application fee.

The “Holy Trinity” Requirement: 500k THB Savings

Unlike Spain, Thailand focuses on assets. However, keep two risks in mind:

- Embassy Lottery: Interpretation of the rules varies wildly. Some consulates accept liquid savings easily; others demand months of “seasoned” bank statements.

- Future Scrutiny: While the 180 day tax loophole exists now, Thailand’s tax interpretation regarding foreign income is actively evolving. Long stays across multiple tax years could attract scrutiny in the future. This is a great visa, but don’t treat it as a permanent tax shield without professional advice.

The Tax Sweet Spot

Thailand operates on a territorial tax system, but rules tightened in 2024. However, because the DTV limits stays to 180 days per entry, many nomads structure their year to stay under 179 days, thereby avoiding Thai tax residency entirely.

2. Malaysia: The “Budget” Alternative (DE Rantau)

If you don’t have $14k in savings for Thailand, Malaysia is the best backup. The DE Rantau Nomad Pass is arguably the most “liveable” visa because it includes a clear path to tax residency if you want it.

- The “Tech” Tier: If you work in IT, Digital Marketing, or Content Creation, the income requirement is only $24,000 USD/year ($2,000/month).

- The “Non Tech” Tier: If you are a general manager or business consultant, the requirement jumps to $60,000/year.

Tier 3: The “Elite” Tier (High Income, Low Validity)

Japan and South Korea have launched visas that sound exciting but are practically useless for true “residents.” They are designed for Workcations extended holidays where you spend money but put down no roots.

3. Japan: The 6 Month “Tease”

The Japan Digital Nomad Visa launched to much hype, but in 2026, the flaws are obvious.

- Income Requirement: 10 Million JPY (approx. $68,000 USD).

- The Deal Breaker: It is valid for only 6 months and is non renewable. You must leave Japan for 6 months before applying again.

- No Residence Card: You are technically a “designated activity” visitor. This means:

- You cannot easily open a local bank account.

- You cannot sign a long term apartment lease.

- You are stuck in Airbnb/Hotel pricing (expensive!).

4. South Korea: The “Workcation” Visa

South Korea’s program is slightly better than Japan’s (1 year validity), but the financial bar is aggressive.

- Income Requirement: You must earn 2x the GNI (Gross National Income) per capita.

- 2026 Estimate: ~88 Million KRW (approx. $66,000 USD).

- The Hidden Cost: You must hold private health insurance with coverage of at least 100 Million KRW ($75,000) for the entire duration of your stay.

Summary: The Asian “Big 4” Comparison Table

| Feature | Thailand (DTV) | Malaysia (DE Rantau) | Japan (Nomad) | South Korea (Workcation) |

| Validity | 5 Years | 1 Year | 6 Months | 1 Year |

| Renewability | Exit Required (Every 180 days) | Renewable (+1 Year) | Non Renewable (Must exit for 6 mo) | Renewable (+1 Year) |

| Financial | $14.5k Savings | $2,000 / mo | $68k / year | ~$66k / year |

| Verdict | Best Value | Best Budget Choice | Good for Tourism | High Earners Only |

Tier 4: The Wildcards (Africa & Americas)

While Europe inflates prices and Asia splits between “Elite” and “Golden” tiers, a third group of countries has emerged in the digital nomad visa 2026 race. These are the “Wildcards” high potential, but with specific quirks you need to know.

1. Kenya: The “Silicon Savannah” (New for 2026)

Kenya officially launched its Class N Digital Nomad Permit to great fanfare, but the requirements have shocked many budget travelers.

- The Income Shock: You must prove an annual income of $55,000 USD.

- Why so high? Kenya is positioning itself as a premium destination for tech workers (“Silicon Savannah”) rather than backpackers.

- The Benefit: It allows you to live in Nairobi or the coast (Mombasa/Lamu) with full legal status, avoiding the hassle of constant tourist visa extensions.

2. South Africa: The Long Wait is Over

After years of delays, the South Africa digital nomad visa 2026 is finally active.

- The Income: You need to earn R650,796 per year (approx. $36,000 USD).

- The Tax Catch: If you stay longer than 6 months (183 days), you are required to register with SARS (South African Revenue Service).

- NomadWallets Tip: Unless you want to navigate South African tax law, we recommend capping your stay at roughly 5 months. Also, if you plan to go on safari, ensure you have specific health insurance for Africa that covers air evacuation.

3. Colombia & Brazil: The “Time Zone Kings”

For US based nomads who need to work EST/PST hours, South America remains undefeated.

- Colombia: The income requirement remains one of the lowest in the world at roughly $900 – $1,400 USD/month (pegged to 3x minimum wage).

- Brazil: Requires $1,500/month OR $18,000 in savings.

- The Trap: Brazil is aggressive about tax residency. At 183+ days, Brazil generally treats you as a tax resident.

Summary: The “Wildcard” Comparison Table

| Country | Income Requirement | Tax Trap | Best For… |

| Kenya (Class N) | $55,000 / year | Low risk (New program) | High earning Tech Workers |

| South Africa | ~$36,000 / year | High Risk (>183 days) | Safari & Lifestyle Lovers |

| Colombia | ~$900 – $1,400 / mo | Medium Risk (>183 days) | Budget Nomads & EST Time Zone |

| Brazil | $1,500 / mo | Immediate (>183 days) | Beach Life & CST/EST Time Zone |

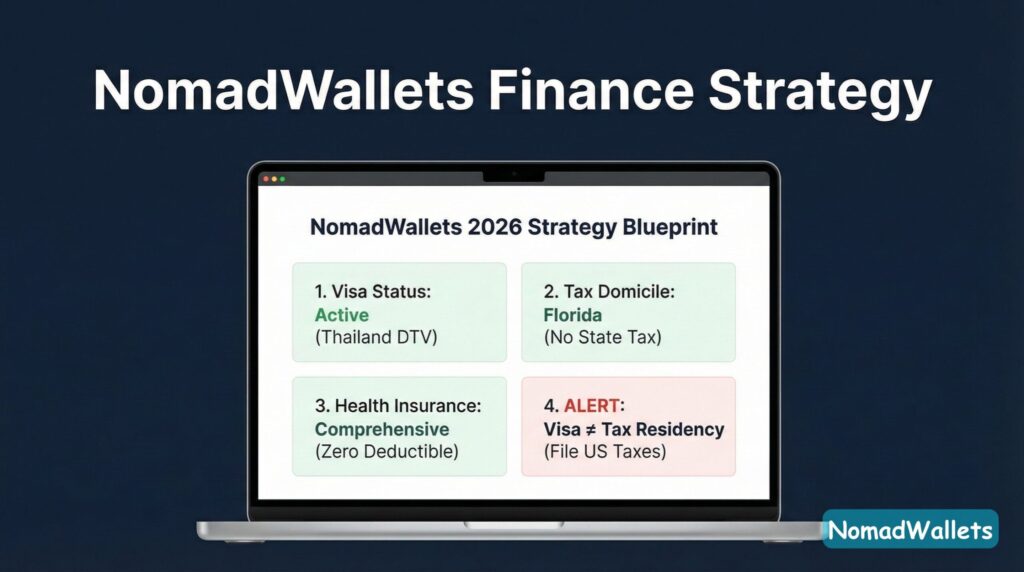

The Finance Strategy (The NomadWallets Blueprint)

Most blogs stop at the visa. But getting a digital nomad visa 2026 is only half the battle. If you don’t structure your finances correctly, that visa could cost you thousands in unexpected taxes.

1. Visa ≠ Tax Residency (The Golden Rule)

Having a visa gives you the right to enter. It does not automatically dictate where you pay taxes.

- The Mistake: Thinking “I have a Thai visa, so I don’t pay US taxes.”

- The Reality: As a US citizen, you are taxed on citizenship, not residency. You must file a US return every year.

- The Fix: You need to qualify for the Foreign Earned Income Exclusion (FEIE) by passing the Physical Presence Test (330 days outside the US).

2. The “Sticky State” Warning

If you leave the US to travel on a digital nomad visa 2026, you must properly change state domicile (see our previous guide) before you go.

- The Risk: If you are from California, New York, or Virginia, these states may claim you never “left” because you didn’t establish a new domicile elsewhere. They will demand state taxes on your global income.

- The Solution: Establish a domicile in a no tax state (Florida, Texas, South Dakota) before you board that plane to Spain or Thailand.

3. The Hidden Cost: Health Insurance

Almost every digital nomad visa 2026 program now requires proof of private health insurance.

- Travel Insurance is NOT enough: “SafetyWing” or “World Nomads” basic travel plans often do not qualify for visa applications in countries like Spain or Germany. You need comprehensive health insurance with roughly €30,000 – €100,000 coverage and zero deductible for hospitalization.

- Budget: Factor in $100 – $300/month for a policy that satisfies immigration officers.

Conclusion: The 2026 Roadmap

The “Wild West” of digital nomadism is over. The digital nomad visa 2026 landscape is professional, regulated, and more expensive.

- If you have high income but want Europe: Choose Slovenia or Spain (but watch the taxes).

- If you have savings but lumpy income: Thailand (DTV) is the undisputed king of value.

- If you are on a budget: Colombia or Malaysia are your safe havens.

Don’t just chase the sunset. Chase the ROI. Secure your visa, cut your tax bill, and protect your wallet.

Frequently Asked Questions About the Digital Nomad Visa 2026

Q1: What is the easiest digital nomad visa 2026 to get?

A: Currently, the Thailand DTV is the easiest application because it focuses on savings rather than monthly income. In Europe, the new Slovenia permit offers a much faster processing time than Spain.

Q2: Which country has the lowest income requirement?

A: For South America, Colombia requires roughly $900/month. In contrast, the Japan digital nomad visa requires over $60,000/year, making it one of the most expensive options this year.

Q3: Do these visas lead to citizenship?

A: Most do not. Spain and Portugal are rare exceptions, offering a path to permanent residency and citizenship after 5 years. The Thailand DTV does not offer a path to PR; it is strictly a long term stay permit.

Q4: How do taxes work with a digital nomad visa 2026?

A: Holding a visa does not exempt you from US taxes. You must still file. However, if your visa allows you to stay abroad for 330+ days, you may qualify for the Foreign Earned Income Exclusion (FEIE) to reduce your tax bill.

Q5: Is there a specific visa for crypto users?

A: Portugal remains the most crypto friendly European option. However, El Salvador (though not a traditional nomad program) offers residency specifically for Bitcoin investment.

Q6: Can I bring my family?

A: Yes, most programs like Spain and Malaysia allow dependents, but be aware that they typically increase the monthly income requirement by 25-75% per family member.

Q7: What health insurance do I need?

A: Most consulates reject standard travel insurance. You need a comprehensive policy (like Genki or SafetyWing Premium) that specifically states “zero deductible” to satisfy immigration officers.

Q8: Which countries are launching a new digital nomad visa 2026?

A: This year, we have seen new programs or updates from Slovenia, Kenya (Class N), Turkey, and South Africa. These new routes offer fresh alternatives to crowded hubs like Bali or Lisbon.

Disclaimer:

Immigration, visa, and tax regulations change frequently and are applied inconsistently by different consulates and tax authorities. This guide is for informational purposes only and does not constitute legal or tax advice. Always verify current requirements with official government sources or consult a qualified immigration or tax professional before applying.

Hi, I’m Tushar a digital nomad and the founder of NomadWallets.com. After years of working remotely and traveling across Asia and Europe, I started NomadWallets to help U.S. nomads confidently manage money, travel, banking, crypto, and taxes. My mission is to make complex financial topics simple, so you can focus on exploring the world and building true location freedom.